Poland Cards and Payments Market Size (2024-2030)

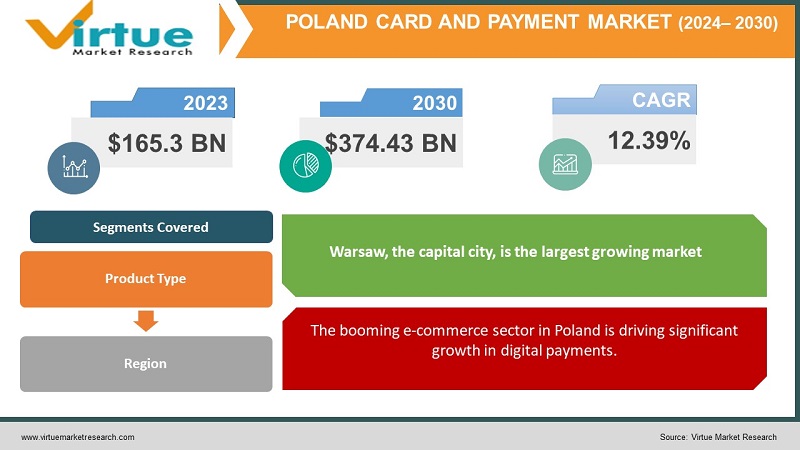

The Poland cards and payments market was valued at USD 165.3 billion in 2023 and is projected to reach a market size of USD 374.43 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.39%.

A convergence of variables, including government initiatives, technology improvements, and cultural preferences, is causing a seismic upheaval in Poland's payment landscape. A tech-savvy populace ready to embrace the efficiency and ease of cashless transactions is at the center of this shift. Poland, in contrast to many of its European peers, has a payments ecosystem where debit cards dominate, accounting for an astounding 79 percent of the market. This dominance can be linked to societal norms that favor debit cards over other payment options because of their lower related fees. The swift adoption of cashless transactions is accelerated by programs such as "Cashless Poland," which are designed to encourage electronic payments and decrease dependence on physical currency.

Key Market Insights:

The payment landscape in Poland is changing dramatically, primarily due to a rise in digital adoption and a slow move away from cash. In Poland, debit cards are the clear leaders, making up about 80% of all payment cards in use, in contrast to many of their Western counterparts. This inclination is a result of historical precedent and cultural influences, but it also reflects the security and ease that come with contemporary debit options. More than 80% of card transactions in Poland are contactless, making it one of the countries in Europe with the greatest penetration rates of contactless payments. Poland is leading the way in the cashless revolution due to its quick adoption, which is being pushed by government initiatives and customer preferences for simplicity and speed. Although global powerhouses such as Visa and Mastercard have considerable influence, a domestic competitor, BLIK, has become a prominent participant. With the help of this cutting-edge mobile payment solution, customers may approve transactions straight from their banking apps, providing a safe and easy experience. BLIK is incredibly popular for online shopping, especially on big shopping days like Black Friday.

Poland Cards and Payments Market Drivers:

The booming e-commerce sector in Poland is driving significant growth in digital payments.

Convenience, choice, and accessibility are driving a dynamic shift in the Polish e-commerce market away from brick-and-mortar supremacy and toward an online realm. Digital payments are at the core of this shift, bringing in a new era of seamless transactions and improved customer experiences. The desire for quick and safe payment options has increased dramatically as online shopping has become more common, which has led to the explosive growth of digital payments in Poland. Credit cards, debit cards, and creative alternative payment gateways are just a few of the payment methods that are integrated to provide customers with a wide range of options for quick and safe payments. With the ability to start transactions straight from bank accounts, online banking has emerged as the mainstay of digital payments. Easy fund transfers, payments, and financial management are now possible with Polish banks' expanding Internet banking services—all from the convenience of your home or mobile device. The easy shopping experience is produced by this seamless integration with e-commerce platforms, which also expedites the payment procedure. These days, e-wallets are essential tools for digital transactions since they provide a safe and easy way to store payment information and make online purchases. Widely used services like PayPal, Google Pay, and Apple Pay offer a seamless payment experience along with improved security due to state-of-the-art authentication and encryption techniques.

The cards and payments market in Poland is being driven by efforts to promote financial inclusion and accessibility.

The development of Poland's card and payments market is mostly determined by factors such as financial inclusion and accessibility, which demonstrate a strong commitment to providing basic banking services and digital payment solutions to all societal sectors. In an attempt to close the gap between underprivileged people and mainstream financial services, this coordinated drive towards inclusion encompasses a blend of technical innovation, regulatory measures, and cooperative endeavors between financial institutions and fintech startups. The fundamental principle of this venture is the unwavering dedication to providing banking services to underserved groups, such as those living in low-income neighborhoods and rural locations. Due to financial difficulties, a lack of physical bank branches, and geographic restrictions, these communities have historically had considerable obstacles when trying to use standard banking services. However, the emergence of mobile payments and digital banking has signaled a revolutionary change that has reduced obstacles and increased the accessibility of financial services for formerly underserved populations.

