Global Polyamide Thin Film Nanocomposite Market Size (2024-2030)

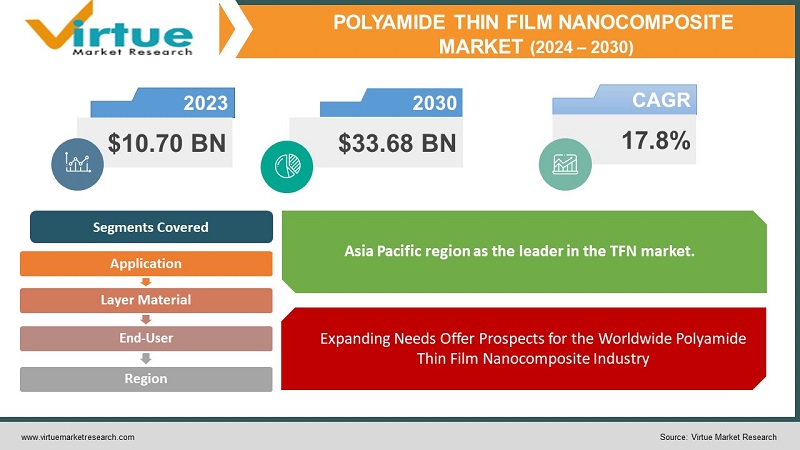

The Global Polyamide Thin Film Nanocomposite Market was valued at USD 10.70 billion in 2023 and is projected to reach a market size of USD 33.68 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.8%.

Polyamide Thin Film Nanocomposite (TFN) membranes represent a technological breakthrough in filtering for applications including desalination and reverse osmosis (RO). expand on thin-film composite membranes that already exist. The TFN membrane is composed of a thin polyamide rejection layer on top of a porous support layer, which is usually comprised of polysulfone for structural support. The rejection layer is produced by interfacial polymerization and has a higher density. Water molecules can go through this layer, but dissolved salts and other contaminants are rejected. The addition of nanoparticles to the PA rejection layer is a major advance in TFN membranes. These nanoparticles can improve a membrane's water permeability, salt rejection, and durability, among other aspects of membrane performance. TFN membranes are being used in more applications, including RO desalination, nanofiltration, ultrafiltration, and even wastewater treatment, because of these advancements.

Key Market Insights:

There is a growing demand for effective water treatment solutions due to the world's population growth, which is predicted to reach 9.7 billion by 2050, as well as the increasing stress on freshwater resources. When compared to conventional membranes, TFN membranes have better filtering capabilities. They are excellent at ultrafiltration (removing colloids and suspended materials), nanofiltration (removing bacteria and viruses), and desalination (removing salts from saltwater for the generation of freshwater).

Advanced filtration technologies are being used by municipalities and enterprises in response to stricter requirements on wastewater treatment and water outflow. These membranes are perfect for adhering to more stringent environmental requirements since they can efficiently remove a greater variety of pollutants. Global wastewater production is predicted to rise by 50% by 2030, underscoring the need for sophisticated treatment methods.

The TFN market is anticipated to be dominated by the Asia Pacific area because of the region's fast industrialization, expanding population, and growing water shortages. Numerous factories and end-user businesses in the area need cutting-edge water treatment technologies. In terms of market share, the Asia Pacific area dominates the nanocomposites industry.

Global Polyamide Thin Film Nanocomposite Market Drivers:

Expanding Needs Offer Prospects for the Worldwide Polyamide Thin Film Nanocomposite Industry

The demand for effective and cutting-edge water treatment technology is expanding because of the world's population growth and the associated strain on freshwater supplies. Polyamide Thin Film Nanocomposite (TFN) membranes are appealing options in this regard. When compared to conventional membranes, TFN membranes have better filtering capabilities. They perform exceptionally well in processes like desalination, which turns salty saltwater into potable water. This is especially helpful in coastal locations and places where freshwater resources are scarce. When it comes to nanofiltration, TFN membranes work well at eliminating bigger molecules as well as impurities like bacteria and viruses from water. Because of this, they are perfect for cleaning water for a variety of uses, such as manufacturing and even the creation of drinking water. Ultrafiltration, which gets rid of even bigger particles such as colloids and suspended solids, can be done with TFN membranes. This may be essential for applications demanding extremely high purity levels or for pre-treating water prior to further filtering stages. In general, the worldwide TFN market is driven primarily by the rising demand for clean water as well as the adaptability of TFN membranes to a variety of filtering procedures.

