Polyacrylamide Water Soluble Polymers Market Size (2024 – 2030)

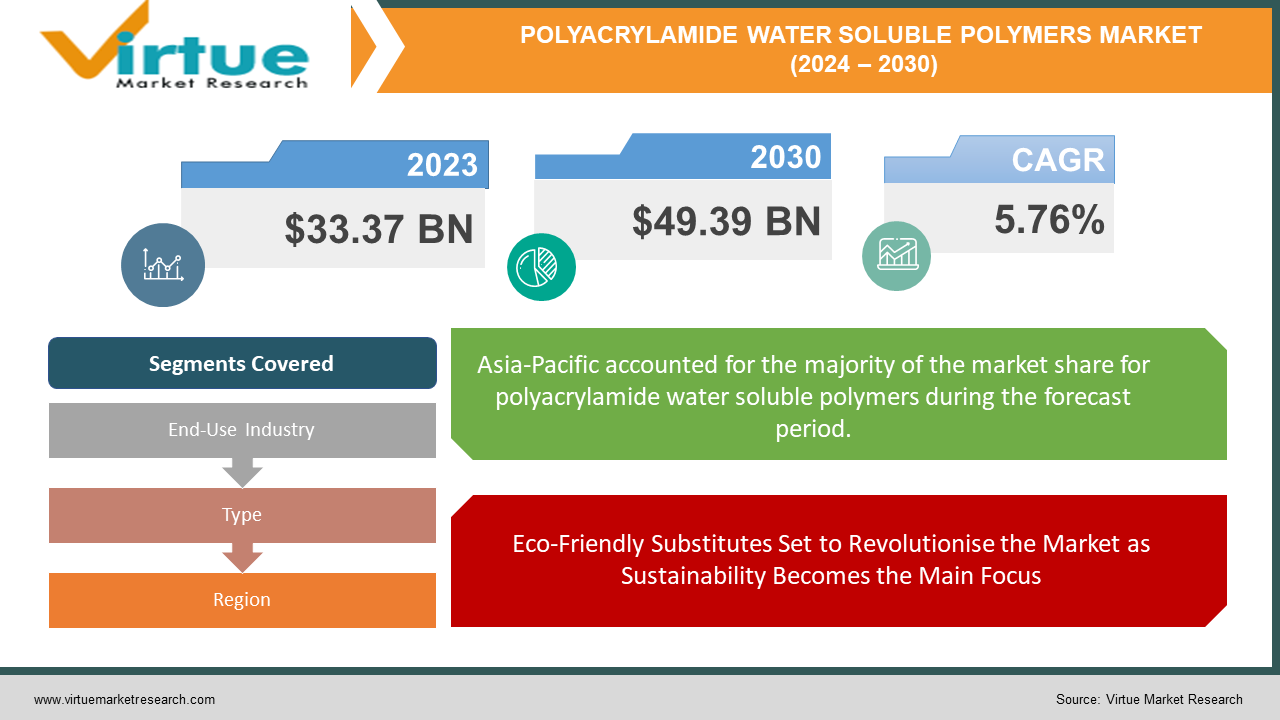

The Global Polyacrylamide Water Soluble Polymers Market was valued at USD 33.37 billion in 2023 and is projected to reach a market size of USD 49.39 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.76%.

Water is ideal for the growth of Polyacrylamide (PAM), a long-chain polymer derived from acrylamide units. PAM is excellent at absorbing and holding onto large amounts of water because of its favorable interaction with water molecules, which makes it very soluble. For uses like diapers and soil conditioners, this makes it a useful tool. PAM could also thicken aqueous solutions, which are useful for fracking fluids, wastewater treatment, and even cosmetics. PAM is surprisingly charge-neutral or charge-positive, which means it may be tailored to specific applications like clumping particles in water purification or other industrial operations.

Key Market Insights:

The market for polyacrylamide is being driven by strict environmental laws and an increasing focus on clean water. Water treatment applications are likely to fuel a large percentage of the market research industry's growth, which is projected to reach $140 billion in sales globally in 2024.

A trend towards sustainability is being observed in the industry with the introduction of bio-based PAMs made from renewable resources. Though they still only make up a minor part of the market, the manufacturing of bio-based PAMs is expanding quickly. By 2027, the market for bio-based plastic is projected to grow to a size of USD 50.63 billion, demonstrating the growing importance of environmentally acceptable substitutes.

Superabsorbent PAMs are being embraced by the agriculture industry as a tool to combat drought. By retaining water up to hundreds of times its weight, these polymers increase agricultural yields while lowering the requirement for irrigation. Using superabsorbent polymers in agriculture can result in an average 17.5% increase in crop output. The market for polyacrylamide has a lot of potential to grow and enter new international markets because of the movement toward sustainable agriculture.

