Plant Genotyping Equipment Market Size (2025 – 2030)

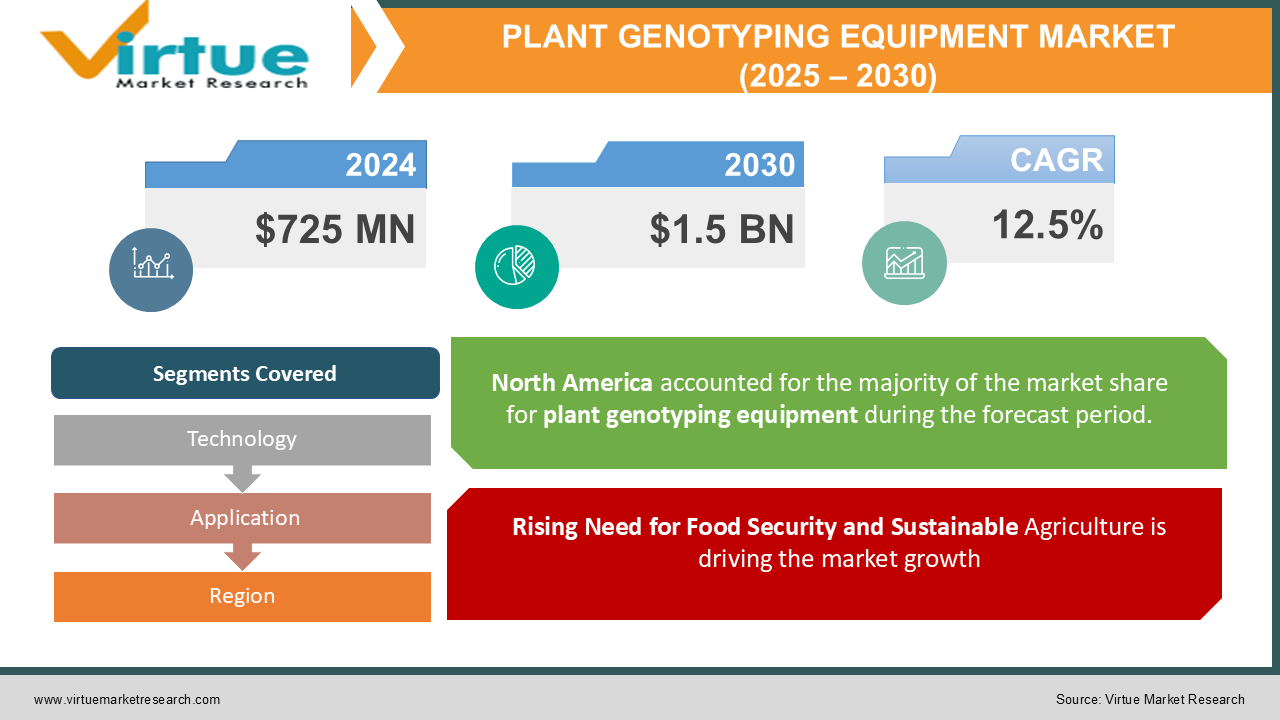

The Global Plant Genotyping Equipment Market was valued at USD 725 million in 2024 and is projected to reach USD 1.5 billion by 2030, growing at a CAGR of 12.5% during the forecast period.

The increasing need for advanced genotyping technologies to address challenges such as food security, climate resilience, and crop productivity is propelling market growth.

Plant genotyping equipment plays a critical role in identifying and analyzing the genetic makeup of plants, enabling researchers and breeders to develop high-yielding and disease-resistant crops. The market is witnessing significant growth due to advancements in genotyping technologies, government support for agricultural research, and rising adoption of precision agriculture practices.

Key Market Insights

-

Next-Generation Sequencing (NGS) technology accounted for the largest revenue share in 2024, driven by its high throughput and accuracy.

-

The crop improvement segment leads the market, reflecting a CAGR of over 13%, fueled by the demand for genetically improved and stress-tolerant crops.

-

North America dominates the market with a 40% share, followed by Europe and Asia-Pacific.

-

Emerging economies in Asia-Pacific are witnessing rapid adoption of genotyping equipment due to increasing agricultural research activities.

-

Government initiatives promoting agricultural sustainability and innovation are driving investments in plant genotyping equipment.

-

The integration of AI and machine learning with genotyping platforms is emerging as a key trend in the market.

Global Plant Genotyping Equipment Market Drivers

1. Rising Need for Food Security and Sustainable Agriculture is driving the market growth

The global population is projected to reach 9.7 billion by 2050, necessitating a significant increase in food production. Traditional farming methods are insufficient to meet this demand, highlighting the need for advanced genetic tools to enhance crop yield and resilience.

Plant genotyping equipment enables breeders to identify desirable traits, such as drought tolerance, pest resistance, and nutrient efficiency, facilitating the development of high-performance crop varieties. This aligns with global efforts to ensure food security and promote sustainable agricultural practices.

