Pocket Projector Market Size (2023 – 2030)

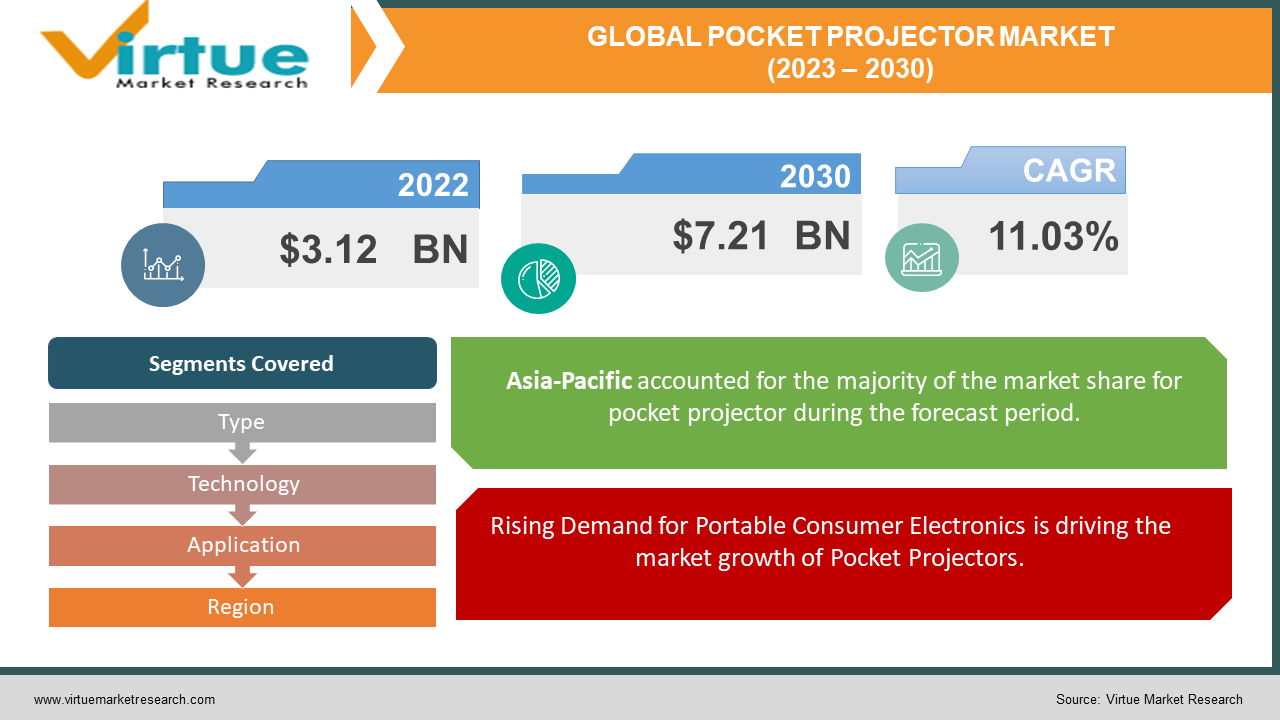

The Global Pocket Projector Market was valued at USD 3.12 billion and is projected to reach a market size of USD 7.21 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 11.03%.

Pocket projectors, or Pocket Projectors, have evolved from a niche concept in the past to mainstream consumer electronics today. These ultra-compact projection devices, small enough to fit in one's pocket, have responded to the growing demand for portable, high-quality displays. Advancements in technology, such as DLP, LCoS, and laser beam scanning, have significantly improved their image quality and brightness, expanding their applications across various sectors, including home entertainment and business presentations. Looking forward, Pocket Projectors are poised for further innovation, likely integrating with wearable devices and enhancing their role as convenient, on-the-go display solutions, shaping the future of projection technology.

Key Market Insights:

Pocket projectors, often referred to as pocket, handheld, or mobile projectors, have revolutionized the way we project video content. These compact hardware devices are designed to project images and videos from various sources like cameras, smartphones, tablets, notebooks, and memory devices onto flat surfaces, eliminating the need for bulky traditional projectors. They have found applications in diverse sectors, from educational institutions to retail, catering to the growing demand for portable and high-quality displays. Pocket Projectors offer an excellent solution for presentations and media viewing, making them increasingly popular among consumers.

