Plastic Pallets Market Size (2024 – 2030)

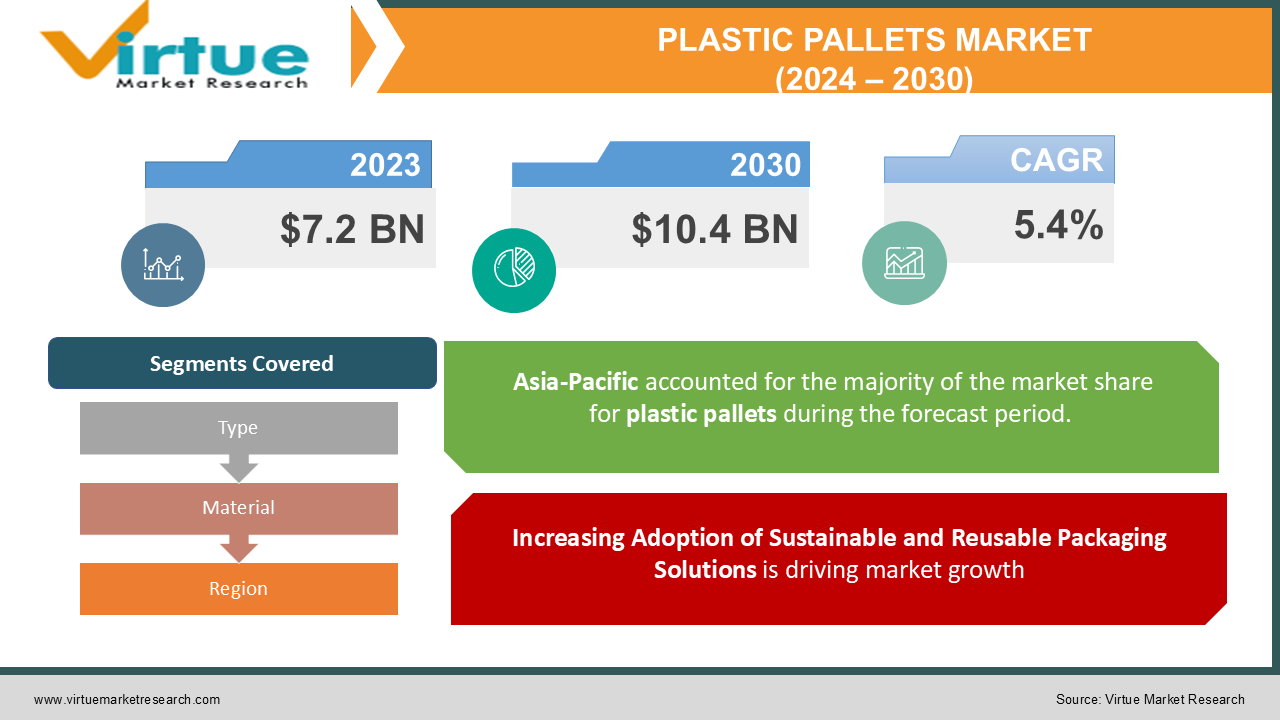

The Global Plastic Pallets Market was valued at USD 7.2 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030, reaching USD 10.4 billion by 2030.

Plastic pallets are flat structures used to support and transport goods efficiently across various industries, including manufacturing, logistics, pharmaceuticals, food & beverages, and retail. Unlike wooden pallets, plastic pallets offer enhanced durability, hygiene, and resistance to environmental elements, making them increasingly preferred in industries requiring high sanitation standards. With a growing emphasis on supply chain efficiency, sustainability, and reusable packaging solutions, the demand for plastic pallets is witnessing steady growth worldwide.

Key Market Insights

-

Recycled plastic pallets are popular recently. Increased sustainability efforts triggered industries to adopt reusable packaging solutions instead of simple linear products that will help save the environment.

-

Injection-molded plastic pallets are also dominating the market share due to their high precision, consistency, and cost-effectiveness during mass production.

-

The Asia-Pacific market leads, due to rapid industrialization and strong demand for manufactured and logistics sectors in China, India, and Southeast Asia.

-

Smart pallets with embedded technology like RFID and sensors are one of the most important trends in that they improve tracking inventory for supply chains.

-

The key producers are focused on technological innovation toward the creation of sturdier and lighter pallets to meet all requirements for reusable solutions friendly to the environment.

Global Plastic Pallets Market Drivers

Increasing Adoption of Sustainable and Reusable Packaging Solutions is driving market growth: Environmental concerns and government regulations are driving industries toward sustainable packaging solutions. Plastic pallets, being durable and reusable, offer a significant advantage over disposable wooden pallets. They can withstand multiple uses over the years, thereby reducing packaging waste and operational costs. Many companies are adopting circular economy models, using recycled plastic pallets to align with sustainability goals. These reusable pallets are particularly popular in sectors like automotive, pharmaceuticals, and electronics, where frequent pallet handling is necessary. Moreover, stringent environmental policies in Europe and North America promote reusable packaging as part of efforts to lower carbon footprints, further boosting market growth.

