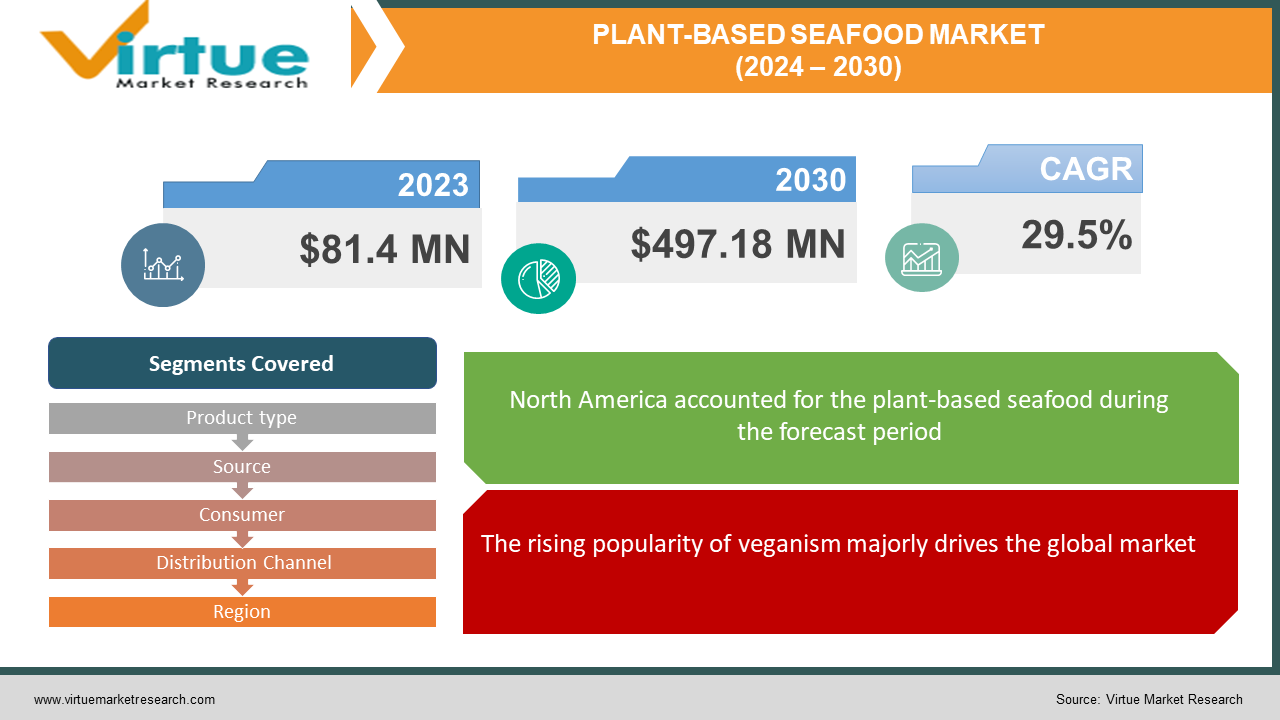

Plant-Based Seafood Market Size (2024 – 2030)

The plant-based seafood market is rapidly growing, driven by increasing demand for vegan and healthy lifestyles. The market was valued at USD 81.4 million in 2023 and is projected to reach a market size of USD 497.18 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 29.5%.

Plant-based seafood is a type of food created from plant sources to imitate the look and feel of real seafood. Ingredients like wheat protein, pea protein, and other plant-based elements are used to provide a sustainable, animal-free alternative to traditional seafood. Beyond being a viable alternative, plant-based seafood also offers a nutritious and flavorful option, closely resembling the taste, texture, and appearance of classic seafood dishes. Furthermore, some plant-based seafood products are enriched with essential vitamins and minerals, making them a suitable choice for health-conscious consumers. The growing emphasis on a healthy diet is driven, in part, by the increasing prevalence of obesity.