The global Pocket Projector market has experienced substantial growth, primarily driven by their integration into a wide range of consumer electronics devices. Devices like smartphones, tablets, and laptops now come equipped with Pocket Projectors, enabling users to enjoy presentations and media content more conveniently. For example, Samsung introduced the Galaxy Beam in June 2021, a foldable smartphone with a built-in Pocket Projector capable of projecting images onto walls. Additionally, the widespread penetration of mobile internet, reaching more than 4.32 billion people globally in 2021, as reported by GSMA Intelligence, has further boosted the demand for Pocket Projectors. With increasing disposable incomes and continuous technological advancements, the global Pocket Projector market is poised for continued expansion in the coming years.

Pocket Projector Market Drivers:

Rising Demand for Portable Consumer Electronics is driving the market growth of Pocket Projectors.

The pocket projector market is experiencing significant growth due to the increasing demand for portable consumer electronics. Consumers today seek compact and versatile devices that can easily fit into their lifestyles. Pocket projectors cater to this demand by offering a portable solution for projecting media content from various devices like smartphones, tablets, and laptops. This trend is driven by the need for on-the-go entertainment and presentations, making pocket projectors a sought-after accessory in the consumer electronics market.

Growing Adoption in Automotive Applications is driving Pocket projectors’ adoption in the automotive sector.

Pocket projectors are finding increased adoption in the automotive sector. This is attributed to their ability to enhance the driving experience by integrating heads-up displays (HUDs) and augmented reality (AR) features into vehicles. These projectors provide crucial information directly onto the windshield, improving safety and convenience for drivers. As automotive manufacturers continue to focus on innovation and smart features, the demand for pocket projectors in this sector is expected to grow further, transforming the way information is presented to drivers.

The healthcare sector is further augmenting the demand for the Pocket Projector market.

The healthcare sector is becoming a significant driver of demand for pocket projectors. These compact projectors are used in various healthcare applications, such as medical imaging, telemedicine, and educational purposes. They enable medical professionals to share visual information with patients and colleagues in a clear and accessible manner. Additionally, pocket projectors support remote consultations and training, making them invaluable tools in the evolving healthcare landscape. The demand for these projectors in healthcare is set to rise as the industry increasingly adopts digital and telehealth solutions to improve patient care and accessibility to medical expertise.

Pocket Projector Market Restraints and Challenges:

Meeting consumer expectations while maintaining a compact size presents technical hurdles for the Pocket Projector Market.

The Pocket Projector Market faces the challenge of balancing consumer expectations with the need to maintain a compact form factor. Consumers demand high-resolution displays, brightness, and connectivity options, all while expecting pocket projectors to remain small and portable. Achieving these technical feats, such as optimizing cooling systems and enhancing optics, can be a daunting task for manufacturers in this competitive space.

Traditional large-scale projectors offering superior performance give tough competition to the Pocket Projectors Market.

The Pocket Projector Market encounters fierce competition from traditional, large-scale projectors that offer superior performance. These larger projectors often boast higher resolutions, brightness, and advanced features, making them a compelling choice for businesses and institutions. Pocket projectors need to continuously innovate and improve their capabilities to carve a niche in the market and cater to specific user needs for portability and convenience.

Pocket Projector Market Opportunities:

Integration in Wearable Devices opens new avenues for market growth for the Pocket projector market.

The Pocket Projector Market is poised for significant growth as it explores integration possibilities with wearable devices. As wearables like smart glasses gain popularity, the incorporation of pocket projectors into these gadgets creates exciting avenues. Imagine accessing a heads-up display or projecting content directly from your eyewear – this opens up new horizons for personal entertainment, professional presentations, and augmented reality experiences. It also caters to the increasing demand for hands-free, portable displays, making pocket projectors a valuable addition to the tech ecosystem and a driving force for market expansion.

Continued advancements in laser projection technology create opportunities for market expansion.

The continuous evolution of laser projection technology is a key driver for the Pocket Projector Market. These advancements enhance the performance and capabilities of pocket projectors. Laser projectors offer sharper images, improved color accuracy, and longer lifespan compared to traditional lamp-based projectors. They also contribute to reduced power consumption and smaller form factors. As laser technology becomes more accessible and affordable, it not only improves the quality of pocket projectors but also expands their application areas, including home entertainment, business presentations, and educational settings, fostering growth opportunities for the market.

POCKET PROJECTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11.03% |

|

Segments Covered |

By Type, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Texas Instruments, Inc., Samsung Electronics Co. Ltd., Aaxa Technologies, Inc., MicroVision, Inc., LG Electronics, Optoma Technology Corp., Opus Microsystems Corp., Lenovo Group Ltd., Syndiant, Celluon, Inc. |

Pocket Projector Market Segmentation: By Type

-

Embedded

-

Stand Alone

In 2022, embedded projectors emerged as the dominant category within the global pocket projector market. These embedded pocket projectors are known for their versatility, compact size, and lightweight design, and are commonly integrated into various smart devices, including laptops, gaming consoles, and portable gadgets. This surge in sales has significantly fueled the overall growth of the global embedded pocket projector market.

