Plastic Films & Sheets Market Size (2025 – 2030)

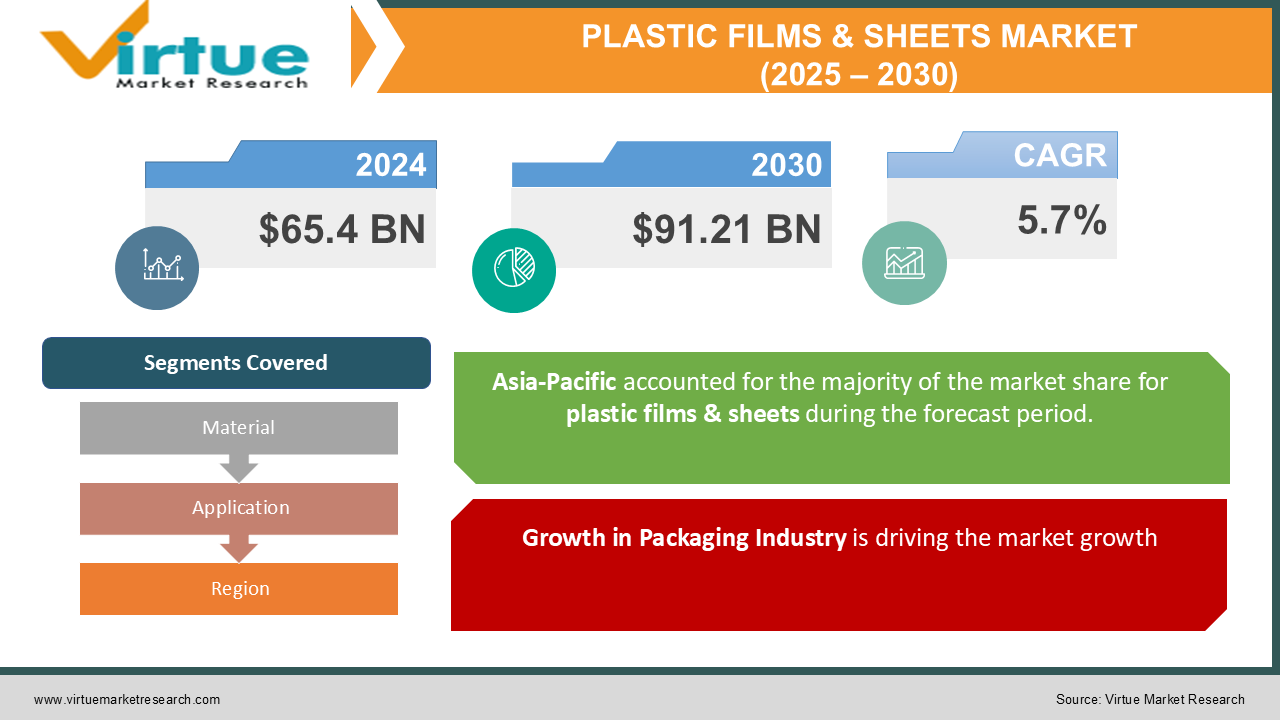

The Global Plastic Films & Sheets Market was valued at USD 65.4 billion in 2024 and is anticipated to reach USD 91.21 billion by 2030, registering a CAGR of 5.7% during the forecast period from 2025 to 2030.

Plastic films and sheets are extensively used across industries such as packaging, agriculture, construction, and consumer goods due to their durability, lightweight properties, and cost-effectiveness.

Rapid urbanization, the growth of the e-commerce sector, and advancements in sustainable plastics are driving the market's expansion. Increasing demand for bio-based and biodegradable films and sheets, coupled with stringent regulations on single-use plastics, are influencing market dynamics.

Key Market Insights

-

Polyethylene (PE) accounted for the largest share in the material segment, representing over 40% of the global market in 2024, owing to its versatility and widespread applications.

-

The packaging sector dominated the application segment with a market share exceeding 50%, driven by the growth of the food & beverage and e-commerce industries.

-

Asia-Pacific emerged as the leading region, capturing 45% of the market share in 2024, due to high production capacities and demand from end-use industries.

Global Plastic Films & Sheets Market Drivers

Growth in Packaging Industry is driving the market growth

The packaging industry is the largest consumer of plastic films and sheets, driven by rising demand for flexible and lightweight packaging solutions. Increasing consumption of packaged food, beverages, and personal care products is propelling the market's growth.

The rapid expansion of the e-commerce sector is further driving the need for efficient packaging materials that ensure product safety during transit. Innovations in barrier films, which provide enhanced protection against moisture, light, and oxygen, are contributing to the growing adoption of plastic films in packaging applications.