Poland Cards and Payments Market Restraints and Challenges:

One of the significant challenges facing the cards and payments market in Poland is the limited digital infrastructure, particularly in rural and remote areas.

The cards and payments industry faces a major obstacle from Poland's sparsely distributed digital infrastructure, which prevents the country's rural and isolated areas from widely adopting electronic payment and digital banking services. Even with the fast technological improvements that urban areas have undergone, many rural populations continue to have unequal access to digital resources and internet connectivity. One of the main issues in rural areas, where access to high-speed broadband networks may be limited or nonexistent, is inadequate internet connectivity. Individuals and organizations are unable to access digital payment platforms, execute electronic transactions, or participate in online banking due to the unreliability of the Internet infrastructure. Residents' access to the advantages of digital financial services may be restricted as a result, forcing them to depend on conventional banking services and cash transactions. In addition, there are frequently few physical bank branches and ATM networks in rural areas, which makes it more difficult for locals to obtain financial services.

Economic uncertainty looms as a formidable obstacle confronting the cards and payments market in Poland.

When economic downturns cast their shadow, consumer confidence often takes a nosedive. Tightened belts and cautious spending have become the norm, with essential purchases prioritized and discretionary expenses falling by the wayside. This translates to fewer transactions, potentially stagnating growth and hindering the adoption of new payment solutions. Adding fuel to the fire, inflation erodes purchasing power, leaving less disposable income for non-essentials. Food, fuel, and housing devour a larger portion of budgets, leaving less room for other goods and services. This translates to softer demand for merchants, impacting transaction volumes and revenue streams. Geopolitical tensions and global economic uncertainties act as storm clouds, casting long shadows over consumer sentiment and investor confidence. Trade disputes, conflicts, and currency fluctuations introduce volatility, prompting businesses to adopt a more conservative approach to expansion and investment. This can stifle innovation and slow down market growth in the payments sector.

Poland Cards and Payments Market Opportunities:

Poland's card and payments market pulsates with potential, fueled by a tech-savvy population, government initiatives, and a booming e-commerce scene. The surging e-commerce sector demands seamless and secure online payments. Open banking solutions and instant payment systems can simplify transactions, while "Buy Now, Pay Later" (BNPL) options cater to millennials seeking flexible payment options. Fingerprint and facial recognition technologies are gaining traction, offering enhanced security and a touch-free experience. Banks and fintech players can capitalize on this trend by integrating biometrics into payment cards and wearables. While e-wallets like Apple Pay and Google Pay are popular, niche solutions like Blik hold immense potential. Further integrating Blik with e-commerce platforms and expanding its functionalities can unlock wider adoption. As the gig economy flourishes, micropayment solutions offering instant and seamless transactions for small-value payments will be crucial. Innovative solutions catering to freelancers and microbusinesses can tap into this burgeoning segment. With rising competition, offering cashback and loyalty programs can incentivize card usage and attract new customers. Banks and fintech companies can partner with retailers to create unique and value-added programs. Collaborations between banks, fintech startups, and established players can foster innovation, share resources, and expand reach, benefiting the entire ecosystem.

POLAND CARDS AND PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.6% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Poland |

|

Key Companies Profiled |

PKO Bank Polski, Santander Bank Polska, Pekao S.A., Millenium Bank, mBank, ING Bank Śląski, Alior Bank, Credit Agricole Bank |

Poland Cards and Payments Market Segmentation

Poland Cards and Payments Market Segmentation: By Product Type

- Cards

- Mobile wallets

- Bank transfers

- Cash

Cards are both the largest and fastest-growing segment, with a share of around 80%. Cash has traditionally been the preferred payment method, and debit cards offer a familiar and convenient alternative with lower fees compared to credit cards. Cashless Poland" initiatives aim to promote debit card usage through incentives and infrastructure development. Poland boasts one of the highest contactless payment penetration rates in Europe, making debit cards even more convenient for everyday transactions. Mobile wallets have been gaining traction, particularly among younger generations. Apple Pay, Google Pay, and BLIK (a local bank-backed system) account for roughly 5% of transactions. BLIK enjoys wider e-commerce integration and boasts impressive user numbers. Bank transfers are still commonly used for online payments and bills, accounting for around 3–5% of transactions. However, their share is expected to decline as digital wallets gain popularity. Cash, although declining, still holds a 2-3% share, primarily among older demographics and in smaller towns. Mobile wallets are undoubtedly the fastest-growing segment. This is driven by increased smartphone penetration, convenience and speed, enhanced security, and integration with e-commerce platforms.

