Pneumatic Components Market Size (2024 – 2030)

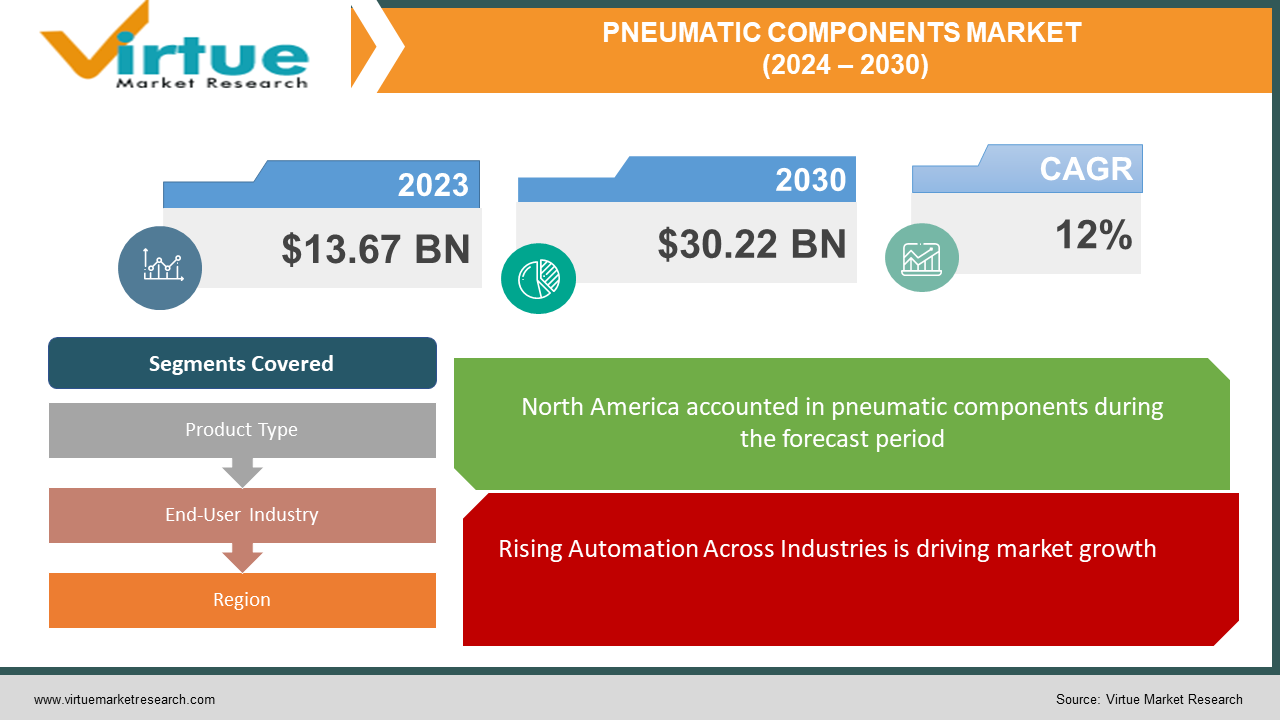

The Global Pneumatic Components Market was valued at USD 13.67 billion in 2023 and will grow at a CAGR of 12% from 2024 to 2030. The market is expected to reach USD 30.22 billion by 2030.

The global pneumatic components market is driven by a growing need for automation across industries like automotive and manufacturing. Asia Pacific leads the way due to its booming industrial base, while key players like Festo and SMC compete in a market segmented by product type (valves dominating) and end-user industry (manufacturing being the top consumer). While the pandemic caused temporary disruptions, the long-term outlook appears positive with advancements in miniaturization and Industry 4.0 integration promising an exciting future for intelligent pneumatics.

Key Market Insights:

The increasing demand for automation in various industries, such as automotive, manufacturing, and food & beverage, is a major driver for the pneumatic components market. According to a McKinsey report, up to 800 million jobs could be automated by 2030 Asia Pacific region is expected to hold the largest market share due to the growing industrial base and increasing government initiatives for industrial automation There is a growing demand for energy-efficient pneumatic components as companies look to reduce operational costs and environmental impact The integration of sensors and communication protocols into pneumatic components is creating "smart" components that can be monitored and controlled remotely

Global Pneumatic Components Market Drivers:

Rising Automation Across Industries is driving market growth

The increasing demand for automation in various industries, such as automotive, manufacturing, and food & beverage, is a major driver for the pneumatic components market. According to a McKinsey report, up to 800 million jobs could be automated by 2030 [Source: McKinsey & Company "Jobs lost, jobs gained: Workforce transitions in a time of automation"]. Pneumatic components, such as cylinders, actuators, and valves, play a crucial role in automating various tasks due to their reliability, simplicity, and cost-effectiveness.

Energy-efficient manufacturing is driving the market growth

Energy-efficient manufacturing and production processes are becoming a global priority to reduce environmental impact and operational costs. Pneumatic components offer several advantages in this regard. They are inherently energy-efficient as they use compressed air, a clean and readily available resource. Additionally, advancements in pneumatic technology, such as low-leakage valves and variable speed drives, further reduce energy consumption.

Integration of Industrial IoT is driving the market growth

The rise of Industrial IoT (IIoT) is revolutionizing pneumatics. By integrating sensors and communication capabilities into traditional components, manufacturers are creating "smart" valves, cylinders, and actuators. This allows for remote monitoring and control, providing real-time data on system performance and health. This data is a game-changer for predictive maintenance. Imagine identifying potential issues before they cause breakdowns, preventing costly downtime, and optimizing system efficiency. These smart components are ushering in a new era of intelligent pneumatics, offering greater process control, improved energy management, and ultimately, a significant boost to overall productivity.

Global Pneumatic Components Market challenges and restraints:

High Initial Investment is restricting the market growth

One of the biggest hurdles for pneumatic systems is their upfront cost burden. From acquiring the necessary compressors, valves, actuators, and other components, to the specialized labor needed for installation and ongoing maintenance, pneumatic systems require a significant initial investment. This can be a major roadblock for smaller companies or those with tighter budgets. While pneumatics might boast lower operating costs in the long run, the upfront financial commitment can be much steeper compared to simpler electrical solutions or even some hydraulic systems. This can be a tough pill to swallow for businesses with limited capital, especially when the payback period for that initial investment might be lengthy.

Competition from Other Technologies is restricting the market growth

Pneumatic systems are facing increasing competition from advancements in alternative technologies like electric and hydraulic systems. These rivals are constantly evolving, becoming more efficient and cost-competitive. This poses a significant threat to pneumatic market share in specific sectors. Electric systems, for example, are becoming increasingly powerful and compact, making them suitable for a wider range of applications previously dominated by pneumatics. Electric systems can also boast greater precision and control, along with improved energy efficiency, which can be a major advantage in today's environmentally conscious market. Hydraulic systems, on the other hand, are particularly well-suited for high-power applications where pneumatics might struggle. While pneumatics might still offer advantages in terms of simplicity and safety in certain situations, the continuous development of electric and hydraulic technology is giving manufacturers more reasons to consider alternatives. This evolving landscape could lead to a decline in pneumatic market share in sectors that can effectively leverage the strengths of these more advanced technologies.

Market Opportunities:

The pneumatic components market, though facing challenges, presents exciting growth opportunities. The ever-increasing demand for automation across various industries, particularly in developing nations, fuels the need for reliable and cost-effective solutions – a niche that pneumatics can effectively fill. Furthermore, the inherent safety of compressed air makes pneumatics an attractive choice for applications in hazardous environments like food processing or chemical handling, where electrical components might pose a risk. Growth in the smart pneumatics sector offers another promising avenue. By integrating sensors and communication capabilities into pneumatic components, manufacturers can create more intelligent and interconnected systems. This allows for real-time monitoring, predictive maintenance, and improved process optimization, leading to increased efficiency and cost savings for users. Additionally, the focus on energy-efficient manufacturing processes aligns well with the inherent strengths of pneumatics. Since compressed air systems are typically simpler than their electric or hydraulic counterparts, they often offer lower energy consumption. By developing components with even greater efficiency and leak reduction, manufacturers can tap into the growing demand for sustainable solutions. Finally, focusing on modular and interchangeable components can open doors to new markets. Standardized and easily customizable pneumatic systems would be a boon for smaller companies or those with specific needs, potentially creating a wider customer base and fostering market growth.

PNEUMATIC COMPONENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Product Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Festo AG, SMC Corporation, Norgren, Parker Hannifin Corporation, Bosch Rexroth AG , IMI Norgren, Aventics Group, Clippard Instrument Laboratory, Inc., Mac Valves Inc. |

Pneumatic Components Market Segmentation: by Product Type

-

Air Treatment Components

-

Pneumatic Valves

-

Pneumatic Cylinders

-

Pneumatic Actuators

Pneumatic valves reign supreme in the pneumatic components market, claiming the largest chunk of revenue. These workhorses control the flow, direction, and pressure of compressed air, acting as the conductors within the entire system. While air treatment components prepare the air for use and other components play crucial roles, valves hold the key to directing this power for various industrial tasks.

Pneumatic Components Market Segmentation: By End-User Industry

-

Automotive

-

Manufacturing

-

Food & Beverage Processing and Packaging

-

Electronics

-

Oil & Gas

The manufacturing sector currently holds the dominant position in consuming pneumatic components. This broad category encompasses various sub-sectors like machinery, electronics, food & beverage, and packaging. Pneumatics play a vital role in automating tasks across these industries, from powering assembly lines and robots in electronics to driving machinery in food processing and operating packaging equipment. While automotive and other sectors rely heavily on pneumatics as well, the sheer breadth and diversity of applications within manufacturing solidify its place as the top consumer.

Pneumatic Components Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the strongest position in the global pneumatic components market. This dominance is driven by several factors, including a well-established manufacturing base, a strong focus on automation across various industries, and significant investments in infrastructure development. However, the Asia-Pacific region is expected to witness the fastest growth in the coming years due to factors like rapid industrialization, government initiatives promoting automation, and a growing middle class driving demand for consumer goods. This suggests a potential shift in regional dominance in the future.

COVID-19 Impact Analysis on the Global Pneumatic Components Market

The COVID-19 pandemic delivered a significant blow to the global pneumatic components market. The initial lockdowns and travel restrictions caused widespread disruptions in supply chains, hindering the production and transportation of these components. Furthermore, the lockdowns led to a sharp decline in demand across key end-user industries like automotive, manufacturing, and oil & gas, as production facilities were forced to shut down or operate at reduced capacity. This resulted in a drop in sales and revenue for pneumatic component manufacturers. However, the impact has been temporary. As the global economy recovers and industrial activities resume, the demand for pneumatic components is expected to rebound. Additionally, the long-term growth drivers of the market, such as rising automation and increasing focus on energy efficiency, remain intact. The pandemic might have even accelerated automation trends in some sectors, potentially leading to a renewed demand for pneumatic components in the future. While the short-term effects were undoubtedly negative, the long-term outlook for the pneumatic components market appears cautiously optimistic.

Latest trends/Developments

The world of pneumatics is experiencing a surge of innovation fueled by miniaturization, energy efficiency, and Industry 4.0 integration. Manufacturers are crafting smaller, lighter components that deliver exceptional performance in space-constrained applications, ideal for the growing automation needs in electronics and life sciences. Sustainability is a top priority, with advancements in low-leakage valves and variable speed drives minimizing energy consumption. But the most transformative trend is the rise of "smart" pneumatics. By embedding sensors and communication protocols into traditional components, valves and cylinders are becoming data-rich assets. This real-time data empowers predictive maintenance, optimizing system performance and preventing costly downtime. Imagine remotely monitoring component health and anticipating potential issues before they escalate into failures. Furthermore, Industry 4.0 integration allows these smart components to seamlessly connect with industrial networks, fostering greater process control and improved overall productivity. The future of pneumatics is intelligent, interconnected, and efficient, offering exciting possibilities for a wide range of industries.

Key Players:

-

Festo AG

-

SMC Corporation

-

Norgren

-

Parker Hannifin Corporation

-

Bosch Rexroth AG

-

IMI Norgren

-

Aventics Group

-

Clippard Instrument Laboratory, Inc.

-

Mac Valves Inc.

Chapter 1. PNEUMATIC COMPONENTS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PNEUMATIC COMPONENTS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PNEUMATIC COMPONENTS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PNEUMATIC COMPONENTS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PNEUMATIC COMPONENTS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PNEUMATIC COMPONENTS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Air Treatment Components

6.3 Pneumatic Valves

6.4 Pneumatic Cylinders

6.5 Pneumatic Actuators

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. PNEUMATIC COMPONENTS MARKET – By End-User Industry

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Manufacturing

7.4 Food & Beverage Processing and Packaging

7.5 Electronics

7.6 Oil & Gas

7.7 Y-O-Y Growth trend Analysis By End-User Industry

7.8 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. PNEUMATIC COMPONENTS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By End-User Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By End-User Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By End-User Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By End-User Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By End-User Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. PNEUMATIC COMPONENTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Festo AG

9.2 SMC Corporation

9.3 Norgren

9.4 Parker Hannifin Corporation

9.5 Bosch Rexroth AG

9.6 IMI Norgren

9.7 Aventics Group

9.8 Clippard Instrument Laboratory, Inc.

9.9 Mac Valves Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Pneumatic Components Market was valued at USD 13.67 billion in 2023 and will grow at a CAGR of 12% from 2024 to 2030. The market is expected to reach USD 30.22 billion by 2030.

Rising Automation Across Industries and integration of Industrial IoT These are the reasons that are driving the market.

Based on product type it is divided into four segments – Air Treatment Components, Pneumatic Valves, Pneumatic Cylinders, and Pneumatic Actuators.

North America is the most dominant region for the Pneumatic Components Market.

Festo AG, SMC Corporation, Norgren, Parker Hannifin Corporation