TFN Membranes in Wastewater Treatment Are Adopted Due to Tight Environmental Regulations

Environmental standards are getting more and more strict, especially when it comes to wastewater treatment and water outflow. Municipalities and businesses are being forced by these more stringent regulations to use cutting-edge filtration technology that can satisfy the constantly changing requirements. This offers Polyamide Thin Film Nanocomposite (TFN) membranes a major opportunity. TFN membranes have the advantage of being able to remove a broader variety of pollutants than standard membranes. Their enhanced filtering capacity makes them especially suitable for adhering to more stringent rules. Industries and municipalities may lower the risk of penalties and environmental harm by ensuring their wastewater discharge satisfies necessary criteria through effective pollution removal. TFN membranes are projected to become more in demand as environmental rules become more stringent because of their capacity to handle this ever-complex regulatory environment.

Global Polyamide Thin Film Nanocomposite Market Restraints and Challenges:

Although they have difficulties, polyamide thin-film nanocomposite (TFN) membranes show promise for water purification. TFN membranes are more costly than conventional membranes, yet they have drawbacks such as an uneven distribution of nanoparticles and a dearth of long-term performance data. Widespread acceptance is further hampered by low manufacturing, ambiguous standards, and possible environmental effects of nanoparticles. The market expansion for TFN membranes depends on overcoming these obstacles via research on reduced costs, optimized nanoparticle integration, and environmental responsibility.

Global Polyamide Thin Film Nanocomposite Market Opportunities:

There is a tonne of potential in the worldwide polyamide thin-film nanocomposite (TFN) market. TFN membranes provide an appealing option with their exceptional filtering capabilities, which are motivated by the increasing demand for clean water, tighter environmental restrictions, and an increasing emphasis on water reuse. Technological advancements have the potential to surmount existing constraints on cost and performance, and their prospective uses outside conventional water treatment, such as in food processing and pharmaceuticals, provide intriguing new growth opportunities.

POLYAMIDE THIN FILM NANOCOMPOSITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.8% |

|

Segments Covered |

By Application, layer material, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dow Chemical, DuPont, LG Chem, Toray Industries |

Global Polyamide Thin Film Nanocomposite Market Segmentation:

Global Polyamide Thin Film Nanocomposite Market Segmentation: By Application:

- Desalination

- Nanofiltration

- Ultrafiltration

- Wastewater Treatment

The TFN market's current leader and potential growth engine is desalination. The significance of desalination is increased by the increased shortage of water and the higher performance and efficiency of TFN membranes. In the TFN market, desalination leads in terms of market size and growth rate because of government expenditures in desalination projects and the technology's growing application, which includes inland brackish water desalination.

Global Polyamide Thin Film Nanocomposite Market Segmentation: By Separation Layer Material:

- Polyamide

- Inorganic Nanomaterials

In TFN membranes, polyamide is still the most common material for the separating layer, although inorganic nanomaterials are expected to increase at the quickest rate. While inorganic nanoparticles have intriguing opportunities for increased water permeability, greater salt rejection, and increased chemical resistance, traditional polyamide has drawbacks. It is anticipated that inorganic nanoparticles will drive TFN membrane performance in the future, driven by current research on these materials.

Global Polyamide Thin Film Nanocomposite Market Segmentation: By End-User:

- Municipal Water Treatment Plants

- Power Plants

- Chemical Industry

- Pharmaceutical Industry

- Food and Beverage Industry

There won't be a single dominating end-user in the TFN market. Rather, growth will come from a range of industries. Regulations and requirements for clean water will result in a consistent need for municipal water treatment facilities. TFN usage will increase in the chemical, pharmaceutical, food and beverage, and power plant industries as their unique requirements for high-purity water and effective filtering match TFN membrane characteristics. The variety of end-user uses for TFN membranes guarantees a strong and diverse market.