Conversely, the standalone segment is anticipated to face a decline in market share in the upcoming years. This can be attributed to challenges such as their relatively higher cost and lower brightness levels, which have led to decreased consumer interest in these standalone projector devices.

Pocket Projector Market Segmentation: By Technology

-

DLP (Digital Light Processing)

-

LCoS (Liquid Crystal on Silicon)

-

LBS (Laser Beam Scanning)

-

Others

In 2022, the DLP (Digital Light Processing) segment asserted its dominance, commanding a substantial 43% share of the market. This preeminence can be attributed to two pivotal factors propelling the growth of digital light processing technology. Firstly, DLP's utilization of sealed imaging chips and filter-free components stands out as a significant growth driver. These imaging chips, integral to DLP projectors, act as effective barriers against dust particles infiltrating the projected image. Furthermore, the absence of air filters in DLP systems translates to reduced maintenance requirements, eliminating the need for filter cleaning.

The digital light processing market's growth trajectory is poised for acceleration. Notably, this includes the development of compact LED pocket projectors, small enough to fit comfortably in a hand and resembling the size of a mobile phone. DLP technology operates through a chip comprising minuscule, microscopic mirrors and a spinning color wheel. Each pixel on this chip functions as a reflecting mirror, with DMDs (Digital Micromirror Devices) housing anywhere from one to two million or more micromirrors. This configuration empowers DLP projectors to deliver exceptionally clear images without the need for filters, while also boasting rapid response times and 3D capabilities. Moreover, the Laser Beam Scanning technology is poised for remarkable growth, with an anticipated high Compound Annual Growth Rate (CAGR). This projection is primarily due to its distinct advantages, such as unparalleled brightness and enhanced image quality, which significantly enhance the overall customer experience.

Pocket Projector Market Segmentation: By Application

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Aerospace & Defense

-

Others

In 2022, the Consumer Electronics sector emerged as the leading contributor to the market, driven by the widespread adoption of smartphones and wearable technology.

Meanwhile, the Healthcare industry is poised for substantial growth in the pocket projector market. These compact projectors are expected to play a pivotal role in enhancing patient management within healthcare facilities. They offer the capability to efficiently share patient data across different departments in hospitals, representing a valuable tool for improving overall healthcare operations.

Pocket Projector Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, the Asia Pacific region asserted its dominance in the global pocket projector market with around 34% of the global share, both in terms of volume and value. This was predominantly influenced by the presence of industry giants like Samsung Electronics Co. Ltd., LG Electronics, Inc., and several other smaller players in the region. The Asia Pacific's ascendancy can also be attributed to substantial investments made by these key players in the manufacturing of electronic devices. Countries such as India, China, and Japan have seen a surge in such investments, further fueling the growth of the pocket projector market.

On the other hand, North America, known for its early adoption of technology and innovation, has exhibited the fastest growth in consumer electronics spending. The region, comprising the United States and Canada, has witnessed a significant uptick in the sales of pocket projectors. This surge can be attributed to the compact design of these projectors and their advanced connectivity features, including Wi-Fi and HDMI interfaces, making them increasingly popular among consumers.

COVID-19 Impact Analysis on the Global Pocket Projector Market:

The global pocket projector market faced a substantial setback in 2020 due to the COVID-19 pandemic. Lockdowns and supply chain disruptions, driven by government restrictions on import/export and retail operations, significantly reduced revenue. However, the pandemic led to a slight uptick in portable pocket projector adoption, especially in educational and corporate sectors.

Post-pandemic, market leaders like Samsung Electronics responded with innovative portable projectors, such as the Freestyle, introduced in March 2022. This advanced device, initially launched in India, met the rising demand and was made available through online channels, marking a strategic move to adapt to changing market dynamics.

Latest Trends/Developments:

In the pocket projector market, several notable trends emerged. Firstly, laser projection technology gained traction, offering benefits like increased brightness and longer lifespan compared to traditional lamp-based projectors.

