Point of Care Diagnostics Market Size (2025 – 2030)

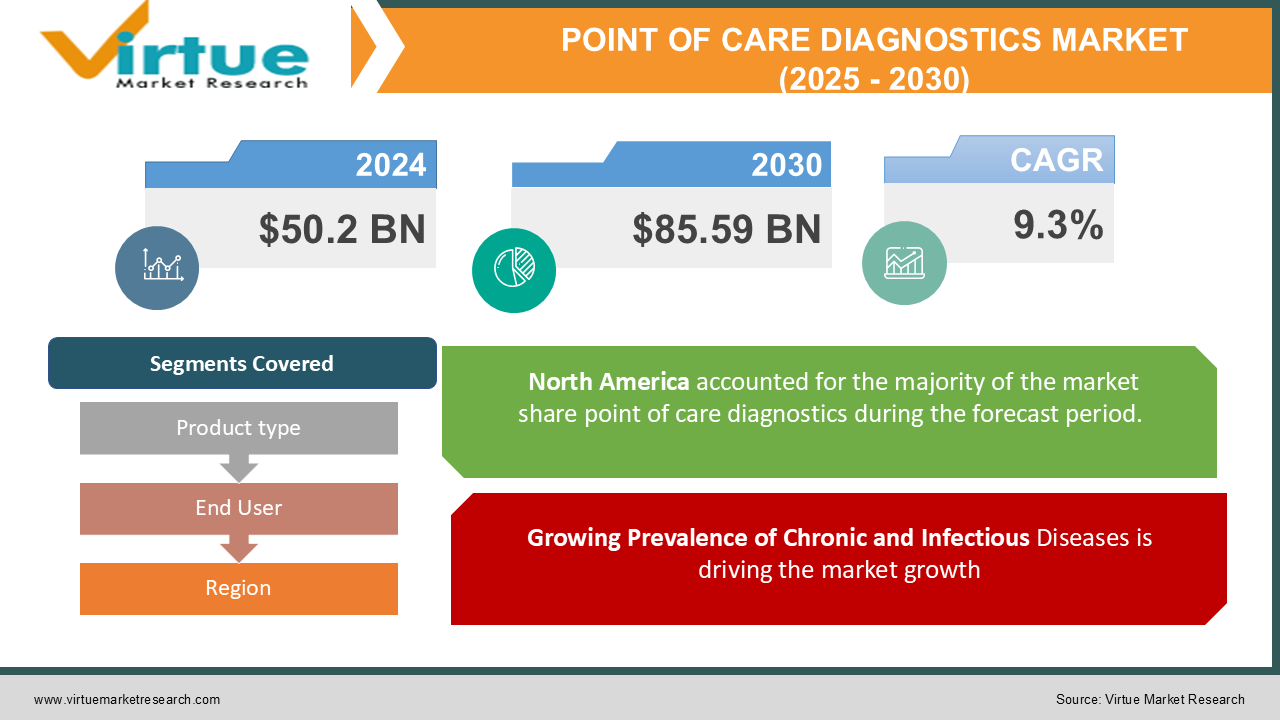

The Global Point of Care (POC) Diagnostics Market was valued at USD 50.2 billion in 2024 and is expected to reach USD 85.59 billion by 2030, growing at a CAGR of 9.3% during the forecast period. Point-of-care diagnostics refer to medical testing conducted at or near the site of patient care to enable rapid decision-making and treatment initiation.

With a growing focus on patient-centric healthcare, advancements in diagnostic technology, and the increasing prevalence of chronic and infectious diseases, POC diagnostics have become a critical component of modern healthcare systems. The market spans a variety of testing categories, including glucose monitoring, infectious disease testing, cardiac markers, and coagulation testing. The advent of portable, user-friendly devices combined with rising adoption in homecare settings has further driven demand. Increasing government initiatives for early disease detection and management have also played a key role in the market's expansion.

Key Market Insights

-

Glucose monitoring devices hold the largest market share, driven by the rising prevalence of diabetes worldwide.

-

Homecare settings are the fastest-growing end-user segment due to an increasing preference for remote patient management. Technological advancements, including the integration of AI and IoT in diagnostic devices, are transforming the market landscape.

-

Infectious disease testing, particularly for respiratory infections like COVID-19 and influenza, remains a prominent driver of market growth.

-

The Asia-Pacific region is expected to witness the highest growth rate due to rising healthcare expenditure and growing awareness of early diagnosis.

-

Regulatory approvals and collaborations between diagnostic companies and healthcare providers are expanding the accessibility of POC testing devices.

-

Challenges include strict regulatory frameworks, high costs associated with advanced diagnostic devices, and concerns about accuracy in non-laboratory settings.