The adoption of plant-based seafood aligns with policies and regulations aimed at promoting sustainable fishing practices and reducing the environmental impact associated with traditional fishing. To make these products more widely available, companies are expanding their distribution networks, responding to the rising awareness of environmental issues in the fishing industry, such as the depletion of fish stocks and damage to marine ecosystems.

Key Market Insights:

The surge towards healthier diets is spurred by rising obesity rates, creating a demand for cholesterol-free and lower saturated-fat options like plant-based diets, including meat and seafood, for weight management. Advances in food technology have yielded plant-based seafood products closely mirroring real seafood, boosting consumer acceptance and demand. Global governments are implementing regulations to promote sustainable fishing, favoring a conducive market for plant-based seafood. The growing vegan and vegetarian population seeks alternatives aligned with ethical beliefs, propelling demand for plant-based seafood. Companies in this market invest in research and development, driving innovation and product diversification.

Plant-based seafood companies expand distribution through partnerships with retailers, online platforms, and food service providers for broader accessibility. These vegan alternatives, crafted from plant protein isolates, soy, starch, and other plant-based components, aim to provide nutrient-equivalent alternatives to conventional products, gaining attention for ethical and health considerations.

.Plant-Based Seafood Market Drivers:

The rising popularity of veganism majorly drives the global market.

The global market is significantly influenced by the increasing popularity of veganism, driving a positive outlook due to the shift from non-vegetarian diets to plant-based protein-sourced foods in response to evolving dietary patterns. Public awareness of the overexploitation of natural resources to meet global seafood demands is a key factor in fostering the need for plant-based seafood. Additionally, the rising consciousness about animal cruelty is encouraging people to adopt plant-based food, contributing to market growth. Notably, approximately 10% of the American population follows a vegan or vegetarian diet, and globally, over 79 million individuals identify themselves as vegan, showcasing the widespread adoption of plant-based lifestyles.

Advancements in food processing technologies and easy availability online and offline:

Companies in the plant-based seafood market are investing significantly in research and development to leverage advancements in food processing technologies, creating products that authentically replicate the taste, texture, and appearance of real seafood. Continuous innovation and product diversification play a pivotal role in attracting consumer interest and driving market growth. These innovations not only enhance the appeal of plant-based alternatives but also encourage wider consumer adoption.

The introduction of new plant protein sources, such as algae and legumes, contributes to the creation of more convincing and palatable plant-based seafood options. The rising acceptance of these alternatives is coupled with an increasing demand for improved quality and a diverse range of plant-based seafood products on a global scale, further propelling market expansion.

The availability of a wide range of frozen, canned, and ready-to-eat plant-based seafood products, accessible through both offline and online distribution channels, caters to various consumer tastes and preferences. This convenience in obtaining plant-based seafood products enhances their market penetration and popularity, contributing to the overall growth of the global market.

Growing environmental concerns and ethical considerations:

The primary driver behind the plant-based seafood market is the increasing consumer demand for sustainable and ethical food options. Plant-based seafood offers a guilt-free alternative to traditional seafood, reducing the environmental impact and ethical concerns associated with fishing. Environmental concerns, fuelled by heightened awareness of the ecological impact of traditional fishing practices, are leading consumers to embrace plant-based seafood as a sustainable alternative. The increasing emphasis on sustainability, particularly among environmentally conscious consumers, is a major factor driving market growth. Conventional seafood production methods, characterized by overfishing, habitat destruction, and bycatch, pose substantial threats to marine ecosystems and biodiversity. Plant-based seafood addresses these issues by lessening dependence on ocean resources, easing the burden on aquatic ecosystems, and offering consumers a more environmentally friendly choice.

