Plastic Films Market Size (2024 – 2030)

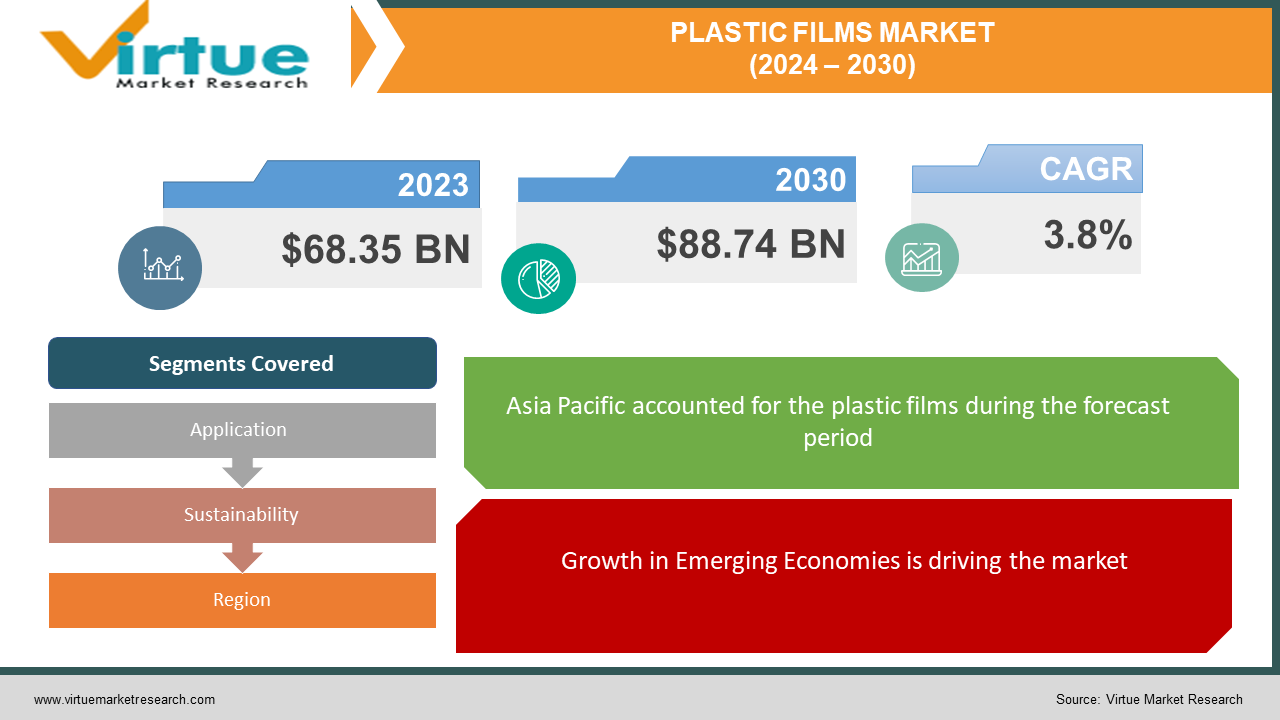

The Global Plastic Films Market was valued at USD 68.35 billion in 2023 and will grow at a CAGR of 3.8% from 2024 to 2030. The market is expected to reach USD 88.74 billion by 2030.

Key Market Insights:

The Plastic film market is booming, driven by surging demand in packaging (especially for food and beverages) and flourishing e-commerce. But sustainability concerns loom large. Biodegradable and compostable films are gaining traction, while regulations on traditional plastics are tightening. This creates opportunities for producers of eco-friendly alternatives but challenges traditional film manufacturers. Expect continued growth in food packaging films and those used in agriculture, while technological advancements in barrier films and high-performance films will open new doors in diverse sectors like construction and healthcare. Overall, the Plastic film market offers promising growth, but innovation and adaptation towards sustainable solutions will be key for long-term success.

