Plant-based Workout Supplements Market Size (2024 – 2030)

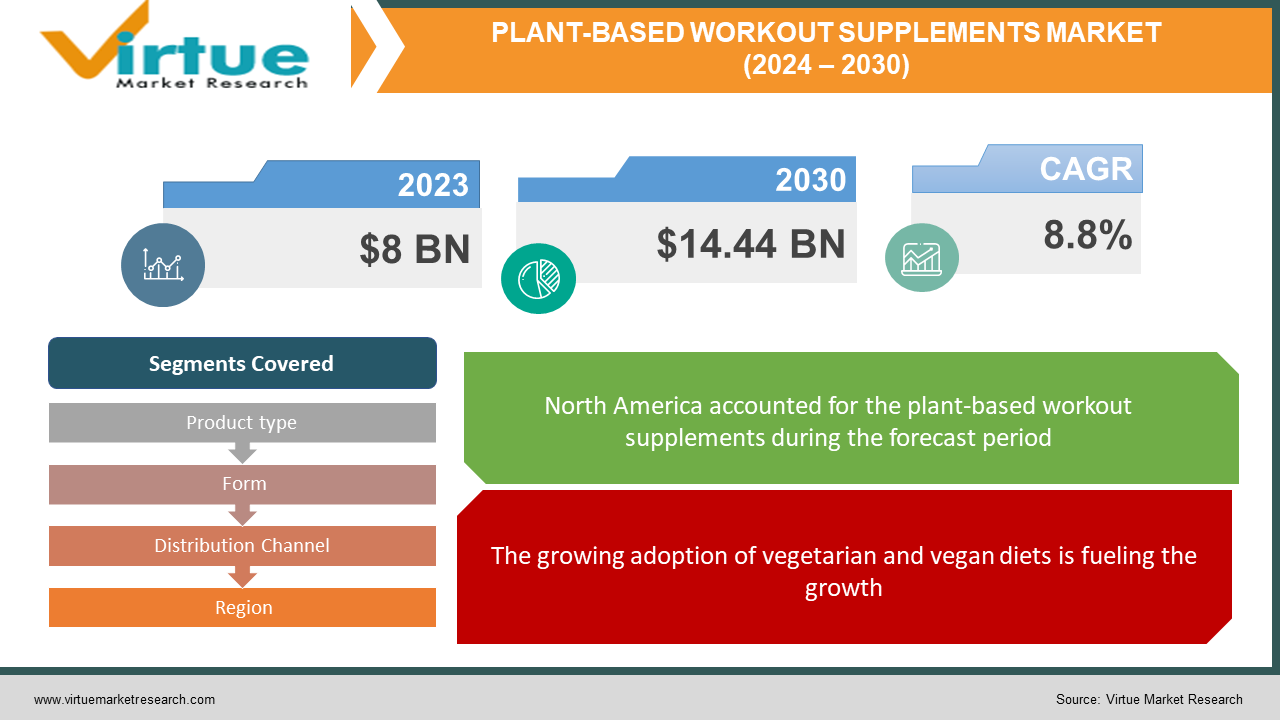

The global plant-based workout supplement market was valued at USD 8 billion in 2023 and is projected to hit around USD 14.44 billion by 2030, growing at a CAGR of 8.8% during the forecast period from 2024 to 2030.

An expanding selection of supplements is available to support the training of plant-based athletes and fitness enthusiasts. To support muscle growth and repair, these people can locate vegan substitutes for a variety of well-known supplements, including protein powders made from peas, brown rice, and soy. Although typically obtained from animals, there are now plant-based alternatives for creatine that are fermented. Vegans can obtain beta-alanine, which is frequently used in pre-workout supplements to increase muscle mass and decrease exhaustion, by using fermented maize. Plant-based versions of branched-chain amino acids (BCAAs), which are essential for muscle repair, can be obtained through fermentation. Like this, some plant-based protein powders contain L-glutamine, another amino acid that promotes healing, which is also sold as a separate supplement.