Increasing awareness about health and wellness trends:

The rise in health and wellness trends is steering consumers towards healthier protein alternatives, with plant-based seafood gaining popularity among the health-conscious. This alternative serves as a nutritious and cholesterol-free protein source, making it an attractive option. Plant-based seafood products are often packed with essential nutrients like protein, vitamins, and minerals and distinguish themselves by being low in saturated fats and cholesterol, making them a healthier choice compared to animal-based seafood. Notably, these products typically contain reduced levels of cholesterol, saturated fats, and allergens in comparison to their animal-based counterparts. Additionally, they are rich in essential nutrients such as plant-based proteins, fiber, vitamins, and minerals, meeting the preferences of those emphasizing health and wellness in their dietary choices.

Supportive government policies and regulations:

Governments around the world are implementing policies and regulations to promote sustainable fishing practices and address the environmental impact of the seafood industry. These efforts are creating a conducive market environment for the growth of plant-based seafood. Many governing bodies actively support and endorse the adoption of environmentally friendly food products, aiming to reduce carbon footprints and contribute to sustainability. This regulatory backing aligns with the increasing awareness of ecological sustainability and plays a crucial role in influencing consumer choices toward more environmentally responsible alternatives, further propelling the plant-based seafood market.

Plant-Based Seafood Market Challenges:

Taste and Texture Challenges:

It's hard to make plant-based seafood taste and feel exactly like real seafood, despite technological progress. Some people may not find plant-based seafood as satisfying in terms of taste and texture as traditional seafood.

Limited Availability and High Costs:

Plant-based seafood is still new, so it might not be available everywhere or could be more expensive. The cost of making plant-based seafood is often higher than traditional seafood, making it less accessible.

Perception and Cultural Preferences:

Many people have strong cultural ties to traditional seafood, making them hesitant to try plant-based alternatives. Some people think plant-based options lack authenticity and may not be as good as the real thing.

Competitive Landscape:

There's a growing number of companies entering the plant-based seafood market, making it more competitive. Existing seafood companies and new players make it challenging for the plant-based seafood market to grow and establish itself.

Plant-Based Seafood Market Opportunities:

Expansion into new markets: The plant-based seafood market holds substantial untapped potential across various regions globally. Companies can seize this opportunity by broadening their distribution networks and introducing their products to new markets.

Partnerships and collaborations: Collaborations between plant-based seafood companies and traditional seafood companies can expedite market growth. Such partnerships leverage the distribution channels and brand recognition of established seafood companies to promote plant-based alternatives effectively.

Product diversification: Continuous product development and diversification are essential to meet evolving consumer demands. Developing a broader range of plant-based seafood options, including different flavors and varieties, can attract a more extensive consumer base.

Marketing and education campaigns: Increasing consumer awareness about the benefits and availability of plant-based seafood through targeted marketing and educational initiatives can drive market growth. Informing consumers about the positive environmental impact and health benefits of these alternatives can help overcome resistance and encourage trials.

PLANT-BASED SEAFOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

29.5% |

|

Segments Covered |

By Product type, Source, Consumer, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Beyond Meat, Inc., Impossible Foods, Inc., Quorn Foods, Good Catch Foods, Ocean Hugger Foods, Inc., Sophie’s Kitchen, New Wave Foods, Gathered Foods Corporation (Good Catch), Atlantic Natural Foods, LLC, Gardein Protein International (Conagra Brands, Inc.) |

Plant-Based Seafood Market Segmentation: By Product Type

-

Fish Products

-

Prawn and Shrimp Products

-

Crab Products

Plant-based fish takes the lead in the plant-based seafood market, propelled by a growing demand for fish alternatives across various cuisines and its adaptability in diverse recipes. This segment is poised to capture a significant market share, spurred by the increasing popularity of plant-based fish alternatives that authentically mimic the taste and texture of real fish. The application of these alternatives extends to a wide range of products, including burgers, cutlets, patties, nuggets, and tenders, delivering comparable nutritional benefits without the need for actual fish. The segment's attractiveness is further enhanced by its ease of availability and allergen-free properties, solidifying its position as a major player in the dynamic landscape of plant-based seafood.

