Polyethylene Naphthalate Barrier Materials Market Size (2024 – 2030)

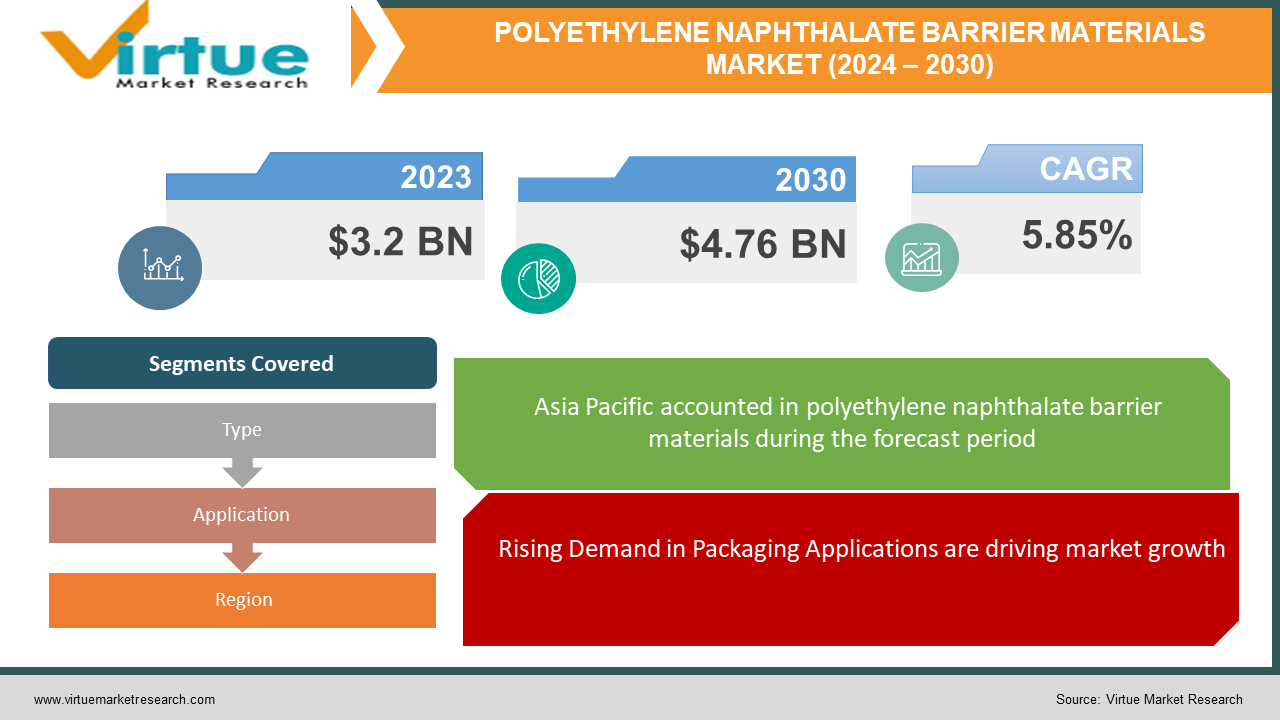

The Global Polyethylene Naphthalate Barrier Materials Market was valued at USD 3.2 billion in 2023 and will grow at a CAGR of 5.85% from 2024 to 2030. The market is expected to reach USD 4.76 billion by 2030.

The Polyethylene Naphthalate Barrier Materials Market focuses on a type of high-performance plastic (PEN) used to create packaging with superior protection against oxygen, water vapor, and other elements. This market is expected to grow steadily due to its increasing use in food and beverage containers, driven by the demand for innovative solutions that keep products fresher for longer. While PEN has other applications, its barrier properties make it a leader in the packaging segment of this market.

Key Market Insights:

The rising need for superior food preservation is a key factor. PEN excels in this area with its exceptional barrier properties against oxygen and water vapor, keeping products fresher for longer.PEN offers high stiffness and excellent barrier capabilities, making it ideal for food and beverage containers.With the increasing demand for convenience foods and longer shelf life, the PEN barrier materials market is poised for significant growth.Competition from alternative barrier materials and cost fluctuations might be challenging to navigate.

Global Polyethylene Naphthalate Barrier Materials Market Drivers:

Rising Demand in Packaging Applications are driving market growth:

The food and beverage industry's relentless pursuit of innovative packaging solutions is a major driver for the Polyethylene Naphthalate Barrier Materials Market. Traditional packaging solutions often struggle to maintain freshness and quality over extended periods, leading to spoilage and unhappy consumers. This is where PEN shines. Its exceptional barrier properties act as a fortress against oxygen, water vapor, and light. Oxygen exposure can lead to oxidation, causing flavor deterioration and shortening shelf life. PEN's near-impenetrable shield minimizes this risk. Similarly, water vapor migration can compromise product texture and consistency. PEN's exceptional barrier against water vapor ensures food and beverages retain their intended texture and mouthfeel. Additionally, light exposure can degrade sensitive nutrients and vitamins in certain products. PEN's ability to block harmful light rays helps preserve these vital elements. By addressing these critical concerns, PEN allows food and beverage companies to deliver fresher, higher-quality products with extended shelf life, ultimately reducing waste and enhancing consumer satisfaction.

Excellent Food Preservation is driving market growth:

Imagine a world where your favorite juice retains its vibrant color and freshness for weeks, or your potato chips stay perfectly crisp until the last bite. This becomes a reality with Polyethylene Naphthalate (PEN) barrier materials. PEN's magic lies in its unique combination of high stiffness and superior barrier properties. Unlike some flimsy packaging materials that easily crumple or puncture, PEN offers remarkable rigidity. This translates to sturdier containers that can withstand transportation and everyday handling, protecting the delicate contents within. But the true brilliance lies in PEN's barrier capabilities. It acts as a formidable shield against oxygen, water vapor, and even light. Oxygen exposure can trigger a cascade of unwanted effects – from rapid spoilage and discoloration in fruits and vegetables to flavor deterioration in fats and oils. PEN's exceptional barrier against oxygen minimizes this risk, ensuring food retains its original taste and nutritional value. Similarly, water vapor migration can be a silent enemy, causing cookies to lose their delightful crunch or potato chips to turn soggy. PEN's exceptional barrier against water vapor ensures food and beverages maintain their intended texture and consistency. Light exposure can also be detrimental, degrading sensitive nutrients and vitamins in certain products. PEN's ability to block harmful light rays helps preserve these vital elements. By addressing these critical concerns, PEN creates the perfect environment for food and beverages to stay fresher for longer periods. This not only reduces spoilage and waste but also translates to happier consumers enjoying a consistently high-quality product.

Growing Focus on Sustainability is driving market growth:

In today's environmentally conscious world, both consumers and manufacturers are placing a premium on sustainable practices. This shift presents a significant opportunity for the Polyethylene Naphthalate (PEN) Barrier Materials Market. Unlike many traditional packaging materials that end up in landfills, PEN offers a glimmer of hope. The good news? PEN is recyclable! This aligns perfectly with the growing demand for eco-friendly packaging solutions. By incorporating recyclable PEN into their packaging strategies, manufacturers can demonstrate their commitment to sustainability, a key factor influencing consumer purchasing decisions. Furthermore, advancements in recycling technologies are making the process of reusing PEN more efficient and cost-effective, further bolstering its environmental credentials. This focus on recyclability isn't just about reputation; it's about creating a closed-loop system that reduces reliance on virgin materials and minimizes overall environmental impact. By choosing PEN, manufacturers can contribute to a more sustainable future for the packaging industry, resonating with environmentally conscious consumers and fostering a win-win situation for both businesses and the planet.

Global Polyethylene Naphthalate Barrier Materials Market challenges and restraints:

High Manufacturing Costs are a significant hurdle for Polyethylene Naphthalate Barrier Materials:

A significant hurdle for the PEN barrier materials market is its cost compared to established alternatives. Currently, the production processes for PEN are more expensive than those for widely used materials like PET. This translates to pricier PEN films and containers, making them a less attractive option for manufacturers focused on tight budgets. Imagine a scenario where a food company has to choose between a PET bottle and a PEN bottle. The PET option might be significantly cheaper, even though the PEN bottle offers superior barrier properties and potentially longer shelf life for the product. This cost factor can be a major deciding point, especially for companies with high production volumes and tight profit margins. As a result, convincing manufacturers to switch from well-established, cost-effective solutions like PET to superior but pricier PEN can be a significant challenge for the PEN barrier materials market.

Competition from Established Alternatives is throwing a curveball at the Polyethylene Naphthalate Barrier Materials market:

The PEN barrier materials market faces an uphill battle against entrenched competitors. Established players like PET and BOPP have a dominant market presence, often at a lower price point compared to PEN. This creates a significant challenge for PEN manufacturers. While PEN boasts superior barrier properties, translating that advantage into widespread adoption can be difficult. Imagine a well-oiled machine – manufacturers have established production lines and supply chains optimized for PET and BOPP. Switching to PEN disrupts this efficiency. Beyond just cost, there's the time and resources needed to integrate PEN into existing operations, test compatibility, and potentially modify packaging designs. Additionally, brand familiarity with existing materials plays a role. For many manufacturers, the established track record of PET and BOPP might seem like a safer bet, even if it means sacrificing some shelf life or barrier properties. PEN needs to overcome this inertia and convince manufacturers that the long-term benefits of superior performance outweigh the initial hurdles of switching from well-established, cost-effective solutions.