Key Market Insights:

The market for plant-based exercise supplements is expanding, driven by the growing popularity of veganism and vegetarianism. A wide range of supplements are in high demand from fitness enthusiasts looking for plant-based substitutes. Producers are experimenting, providing muscle-supporting protein powders made of soy, brown rice, and peas. Through fermentation, traditionally animal-derived nutrients like creatine and beta-alanine (for endurance) can now be found in plant-based forms. Plant-based versions of recovery-oriented BCAAs and L-glutamine are also accessible. However, these supplements are not a quick fix for fitness. The keys are still a balanced diet, consistent exercise, and enough sleep

Global Plant-Based Workout Supplements Market Drivers:

The growing adoption of vegetarian and vegan diets is fueling the growth.

The market for plant-based exercise supplements is expanding due in large part to the rise in vegan and vegetarian diets. Many people select plant-based substitutes in many facets of their lives, including their exercise regimens, due to ethical concerns about animal suffering and the effects animal agriculture has on the environment. Fitness enthusiasts who prioritize their health also find solace in the potential health advantages of plant-based diets, such as a decreased chance of developing specific chronic illnesses. Because of this, there is a huge need for plant-based protein powders, vegan substitutes for conventional supplements like creatine and BCAAs, and other plant-based products that fit their beliefs and dietary preferences. The market for plant-based exercise supplements is rising to new heights because of this shift in consumer preferences.

Growing knowledge of health advantages is facilitating the expansion.

Plant-based protein sources are gaining popularity among consumers because of their possible health benefits. They usually have lower cholesterol and saturated fat contents than animal protein, which may be good for heart health. Beyond only protein, plant-based proteins frequently contain high levels of fiber, vitamins, and minerals, providing an abundance of nutrients. As people look to support their general well-being and fitness goals, the appeal of plant-based protein sources, including workout supplements, is being driven by these combined potential health benefits.

Enhanced marketing and accessibility are accelerating the growth rate.

Plant-based fitness supplements are becoming increasingly popular due to increased accessibility and focused marketing. It's becoming simpler for people who desire these supplements to find them because of the growth of specialty stores selling plant-based and vegan goods. The reach of these products is further increased by the large assortment and easy accessibility provided by internet sellers. In the meantime, producers are stepping up their marketing campaigns, emphasizing the advantages of plant-based supplements and successfully directing them toward athletes and fitness enthusiasts who are health-conscious. Plant-based workout supplements are becoming more widely known and popular among consumers because of their focused marketing and expanded availability.

Global Plant-Based Workout Supplements Market Restraints and Challenges:

Associated costs, a lack of information, and limited availability are the main issues that the market is currently facing.

The expense of obtaining and processing plant-based proteins frequently results in increased costs for customers, which may put people on a tight budget. Secondly, although there is a lot of study on the advantages of plant-based protein, it does not have the same depth of information as that of animal protein, which makes some customers hesitant. Plant-based protein powders might sometimes have fewer appealing textures and tastes than traditional choices, which is a constant challenge for producers. Moreover, restricted accessibility and market expansion may be impeded by restricted availability in specific areas and a complicated regulatory environment that differs throughout nations. The market for plant-based workout supplements must continue to grow to overcome these challenges through joint efforts towards uniform global standards, taste and texture enhancements, and ongoing research.

Global Plant-Based Workout Supplements Market Opportunities:

Growing numbers of vegans and vegetarians around the world increase the market's potential consumer base and fuel demand. Producers are driving this expansion by consistently coming up with new protein sources, functional mixes, and specialized supplements that meet the needs of a wide range of athletes. Growth is further fueled by increased investment from both new and incumbent players, which broadens the market and advances product development. Furthermore, the decreased environmental effect of producing plant-based proteins coincides well with the increased emphasis on sustainability, offering this market segment a huge opportunity. Strategic alliances between producers, distributors, and fitness experts can unleash enormous potential by increasing customer awareness, enhancing distribution, and making tailored recommendations. The market for plant-based exercise supplements is well-positioned for long-term growth and major health benefits by making use of these prospects.