Global Polyacrylamide Water Soluble Polymers Market Drivers:

The market for polyacrylamide is rising as PAM becomes the preferred flocculant due to strict regulations and a growing demand for clean water.

Tight environmental laws and an increasing emphasis on clean water on a worldwide scale are driving the polyacrylamide industry. This is mostly due to PAM's superpower status as a flocculant in the water treatment industry. Its capacity to group suspended particles together like little magnets is the source of its hidden power. These solids, which are frequently contaminants or microorganisms that cause illness, can cloud water and make it unfit for human or commercial usage. PAM works like magic to produce bigger, heavier flocs that quickly separate from the water and are easier to remove during filtering. Cleaner water will benefit our homes, businesses, and ecosystems as a result. PAM's flocculating ability is anticipated to be a key factor driving the worldwide polyacrylamide market ahead in the upcoming years as laws tighten and the need for clean water increases.

Eco-Friendly Substitutes Set to Revolutionise the Market as Sustainability Becomes the Main Focus

The market for polyacrylamides is shifting towards sustainability, and bio-based PAMs are emerging as a game-changer. These innovative polymers provide a far cleaner option to conventional PAM manufacture since they are made from renewable resources like plant starches or microbial fermentation. This is in line with the increased demand from industry and consumers for ecologically friendly solutions as awareness of environmental issues rises. PAMs derived from biotechnology have great potential to transform the market. Bio-based alternatives are not only in line with sustainability objectives, but they may also become more popular if traditional PAM production is subject to tougher controls because of environmental concerns. This environmentally friendly invention has the power to completely change the polyacrylamide business, guaranteeing a profitable and sustainable future.

Global Polyacrylamide Water Soluble Polymers Market Restraints and Challenges:

The worldwide market for polyacrylamide is not without its challenges. First, the market faces unstable raw material prices, especially for acrylamide, which has a big influence on manufacturing costs and gives producers a lot of anxiety. Environmental issues also cast a shadow. Aquatic life can be harmed by improperly handled PAM, particularly if it contains leftover acrylamide. Complicating matters are tighter rules and the emergence of cheaper, more environmentally friendly alternatives. Finally, there is a danger of competition from developments in water treatment technology such as membrane filtration. The polyacrylamide market must concentrate on cost containment, create environmentally friendly PAM variants, and investigate novel uses if it is to remain competitive.

Global Polyacrylamide Water Soluble Polymers Market Opportunities:

The market for polyacrylamides worldwide is full of prospects. PAM is a strong flocculant in water treatment that is in high demand due to strict environmental restrictions; this makes it an advocate for clean water. Superabsorbent PAMs are enabling agriculture to embrace a revolution by increasing crop yields and using them as weapons against drought. PAM's potential is also being seen by the oil and gas sector, which is hinting at a profitable new market niche. Lastly, the emergence of bio-based PAMs presents an environmentally friendly substitute that has the potential to completely change the market landscape, in line with the increased emphasis on sustainability. By taking advantage of these prospects, the worldwide polyacrylamide industry is set up for success in the future.

POLYACRYLAMIDE WATER SOLUBLE POLYMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.76% |

|

Segments Covered |

By End-Use Industry, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Anhui Jucheng Fine Chemicals Co., Ltd., BASF SE, Black Rose Industries Limited, Kemira Oyj, SNF Group, Solenis LLC, Xitao Polymer Co., Ltd. |

Global Polyacrylamide Water Soluble Polymers Market Segmentation: By End-Use Industry

-

Water Treatment

-

Enhance Oil Recovery

-

Pulp & Paper

-

Mineral Processing

-

Others

The industries that polyacrylamide serves divide the market. The industry leader in terms of size and rate of growth is water treatment. Stricter environmental laws and the constant demand for clean water are the main drivers of this domination. PAM leads this crucial market category because of its exceptional ability to remove contaminants from water, which makes it a hero in the wastewater treatment and municipal water purification industries.

Global Polyacrylamide Water Soluble Polymers Market Segmentation: By Type

-

Cationic PAM

-

Anionic PAM

-

Nonionic PAM

Looking closer, the electrical charge of polyacrylamide allows for the segmentation of the market based on its very nature. Because it is so versatile, Cationic PAM is the biggest category. This positively charged powerhouse is an absolute star in the treatment of wastewater and mineral processing because it attracts, and aggregates negatively charged particles. Whereas nonionic PAM, which is charge-free, performs well in thickening applications in a variety of sectors, anionic PAM, which is negatively charged, combats positively charged particles in certain water treatment applications.