Limited Availability of Recycled PEN is a growing nightmare for Polyethylene Naphthalate Barrier Materials:

The recyclability of PEN presents a double-edged sword for the market. While PEN itself can be recycled, a major hurdle lies in the limitations of the current recycling infrastructure. Large-scale, cost-effective recycling options for PEN are scarce. This creates a bottleneck – the readily available supply of recycled PEN is restricted. This can be a significant drawback for companies that prioritize sustainability. Imagine a manufacturer eager to use recycled materials in their packaging to showcase their eco-friendly practices. With limited access to recycled PEN, they might be forced to choose virgin PEN, negating some of the environmental benefits, or switch to entirely different recyclable materials. This lack of robust and cost-efficient recycling infrastructure for PEN creates a barrier to wider adoption, especially amongst sustainability-focused companies. Overcoming this challenge requires investment in improved recycling technologies and processes that can make recycled PEN a more viable and readily available option within the market.

Market Opportunities:

The Polyethylene Naphthalate (PEN) Barrier Materials Market is brimming with exciting opportunities fueled by the ever-evolving food and beverage industry. Consumers' insatiable demand for fresh, high-quality, and convenient food creates a perfect storm for PEN's exceptional barrier properties to shine. PEN's ability to create near-impenetrable shields against oxygen, water vapor, and light translates to extended shelf life, reduced spoilage, and improved food safety – a win for both manufacturers and consumers. This translates to a wider range of innovative packaging solutions, like lighter and more sustainable containers for everything from delicate fruits and vegetables to shelf-stable, single-serve beverages. Furthermore, the growing market for convenience foods presents a golden opportunity. PEN's ability to maintain freshness and quality over extended periods aligns perfectly with the needs of this segment. Beyond food and beverage, PEN's potential extends to other industries. Its high stiffness and barrier properties make it suitable for applications in pharmaceuticals, electronics, and automotive parts, where protecting sensitive components from degradation is crucial. Additionally, advancements in PEN production technologies and recycling infrastructure can bring down costs and create a more sustainable solution, further bolstering its appeal. By addressing these opportunities and overcoming challenges like cost competitiveness and established competition, the PEN Barrier Materials Market is poised for significant growth, shaping the future of packaging with its innovative and high-performance solutions.

POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.85% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Teijin DuPont Films, SASA Polyester Sanayi A.Ş., KOLON PLASTIC INC., GTS Flexible Ltd., Polyonics, SKC Inc., DuraFiber Technologies, Inc., Sumitomo Chemical Co., Ltd, Toray Monofilament Co., Ltd., DuPont |

Polyethylene Naphthalate Barrier Materials Market Segmentation - By Type

-

Standard PEN

-

Reinforced PEN

Standard PEN currently reigns supreme in the Polyethylene Naphthalate Barrier Materials Market, capturing roughly 40% of the market share [Credence Research]. This dominance stems from its versatility and cost-effectiveness. It offers a good balance of barrier properties, strength, and affordability, making it suitable for a wide range of applications, particularly in food and beverage packaging. While reinforced PEN offers enhanced strength and heat resistance, its higher cost limits its application to specific, demanding scenarios like automotive components. Standard PEN's ability to cater to a broader range of needs at a more competitive price point solidifies its position as the leading segment within the market.

Polyethylene Naphthalate Barrier Materials Market Segmentation - By Application

-

Packaging

-

Electronics

Packaging is the undisputed king of the Polyethylene Naphthalate Barrier Materials Market, claiming over 39% of the market share compared to electronics [Grand View Research]. This dominance is driven by the ever-growing food and beverage industry's insatiable demand for innovative packaging solutions. PEN's exceptional barrier properties against oxygen, water vapor, and light make it the perfect fit for extending shelf life, minimizing spoilage, and enhancing food safety. This translates into a wide range of packaging applications, from lightweight and sustainable containers for delicate produce to shelf-stable, single-serve beverages. While PEN finds use in electronics due to its electrical insulation and stability, the sheer volume and diverse needs of the packaging industry solidify it as the most prominent sector within the PEN Barrier Materials Market.