PLANT-BASED WORKOUT SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.8% |

|

Segments Covered |

By Product type, Form, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, AMCO Proteins, Glanbia plc, IOVATE Health Sciences International, Inc., MusclePharm Corporation, NOW Foods, Quest Nutrition, The Bountiful Company, Transparent Labs, WOODBOLT DISTRIBUTION LLC |

Global Plant-based Workout Supplements Market Segmentation: By Product Type

-

Protein Powders

-

Creatine

-

Beta-Alanine

-

Branched-Chain Amino Acids (BCAAs)

-

L-Glutamine

-

Other Supplements

Protein powders are the largest growing segment of plant-based workout supplements. With a variety of plant-based sources to suit a range of tastes, they provide a flexible and easy approach to increasing our protein intake. Furthermore, their versatility makes it simple to include them in different recipes and customize consumption. Moreover, plant-based diets are becoming more and more popular, and consumers are becoming more conscious of the possible health advantages of these plant-based protein sources. These factors have contributed to the rapid expansion of protein powders. Branched-chain amino acids are the fastest-growing category. Leucine, isoleucine, and valine are the three essential amino acids known as BCAAs, and they are vital for the synthesis of proteins. It has been demonstrated that leucine in particular promotes the synthesis of muscle proteins, which is necessary for both muscular development and post-exercise recovery. Because of this, BCAAs are especially desirable for people who want to gain and keep muscular mass.

Global Plant-Based Workout Supplements Market Segmentation: By Form

-

Powder

-

Capsule

-

Bar

-

Liquid

-

Others

Based on form, the powder segment is the largest and fastest-growing. Customers frequently like powder form because of its adaptability. Protein powders made from plants may be blended into shakes, smoothies, and other drinks with ease, offering a quick and easy option to consume more protein during the day or after a workout. Furthermore, powders provide dosage flexibility, enabling people to modify dose quantities according to their dietary requirements.

Global Plant-based Workout Supplements Market Segmentation: By Distribution Channel

-

Online Retailers

-

Specialty Stores

-

Traditional Sports Nutrition Stores

-

Gyms and Fitness Centers

The market for plant-based workout supplements is dominated by online retailers because of their wide assortment, ability to be accessed around the clock, and often affordable prices. Besides, the products they order are delivered to their homes, making this channel a convenient one. Furthermore, with the growing trend towards digitalization, this category has gained prominence. Gyms and fitness centers are the fastest-growing segment. Customers may buy training supplements in a handy and accessible location at gyms and fitness centers. These facilities frequently contain retail stores or vending machines on the premises that sell a range of fitness-related goods, including supplements. Gyms and fitness centers are important distribution channels for supplements since members may also be more likely to buy them right before or right after their workouts.

Global Plant-based Workout Supplements Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market for plant-based workout supplements is currently led by North America because of the region's high rate of veganism and vegetarianism, well-established distribution networks, and significant investment in the business. Many prominent companies are located in this area. These companies have a global presence. A few notable ones include Vega, Garden of Life, Nutiva, Sunwarrior, etc. But because of its enormous population that offers enormous potential for market expansion, growing awareness of plant-based lifestyles, and rising disposable income, Asia-Pacific is predicted to grow at the fastest rate. This region has undergone significant changes in the economy. Moreover, many research and developmental activities are being conducted to find out more about these products.

