Poland Masterbatches Market Size (2024-2030)

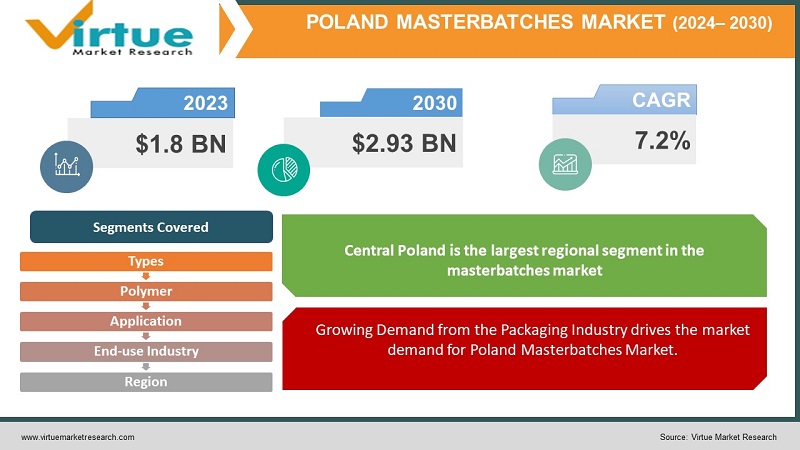

The Poland Masterbatches Market is valued at USD 1.8 Billion and is projected to reach a market size of USD 2.93 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

The molecular diagnostics market has witnessed substantial growth over the past few years. This field involves testing and analyzing biological markers in the genome and proteome. These diagnostics are crucial for detecting and monitoring diseases, understanding their mechanisms, and determining the best treatment options. One of the most significant long-term drivers for the molecular diagnostics market is the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases. As the global population ages, the incidence of these chronic conditions rises, necessitating advanced diagnostic tools for early detection and management. Molecular diagnostics play a critical role in identifying specific genetic mutations and biomarkers associated with these diseases, allowing for personalized treatment plans that improve patient outcomes.

One notable opportunity in the molecular diagnostics market is the expanding application of next-generation sequencing (NGS). NGS technology allows for comprehensive analysis of genetic information, enabling the identification of rare genetic variants and the discovery of new biomarkers.

A prominent trend in the molecular diagnostics industry is the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI and ML are being used to analyze large datasets generated by molecular diagnostic tests, uncovering patterns and insights that may not be apparent through traditional analysis methods.

Key Market Insights:

The Poland Masterbatches Market is projected to expand at a compound annual growth rate of over 7.1% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Ampacet Corporation, A. Schulman Inc., and Avient Corporation are some examples of Poland Masterbatches Market.

Central Poland & Western Poland account for approximately 65-70 % of the Poland Masterbatches Market, driven by Growing Demand from the Packaging Industry, Expansion of the Automotive Sector, Increasing Use in Construction Materials & Advancements in Masterbatch Technology.

Poland Masterbatches Market Drivers:

Growing Demand from the Packaging Industry drives the market demand for Poland Masterbatches Market.

The packaging industry is one of the largest consumers of masterbatches in Poland. With the rise in consumerism and the increasing demand for packaged goods, there is a significant need for high-quality, aesthetically appealing packaging materials. Masterbatches are essential in providing the vibrant colors and functional properties needed for various packaging applications, from food and beverages to pharmaceuticals and cosmetics. The trend towards sustainable and recyclable packaging is also driving the demand for innovative masterbatch solutions that can meet environmental standards while maintaining performance.

Expansion of the Automotive Sector drives the market demand for Poland Masterbatches Market.

Poland's automotive industry is another major driver of the masterbatches market. The country has become a hub for automobile manufacturing and assembly, attracting investments from global automotive giants. The use of plastics in automotive components is growing due to their lightweight, durability, and cost-effectiveness. Masterbatches play a crucial role in enhancing the properties of these plastics, providing UV resistance, improved mechanical strength, and custom colors that meet the stringent requirements of automotive manufacturers. As the automotive sector continues to expand, the demand for specialized masterbatches is expected to rise.

Increasing Use in Construction Materials drives the market demand for Poland Masterbatches Market.

The construction industry in Poland is experiencing robust growth, driven by both residential and commercial projects. Plastics are increasingly being used in construction materials for their versatility, durability, and ease of installation. Masterbatches are essential in this sector for producing colored and additive-enhanced plastic products like pipes, fittings, and panels. They provide UV stabilization, flame retardancy, and other critical properties that improve the performance and longevity of construction materials. The ongoing infrastructure development and modernization projects across Poland are likely to further boost the demand for masterbatches in this sector.

