Plasma Facing Materials Market Size (2024-2030)

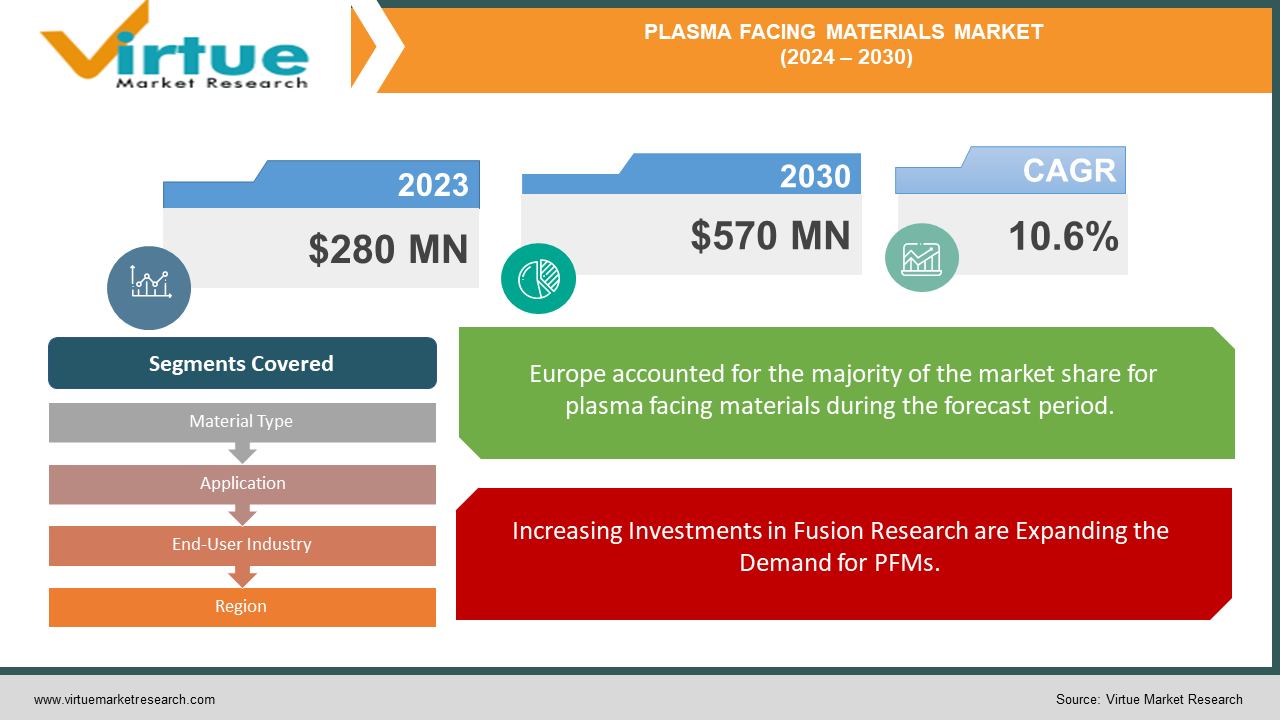

The Plasma Facing Materials Market was valued at USD 280 million in 2023 and is projected to reach a market size of USD 570 million by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.6%.

The Plasma Facing Materials (PFM) market is integral to the development of nuclear fusion technology, requiring materials that can withstand extreme conditions like high temperatures, radiation, and plasma interactions in reactors. Essential PFMs include tungsten, beryllium, and carbon composites, chosen for their high thermal conductivity, resistance to erosion, and high melting points. The market is expanding due to increasing investments in nuclear fusion projects and the global pursuit of sustainable energy solutions. Ongoing innovations in material science are enhancing the performance, durability, and cost-effectiveness of PFMs, making them indispensable for the future of clean energy from nuclear fusion.

Key Market Insights:

Annual global demand for PFMs in 2023 was approximately 2,800 tons. This demand is anticipated to double to about 5,600 tons by 2030, highlighting the growing need for high-performance materials for fusion reactors and advanced scientific applications.

Ceramics led the market in 2023, commanding more than 45% of the revenue share due to their excellent durability and performance under extreme conditions, crucial for fusion reactors and high-energy physics applications.

Fusion reactors were the dominant application sector in 2023, contributing 55% of the total market revenue. This sector's growth is driven by international fusion projects such as ITER and the pursuit of commercial fusion energy solutions.

Innovative production techniques for PFMs are reducing costs by up to 15% and improving the performance of materials for extreme conditions, supporting the expansion of fusion research.

Plasma Facing Materials Market Drivers:

Increasing Investments in Fusion Research are Expanding the Demand for PFMs.

Investment from both governmental and private sectors in nuclear fusion research is a primary driver for the PFM market. Major initiatives like ITER require advanced PFMs for reactor construction and operation, spurring market growth through increased funding and technological development.

Technological Innovations are Enhancing PFM Properties and Reducing Costs.

Technological advancements are improving PFM properties and lowering costs. Innovations in high-strength materials and advanced composites enhance thermal resistance and durability, making PFMs more effective and cost-efficient for fusion reactors.