Global Point of Care Diagnostics Market Drivers

Growing Prevalence of Chronic and Infectious Diseases is driving the market growth

The increasing global burden of chronic diseases such as diabetes, cardiovascular disorders, and cancer, along with infectious diseases like COVID-19, influenza, and tuberculosis, is driving demand for point-of-care diagnostics. According to the World Health Organization (WHO), over 422 million people globally suffer from diabetes, with the number rising steadily. POC diagnostics provide rapid results, enabling timely interventions that are particularly critical for managing these diseases. For instance, glucose monitoring systems allow diabetic patients to self-monitor their blood sugar levels, improving disease management and reducing complications. Similarly, the demand for rapid COVID-19 antigen tests during the pandemic demonstrated the pivotal role of POC diagnostics in infectious disease control.

Advancements in Diagnostic Technologies is driving the market growth

Technological advancements, such as miniaturized biosensors, portable testing devices, and the integration of AI and IoT, have significantly enhanced the capabilities and accessibility of POC diagnostic tools. Innovations in molecular diagnostics, including polymerase chain reaction (PCR) and isothermal amplification technologies, have expanded the scope of POC testing to include complex diagnostic applications like genetic testing and cancer biomarker analysis. Moreover, connectivity features in modern devices enable real-time data sharing with healthcare providers, facilitating better patient monitoring and care coordination.

Shift Towards Decentralized Healthcare and Homecare Settings is driving the market growth

With healthcare systems moving toward decentralized models, there is a growing emphasis on delivering diagnostic solutions outside of traditional laboratory environments. The convenience, cost-effectiveness, and ease of use associated with POC devices make them ideal for homecare settings, rural healthcare centers, and emergency medical scenarios. For example, wearable glucose monitors and portable ECG devices allow patients to monitor their health conditions in real-time without frequent hospital visits. This trend aligns with the broader push for value-based healthcare, where early diagnosis and preventive care take precedence.

Global point of care diagnostics Market Challenges and Restraints

Regulatory and Accuracy Challenges is restricting the market growth

One of the primary challenges in the POC diagnostics market is navigating the stringent regulatory requirements for device approval. Regulatory bodies such as the FDA, EMA, and others demand rigorous clinical validation to ensure the accuracy, reliability, and safety of diagnostic devices.

Additionally, concerns about the accuracy of POC tests compared to laboratory-based testing persist, particularly for complex diagnostic applications. Inadequate training and improper usage of devices in non-clinical settings can lead to erroneous results, undermining the reliability of these solutions.

High Costs of Advanced Diagnostic Devices is restricting the market growth

While POC diagnostics are generally cost-effective in the long term, the initial costs associated with advanced devices can be prohibitive, particularly for small clinics and healthcare providers in low-income regions. For example, molecular diagnostic tools for infectious disease detection often require specialized reagents and equipment, increasing overall costs. This limits their adoption, especially in resource-constrained settings where affordability is a critical factor.

Market Opportunities

The Global Point of Care Diagnostics Market presents significant growth opportunities across multiple dimensions. The rising focus on personalized medicine and early disease detection is expected to drive innovation in POC technologies. Devices capable of simultaneous multi-analyte testing, such as platforms that can detect glucose, cholesterol, and cardiac markers in a single test, are gaining traction. The demand for POC diagnostics in emerging markets is another major growth area. Countries in the Asia-Pacific and Africa regions are witnessing rapid improvements in healthcare infrastructure, along with increasing awareness of preventive healthcare. Governments and NGOs are launching initiatives to provide affordable diagnostic solutions, creating a favorable market environment. Another area of opportunity lies in the development of AI-powered POC diagnostic tools. AI algorithms can enhance test accuracy, automate result interpretation, and facilitate better decision-making for healthcare providers. For instance, AI-integrated digital pregnancy tests and AI-powered portable ultrasound devices represent the future of POC diagnostics. Collaboration between device manufacturers, healthcare providers, and technology companies will further accelerate the adoption of these solutions. Additionally, partnerships with telemedicine platforms can create integrated care ecosystems, enhancing the utility and appeal of POC devices.

POINT OF CARE DIAGNOSTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.3% |

|

Segments Covered |

By Product, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, QuidelOrtho Corporation, bioMérieux SA, Thermo Fisher Scientific, EKF Diagnostics, Nova Biomedical, Trinity Biotech |

Point of Care Diagnostics Market Segmentation - By Product

-

Glucose Monitoring Devices

-

Infectious Disease Testing Kits

-

Cardiac Markers

-

Coagulation Testing

-

Hematology Testing

-

Others

Glucose monitoring devices dominate the product segment, driven by the rising prevalence of diabetes and the widespread adoption of self-monitoring devices like glucometers and continuous glucose monitors. The infectious disease testing segment is also growing rapidly, with increased demand for rapid COVID-19, flu, and malaria testing kits.

Point of Care Diagnostics Market Segmentation - By End-User

-

Hospitals and Clinics

-

Homecare Settings

-

Diagnostic Laboratories

Homecare settings represent the fastest-growing segment due to the rising adoption of portable and user-friendly diagnostic devices. Meanwhile, hospitals and clinics remain the primary end-users due to the higher accuracy and reliability required for critical care diagnostics.