Growing E-commerce and Logistics Industry is driving market growth: The boom in e-commerce and increasing demand for fast and efficient delivery systems are significantly driving the plastic pallets market. With the rise of just-in-time inventory management and increased product turnover rates, companies require durable, lightweight, and easy-to-handle pallets for warehouse operations. Plastic pallets are highly suitable for automated warehousing systems as they offer high dimensional stability and reduce the risk of machinery breakdowns compared to wooden alternatives. Additionally, the rise in cross-border trade and globalization has increased the need for standardized and hygienic pallets, further supporting the adoption of plastic pallets in the logistics industry.

Regulatory Push for Hygiene and Safety Compliance is driving market growth: Industries such as food & beverages, pharmaceuticals, and chemicals are subject to stringent health and safety regulations. Traditional wooden pallets are prone to moisture absorption and bacterial growth, raising hygiene concerns in these sectors. In contrast, plastic pallets offer superior resistance to contamination, pests, and moisture. This makes them highly suitable for cold storage and clean-room environments. With increasing regulatory requirements and certifications needed for the safe handling of food and pharmaceutical products, plastic pallets have become the preferred choice among companies operating in these sectors.

Global Plastic Pallets Market Challenges and Restraints

High Initial Cost Compared to Wooden Pallets is restricting market growth: One of the primary challenges for the plastic pallets market is their high initial investment cost. Plastic pallets, especially those made through advanced techniques like injection molding, are more expensive than wooden alternatives. This price difference can be a deterrent for small and medium enterprises (SMEs) that operate with limited budgets. Although plastic pallets offer long-term savings due to their durability and reusability, companies with tight working capital might hesitate to make the switch. Additionally, the fluctuating prices of raw materials, such as polypropylene (PP) and high-density polyethylene (HDPE), can further impact production costs, posing challenges for market players.

Environmental Concerns Related to Plastic Waste are restricting market growth: While plastic pallets are durable and reusable, they also contribute to the accumulation of plastic waste at the end of their lifecycle. Improper disposal or lack of recycling infrastructure can lead to plastic pollution, which is a major concern worldwide. Although many companies are developing recycled plastic pallets, these solutions are not yet adopted on a large scale due to technological and cost limitations. Governments and environmental organizations are introducing stricter waste management policies, which may put pressure on manufacturers to innovate sustainable solutions or face penalties for non-compliance. The environmental challenges associated with plastic use remain a significant restraint for the market.

Market Opportunities

The plastic pallet market is already being pushed onto its growth path by the desire for sustainable supply chain solutions. Companies find it challenging to remain as non-ecological firms and more and more firms are being forced to use recyclable and reusable plastic pallets rather than one-time-packaging material. Manufacturers can now produce plastic pallets with less carbon footprint through advancements in recycling technology that incorporate corporate sustainability goals. Moreover, smart pallet solutions with RFID chips or IoT sensors mean another big market opportunity for the players in this industry. Smart pallets can track the movements of goods, hence improving the supply chain's transparency and efficiency, and making the logistics business streamline their operations and cut losses due to misplaced shipments. There are tremendous growth opportunities through the rapid expansion of the food and beverage and pharmaceutical industries. Factors that boost an increase in population and health care demands increase the interest of these industries towards plastic pallets, primarily due to their compliance with hygienic standards, lightweight, and suitability to automated warehouse systems. Industry-specific manufacturers of plastic pallets are expected to realize growth in newly opened revenue channels as well as a competitive edge. They can become leaders in different areas by speaking to their specific needs in such a landscape that is driven toward being sustainable and efficient.

PLASTIC PALLETS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Brambles Ltd., ORBIS Corporation, Schoeller Allibert Group, CABKA Group, Greystone Logistics Inc., Rehrig Pacific Company, Polymer Solutions International Inc., Allied Plastics Inc., Euro Pool Group, Buckhorn Inc. |

Plastic Pallets Market Segmentation - By Type

-

Nestable Pallets

-

Rackable Pallets

-

Stackable Pallets

-

Others

Nestable pallets dominate the market as they provide efficient space-saving solutions. Their stackable nature reduces storage and transportation costs, making them a preferred option across industries with tight warehouse spaces.

Plastic Pallets Market Segmentation - By Material

-

High-Density Polyethylene (HDPE)

-

Polypropylene (PP)

-

Recycled Plastic

High-density polyethylene (HDPE) pallets hold the largest share due to their superior durability, chemical resistance, and ability to withstand harsh environmental conditions. HDPE is widely used in industries such as food & beverages and pharmaceuticals, where hygiene and product safety are paramount.