2. Advancements in Genotyping Technologies is driving the market growth

Technological innovations in genotyping platforms, such as Next-Generation Sequencing (NGS), polymerase chain reaction (PCR), and microarrays, have revolutionized plant genetics research. These technologies provide faster, more accurate, and cost-effective solutions for analyzing plant genomes.

NGS, in particular, has emerged as a game-changer, enabling high-throughput sequencing of plant genomes and accelerating the discovery of genetic markers. Similarly, advancements in PCR technology have enhanced its efficiency and sensitivity, making it a popular choice for genotyping applications.

3. Government and Institutional Support for Agricultural Research is driving the market growth

Governments and research institutions worldwide are investing heavily in agricultural biotechnology to address challenges related to climate change, pest outbreaks, and declining soil fertility. Initiatives such as the European Green Deal, India’s National Mission for Sustainable Agriculture, and the US Department of Agriculture’s (USDA) research programs are driving the adoption of plant genotyping equipment.

Public-private partnerships and funding for plant genomics research are further bolstering market growth. For instance, the International Maize and Wheat Improvement Center (CIMMYT) and other global organizations are leveraging genotyping technologies to develop improved crop varieties.

Global Plant Genotyping Equipment Market Challenges and Restraints

1. High Cost of Genotyping Equipment is restricting the market growth

The high cost of plant genotyping equipment and associated technologies remains a significant barrier to market adoption, particularly in developing economies. Advanced platforms like NGS require substantial investments in infrastructure, reagents, and skilled personnel, limiting their accessibility to large research institutions and multinational corporations.

To overcome this challenge, manufacturers are focusing on developing cost-effective solutions and offering flexible financing options to increase accessibility. Governments and international organizations are also providing subsidies and grants to promote the adoption of genotyping technologies.

2. Limited Technical Expertise and Infrastructure is restricting the market growth

The adoption of genotyping equipment requires specialized expertise and infrastructure, which are often lacking in many agricultural research institutions and small-scale breeding programs. This challenge is particularly pronounced in developing regions, where limited access to training and resources hinders the widespread use of genotyping technologies.

To address this issue, manufacturers and research organizations are offering training programs and technical support to enhance user capabilities. Collaborative initiatives, such as partnerships between universities and technology providers, are also helping bridge the skill gap.

Market Opportunities

The Global Plant Genotyping Equipment Market is poised for substantial growth, driven by the increasing adoption of precision agriculture practices, a heightened focus on developing climate-resilient crops, and rapid advancements in biotechnology. Emerging markets in Asia-Pacific and Latin America, particularly in countries like China, India, and Brazil, are witnessing a surge in demand for genotyping equipment as these regions prioritize agricultural research and development to enhance crop productivity and address food security challenges. The integration of artificial intelligence (AI) and big data analytics with genotyping platforms is revolutionizing plant research. These technologies empower researchers to analyze vast datasets, identify intricate genetic patterns, and make data-driven decisions, significantly accelerating the pace of plant breeding programs. The escalating frequency of climate-related challenges, including droughts, floods, and pest outbreaks, necessitates the development of crop varieties that can withstand these adverse conditions. Genotyping equipment plays a pivotal role in identifying genetic traits associated with stress tolerance, enabling the creation of climate-resilient crops that can thrive in challenging environments. Furthermore, the growing involvement of private companies in commercial breeding programs is driving significant investments in genotyping equipment. These companies are leveraging advanced genetic tools to develop high-performance crop varieties with enhanced yield, quality, and disease resistance, thereby gaining a competitive edge in the global agricultural market.

PLANT GENOTYPING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.5% |

|

Segments Covered |

By Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN N.V., Eurofins Scientific, LGC Biosearch Technologies, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., NRGene, Neogen Corporation |

Plant Genotyping Equipment Market Segmentation - By Technology

-

Polymerase Chain Reaction (PCR)

-

Microarrays

-

Next-Generation Sequencing (NGS)

-

Others

The global plant genotyping equipment market is primarily driven by Next-Generation Sequencing (NGS) technologies, which have emerged as the dominant force due to their unparalleled advantages. NGS platforms offer significantly higher throughput compared to traditional Sanger sequencing methods, enabling researchers to analyze vast amounts of genetic data in a relatively short timeframe. This high throughput capacity is crucial for large-scale genotyping projects, such as genome-wide association studies (GWAS) and genomic selection, which require the analysis of numerous genetic markers across a large number of individuals. Moreover, NGS technologies boast exceptional accuracy and precision, minimizing the risk of errors in data generation and analysis. This high level of accuracy is critical for identifying subtle genetic variations and making reliable inferences about the genetic architecture of complex traits. Furthermore, the continuous advancements in NGS technologies have led to a significant reduction in sequencing costs, making it a more cost-effective option for a wider range of research applications and commercial breeding programs. The combination of high throughput, accuracy, and cost-effectiveness has solidified the position of NGS as the preferred technology for plant genotyping, driving innovation and accelerating the pace of plant breeding in the modern era.