Market Segmentation: Regional Analysis

Warsaw, the capital city, is the largest growing market, accounting for approximately 30% of the total market share. Warsaw boasts the largest population in Poland, translating to a higher concentration of potential users and merchants. The city serves as a major financial and business hub, attracting diverse industries and fostering higher disposable income. Warsaw benefits from a well-developed payment infrastructure, facilitating wider adoption of digital payment methods. The city attracts a tech-savvy population that readily embraces new payment technologies. Kraków, the second-largest city, is the fastest-growing area. It holds a significant share of around 20%, driven by its cultural significance, tourism industry, and growing tech sector. The city attracts a significant number of tourists, contributing to increased cashless transactions. Kraków is becoming a hub for innovative startups, including fintech companies, fueling digital payment adoption. Like Warsaw, government initiatives like "Cashless Krakow" are actively promoting digital payments. In Łódź and Wrocław, steady growth is being seen due to their developing economies and increasing digital adoption. Smaller towns and rural areas collectively have cash still holding a stronger presence due to demographic factors and slower infrastructure development.

COVID-19 Impact Analysis on the Poland Card and Payments Market.

Hygiene concerns fueled the rapid adoption of contactless payments, pushing Poland even further towards its "Cashless Poland" vision. Contactless transactions skyrocketed, exceeding 80%, solidifying their dominance. Lockdowns and social distancing drove a surge in online shopping, forcing businesses to adopt secure digital payment methods. This propelled mobile wallets like BLIK and international players like Apple Pay and Google Pay to prominence. Initiatives like "Polska Bezgotówkowa" (Cashless Poland) offered incentives for both consumers and merchants, further accelerating the shift towards digital transactions. Concerns about online fraud led to increased development and adoption of advanced security measures like biometrics and tokenization. Growing demand for seamless online transactions fueled the adoption of open banking solutions, enabling secure data sharing between banks and third-party providers for innovative payment experiences. Despite the progress, disparities in internet access and digital literacy remain, particularly in rural areas. Bridging this gap is crucial for inclusive financial participation.

Latest Trends/ Developments:

Poland's card and payment landscape is pulsating with change, driven by a tech-savvy population and a government actively pushing for a cashless society. Fingerprint and facial recognition technologies are increasingly embedded in cards and mobile wallets, offering both convenience and security. Banks are leading the charge, with institutions like Bank Pocztowy launching biometric Mastercard debit cards. This trend enhances the user experience and addresses growing security concerns. Open banking regulations are unlocking innovation, allowing third-party providers to access financial data with user consent. This fosters competition and personalized financial solutions. For example, the "Instant Payments" system allows near-instant money transfers between different banks, revolutionizing online transactions. Poland's booming e-commerce sector demands an agile payments ecosystem. Secure online gateways like Przelewy24 and Dotpay are expanding, integrating various payment methods like BLIK and BLIK Code, a QR code solution, for a seamless online shopping experience. While the zloty remains king, cryptocurrencies like Bitcoin and stablecoins are gaining traction. Though not yet mainstream, crypto-friendly businesses are emerging, and the government is exploring regulatory frameworks for this nascent space. With increased digital transactions, data privacy and security concerns are paramount. The government is implementing stricter regulations like PSD2, demanding strong authentication and data protection measures. Consumers are also becoming more aware of their rights and opting for secure payment methods. The National Bank of Poland (NBP) plays a crucial role in shaping the market. Initiatives like "Cashless Poland" promote digital payments, while regulations like open banking encourage competition and innovation. These developments create a dynamic environment for growth and consumer choice. Embracing emerging trends like biometrics, open banking, and alternative currencies will be crucial for players to stay ahead of the curve.

Key Players:

- PKO Bank Polski

- Santander Bank Polska

- Pekao S.A.

- Millenium Bank

- mBank

- ING Bank Śląski

- Alior Bank

- Credit Agricole Bank

Chapter 1. Poland Card and Payments Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Poland Card and Payments Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Poland Card and Payments Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Poland Card and Payments Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Poland Card and Payments Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Poland Card and Payments Market– By Product Type

6.1. Introduction/Key Findings

6.2. Cards

6.3. Mobile wallets

6.4. Bank transfers

6.5. Cash

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Poland Card and Payments Market, By Geography – Market Size, Forecast, Trends & Insights

7.1. Poland

7.1.1. By Country

7.1.1.1. Poland

7.1.2. By Product Type

7.1.3. Countries & Segments - Market Attractiveness Analysis

Chapter 8. Poland Card and Payments Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 PKO Bank Polski

8.2. Santander Bank Polska

8.3. Pekao S.A.

8.4. Millenium Bank

8.5. mBank

8.6. ING Bank Śląski

8.7. Alior Bank

8.8. Credit Agricole Bank

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The e-commerce sector and efforts to promote financial inclusion as well as accessibility are the main drivers in this market

Limited digital infrastructure and economic uncertainty are the main concerns being faced by the market

PKO Bank Polski, Santander Bank Polska, Pekao S.A., Millenium Bank, mBank, ING Bank Śląski, Alior Bank, and Credit Agricole Bank are the prominent players.

Warsaw currently holds the largest market share, estimated at around 30%.

Kraków exhibits the fastest growth, driven by its increasing population, expanding economy, and government programs aimed at bridging the digital divide and fostering technological innovation.