Polyethylene Naphthalate Barrier Materials Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

Currently, the Asia Pacific region reigns supreme in the Polyethylene Naphthalate Barrier Materials Market. This dominance is fueled by a confluence of factors: a booming food and beverage industry, particularly in China and India, rising demand for convenience foods perfectly aligned with PEN's shelf-life extension capabilities, and stricter government regulations on food safety and packaging waste that can indirectly benefit PEN's superior barrier properties and recyclability. While Europe and North America are strong contenders with their focus on sustainability and innovative packaging solutions respectively, Asia Pacific's sheer growth, population, and production volume solidify its position as the most dominant region in the PEN Barrier Materials Market.

COVID-19 Impact Analysis on the Global Polyethylene Naphthalate Barrier Materials Market

The COVID-19 pandemic caused a ripple effect on the Global Polyethylene Naphthalate Barrier Materials Market. Initially, disruptions in supply chains and lockdowns led to a temporary dip in demand. However, the market witnessed a rebound due to changing consumer habits. The surge in online grocery shopping and demand for packaged food with a longer shelf life to minimize store visits played in PEN's favor. Additionally, the focus on hygiene and food safety during the pandemic might have driven the use of PEN in certain food packaging applications. However, the pandemic also presented challenges. Fluctuations in raw material prices and disruptions in logistics networks impacted production costs and delivery timelines. Moreover, economic downturns in some regions might have led to budget-conscious manufacturers opting for cheaper alternatives to PEN. Overall, the long-term impact of COVID-19 on the PEN Barrier Materials Market remains to be seen. While the initial shock subsided, the focus on hygiene, convenience, and extended shelf life could benefit PEN in the long run. However, navigating cost fluctuations and ensuring efficient supply chains will be crucial for market growth.

Latest trends/Developments

The Polyethylene Naphthalate Barrier Materials Market is abuzz with exciting developments. Sustainability is a major driving force, with advancements in recycling technologies making recycled PEN (r-PEN) a more viable option. This resonates with eco-conscious consumers and manufacturers, fostering a closed-loop system and reducing reliance on virgin materials. Innovation is another key trend. Manufacturers are constantly exploring ways to improve PEN's performance. This includes the development of bio-based PEN alternatives derived from renewable resources, further reducing the environmental footprint. Additionally, research on incorporating nanomaterials into PEN is underway, potentially leading to enhanced barrier properties and functionalities. The market is also witnessing a rise in demand for lightweight and downsized PEN containers, catering to consumer preferences for portability and reduced environmental impact. Furthermore, collaborations between PEN producers, packaging companies, and brand owners are accelerating the development of innovative packaging solutions that leverage PEN's superior barrier properties to extend shelf life, minimize food waste, and enhance product safety. This collaborative approach is shaping the future of the PEN Barrier Materials Market, ensuring it remains at the forefront of sustainable and high-performance packaging solutions.

Key Players:

-

Teijin DuPont Films

-

SASA Polyester Sanayi A.Ş.

-

KOLON PLASTIC INC.

-

GTS Flexible Ltd.

-

Polyonics

-

SKC Inc.

-

DuraFiber Technologies, Inc.

-

Sumitomo Chemical Co., Ltd.

-

Toray Monofilament Co., Ltd.

-

DuPont

Chapter 1. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – By Application

6.1 Introduction/Key Findings

6.2 Packaging

6.3 Electronics

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – By Type

7.1 Introduction/Key Findings

7.2 Standard PEN

7.3 Reinforced PEN

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. POLYETHYLENE NAPHTHALATE BARRIER MATERIALS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Teijin DuPont Films

9.2 SASA Polyester Sanayi A.Ş.

9.3 KOLON PLASTIC INC.

9.4 GTS Flexible Ltd.

9.5 Polyonics

9.6 SKC Inc.

9.7 DuraFiber Technologies, Inc.

9.8 Sumitomo Chemical Co., Ltd.

9.9 Toray Monofilament Co., Ltd.

9.10 DuPont

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polyethylene Naphthalate Barrier Materials Market was valued at USD 3.2 billion in 2023 and will grow at a CAGR of 5.85% from 2024 to 2030. The market is expected to reach USD 4.76 billion by 2030.

Rising Demand for Packaging Applications, Excellent Food Preservation, and a Growing Focus on Sustainability are the reasons that are driving the market.

Based on the Application it is divided into two segments – Packaging and electronics.

Asia is the most dominant region for the luxury vehicle Market.

Teijin DuPont Films, SASA Polyester Sanayi A.Ş. KOLON PLASTIC INC., GTS Flexible Ltd., Polyonics.