COVID-19 Impact Analysis on the Global Plant-Based Workout Supplements Market:

The COVID-19 pandemic had a mixed effect on the market for plant-based exercise supplements. Lockdowns, social isolation, and movement restrictions were the new norm. This caused a brief decline in demand due to gym closures and economic concerns; the pandemic ultimately contributed to the segment's expansion. People's increased consciousness of their health prompted them to choose healthier options, such as supplements made of plants. The increase in internet sales also increased market reach and offered quick access. In response to supply chain interruptions, manufacturers may have sourced ingredients locally, hastening the transition to more robust systems. The pandemic may have had a mostly beneficial impact on the market, despite brief difficulties, by exposing the segment's potential for sustained expansion and possibly quickening current trends.

Recent Trends and Developments in the Global Plant-Based Workout Supplements Market:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

In November 2023, four new limited-edition flavors were introduced by Glanbia Performance Nutrition's sports nutrition brand, Optimum Nutrition, for its Gold Standard 100% Whey and AMIN.O. ENERGY product lines. All four alternatives are made to delight in the flavors of

Fruity Cereal, Cinnamon Roll, Tropical Sunrise, and Citrus Spritz all meet the Optimum Nutrition standard for quality and taste. With 24 grams of premium protein in each of the new Gold Standard 100% Whey Fruity Cereal and Cinnamon Roll flavors, customers have a tasty option to meet their daily protein requirements, fuel their post-workout, or aid in muscle recovery. With only 1 gram of sugar and 130–140 calories per serving, it is low in sugar.

Key Players:

-

Abbott Laboratories

-

AMCO Proteins

-

Glanbia plc

-

IOVATE Health Sciences International, Inc.

-

MusclePharm Corporation

-

NOW Foods

-

Quest Nutrition

-

The Bountiful Company

-

Transparent Labs

-

WOODBOLT DISTRIBUTION LLC

In July 2022, to generate proteins using biotechnological techniques for a variety of uses, including nutrition, cosmetics, pharmaceuticals, and medical items, GELITA AG developed a biotechnology center in Frankfurt, Germany. GELITA has reached a significant milestone in its journey towards expanding its sustainable product offering with the acquisition of the new property.

Chapter 1. Plant-based Workout Supplements Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plant-based Workout Supplements Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant-based Workout Supplements Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant-based Workout Supplements Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant-based Workout Supplements Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant-based Workout Supplements Market – By Product Type

6.1 Introduction/Key Findings

6.2 Protein Powders

6.3 Creatine

6.4 Beta-Alanine

6.5 Branched-Chain Amino Acids (BCAAs)

6.6 L-Glutamine

6.7 Other Supplements

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Plant-based Workout Supplements Market – By Form

7.1 Introduction/Key Findings

7.2 Powder

7.3 Capsule

7.4 Bar

7.5 Liquid

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Form

7.8 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Plant-based Workout Supplements Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online Retailers

8.3 Specialty Stores

8.4 Traditional Sports Nutrition Stores

8.5 Gyms and Fitness Centers

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Plant-based Workout Supplements Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Form

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Form

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Form

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Form

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Form

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Plant-based Workout Supplements Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott Laboratories

10.2 AMCO Proteins

10.3 Glanbia plc

10.4 IOVATE Health Sciences International, Inc.

10.5 MusclePharm Corporation

10.6 NOW Foods

10.7 Quest Nutrition

10.8 The Bountiful Company

10.9 Transparent Labs

10.10 WOODBOLT DISTRIBUTION LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global plant-based workout supplement market is valued at USD 8 billion in 2023.

The worldwide global plant-based workout supplement market growth is estimated to be 8.8% from 2024 to 2030.

The global plant-based workout supplement market is segmented by product type, form, distribution channel, and region.

Supplements for exercise derived from plants have a bright future. More advancements in personalized selections, functional blends, and protein sources are anticipated. Sustainability will be a major priority, and market expansion and consumer adoption will be further fueled by manufacturers, retailers, and fitness experts working together strategically.

While gym closures and economic concerns had an early negative influence on the market for plant-based workout supplements, the pandemic ultimately helped the industry. Plant-based solutions became more popular as health consciousness increased and the growth of internet sales broadened accessibility and market penetration.