Global Polyacrylamide Water Soluble Polymers Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographically speaking, the largest and fastest-growing region is Asia-Pacific, which dominates the worldwide polyacrylamide market. This dominance is the result of a number of interrelated factors, including growing government infrastructure spending, the need for water treatment due to urbanization and industrialization, the need for improved soil and water retention in agriculture, and the prominence of polyacrylamide producers in China and India. North America is the next established market, growing steadily, while Europe concentrates on sustainability and environmental rules, growing moderately. South America, the Middle East, and Africa, on the other hand, have significant prospects because of their emerging economies and infrastructural developments.

COVID-19 Impact Analysis on the Global Polyacrylamide Water Soluble Polymers Market:

The worldwide polyacrylamide market saw mixed results because of the COVID-19 epidemic. Growing hygienic concerns led to an increase in demand for PAM in water treatment and disinfectants, which are essential for stopping the virus's spread. Lockdowns and travel restrictions, however, caused supply chain delays that offset this development. Moreover, PAM consumption for certain applications decreased because of declining activity in sectors like papermaking. All things considered, the pandemic's effects were uneven, with certain industries seeing increases in demand and others seeing declines.

Recent Trends and Developments in the Global Polyacrylamide Water Soluble Polymers Market:

There is a tonne of innovative advancements in the worldwide polyacrylamide market. PAM, an extremely powerful flocculant, is becoming ever more in demand as strict environmental rules are tightening their hold on the water treatment industry. Superabsorbent PAMs are being used in agriculture to improve soil water retention, opening a promising new field. PAM's prospective uses are also being hinted at by the oil and gas sector, which may lead to possible market growth. The development of bio-based PAMs is also gathering steam, providing a sustainable substitute that is in perfect harmony with the increasing emphasis on environmentally responsible solutions. With these cutting-edge developments opening the door for more market expansion, the future of polyacrylamide seems bright.

Key Players:

-

Anhui Jucheng Fine Chemicals Co., Ltd.

-

BASF SE

-

Black Rose Industries Limited

-

Kemira Oyj

-

SNF Group

-

Solenis LLC

-

Xitao Polymer Co., Ltd.

Chapter 1. Polyacrylamide Water Soluble Polymers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Polyacrylamide Water Soluble Polymers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Polyacrylamide Water Soluble Polymers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Polyacrylamide Water Soluble Polymers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Polyacrylamide Water Soluble Polymers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Polyacrylamide Water Soluble Polymers Market – By End-Use Industry

6.1 Introduction/Key Findings

6.2 Water Treatment

6.3 Enhance Oil Recovery

6.4 Pulp & Paper

6.5 Mineral Processing

6.6 Others

6.7 Y-O-Y Growth trend Analysis By End-Use Industry

6.8 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 7. Polyacrylamide Water Soluble Polymers Market – By Type

7.1 Introduction/Key Findings

7.2 Cationic PAM

7.3 Anionic PAM

7.4 Nonionic PAM

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Polyacrylamide Water Soluble Polymers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Use Industry

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Use Industry

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Use Industry

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Use Industry

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Use Industry

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Polyacrylamide Water Soluble Polymers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Anhui Jucheng Fine Chemicals Co., Ltd.

9.2 BASF SE

9.3 Black Rose Industries Limited

9.4 Kemira Oyj

9.5 SNF Group

9.6 Solenis LLC

9.7 Xitao Polymer Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polyacrylamide Water Soluble Polymers Market size is valued at USD 33.37 billion in 2023.

The worldwide Global Polyacrylamide Water Soluble Polymers Market growth is estimated to be 5.76% from 2024 to 2030.

The Global Polyacrylamide Water Soluble Polymers Market is segmented By End-Use Industry (Water Treatment, Enhance Oil Recovery, Pulp & Paper, Mineral Processing, Others); By Type (Cationic PAM, Anionic PAM, Nonionic PAM), and by region.

There are various sectors where the worldwide polyacrylamide market is anticipated to expand. Stricter environmental rules will focus more on wastewater management and water treatment, which will increase demand for PAM. Another encouraging development is the growing use of superabsorbent polymers in agriculture to retain water in the soil. In addition, promising prospects for the future include the development of bio-based PAMs and their uses in the oil and gas sector.

The COVID-19 pandemic had a conflicting effect on the world market for polyacrylamide. Disruptions in supply chains and decreased activity in industries such as papermaking resulted in a reduction in other applications of PAM, while hygiene concerns drove greater demand for PAM in disinfectants and water treatment. The market was affected in a complicated way overall.