Advancements in Masterbatch Technology drive the market demand for Poland Masterbatches Market.

Technological advancements in masterbatch production are significantly driving the market in Poland. Innovations such as the development of biodegradable masterbatches, high-performance additive masterbatches, and custom color matching have expanded the application possibilities. These advancements allow manufacturers to meet the specific needs of various industries more effectively. The ability to produce masterbatches with enhanced performance characteristics, such as improved dispersion, higher concentration of additives, and better processability, is attracting more industries to adopt masterbatch solutions. Continuous research and development efforts in this field are expected to keep driving the market forward.

Poland Masterbatches Market Restraints and Challenges:

One of the primary challenges in the masterbatches market is the volatility of raw material prices. Masterbatches are typically made from polymers and various additives, whose prices can be influenced by factors such as crude oil fluctuations, geopolitical tensions, and supply chain disruptions. These price variations can affect the profitability of masterbatch manufacturers, as they may find it difficult to pass on increased costs to end-users. Managing these fluctuations requires effective procurement strategies and cost management practices, which can be complex and resource-intensive.

Poland Masterbatches Market Opportunities:

As environmental concerns continue to rise, there is a growing demand for sustainable and eco-friendly products. This shift presents a substantial opportunity for the masterbatches market. Manufacturers can develop biodegradable and recycled masterbatch solutions that align with the circular economy principles. By focusing on sustainable practices, companies can cater to the increasing consumer and regulatory demand for green products. Investments in research and development of biodegradable masterbatches and recycling technologies can open new market segments and enhance the reputation of companies as environmentally responsible entities.

POLAND MASTERBATCHES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, polymer, application, end user industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

poland |

|

Key Companies Profiled |

Ampacet Corporation, A. Schulman Inc., Avient Corporation, Cabot Corporation, Clariant AG, Gabriel-Chemie, Hubron International, Penn Color Inc., Plastika Kritis S.A., Polyone Corporation, Tosaf Group Ltd. |

Poland Masterbatches Market Segmentation:

Poland Masterbatches Market Segmentation: By Type

- Color Masterbatches

- Additive Masterbatches

- White Masterbatches

- Black Masterbatches

- Filler Masterbatches

Color masterbatches represent the largest segment in the Poland masterbatches market. These masterbatches are widely used across various industries, including packaging, automotive, consumer goods, and construction, to impart vibrant and consistent colors to plastic products. The versatility of color masterbatches makes them indispensable for creating visually appealing and customized plastic items. The demand for aesthetically pleasing packaging, especially in the food and beverage and cosmetic industries, significantly drives this segment. Additionally, advancements in color technology, which allow for the creation of special effects such as metallic and pearlescent finishes, further bolster the popularity of color masterbatches.

Additive masterbatches are the fastest-growing segment in the Poland masterbatches market. These masterbatches enhance the functional properties of plastics, making them more durable, UV resistant, flame retardant, and antimicrobial, among other characteristics. The growing awareness and regulatory requirements for safety, sustainability, and performance in various end-use industries are driving the demand for additive masterbatches. For instance, the automotive and construction industries increasingly require plastics that can withstand harsh environmental conditions and comply with safety standards. The rising trend of smart packaging, which incorporates functionalities such as freshness indicators and antimicrobial properties, also contributes to the rapid growth of the additive masterbatches segment.

Poland Masterbatches Market Segmentation: By Polymer

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Other Polymers

Polyethylene (PE) masterbatches constitute the largest segment by polymer type in the Poland masterbatches market. PE is widely favored for its versatility, cost-effectiveness, and excellent properties such as flexibility, chemical resistance, and durability. These characteristics make PE masterbatches ideal for a broad range of applications, particularly in the packaging industry. The demand for PE masterbatches is driven by their extensive use in producing plastic films, bags, bottles, and containers. The packaging industry's continual growth, fueled by increasing consumerism and the need for efficient packaging solutions, ensures the dominance of PE masterbatches in the market. Additionally, PE's recyclability and adaptability to various processing techniques further enhance its widespread adoption across multiple sectors.

Polypropylene (PP) masterbatches are the fastest growing segment in the Poland masterbatches market. PP is known for its high melting point, superior strength, and resistance to environmental stress cracking, making it highly suitable for demanding applications. The automotive and construction industries are key drivers of this segment, as they increasingly incorporate PP for manufacturing components like automotive parts, pipes, and fittings due to its robustness and lightweight nature. Furthermore, the rise in the production of consumer goods and the growing trend towards using plastics that offer better performance and longer life contribute to the rapid growth of PP masterbatches. The polymer's versatility, combined with ongoing innovations in PP formulations that enhance its properties, ensures its accelerating demand in the masterbatches market.