Plastic Pallets Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the global plastic pallets market, driven by rapid industrialization, growing e-commerce, and expansion of manufacturing and logistics sectors in countries such as China, India, and Japan. The region's strong demand for affordable and durable packaging solutions makes plastic pallets highly attractive. Additionally, government investments in infrastructure and the expansion of cross-border trade contribute to the region’s leadership in the market.

COVID-19 Impact Analysis on the Plastic Pallets Market

The COVID-19 pandemic had more complex effects on the plastic pallets market. On one hand, supply chain disruptions and temporary shutdowns of manufacturing facilities slowed the growth. On the other hand, the peak rise in e-commerce and home deliveries during the pandemic put a higher demand on durable, hygienic packaging solutions. In that respect, plastic pallets became in great demand within pharmaceutical and food supply chains because of their easiness to clean-in properties ensuring product safety while in transit. More hygienic was what businesses needed to stay in line with standards of safety in light of health issues. The pandemic also accelerated the change in consumer preference to more sustainable and reusable packaging options. This growth was most advantageous to the plastic pallets market because businesses realize that an eco-friendly solution is needed for their logistic operations. As businesses step into this new normal, the demand for effective logistics solutions like plastic pallets is likely to be strong. Strong emphasis remains on sustainability as well as hygiene and will continue to fuel growth within this sector as plastic pallets pose as a mainstay in modern supply chains.

Latest Trends/Developments

Among the myriad of present-day trends and factors that will define the future of the plastic pallets market, a number of notable ones have emerged. One of the biggest developments is that smart pallets with RFID and IoT technologies are increasingly the order of the day. Such developments improve supply chains and help provide real-time tracking and inventory management, which supports streamlined operations for businesses. Another recent development is the growing deployment of recycled plastic pallets. Underpinning the heightened urgency to environmental issues, companies have devoted much importance to recycling technologies to make eco-friendly pallets that link with circular economy goals. Besides waste reduction, this approach has satisfied the demand for sustainable packaging solutions as well. Lightweight plastic pallets are in great demand for automated warehouse systems. This pallet has emerged as important for maximum efficiency in logistics through better handling, faster movement, and subsequently lower operational costs. The second is in collaboration between plastic pallet manufacturers and logistics companies. The customized pallet solutions are engineered to cater to specific industries with such partnerships improving the effectiveness of supply chain operations, and the pallets are able to meet the particular requirements of different sectors. As these trends gain momentum, the plastic pallet market will be a high-growth innovative market that continues to expand.

Key Players

-

Brambles Ltd.

-

ORBIS Corporation

-

Schoeller Allibert Group

-

CABKA Group

-

Greystone Logistics Inc.

-

Rehrig Pacific Company

-

Polymer Solutions International Inc.

-

Allied Plastics Inc.

-

Euro Pool Group

-

Buckhorn Inc.

Chapter 1. Plastic Pallets Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plastic Pallets Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plastic Pallets Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plastic Pallets Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plastic Pallets Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plastic Pallets Market – By Type

6.1 Introduction/Key Findings

6.2 Nestable Pallets

6.3 Rackable Pallets

6.4 Stackable Pallets

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Plastic Pallets Market – By Material

7.1 Introduction/Key Findings

7.2 High-Density Polyethylene (HDPE)

7.3 Polypropylene (PP)

7.4 Recycled Plastic

7.5 Y-O-Y Growth trend Analysis By Material

7.6 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Plastic Pallets Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Material

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Material

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Material

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Material

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Material

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plastic Pallets Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Brambles Ltd.

9.2 ORBIS Corporation

9.3 Schoeller Allibert Group

9.4 CABKA Group

9.5 Greystone Logistics Inc.

9.6 Rehrig Pacific Company

9.7 Polymer Solutions International Inc.

9.8 Allied Plastics Inc.

9.9 Euro Pool Group

9.10 Buckhorn Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Plastic Pallets Market was valued at USD 7.2 billion in 2023 and is projected to reach USD 10.4 billion by 2030, growing at a CAGR of 5.4%.

rivers include the rising demand for sustainable packaging solutions, the growth of e-commerce and logistics, and the need for hygiene compliance in the food & beverage and pharmaceutical sectors.

The market is segmented by type (nestable, rackable, stackable, and others) and material (HDPE, PP, recycled plastic).

Asia-Pacific is the dominant region, driven by industrialization, manufacturing expansion, and strong e-commerce growth.

Leading players include Brambles Ltd., ORBIS Corporation, Schoeller Allibert Group, CABKA Group, and Greystone Logistics Inc.