Global Plastic Films Market Drivers:

Growth in Emerging Economies is driving the market

The thriving food processing, healthcare, and construction industries are fueling a surge in demand for plastic films. In the food processing sector, plastic films are vital for packaging a wide range of products, ensuring freshness, safety, and extended shelf life. This caters to the growing demand for convenience foods and reduces food waste. Similarly, the healthcare industry utilizes plastic films for sterile packaging of medical devices and pharmaceuticals, while also playing a crucial role in hygiene products like adult diapers and bandages. These films contribute to improved hygiene practices and patient safety. The construction industry is another major driver, with plastic films finding application in vapor barriers, waterproofing membranes, and even as lightweight yet durable building materials. This translates to faster construction times, improved energy efficiency in buildings, and overall cost savings. Essentially, the expansion of these industries creates a ripple effect, driving innovation in plastic film functionalities and propelling the overall market forward.

The development of new types of plastic films is driving the market

Innovation in plastic films is a double win for the market and the environment. New developments, like bi-axially oriented films (BO films), offer superior functionality while addressing sustainability concerns. BO films, for example, are stretched in two directions, resulting in increased strength, clarity, and barrier properties, all while using less material. This translates to lighter packaging, reducing transportation costs and environmental impact. Furthermore, research is actively improving the recyclability of plastic films. By making them easier to identify and sort during recycling processes, these advancements contribute to a circular economy for plastics. This not only reduces plastic waste but also creates new market opportunities for recycled plastic content, appealing to environmentally conscious consumers and aligning with stricter regulations. Ultimately, innovation in plastic films allows manufacturers to cater to both sustainability demands and market growth.

The expansion of industries like food processing, healthcare, and construction is driving the market

The thriving food processing, healthcare, and construction industries are fueling a surge in demand for plastic films. In the food processing sector, plastic films are vital for packaging a wide range of products, ensuring freshness, safety, and extended shelf life. This caters to the growing demand for convenience foods and reduces food waste. Similarly, the healthcare industry utilizes plastic films for sterile packaging of medical devices and pharmaceuticals, while also playing a crucial role in hygiene products like adult diapers and bandages. These films contribute to improved hygiene practices and patient safety. The construction industry is another major driver, with plastic films finding application in vapor barriers, waterproofing membranes, and even as lightweight yet durable building materials. This translates to faster construction times, improved energy efficiency in buildings, and overall cost savings. Essentially, the expansion of these industries creates a ripple effect, driving innovation in plastic film functionalities and propelling the overall market forward.

Global Plastic Films Market challenges and restraints:

Public pressure and stricter environmental regulations are restricting the market growth

The tide is turning against traditional plastic films. Growing public concern about plastic pollution and stricter environmental regulations are forcing a major shift. Consumers are increasingly vocal in demanding eco-friendly packaging, and governments are implementing bans or limitations on single-use plastics, especially plastic bags and films. This puts immense pressure on plastic film producers. To stay afloat, they need to innovate and adopt more sustainable alternatives. This could involve developing new bio-based or biodegradable plastic films, exploring innovative recycling technologies, or even focusing on compostable options. The good news is that these efforts can open new markets and cater to environmentally conscious consumers. However, navigating this transition requires significant investment in research and development, potentially impacting production costs in the short term. The future of the plastic film industry hinges on its ability to adapt and embrace sustainable solutions.

Vulnerability to Raw Material Costs is restricting the market growth

Plastic film manufacturers walk a tightrope when it comes to raw materials. Their bread and butter – oil and natural gas – are a double-edged sword. While these fossil fuels are readily available and relatively inexpensive to refine into plastic film precursors, their prices are notoriously volatile. Geopolitical tensions, supply chain disruptions, and even shifts in consumer behavior towards renewable energy can send oil and gas prices on a rollercoaster ride. This directly translates to fluctuating production costs for plastic film manufacturers. When prices spike, their profit margins shrink. To maintain profitability, they may have to raise their prices, potentially getting passed down the line to consumers. This price sensitivity can lead to decreased demand, creating a precarious situation for manufacturers. To mitigate this risk, some companies are exploring alternative, more stable raw materials or even integrating production with reliable suppliers. The quest for cost stability is a constant battle for plastic film producers in a world increasingly focused on price predictability.

Market Opportunities:

The Plastic Films Market presents a multitude of exciting opportunities for innovation and growth. Sustainability concerns are driving the development of eco-friendly plastic films. Bio-based and biodegradable films are gaining traction, catering to environmentally conscious consumers and potentially mitigating plastic pollution. Research into improved recyclability is another promising avenue. By creating films that are easier to sort and reprocess, manufacturers can contribute to a circular economy for plastics, reducing waste and creating a market for recycled content. Technological advancements are also opening doors for high-performance films. Bi-axially oriented films (BO films) exemplify this, offering superior strength, clarity, and barrier properties with less material. This translates to lighter packaging, minimizing transportation costs and environmental impact. The burgeoning food processing, healthcare, and construction industries create significant demand for plastic films with specialized functionalities. In food processing, films can extend shelf life and improve food safety. The healthcare sector requires sterile packaging for medical devices and pharmaceuticals, while also utilizing films in hygiene products. The construction industry presents opportunities for plastic films in vapor barriers, waterproofing membranes, and even lightweight building materials. These applications can lead to faster construction times, improved energy efficiency, and overall cost savings. Furthermore, the rise of e-commerce creates a demand for durable and tamper-evident packaging solutions, which plastic films can deliver effectively. By focusing on innovation, sustainability, and catering to the specific needs of expanding industries, plastic film manufacturers can capitalize on these exciting market opportunities and ensure their continued success.

PLASTIC FILMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.8% |

|

Segments Covered |

By Application, Sustainability, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DowDuPont, Exxon Mobil Corporation, Chevron Phillips Chemical Company LLC, LyondellBasell Industries Holdings, LLC, SABIC, Braskem S.A., Sinopec Corp., Toray Industries, Inc., Berry Global Group, Inc., Sealed Air Corporation, Treofan GmbH, Uflex Limited |

Plastic Films Market Segmentation - By Application

-

Packaging

-

Agriculture

-

Construction

While Packaging, Agriculture, and Construction are all significant segments in the Plastic Films Market, Packaging reigns supreme. It encompasses a vast array of sub-segments, including food packaging, beverage packaging, and industrial packaging. Each with specific requirements for film properties like strength, clarity, and barrier protection. This vastness and critical role in numerous industries solidify Packaging's dominance within the Plastic Films Market.

Plastic Films Market Segmentation - By Sustainability

-

Traditional plastic films

-

Biodegradable films

-

Compostable films

-

Bio-based films

While traditional plastic films currently hold the dominant position in the market due to their established infrastructure and cost-effectiveness, their reign is facing challenges. Growing environmental concerns and stricter regulations are propelling a shift towards more sustainable alternatives. Among these, biodegradable films are currently experiencing the most significant growth. Their ability to decompose naturally under specific conditions resonates with eco-conscious consumers, offering a solution to plastic waste woes.

Plastic Films Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The crown for the dominant market in plastic films belongs to Asia Pacific. This region boasts a booming population, rapid industrialization, and a prioritization of cost-effective solutions, making traditional plastic films still a popular choice. Conversely, the fastest growing market is also in Asia Pacific. The same factors driving dominance also fuel significant growth, with a rising middle class and increasing demand for packaged goods propelling the market forward. However, watch out for a shift towards sustainable alternatives as environmental awareness takes hold in this dynamic region.

COVID-19 Impact Analysis on the Global Plastic Films Market

The COVID-19 pandemic delivered a complex impact on the Global Plastic Films Market. Initially, disruptions in supply chains and lockdowns caused a decline in demand across most sectors. However, this was countered by a surge in specific areas. The rise in hygiene concerns led to a significant increase in demand for plastic films used in medical supplies like personal protective equipment (PPE) and sterile packaging. Additionally, the boom in e-commerce and home deliveries fueled the need for plastic films in tamper-evident packaging. This rise in demand for specific applications partially offset the decline in other sectors like automotive and industrial manufacturing. Overall, the pandemic caused a temporary dip in the market growth, but estimates suggest it is on track for recovery and continued growth. Looking ahead, the long-term impact of COVID-19 on the Plastic Films Market remains to be seen. Increased focus on hygiene and sanitation may lead to a lasting rise in demand for plastic films in healthcare and hygiene products. However, growing awareness of plastic pollution and potential regulations to curb single-use plastics could pose challenges. The market's future success will depend on the development of sustainable and eco-friendly plastic film alternatives, improved recycling technologies, and the ability to cater to the evolving needs of the post-pandemic world.

Latest trends/Developments

The Plastic film market is witnessing a wave of innovation driven by sustainability concerns, technological advancements, and the demands of burgeoning industries. Bio-based and biodegradable films are gaining ground, addressing environmental issues and appealing to eco-conscious consumers. Improved recyclability is another hot trend, with research focusing on films easier to sort and reprocess, promoting a circular economy for plastics. Technology is playing a key role in the development of high-performance films like bi-axially oriented (BO) films. These films offer superior strength, clarity, and barrier properties using less material, resulting in lighter packaging and a reduced environmental footprint. Specific industries are driving demand for specialized films. The food processing sector seeks films that extend shelf life and enhance food safety, while healthcare relies on them for sterile medical device packaging and hygiene products. The construction industry presents opportunities for plastic films in vapor barriers, waterproofing, and even lightweight, yet sturdy building materials, promoting faster construction times and improved energy efficiency. E-commerce is another growth driver, demanding durable and tamper-evident packaging solutions that plastic films can effectively provide. Overall, the latest trends in the Plastic film market highlight a focus on innovation, sustainability, and catering to the evolving needs of various industries, ensuring its continued growth and adaptation in the face of ever-changing market dynamics.

Key Players:

-

DowDuPont

-

Exxon Mobil Corporation

-

Chevron Phillips Chemical Company LLC

-

LyondellBasell Industries Holdings, LLC

-

SABIC

-

Braskem S.A.

-

Sinopec Corp.

-

Toray Industries, Inc.

-

Berry Global Group, Inc.

-

Sealed Air Corporation

-

Treofan GmbH

-

Uflex Limited

Chapter 1. PLASTIC FILMS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PLASTIC FILMS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PLASTIC FILMS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PLASTIC FILMS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PLASTIC FILMS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PLASTIC FILMS MARKET – By Sustainability

6.1 Introduction/Key Findings

6.2 Traditional plastic films

6.3 Biodegradable films

6.4 Compostable films

6.5 Bio-based films

6.6 Y-O-Y Growth trend Analysis By Sustainability

6.7 Absolute $ Opportunity Analysis By Sustainability, 2024-2030

Chapter 7. PLASTIC FILMS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Agriculture

7.4 Construction

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. PLASTIC FILMS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Sustainability

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Sustainability

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Sustainability

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Sustainability

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Sustainability

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. PLASTIC FILMS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DowDuPont

9.2 Exxon Mobil Corporation

9.3 Chevron Phillips Chemical Company LLC

9.4 LyondellBasell Industries Holdings, LLC

9.5 SABIC

9.6 Braskem S.A.

9.7 Sinopec Corp.

9.8 Toray Industries, Inc.

9.9 Berry Global Group, Inc.

9.10 Sealed Air Corporation

9.11 Treofan GmbH

9.12 Uflex Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Plastic Films Market was valued at USD 68.35 billion in 2023 and will grow at a CAGR of 3.8% from 2024 to 2030. The market is expected to reach USD 88.74 billion by 2030.

Growth in Emerging Economies, Development of new types of plastic films, and expansion of industries like food processing, healthcare, and construction are the reasons that are driving the market.

Based on application it is divided into three segments- Packaging, Agriculture, Construction

Asia-Pacific is the most dominant region for the Plastic Films Market.

Exxon Mobil Corporation, Chevron Phillips Chemical Company LLC, LyondellBasell Industries Holdings, LLC, SABIC