Global Polyamide Thin Film Nanocomposite Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

A few variables are coming together to position the Asia Pacific region as the leader in the TFN market. The need for effective water treatment solutions is growing due to factors including rapid industrialization, population growth that is taxing water resources, and growing water shortages. Because of TFN membranes' excellent filtering and desalination capabilities, governments are placing more emphasis on infrastructure and environmental laws. With this combination, Asia Pacific is positioned to lead the TFN membrane market in terms of size and growth rate.

COVID-19 Impact Analysis on the Global Polyamide Thin Film Nanocomposite Market:

The COVID-19 pandemic has both positive and negative effects on the TFN market. Increased awareness of good hygiene is encouraging for future demand, although there may have been a little setback due to supply chain issues and postponed infrastructure projects. The market's capacity to recover and satisfy the expanding demand for clean water technology will determine how big it may develop in the long run.

Recent Trends and Developments in the Global Polyamide Thin Film Nanocomposite Market:

The market for polyamide thin-film nanocomposite (TFN) products is booming because of recent advancements. Manufacturers are attempting to save costs by using innovative techniques and materials. Researchers are experimenting with nanoparticles to create more specialized membrane designs for certain uses and improved compatibility. Research on environmentally friendly nanoparticles and appropriate disposal techniques is being done to solve environmental problems. Lastly, TFN membranes are being combined with other cutting-edge technologies to provide water treatment solutions that are even more potent. TFN membranes have a promising future in the field of clean water technologies, according to these tendencies.

Key Players:

- Dow Chemical

- DuPont

- LG Chem

- Toray Industries

Chapter 1. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET– BY Application

6.1. Introduction/Key Findings

6.2. Desalination

6.3. Nanofiltration

6.4. Ultrafiltration

6.5. Wastewater Treatment

6.6. Y-O-Y Growth trend Analysis By Application

6.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET– BY Separation Layer Material

7.1. Introduction/Key Findings

7.2. Polyamide

7.3. Inorganic Nanomaterials

7.4. Y-O-Y Growth trend Analysis By Separation Layer Material

7.5. Absolute $ Opportunity Analysis By Separation Layer Material, 2024-2030

Chapter 8. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET– BY End-User

8.1. Introduction/Key Findings

8.2. Municipal Water Treatment Plants

8.3. Power Plants

8.4. Chemical Industry

8.5. Pharmaceutical Industry

8.6. Food and Beverage Industry

8.7. Y-O-Y Growth trend Analysis End-User

8.8. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 9. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Separation Layer Material

9.1.3. By Application

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Separation Layer Material

9.2.3. By End-User

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Separation Layer Material

9.3.3. By Application

9.3.4. By End-User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.3. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Separation Layer Material

9.4.3. By Application

9.4.4. By End-User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Separation Layer Material

9.5.3. By Application

9.5.4. By End-User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL POLYAMIDE THIN FILM NANOCOMPOSITE MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Dow Chemical

10.2. DuPont

10.3. LG Chem

10.4. Toray Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polyamide Thin Film Nanocomposite Market size is valued at USD 10.70 billion in 2023

The worldwide Global Polyamide Thin Film Nanocomposite Market growth is estimated to be 17.8% from 2024 to 2030.

The Global Polyamide Thin Film Nanocomposite Market is segmented By Application (Desalination, Nanofiltration, Ultrafiltration, Wastewater Treatment); By Separation Layer Material (Polyamide, Inorganic Nanomaterials); By End-User (Municipal Water Treatment Plants, Power Plants, Chemical Industry, Pharmaceutical Industry, Food and Beverage Industry) and by region.

. Cost reduction, sophisticated nanoparticles, and integration with other technologies are anticipated advancements in the TFN industry, which would greatly expand the prospects for clean water solutions

The TFN market saw a mixed response to the COVID-19 epidemic. Growth was first hampered by interruptions, but increased awareness of cleanliness practices may increase demand for this cutting-edge water treatment technology in the future.