Secondly, miniaturization continued to make pocket projectors even smaller and more portable, suitable for integration into smartphones, laptops, and wearables. Wireless connectivity became a standard feature in many pocket projectors, facilitating easy content streaming from mobile devices. Battery life improvements ensured extended usage without frequent recharging. Some models even offered higher resolutions like HD and 4K for sharper visuals. Additionally, smart features, such as built-in operating systems and app stores, enhanced versatility. Beyond entertainment, pocket projectors found applications in various sectors, including business presentations, education, and healthcare. They also began integrating into augmented and virtual reality systems, with manufacturers increasingly focusing on eco-friendly designs to reduce power consumption and environmental impact.

Key Players:

-

Texas Instruments, Inc.

-

Samsung Electronics Co. Ltd.

-

Aaxa Technologies, Inc.

-

MicroVision, Inc.

-

LG Electronics

-

Optoma Technology Corp.

-

Opus Microsystems Corp.

-

Lenovo Group Ltd.

-

Syndiant

-

Celluon, Inc.

In August 2023, Samsung announced the Freestyle Gen 2 at CES 2023. The compact 1080p mini-projector maintains its high level of portability with a weight of less than 2 pounds and yet is still capable of creating an image between 30 to 100 inches. The Freestyle projector features a unique 180-degree swivel cradle stand that lets you project onto pretty much any surface. All you need to do is point it at the wall and the auto-correction with fix the image so it's squared off.

Chapter 1. Pocket Projector Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pocket Projector Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pocket Projector Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pocket Projector Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pocket Projector Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pocket Projector Market – By Type

6.1 Introduction/Key Findings

6.2 Embedded

6.3 Stand Alone

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Pocket Projector Market – By Technology

7.1 Introduction/Key Findings

7.2 DLP (Digital Light Processing)

7.3 LCoS (Liquid Crystal on Silicon)

7.4 LBS (Laser Beam Scanning)

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2023-2030

Chapter 8. Pocket Projector Market - By Application

8.1 Introduction/Key Findings

8.2 Consumer Electronics

8.3 Automotive

8.4 Healthcare

8.5 Aerospace & Defense

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Pocket Projector Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.2 By Type

9.3 By Technology

9.4 By Application

9.5 Countries & Segments - Market Attractiveness Analysis

9.6 Europe

9.6.1 By Country

9.6.1.1 U.K.

9.6.1.2 Germany

9.6.1.3 France

9.6.1.4 Italy

9.6.1.5 Spain

9.6.1.6 Rest of Europe

9.7 By Type

9.8 By Technology

9.9 By Application

9.10 Countries & Segments - Market Attractiveness Analysis

9.11 Asia Pacific

9.11.1 By Country

9.11.1.1 China

9.11.1.2 Japan

9.11.1.3 South Korea

9.11.1.4 India

9.11.1.5 Australia & New Zealand

9.11.1.6 Rest of Asia-Pacific

9.12 By Type

9.13 By Technology

9.14 By Application

9.15 Countries & Segments - Market Attractiveness Analysis

9.16 South America

9.16.1 By Country

9.16.1.1 Brazil

9.16.1.2 Argentina

9.16.1.3 Colombia

9.16.1.4 Chile

9.16.1.5 Rest of South America

9.17 By Type

9.18 By Technology

9.19 By Application

9.20 Countries & Segments - Market Attractiveness Analysis

9.21 Middle East & Africa

9.21.1 By Country

9.21.1.1 United Arab Emirates

9.21.1.2 Saudi Arabia

9.21.1.3 Qatar

9.21.1.4 Israel

9.21.1.5 South Africa

9.21.1.6 Nigeria

9.21.1.7 Kenya

9.21.1.8 Egypt

9.21.1.9 Rest of MEA

9.22 By Type

9.23 By Technology

9.24 By Application

9.25 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Pocket Projector Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Texas Instruments, Inc.

10.2 Samsung Electronics Co. Ltd.

10.3 Aaxa Technologies, Inc.

10.4 MicroVision, Inc.

10.5 LG Electronics

10.6 Optoma Technology Corp.

10.7 Opus Microsystems Corp.

10.8 Lenovo Group Ltd.

10.9 Syndiant

10.10 Celluon, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Pocket Projector Market was valued at USD 3.12 billion and is projected to reach a market size of USD 7.21 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 11.03%

The integration of pocket projectors into devices like smartphones and tablets, meeting the demand for portable, high-quality displays, is driving growth.

Integration with wearables, like smart glasses, opens new avenues for personal entertainment, presentations, and augmented reality experiences.

The Asia Pacific dominated the market, driven by leading companies and substantial investments in electronic device manufacturing.

Texas Instruments, Inc., Samsung Electronics Co. Ltd., Aaxa Technologies, Inc., MicroVision, Inc., LG Electronics, Optoma Technology Corp., and others are the key players in the Global Pocket Projector Market.