Growing Global Focus on Clean Energy Solutions is Boosting PFM Market Opportunities.

The global shift towards clean energy sources is fueling demand for PFMs. As nations prioritize reducing carbon emissions, the potential of nuclear fusion as a sustainable energy source drives investments in PFMs essential for the success of fusion energy projects.

Stringent Safety and Performance Standards are Driving Advances in PFM Technology.

Strict safety and performance regulations for fusion reactors drive PFM development. These regulations ensure that PFMs meet high standards for extreme conditions, which encourages innovation and the creation of high-quality materials for fusion reactors.

Plasma Facing Materials Market Restraints and Challenges:

One of the significant challenges facing the Plasma Facing Materials (PFM) market is the high development cost associated with creating advanced materials for fusion reactors. Developing PFMs that can withstand extreme temperatures, high radiation levels, and intense mechanical stress requires substantial investment in research and development. The sophisticated materials needed for these applications often involve complex fabrication processes and expensive raw materials, leading to elevated costs for manufacturers and research institutions. This financial burden can hinder the progress of PFM technologies and delay the development of viable fusion energy solutions.

In addition to high costs, the technical complexities involved in developing PFMs present another major challenge. Creating materials that meet the demanding performance standards for fusion reactors requires overcoming significant scientific and engineering obstacles. The development process involves intricate material science and advanced testing to ensure that PFMs can perform reliably under extreme conditions. Furthermore, the need for specialized testing facilities and rigorous validation procedures adds to the time and expense required for PFM development. These technical challenges can slow market advancement and affect the pace of innovation in the fusion energy sector.

Plasma Facing Materials Market Opportunities:

The Plasma Facing Materials (PFM) market is poised for growth due to increasing investments in fusion energy research. Governments and private sectors are channeling substantial funds into fusion research initiatives like ITER and the National Fusion Facility, which aim to make fusion energy a viable and sustainable power source. These investments not only provide financial support for the development of advanced PFMs but also drive innovation and collaboration among researchers, manufacturers, and energy companies. This surge in funding helps accelerate the development of new PFMs that can meet the extreme conditions required for successful fusion reactions, thereby expanding opportunities for market growth and technological advancement..

Beyond fusion reactors, advanced Plasma Facing Materials are finding new applications in a variety of high-tech industries. Innovations in material science are leading to the development of PFMs with superior properties, such as enhanced thermal stability and radiation resistance, which are applicable in fields such as aerospace, defense, and high-energy particle physics. These advancements open up new market segments for PFMs, as these materials are increasingly used in advanced technologies and experimental setups. The expanding range of applications for PFMs in environments demanding high performance and durability presents fresh commercial opportunities and stimulates further growth in the market.

PLASMA FACING MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.6% |

|

Segments Covered |

By Material Type, Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Materion Corporation, Plansee SE, Tokyo Electron Limited, Furukawa Electric Co., Ltd., Fusion for Energy (F4E), Vacuumschmelze GmbH & Co. KG, Sierra Materials, SAES Getters S.p.A., Westinghouse Electric Company, Mitsubishi Heavy Industries, Ltd |

Plasma Facing Materials Market Segmentation: By Material Type

-

Ceramics

-

Metals

-

Composites

In the Plasma Facing Materials (PFM) market, metals represent the largest segment due to their high thermal conductivity, strength, and ability to endure intense plasma conditions, making them essential in fusion reactors and high-energy physics applications. Tungsten, in particular, is widely used due to its exceptional performance under extreme conditions. Composites, on the other hand, are the fastest-growing segment. Their ability to combine the advantageous properties of different materials such as enhanced thermal stability and erosion resistance drives their increasing adoption in advanced aerospace and high-temperature industrial applications. The growing need for durable and high-performance materials in these sectors propels the rapid expansion of the composites segment.

Plasma Facing Materials Market Segmentation: By Application

-

Fusion Reactors

-

Aerospace

-

High-Energy Physics

In the Plasma Facing Materials (PFM) market, fusion reactors constitute the largest application segment, driven by significant investments in fusion energy projects such as ITER. The demand for PFMs in this segment is propelled by the need for materials that can withstand extreme temperatures and radiation. Meanwhile, the aerospace sector is the fastest-growing segment, fueled by advancements in space exploration and satellite technology. The increasing complexity of aerospace missions and the need for materials that offer superior thermal and mechanical performance are driving the rapid adoption of PFMs in this sector.

Plasma Facing Materials Market Segmentation: By End-User Industry

-

Energy

-

Aerospace

-

Defense

The energy sector represents the largest end-user industry, primarily driven by the extensive use of PFMs in fusion energy projects which require materials capable of withstanding extreme conditions. Meanwhile, the aerospace industry is the fastest-growing segment, propelled by increasing investments in space exploration and advanced aerospace technologies. The sector's rapid growth is due to the critical need for high-performance materials that can endure the demanding thermal and mechanical stresses encountered in aerospace applications.

Plasma Facing Materials Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Europe stands out as the largest regional segment due to significant investments in fusion energy projects like ITER and strong research initiatives in advanced materials. On the other hand, Asia-Pacific is the fastest-growing region, driven by rapid industrialization, increasing research activities in fusion energy, and expanding aerospace and high-energy physics sectors in countries such as China and Japan. The region's robust economic growth and substantial government support for technological advancements contribute to its accelerating demand for PFMs.

COVID-19 Impact Analysis on the Plasma Facing Materials Market:

The COVID-19 pandemic had a multifaceted impact on the Plasma Facing Materials (PFM) market. Initially, the global lockdowns and supply chain disruptions significantly slowed down manufacturing activities and delayed several key projects, particularly in the energy and aerospace sectors. The halt in production and logistical challenges affected the availability and distribution of PFMs, leading to project postponements and increased costs. Additionally, many research and development initiatives were temporarily suspended or scaled back, affecting the progress of ongoing studies in fusion energy and high-energy physics.

Despite these challenges, the market began to recover as industries adapted to the new normal. Governments and private sectors increased their investments in sustainable energy solutions, including fusion energy projects, to ensure long-term energy security and resilience against future crises. This renewed focus on energy sustainability accelerated the demand for advanced PFMs. Moreover, the aerospace sector, driven by the resurgence of space exploration missions and satellite deployments, witnessed a rebound, further boosting the market. The pandemic underscored the importance of robust supply chains and innovative materials, leading to increased research and development efforts to enhance the performance and reliability of PFMs in various applications.

Latest Trends/ Developments:

The Plasma Facing Materials (PFM) market is witnessing dynamic advancements driven by a range of innovative trends and emerging developments. One prominent trend is the evolution of advanced composite materials designed to endure the extreme conditions encountered in fusion reactors and high-energy physics applications. New materials such as carbon-carbon composites and tungsten-ceramic composites are at the forefront of this development, offering enhanced thermal resistance, structural integrity, and durability under intense heat flux and radiation. These advanced materials are being developed to meet the demanding requirements of next-generation fusion reactors and experimental setups, which are pushing the limits of material science. Another significant trend is the increase in private sector investments aimed at accelerating advancements in both space exploration and fusion energy technologies. Major companies, including SpaceX and Blue Origin, are significantly expanding their missions and research initiatives, which include developing next-generation propulsion systems and supporting high-profile projects like the International Thermonuclear Experimental Reactor (ITER). This influx of investment is not only fueling the advancement of existing PFM technologies but also driving the development of innovative solutions for future energy and space exploration endeavors. Moreover, the growth in funding is also leading to the establishment of new research facilities and collaborations, which are essential for advancing PFM technologies and achieving milestones in fusion energy and space missions.

Key Players:

-

Materion Corporation

-

Plansee SE

-

Tokyo Electron Limited

-

Furukawa Electric Co., Ltd.

-

Fusion for Energy (F4E)

-

Vacuumschmelze GmbH & Co. KG

-

Sierra Materials

-

SAES Getters S.p.A.

-

Westinghouse Electric Company

-

Mitsubishi Heavy Industries, Ltd

Chapter 1. Plasma Facing Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plasma Facing Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plasma Facing Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plasma Facing Materials Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plasma Facing Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plasma Facing Materials Market – By Material Type

6.1 Introduction/Key Findings

6.2 Ceramics

6.3 Metals

6.4 Composites

6.5 Y-O-Y Growth trend Analysis By Material Type

6.6 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Plasma Facing Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Fusion Reactors

7.3 Aerospace

7.4 High-Energy Physics

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Plasma Facing Materials Market – By End User

8.1 Introduction/Key Findings

8.2 Energy

8.3 Aerospace

8.4 Defense

8.5 Y-O-Y Growth trend Analysis By End User

8.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Plasma Facing Materials Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material Type

9.1.3 By Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material Type

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material Type

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material Type

9.4.3 By Application

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material Type

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Plasma Facing Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Materion Corporation

10.2 Plansee SE

10.3 Tokyo Electron Limited

10.4 Furukawa Electric Co., Ltd.

10.5 Fusion for Energy (F4E)

10.6 Vacuumschmelze GmbH & Co. KG

10.7 Sierra Materials

10.8 SAES Getters S.p.A.

10.9 Westinghouse Electric Company

10.10 Mitsubishi Heavy Industries, Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Plasma Facing Materials market was valued at USD 280 million in 2023 and is projected to reach USD 570 million by the end of 2030. Over the forecast period of 2024 – 2030, the market is expected to grow at a CAGR of 10.6%.

Increasing Investments in Fusion Energy Research Drive PFM Demand, Technological Advancements Enhance PFM Performance and Reduce Costs, Growing Focus on Clean Energy Solutions Creates PFM Market Opportunities, Strict Safety and Performance Standards Drive PFM Technological Progress.

Segments under the Plasma Facing Materials Market By End-User Industry are Energy, Aerospace, and Defense.

Europe dominates the plasma-facing materials market due to major investments in fusion energy projects like ITER and advanced material research.

Materion Corporation, Plansee SE, Tokyo Electron Limited, Furukawa Electric Co., Ltd., Fusion for Energy (F4E), Vacuumschmelze GmbH & Co. KG, Sierra Materials, SAES Getters S.p.A., Westinghouse Electric Company, Mitsubishi Heavy Industries, Ltd.