Advancements in Sustainable Materials is driving the market growth

Stringent environmental regulations and growing consumer awareness about plastic waste have accelerated the development and adoption of biodegradable and bio-based plastic films. These sustainable alternatives are increasingly being used in packaging, agriculture, and consumer goods sectors.

Governments worldwide are promoting the use of eco-friendly materials through initiatives and subsidies. For instance, the European Union's directive on single-use plastics has encouraged manufacturers to invest in sustainable plastic films, boosting market growth.

Rising Demand in Agricultural Applications is driving the market growth

Plastic films play a vital role in modern agriculture, particularly in greenhouse covering, mulching, and silage applications. The increasing adoption of greenhouse farming to enhance crop yield and reduce dependency on climatic conditions is driving demand for high-quality agricultural films.

Advancements in UV-resistant and anti-fog films are further improving their efficiency and durability, making them indispensable for agricultural practices. Emerging economies in Asia-Pacific and Africa are witnessing significant growth in agricultural film usage due to increasing focus on food security and efficient farming practices.

Global Plastic Films & Sheets Market Challenges and Restraints

Environmental Concerns and Recycling Issues is restricting the market growth

The environmental impact of non-biodegradable plastic waste is a significant challenge for the plastic films and sheets market. Despite advancements in recycling technologies, a large proportion of plastic films end up in landfills or oceans, contributing to pollution.

Regulatory pressures to reduce single-use plastics and promote sustainability are compelling manufacturers to develop eco-friendly alternatives. However, the high cost of biodegradable films and limited recycling infrastructure in developing regions remain hurdles for market growth.

Volatility in Raw Material Prices is restricting the market growth

The plastic films and sheets industry is heavily reliant on petrochemical derivatives, such as polyethylene and polypropylene, as raw materials. Fluctuations in crude oil prices directly impact the cost of these materials, creating uncertainty for manufacturers.

Geopolitical tensions, supply chain disruptions, and increasing demand for alternative energy sources further exacerbate raw material price volatility. This unpredictability poses a challenge for small and medium-sized enterprises (SMEs) operating in the market.

Market Opportunities

The Global Plastic Films & Sheets Market is poised for growth with numerous opportunities stemming from technological advancements, sustainability initiatives, and expanding applications in emerging markets. The development of multilayer films with enhanced barrier properties is creating new avenues for the packaging industry. These films provide superior protection against external factors, extending the shelf life of packaged products and catering to the rising demand for convenience foods. Sustainability trends are driving the adoption of compostable and bio-based plastic films, particularly in regions with stringent environmental regulations. Innovations in material science, such as the use of polylactic acid (PLA) and polyhydroxyalkanoates (PHA), are enabling the production of high-performance biodegradable films. Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities due to rapid urbanization, increasing disposable incomes, and growing awareness about modern agricultural practices. Investments in recycling infrastructure and government initiatives to reduce plastic waste further support market expansion in these regions.

PLASTIC FILMS & SHEETS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Berry Global Inc., Amcor Plc, Sealed Air Corporation, Toray Industries, Inc., Mondi Group, Polyplex Corporation Limited, Jindal Poly Films Ltd., Uflex Ltd., DuPont Teijin Films, Sabic |

Plastic Films & Sheets Market Segmentation - By Material

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Others

Polyethylene (PE) dominated the material segment in 2024 due to its widespread use in packaging, agriculture, and construction applications. Its properties, such as flexibility, chemical resistance, and low cost, make it a preferred choice across industries.

Plastic Films & Sheets Market Segmentation - By Application

-

Packaging

-

Agriculture

-

Construction

-

Consumer Goods

-

Others

The packaging industry stands as the dominant application segment for injection molding, fueled by the burgeoning demand for flexible packaging solutions across diverse sectors. As consumers increasingly seek convenient, safe, and sustainable packaging options, injection molding emerges as a versatile and efficient manufacturing process to meet these evolving needs. The food and beverage industry is a significant driver of demand for injection molded packaging. From rigid containers for dairy products and sauces to closures for bottles and jars, injection molding enables the production of a wide range of packaging solutions that protect product integrity, extend shelf life, and enhance brand appeal. The e-commerce boom has further accelerated the demand for flexible and durable packaging materials. Injection molding plays a crucial role in manufacturing protective packaging components, such as inserts, trays, and cushioning materials, ensuring the safe transportation and delivery of products. Additionally, the growing emphasis on sustainability and eco-friendly packaging practices has led to the development of innovative injection molding solutions. Manufacturers are exploring the use of recyclable and biodegradable materials, as well as designing packaging with reduced material usage and optimized designs. By embracing these trends and leveraging the versatility of injection molding, the packaging industry continues to shape the way products are delivered to consumers, ensuring product protection, brand differentiation, and environmental responsibility.

Plastic Films & Sheets Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific dominated the global plastic films and sheets market in 2024, accounting for 45% of the total revenue. The region's growth is attributed to high production capacities, low manufacturing costs, and robust demand from end-use industries. China and India are key contributors to the regional market, driven by rapid industrialization, urbanization, and the expansion of the packaging and agricultural sectors. Additionally, government initiatives promoting sustainable agriculture and local manufacturing are supporting market growth. North America and Europe are mature markets, characterized by stringent environmental regulations and a growing focus on biodegradable films.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the plastic films and sheets market. While the demand for packaging materials surged due to increased consumption of packaged foods, personal care products, and e-commerce deliveries, the construction and automotive sectors experienced a temporary slowdown. Post-pandemic, the market witnessed a strong recovery, driven by renewed investments in sustainable packaging solutions and growing awareness about hygiene and safety. The healthcare sector's demand for plastic films, particularly for medical packaging and protective equipment, further supported market growth during the recovery phase.

Latest Trends/Developments

The plastic film industry is undergoing a significant transformation driven by environmental concerns, technological advancements, and changing consumer preferences. The increasing adoption of bio-based and compostable plastic films is a notable trend, as industries and consumers seek sustainable alternatives to traditional petroleum-based plastics. These biodegradable films are designed to decompose naturally, reducing plastic pollution and minimizing environmental impact. In addition to sustainability, technological advancements are driving innovation in the plastic film industry. The development of multilayer and high-barrier films is enhancing the performance and functionality of plastic films, offering improved protection, extended shelf life, and enhanced product presentation. These advanced films are finding applications in various sectors, including food packaging, medical packaging, and industrial packaging. To address the growing concern of plastic waste, companies are investing in recycling technologies and developing closed-loop systems to improve material recovery rates. By recycling plastic waste and reintroducing it into the production process, the industry can reduce its reliance on virgin materials and minimize its environmental footprint. In the agricultural sector, the demand for specialized plastic films is increasing. UV-resistant, anti-fog, and thermally efficient films are being used to protect crops from harsh weather conditions, improve crop yields, and reduce water usage. These innovative films contribute to sustainable farming practices and enhance agricultural productivity. Furthermore, the integration of digital printing technology with plastic films is revolutionizing the packaging industry. Digital printing enables the creation of customized and visually appealing designs on plastic films, allowing brands to differentiate their products and attract consumers. This technology offers flexibility, reduced lead times, and the ability to produce small-batch, personalized packaging solutions. As the plastic film industry continues to evolve, these trends will shape the future of packaging and other applications, driving innovation, sustainability, and consumer satisfaction.

Key Players

-

Berry Global Inc.

-

Amcor Plc

-

Sealed Air Corporation

-

Toray Industries, Inc.

-

Mondi Group

-

Polyplex Corporation Limited

-

Jindal Poly Films Ltd.

-

Uflex Ltd.

-

DuPont Teijin Films

-

Sabic

Chapter 1. Plastic Films & Sheets Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plastic Films & Sheets Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plastic Films & Sheets Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plastic Films & Sheets Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plastic Films & Sheets Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plastic Films & Sheets Market – By Material

6.1 Introduction/Key Findings

6.2 Polyethylene (PE)

6.3 Polypropylene (PP)

6.4 Polyvinyl Chloride (PVC)

6.5 Polyethylene Terephthalate (PET)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Material

6.8 Absolute $ Opportunity Analysis By Material, 2025-2030

Chapter 7. Plastic Films & Sheets Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Agriculture

7.4 Construction

7.5 Consumer Goods

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Plastic Films & Sheets Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plastic Films & Sheets Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Berry Global Inc.

9.2 Amcor Plc

9.3 Sealed Air Corporation

9.4 Toray Industries, Inc.

9.5 Mondi Group

9.6 Polyplex Corporation Limited

9.7 Jindal Poly Films Ltd.

9.8 Uflex Ltd.

9.9 DuPont Teijin Films

9.10 Sabic

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Plastic Films & Sheets Market was valued at USD 65.4 billion in 2024 and is anticipated to reach USD 91.21 billion by 2030, registering a CAGR of 5.7% during the forecast period from 2025 to 2030.

Key divers include growth in the packaging industry, advancements in sustainable materials, and rising demand in agricultural applications.

Segments include Material (Polyethylene, Polypropylene, Polyvinyl Chloride, PET) and Application (Packaging, Agriculture, Construction, Consumer Goods).

Asia-Pacific dominates the market, accounting for over 45% share, driven by high production capacities and demand from end-use industries.

Leading players include Berry Global Inc., Amcor Plc, Sealed Air Corporation, and Toray Industries, Inc.