Plant Genotyping Equipment Market - By Application

-

Crop Improvement

-

Plant Research

-

Others

The crop improvement segment holds the largest share of the plant genotyping equipment market, primarily driven by the urgent need to enhance crop productivity and resilience in the face of growing global food demands and changing environmental conditions. Plant breeders extensively utilize genotyping equipment to accelerate the development of improved crop varieties. By identifying specific genetic markers associated with desirable traits such as pest resistance, drought tolerance, nutrient efficiency, and high yield potential, breeders can efficiently select and combine beneficial genes, leading to the development of superior crop varieties that can withstand environmental stresses, produce higher yields, and improve overall agricultural sustainability.

Plant Genotyping Equipment Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America currently leads the global plant genotyping equipment market, capturing over 40% of global revenue in 2024, driven by advanced research infrastructure, strong government support, and widespread adoption of precision farming technologies. Europe holds a significant market share, primarily attributed to stringent environmental regulations, government initiatives promoting sustainable agriculture, and the presence of renowned research institutions. The region is also witnessing a growing focus on developing climate-resilient crops. The Asia-Pacific region is experiencing the most rapid growth, with a projected CAGR exceeding 14%, fueled by increasing investments in agricultural biotechnology, rising demand for high-yielding crops, and supportive government policies in countries like India, China, and Japan. Latin America is emerging as a key market, driven by the expansion of agricultural research activities and the adoption of advanced breeding techniques, with Brazil and Argentina playing a pivotal role in improving the productivity of key crops. While the Middle East & Africa market is still nascent, it is steadily growing due to increasing investments in agricultural research and the rising adoption of precision farming practices.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the plant genotyping equipment market. While disruptions in supply chains and research activities hindered market growth initially, the pandemic also highlighted the importance of food security and agricultural sustainability. The increased focus on developing resilient and high-yielding crops during the pandemic has accelerated the adoption of genotyping technologies. Governments and research institutions are prioritizing investments in plant genomics to address post-pandemic challenges related to food supply and climate resilience.

Latest Trends/Developments

The plant genotyping equipment market is witnessing several key advancements. Manufacturers are developing portable genotyping devices, enabling on-field genetic analysis and reducing reliance on laboratory infrastructure. The adoption of CRISPR-based gene editing tools is gaining traction in plant genotyping due to their precision and cost-effectiveness. Collaborative research programs, including public-private partnerships and international collaborations, are driving innovation and accelerating the development of novel genotyping technologies. Furthermore, the integration of genotyping with other omics technologies, such as transcriptomics, proteomics, and metabolomics, is providing a more comprehensive understanding of plant genetics and physiology. Finally, the utilization of cloud-based platforms is enabling real-time data sharing and analysis, facilitating collaboration among researchers and accelerating the pace of scientific discovery.

Key Players

-

Thermo Fisher Scientific Inc.

-

Illumina, Inc.

-

Agilent Technologies, Inc.

-

QIAGEN N.V.

-

Eurofins Scientific

-

LGC Biosearch Technologies

-

PerkinElmer, Inc.

-

Bio-Rad Laboratories, Inc.

-

NRGene

-

Neogen Corporation

Chapter 1. Plant Genotyping Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Source

Chapter 2. Plant Genotyping Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant Genotyping Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant Genotyping Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant Genotyping Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant Genotyping Equipment Market – By Technology

6.1 Introduction/Key Findings

6.2 Polymerase Chain Reaction (PCR)

6.3 Microarrays

6.4 Next-Generation Sequencing (NGS)

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2025-2030

Chapter 7. Plant Genotyping Equipment Market – By Application

7.1 Introduction/Key Findings

7.2 Crop Improvement

7.3 Plant Research

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Plant Genotyping Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plant Genotyping Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Thermo Fisher Scientific Inc.

9.2 Illumina, Inc.

9.3 Agilent Technologies, Inc.

9.4 QIAGEN N.V.

9.5 Eurofins Scientific

9.6 LGC Biosearch Technologies

9.7 PerkinElmer, Inc.

9.8 Bio-Rad Laboratories, Inc.

9.9 NRGene

9.10 Neogen Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Plant Genotyping Equipment Market was valued at USD 725 million in 2024 and is projected to reach USD 1.5 billion by 2030, growing at a CAGR of 12.5%.

Key drivers include the rising need for food security, advancements in genotyping technologies, and government support for agricultural research.

Segments include Technology (PCR, Microarrays, NGS, Others) and Application (Crop Improvement, Plant Research, Others).

North America dominates the market, accounting for over 40% of global revenue in 2024, driven by advanced research infrastructure and high adoption of precision farming.

Key players include Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN N.V., and Eurofins Scientific.