Point of Care Diagnostics Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest share of the global market, driven by advanced healthcare infrastructure, high adoption of innovative technologies, and a strong focus on chronic disease management. The U.S., in particular, leads the region due to widespread use of glucose monitors and growing demand for home-based diagnostics. The Asia-Pacific region is expected to witness the highest growth during the forecast period, supported by rising healthcare expenditure, increasing prevalence of chronic diseases, and government initiatives promoting early diagnosis. Countries like India, China, and Japan are at the forefront of this growth.

COVID-19 Impact Analysis

The COVID-19 pandemic served as a catalyst for the rapid advancement and widespread adoption of point-of-care (POC) diagnostics. The urgent need for rapid and accurate testing to contain the virus spurred significant investments in research and development, leading to the accelerated development and deployment of POC testing solutions. The pandemic underscored the critical role of decentralized testing in public health emergencies, as POC devices enabled timely diagnosis and isolation of infected individuals, even in remote and resource-limited settings. Companies like Abbott and Roche Diagnostics emerged as key players, introducing innovative COVID-19 POC tests that gained rapid regulatory approval and widespread use. While the pandemic highlighted the potential of POC diagnostics, it also exposed vulnerabilities in the supply chain and regulatory processes. Supply chain disruptions and the need for rapid regulatory approvals presented significant challenges to the industry. However, the lessons learned from the pandemic have the potential to drive future innovation and preparedness for future health crises. By addressing supply chain resilience and streamlining regulatory pathways, the industry can ensure a robust and responsive POC diagnostics ecosystem.

Latest Trends/Developments

The field of diagnostics is undergoing a transformative phase, driven by technological advancements and evolving healthcare needs. Molecular diagnostics, powered by cutting-edge techniques like CRISPR and NGS, are paving the way for rapid and accurate detection of complex diseases, including cancer and genetic disorders. These technologies are enabling the development of point-of-care (POC) devices, bringing diagnostic capabilities to remote and underserved areas. Wearable diagnostic devices, equipped with biosensors, are revolutionizing personal health monitoring by providing real-time insights into vital parameters like glucose levels and heart rate. AI and big data are further elevating the diagnostic landscape, enabling predictive analytics and personalized healthcare. By analyzing vast amounts of patient data, AI algorithms can identify patterns and trends, leading to early disease detection and intervention. In addition to technological advancements, sustainability is emerging as a key focus area for diagnostic manufacturers. The industry is increasingly adopting eco-friendly practices, such as the use of recyclable materials and energy-efficient designs. Moreover, the development of multi-analyte platforms is gaining momentum, offering the potential for comprehensive health assessments with a single test. These devices can simultaneously measure multiple biomarkers, providing valuable information for chronic disease management and preventive healthcare. As the diagnostic landscape continues to evolve, these trends are poised to reshape healthcare delivery, empowering individuals to take control of their health and enabling healthcare providers to make informed decisions.

Key Players

-

Abbott Laboratories

-

Roche Diagnostics

-

Siemens Healthineers

-

Danaher Corporation

-

QuidelOrtho Corporation

-

bioMérieux SA

-

Thermo Fisher Scientific

-

EKF Diagnostics

-

Nova Biomedical

-

Trinity Biotech

Chapter 1. Point of Care Diagnostics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Point of Care Diagnostics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Point of Care Diagnostics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Point of Care Diagnostics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Point of Care Diagnostics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Point of Care Diagnostics Market – By End-User

6.1 Introduction/Key Findings

6.2 Hospitals and Clinics

6.3 Homecare Settings

6.4 Diagnostic Laboratories

6.5 Y-O-Y Growth trend Analysis By End-User

6.6 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 7. Point of Care Diagnostics Market – By Product Type

7.1 Introduction/Key Findings

7.2 Glucose Monitoring Devices

7.3 Infectious Disease Testing Kits

7.4 Cardiac Markers

7.5 Coagulation Testing

7.6 Hematology Testing

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Product Type

7.9 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 8. Point of Care Diagnostics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-User

8.1.3 By Product Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-User

8.2.3 By Product Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-User

8.3.3 By Product Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-User

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-User

8.5.3 By Product Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Point of Care Diagnostics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Abbott Laboratories

9.2 Roche Diagnostics

9.3 Siemens Healthineers

9.4 Danaher Corporation

9.5 QuidelOrtho Corporation

9.6 bioMérieux SA

9.7 Thermo Fisher Scientific

9.8 EKF Diagnostics

9.9 Nova Biomedical

9.10 Trinity Biotech

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 50.2 billion in 2023 and is projected to reach USD 85.59 billion by 2030, growing at a CAGR of 9.3%.

Key drivers include the rising prevalence of chronic and infectious diseases, advancements in diagnostic technology, and increasing adoption in homecare settings.

The market is segmented by product (glucose monitoring, infectious disease testing, cardiac markers, etc.) and end-user (hospitals, homecare, labs).

North America dominates, driven by advanced healthcare infrastructure and high adoption of innovative technologies.

Leading players include Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers.