Plating on Plastics Market Size (2024–2030)

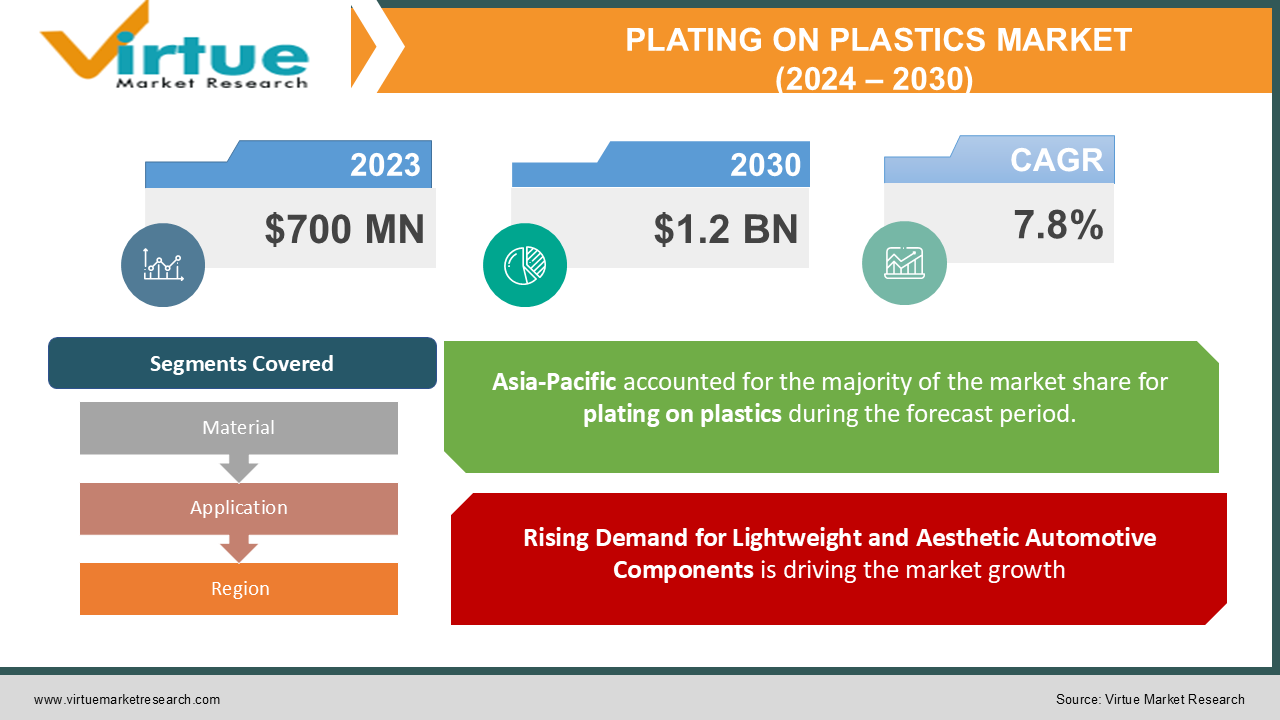

The Global Plating on Plastics (POP) Market was valued at USD 700 million in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030, reaching USD 1.2 billion by 2030.

The rising demand for lightweight and cost-effective materials across various industries such as automotive, electronics, and consumer goods is driving the growth of the POP market. Plating on plastics allows for the integration of metallic coatings on plastic surfaces, offering aesthetic appeal, corrosion resistance, and functional properties such as conductivity and durability.

Key factors contributing to the market's growth include the growing adoption of Acrylonitrile Butadiene Styrene (ABS) as a plating substrate, advancements in POP technologies, and increasing environmental awareness leading to the preference for sustainable materials. Moreover, the automotive sector, in particular, is seeing a significant rise in the use of plated plastic components for decorative and functional purposes, spurred by the trend toward lightweight vehicles that meet fuel efficiency and emission standards.

Key Market Insights:

-

Acrylonitrile Butadiene Styrene (ABS) is the most widely used plastic for plating, accounting for over 60% of the market share in 2023, due to its favorable properties such as ease of molding and compatibility with metallic coatings.

-

The automotive industry is the largest end-use segment, contributing 45% of the total market revenue in 2023, driven by the demand for lightweight materials and decorative finishes on components like grilles, trims, and badges.

-

Chrome plating remains the most popular type of coating, favored for its high durability, corrosion resistance, and aesthetic finish. It is expected to maintain a significant market share, even as more environmentally friendly alternatives emerge.

-

The electronics segment is projected to grow at the highest CAGR of 8.2% during the forecast period, supported by the rising demand for electroplated plastic components in devices such as smartphones, laptops, and wearables.

-

Asia-Pacific holds the dominant regional market share, contributing 35% of global revenues in 2023, with China, Japan, and South Korea being major producers and consumers of POP products, especially in automotive and electronics sectors.

-

Increasing adoption of sustainable and eco-friendly POP technologies is a notable trend, with many companies focusing on hexavalent chromium-free processes to meet regulatory and environmental requirements.

-

Advances in plasma polymerization and electroless plating technologies are revolutionizing the POP market by enhancing the adhesion properties of metallic coatings on plastic substrates, providing more consistent and durable finishes.

Global Plating on Plastics Market Drivers:

Rising Demand for Lightweight and Aesthetic Automotive Components is driving the market growth:

The global automotive industry is shifting toward the use of lightweight materials to improve fuel efficiency and reduce carbon emissions. This trend is significantly driving the demand for plating on plastics (POP) in automotive applications. Plated plastic components, such as exterior trims, grilles, mirrors, emblems, and interior decorative elements, offer the dual benefit of being lightweight while still providing the aesthetic appeal and durability of metal parts. Acrylonitrile Butadiene Styrene (ABS) is the preferred material for POP in automotive applications due to its excellent molding properties and compatibility with metal coatings. Chrome-plated ABS components, in particular, are widely used in the automotive industry for both functional and decorative purposes. Chrome plating provides a corrosion-resistant and high-gloss finish, which enhances the overall appearance of the vehicle while also protecting components from wear and tear. Additionally, the growing trend of electric vehicles (EVs) is further boosting the demand for POP. As EV manufacturers prioritize lightweighting to extend battery life and vehicle range, the use of plated plastics in non-structural components is becoming more prevalent. The decorative finishes provided by POP help automakers maintain the premium look and feel of their vehicles without adding unnecessary weight.

Advancements in Plating Technologies is driving the market growth:

Technological advancements in plating on plastics have been a key driver of market growth. Traditionally, electroplating on plastics was a complex process requiring extensive surface preparation and specific plastic types, such as ABS. However, recent innovations in plating technologies, such as electroless plating and plasma polymerization, have expanded the range of plastics that can be plated and improved the adhesion of metallic coatings. Electroless plating is an autocatalytic process that allows for the deposition of a metal coating on a plastic substrate without the need for an external electrical current. This method has gained popularity due to its ability to produce uniform coatings on complex shapes and parts. Plasma polymerization is another advanced technology used to enhance the adhesion of metallic coatings to plastic surfaces by modifying the surface energy of the substrate. These innovations have made it possible to plate a wider variety of plastics, including polypropylene (PP) and polycarbonate (PC), which are increasingly being used in industries such as electronics and consumer goods. Furthermore, the development of hexavalent chromium-free plating processes, in response to environmental and health concerns, has led to the adoption of more sustainable and eco-friendly POP technologies. These advancements are expected to drive further growth in the POP market by enabling more applications across different industries.

Growing Adoption in the Electronics Industry is driving the market growth:

The electronics industry is another key driver of the global POP market, with increasing demand for plated plastic components in products such as smartphones, laptops, tablets, and wearable devices. As consumer electronics become more compact and lightweight, manufacturers are turning to plated plastics for both functional and decorative purposes. Plating on plastics allows electronic devices to have metal-like finishes while maintaining the advantages of lightweight plastic components. In addition to aesthetic benefits, POP offers functional advantages in electronics. For example, plated plastic components can provide electromagnetic interference (EMI) shielding and electrostatic discharge (ESD) protection, which are critical in electronic devices. Nickel and copper plating are commonly used for these purposes, offering excellent conductivity and shielding properties. The rise of smart home devices and the increasing integration of electronics in everyday products are further boosting the demand for POP. As manufacturers seek to differentiate their products through design and functionality, the use of electroplated plastic components is expected to grow. The electronics industry’s focus on miniaturization, combined with the need for lightweight, durable, and conductive materials, is creating significant growth opportunities for the POP market.

Global Plating on Plastics Market Challenges and Restraints:

Environmental and Regulatory Challenges is restricting the market growth:

One of the key challenges facing the global POP market is the environmental impact of traditional plating processes, particularly those involving hexavalent chromium. Hexavalent chromium, commonly used in chrome plating, is a toxic and carcinogenic substance that poses serious environmental and health risks. As a result, many countries have implemented strict regulations to limit or ban the use of hexavalent chromium in industrial processes. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation restricts the use of hexavalent chromium, and similar regulations have been introduced in other regions, including North America and Asia-Pacific. Compliance with these regulations requires significant investment in alternative plating technologies and environmentally friendly processes, which can increase operational costs for manufacturers. The transition to trivalent chromium, which is considered a safer alternative to hexavalent chromium, has been a focus for the industry. However, trivalent chromium plating has its own challenges, including differences in appearance and durability compared to traditional chrome finishes. Manufacturers must invest in research and development to improve the performance of alternative plating materials and processes, which may limit the market’s growth in the short term.

Cost Constraints and Limited Material Compatibility is restricting the market growth:

While plating on plastics offers numerous advantages, the process can be costly, particularly when using advanced technologies such as electroless plating or plasma polymerization. The preparation of plastic substrates for plating, which often involves cleaning, etching, and activation steps, adds to the overall cost of production. Additionally, the use of precious metals like gold, silver, or platinum in some applications further increases the cost of plating. Another challenge is the limited material compatibility of certain plastics with traditional plating processes. For example, ABS is the most commonly used plastic for plating due to its excellent adhesion properties, but other plastics such as polypropylene (PP) and polyethylene (PE) are more difficult to plate without special surface treatments. This limits the range of applications for POP in industries where these materials are widely used. The development of new plating technologies and surface treatment methods is helping to overcome these limitations, but the costs associated with these innovations may be prohibitive for some manufacturers. As a result, the adoption of POP in certain industries may be slower than anticipated, particularly in price-sensitive markets such as consumer goods.

Market Opportunities:

The global POP market presents significant growth opportunities, particularly in the areas of sustainable and eco-friendly plating technologies and the increasing use of POP in emerging industries such as electric vehicles (EVs) and smart electronics. As environmental regulations continue to tighten, the demand for green plating technologies that reduce or eliminate the use of harmful chemicals is expected to rise. Trivalent chromium plating, water-based coatings, and hexavalent chromium-free processes are gaining traction as alternatives to traditional electroplating methods. Manufacturers that invest in these technologies will be well-positioned to capture market share, particularly in regions with strict environmental regulations. Another key area of opportunity is the growing use of POP in the electric vehicle (EV) market. As automakers focus on reducing the weight of vehicles to improve efficiency and range, the use of plated plastic components is expected to increase. POP allows for the production of lightweight yet durable and aesthetically appealing components that meet the demands of EV manufacturers. Additionally, the rise of autonomous vehicles and the increasing integration of smart technologies in vehicles is expected to drive further demand for POP in the automotive sector.

PLATING ON PLASTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Material, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

MacDermid Enthone Industrial Solutions, Atotech, Coventya, C. Uyemura & Co. Ltd., DowDuPont Inc., Galva Decoparts Pvt. Ltd., Enthone, Kunststoffe GmbH, Sarrel Group, Cybershield |

Plating on Plastics Market Segmentation: By Material

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polycarbonate

-

Polypropylene

-

Others

The Acrylonitrile Butadiene Styrene (ABS) segment is the dominant material in the global plating on plastics market, accounting for over 60% of the market share in 2023. ABS is favored for its excellent molding properties, chemical resistance, and ease of adhesion to metal coatings. It is widely used in automotive, electronics, and consumer goods applications due to its versatility and cost-effectiveness.

Plating on Plastics Market Segmentation: By Application

-

Automotive

-

Electronics

-

Consumer Goods

-

Others

The automotive segment is the largest application segment in the global POP market, contributing 45% of the total market revenue in 2023. The demand for lightweight and aesthetically appealing components in the automotive industry is driving the growth of POP in this segment. Plated plastic components, such as exterior trims, grilles, and interior decorative elements, are widely used in vehicles for both functional and decorative purposes.

Plating on Plastics Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific is the dominant region in the global plating on plastics market, accounting for 35% of the market share in 2023. The region’s dominance is driven by the presence of large automotive and electronics manufacturing industries in countries such as China, Japan, and South Korea. The growing demand for plated plastic components in these industries, combined with the availability of cost-effective raw materials and labor, has contributed to the region’s leadership in the POP market.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the global plating on plastics market. In the initial stages of the pandemic, the market experienced a decline in demand due to disruptions in supply chains, factory shutdowns, and reduced consumer spending. The automotive and electronics industries, which are major end-users of POP, were particularly affected as production lines were halted and demand for new vehicles and electronic devices plummeted. However, as economies began to recover and industries adapted to the new normal, the POP market saw a resurgence in demand, particularly from the automotive and electronics sectors. The pandemic also accelerated the shift toward lightweighting in the automotive industry, as manufacturers sought to improve fuel efficiency and reduce emissions. This trend is expected to continue driving the demand for POP in the post-pandemic era. The pandemic also highlighted the importance of sustainable and eco-friendly manufacturing practices, leading to increased investment in green plating technologies. As environmental regulations tighten in response to growing concerns about pollution and resource depletion, the adoption of environmentally friendly POP processes is expected to gain momentum.

Latest Trends/Developments:

The global plating on plastics market is witnessing several key trends and developments that are shaping its future growth. One of the most significant trends is the increasing adoption of sustainable plating technologies. As environmental concerns grow and regulatory frameworks become more stringent, manufacturers are turning to hexavalent chromium-free plating processes and other eco-friendly alternatives to meet compliance requirements. These technologies not only reduce the environmental impact of plating but also offer improved performance in terms of corrosion resistance and durability. Another important trend is the rise of advanced surface treatment technologies such as plasma polymerization and laser texturing. These technologies are enabling better adhesion of metallic coatings to plastic substrates, resulting in higher quality and more durable plated products. The integration of these technologies with traditional plating processes is helping to expand the range of plastics that can be plated, opening up new applications in industries such as aerospace, medical devices, and consumer electronics. The growing adoption of 3D printing and additive manufacturing in combination with plating on plastics is also creating new opportunities for the market. The ability to produce complex, custom-designed plastic parts and then apply metallic coatings allows for greater design flexibility and faster production times. This trend is particularly relevant in industries that require highly customized components, such as medical devices and aerospace.

Key Players:

-

MacDermid Enthone Industrial Solutions

-

Atotech

-

Coventya

-

C. Uyemura & Co. Ltd.

-

DowDuPont Inc.

-

Galva Decoparts Pvt. Ltd.

-

Enthone

-

Kunststoffe GmbH

-

Sarrel Group

-

Cybershield

Chapter 1. Plating on Plastics (POP) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plating on Plastics (POP) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plating on Plastics (POP) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plating on Plastics (POP) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plating on Plastics (POP) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plating on Plastics (POP) Market – By Material

6.1 Introduction/Key Findings

6.2 Acrylonitrile Butadiene Styrene (ABS)

6.3 Polycarbonate

6.4 Polypropylene

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Material

6.7 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Plating on Plastics (POP) Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Electronics

7.4 Consumer Goods

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Plating on Plastics (POP) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plating on Plastics (POP) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 MacDermid Enthone Industrial Solutions

9.2 Atotech

9.3 Coventya

9.4 C. Uyemura & Co. Ltd.

9.5 DowDuPont Inc.

9.6 Galva Decoparts Pvt. Ltd.

9.7 Enthone

9.8 Kunststoffe GmbH

9.9 Sarrel Group

9.10 Cybershield

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global plating on plastics market was valued at USD 700 million in 2023 and is projected to reach USD 1.2 billion by 2030, growing at a CAGR of 7.8%.

Key drivers include the rising demand for lightweight and aesthetic automotive components, advancements in plating technologies, and the growing adoption of POP in the electronics industry.

The market is segmented by material (ABS, polycarbonate, polypropylene, others) and application (automotive, electronics, consumer goods, others).

Asia-Pacific dominates the global plating on plastics market, accounting for 35% of the market share in 2023.

Leading players include MacDermid Enthone Industrial Solutions, Atotech, Coventya, C. Uyemura & Co. Ltd., and DowDuPont Inc.