Poland Masterbatches Market Segmentation: By Application

- Packaging

- Automotive

- Construction

- Consumer Goods

- Agriculture

- Textiles

- Medical and Healthcare

- Others

The packaging segment stands as the largest application segment in the Poland masterbatches market. This prominence is driven by the extensive use of plastics in the packaging industry, which requires consistent quality and vibrant colors to enhance product appeal and brand differentiation. Masterbatches are essential in creating various packaging solutions, including food and beverage containers, pharmaceutical packaging, and industrial packaging materials. The demand for innovative and sustainable packaging options, such as recyclable and biodegradable materials, further fuels the growth of this segment. As consumer preferences shift towards visually appealing and eco-friendly packaging, the packaging industry's reliance on masterbatches continues to expand, solidifying its position as the largest application segment.

The automotive segment is the fastest-growing application segment in the Poland masterbatches market. The increasing use of plastics in the automotive industry is driven by the need for lightweight, durable, and cost-effective materials that can enhance fuel efficiency and reduce emissions. Masterbatches play a crucial role in this sector by providing the necessary properties, such as UV resistance, flame retardancy, and improved mechanical strength, required for various automotive components. As the automotive industry in Poland continues to grow, with investments from global car manufacturers and the rise of electric vehicles, the demand for advanced plastic materials is surging. This trend propels the rapid growth of the masterbatches market within the automotive sector, as manufacturers seek innovative solutions to meet stringent performance and safety standards.

Poland Masterbatches Market Segmentation: By End-use Industry

- Packaging Industry

- Automotive Industry

- Construction Industry

- Consumer Goods Industry

- Agriculture Industry

- Textile Industry

- Medical and Healthcare Industry

- Electrical and Electronics Industry

- Others

The packaging industry is the largest end-use segment in the Poland masterbatches market. This sector dominates due to the pervasive use of plastic packaging across various consumer goods, including food, beverages, pharmaceuticals, and cosmetics. Masterbatches play a critical role in this industry by providing color, enhancing performance, and improving the appearance of packaging materials. With the increasing demand for eye-catching and functional packaging solutions that extend shelf life and ensure product safety, the packaging industry drives a significant portion of masterbatch consumption. Additionally, the push towards sustainable and recyclable packaging solutions is fostering innovation in masterbatch formulations, reinforcing the packaging sector's leading position in the market.

The automotive industry is the fastest-growing end-use segment in the Poland masterbatches market. The shift towards using more plastics in vehicle manufacturing is driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. Masterbatches are essential in this sector for imparting specific properties such as UV resistance, thermal stability, and impact resistance to automotive components. As Poland’s automotive sector expands, fueled by investments from major global manufacturers and the rise of electric vehicles, the demand for advanced plastic materials and masterbatches grows rapidly. This trend reflects the automotive industry's push for innovation and performance, making it a key driver of growth in the masterbatches market.

Poland Masterbatches Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Central Poland is the largest regional segment in the masterbatches market. This region, which includes major industrial hubs such as Warsaw and Łódź, benefits from a well-established manufacturing infrastructure and a dense network of industrial facilities. Central Poland's prominence in the masterbatches market is largely due to its strong base in the packaging, automotive, and consumer goods industries, which are significant consumers of masterbatch products. The presence of numerous production facilities and distribution centers in this region enhances the accessibility and supply of masterbatch products, making it a central hub for the industry. Additionally, Central Poland's strategic location provides easy access to other European markets, further boosting its role in the masterbatches sector.

Western Poland is the fastest-growing regional segment in the masterbatches market. This growth is driven by the region's burgeoning industrial activities and increasing investments in sectors such as automotive manufacturing, packaging, and construction. Cities like Wrocław and Poznań are emerging as key industrial centers, attracting significant investments and fostering a dynamic environment for manufacturing and innovation. The expansion of industrial parks and the establishment of new production facilities in Western Poland are contributing to the rising demand for masterbatch products. Furthermore, the region's focus on modernizing its infrastructure and enhancing its manufacturing capabilities is accelerating its growth in the masterbatches market, making it a rapidly expanding area with substantial future potential.

COVID-19 Impact Analysis on Poland Masterbatches Market:

The COVID-19 pandemic significantly impacted the Poland masterbatches market, which involves the production of concentrated mixtures used to impart color or specific properties to plastics. The initial phase of the pandemic saw disruptions in supply chains due to lockdowns and restrictions, leading to delays in raw material procurement and a slowdown in production. Many manufacturing facilities faced temporary closures or operated at reduced capacity, affecting the overall output. The demand for masterbatches fluctuated, with sectors such as automotive and construction witnessing a decline due to halted projects and reduced consumer spending, while the packaging sector saw a surge driven by increased demand for food and medical supplies.

Latest Trends/ Developments:

The Poland masterbatches market is witnessing several key trends and developments that are shaping its future. One notable trend is the growing demand for sustainable and eco-friendly masterbatches. With increasing environmental awareness, manufacturers are focusing on developing biodegradable and recyclable masterbatches to meet stringent regulations and cater to the preferences of eco-conscious consumers. This shift is driven by both governmental policies aimed at reducing plastic waste and the rising consumer demand for greener products. Companies are investing in research and development to create innovative solutions that offer the same performance as traditional masterbatches while minimizing environmental impact.

Key Players:

- Ampacet Corporation

- A. Schulman Inc.

- Avient Corporation

- Cabot Corporation

- Clariant AG

- Gabriel-Chemie

- Hubron International

- Penn Color Inc.

- Plastika Kritis S.A.

- Polyone Corporation

- Tosaf Group Ltd.

Chapter 1. POLAND MASTERBATCHES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. POLAND MASTERBATCHES MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. POLAND MASTERBATCHES MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. POLAND MASTERBATCHES MARK ET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. POLAND MASTERBATCHES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. POLAND MASTERBATCHES MARKET – By Type

6.1 Introduction/Key Findings

6.2. Color Masterbatches

6.3. Additive Masterbatches

6.4. White Masterbatches

6.5. Black Masterbatches

6.6. Filler Masterbatches

6.7 . Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. POLAND MASTERBATCHES MARKET – By Polymer

7.1. Introduction/Key Findings

7.2. Polyethylene (PE)

7.3. Polypropylene (PP)

7.4. Polyvinyl Chloride (PVC)

7.5. Polystyrene (PS)

7.6. Acrylonitrile Butadiene Styrene (ABS)

7.7. Polyethylene Terephthalate (PET)

7.8. Polycarbonate (PC)

7.9. Other Polymers

7.10. Y-O-Y Growth trend Analysis By Polymer

7.11. Absolute $ Opportunity Analysis By Polymer , 2023-2030

Chapter 8. POLAND MASTERBATCHES MARKET – By Application

8.1. Introduction/Key Findings

8.2. Packaging

8.3. Automotive

8.4. Construction

8.5. Consumer Goods

8.6. Agriculture

8.7. Textiles

8.8. Medical and Healthcare

8.9. Others

8.10. Y-O-Y Growth trend Analysis Application

8.11. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 9. POLAND MASTERBATCHES MARKET –By End-use Industry

9.1. Introduction/Key Findings

9.2. Packaging Industry

9.3. Automotive Industry

9.4. Construction Industry

9.5. Consumer Goods Industry

9.6. Agriculture Industry

9.7. Textile Industry

9.8. Medical and Healthcare Industry

9.9. Electrical and Electronics Industry

9.10. Others

9.11. Y-O-Y Growth trend Analysis End-use Industry

9.12. Absolute $ Opportunity Analysis End-use Industry , 2023-2030

Chapter 10. POLAND MASTERBATCHES MARKET – By Region

10.1. Asia Pacific

10.1.1. By Country

10.1.1.1. China

10.1.1.2. Japan

10.1.1.3. South Korea

10.1.1.4. India

10.1.1.5. Australia & New Zealand

10.1.1.6. Rest of Asia-Pacific

10.1.2. By Application

10.1.3. By Polymer

10.1.4. By End-use Industry

10.1.5. By Product Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. POLAND MASTERBATCHES MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Ampacet Corporation

11.2. A. Schulman Inc.

11.3. Avient Corporation

11.4. Cabot Corporation

11.5. Clariant AG

11.6. Gabriel-Chemie

11.7. Hubron International

11.8. Penn Color Inc.

11.9. Plastika Kritis S.A.

11.10. Polyone Corporation

11.11. Tosaf Group Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

. The Poland Masterbatches Market is valued at USD 1.8 Billion and is projected to reach a market size of USD 2.93 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

. Growing Demand from the Packaging Industry, Expansion of the Automotive Sector, Increasing Use in Construction Materials & Advancements in Masterbatch Technology are the major drivers of the Poland Masterbatches Market

Color Masterbatches, Additive Masterbatches, White Masterbatches, Black Masterbatches, and Filler Masterbatches are the segments under the Poland Masterbatches Market by type.

Central Poland is the most dominant region for the Poland Masterbatches Market.

Western Poland is the fastest-growing region in the Poland Masterbatches Market.