Plant-based shrimp is witnessing substantial growth, driven by the widespread popularity of shrimp dishes and the need for sustainable alternatives to traditional shrimp farming. The prawn and shrimp products segment is anticipated to experience robust growth globally. This surge in demand is attributed to increasing concerns about overfishing and its adverse impact on marine ecosystems. As consumers become more environmentally conscious, there is a noticeable trend towards seeking eco-friendly alternatives in the plant-based shrimp market. This indicates a shift in consumer preferences towards more sustainable and ethical choices in the realm of seafood consumption.

Plant-based crab products are becoming increasingly popular among consumers who enjoy the taste and texture of crab-based dishes. This rising interest is primarily fueled by individuals actively seeking more ethical and sustainable options in their dietary choices. The prevailing market trend mirrors a broader shift towards opting for alternatives that align with ethical and sustainable practices, particularly in the domain of seafood consumption. As consumers become more aware of the environmental and ethical implications of their food choices, plant-based crab products emerge as a viable and attractive option that not only satisfies culinary preferences but also addresses ethical considerations.

Plant-Based Seafood Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online and Others

Supermarkets and hypermarkets play a pivotal role as distribution channels for plant-based seafood, offering a diverse array of food options under one roof. These retail outlets provide convenience and accessibility, enabling shoppers to explore and purchase various plant-based seafood products conveniently. Within these retail channels, consumers have the opportunity to compare different brands and product offerings, making informed decisions based on factors such as nutritional information and price points. The widespread availability of plant-based seafood in supermarkets and hypermarkets enhances visibility, contributing to the growing adoption of sustainable and healthier dietary options. Additionally, these retail giants contribute to the segment's expansion by ensuring the easy availability of different fish products at affordable prices, making plant-based seafood more accessible to a broader consumer base.

The online sales sector is predicted to show the highest annual growth rate of 44.7% in the foreseeable future. This surge is attributed to the increasing preference for the online platform as a convenient way to purchase packaged foods, especially plant-based seafood. The convenience of availability, coupled with the benefits of detailed product information, time-saving features, and home delivery, contributes to the popularity of online purchases. Consumers are drawn to online shopping due to its convenience and the wide array of brands that might not be accessible in traditional retail settings. Notably, the online sales channel has become a crucial revenue stream for many plant-based seafood companies, taking advantage of its ability to reach a broader consumer base. The anticipated uptick in online sales is driven by the rapid rise in mobile users, a growing trend in e-commerce, enhancements in logistics services, and simplified payment options, all of which play pivotal roles in fostering the growth of the global plant-based seafood market.

Plant-Based Seafood Market Segmentation: By Source

-

Lentils

-

Canola

-

Peas

-

Soy

-

Others

The soy segment is set to witness substantial growth, driven by a notable compound annual growth rate (CAGR) during the forecast period, primarily owing to its nutritional benefits. Soy emerges as a rich source of essential amino acids and fiber, making it a preferred choice for fortifying plant-based products with additional vitamins and minerals. Manufacturers frequently utilize soy ingredients for their capacity to replace animal protein while offering nutritional advantages, including no cholesterol and low saturated fat. In 2023, the soy segment dominated the market, capturing a substantial 36.3% market share. Soybeans stand out as a robust protein source, encompassing all eight essential amino acids crucial for a balanced diet. Furthermore, soybeans boast high levels of calcium, zinc, fiber, iron, and vitamin B, amplifying their attractiveness for crafting plant-based seafood. The nutritional prowess of soy is anticipated to fuel the demand for plant-based seafood in the foreseeable future.

The wheat segment is poised for rapid growth, driven by its meat-like texture properties, allowing it to create a firm meat protein texture that makes it an excellent choice for developing plant-based seafood. Anticipated to be the fastest-growing segment during the forecast period, wheat protein plays a crucial role in manufacturing various plant-based fish products such as tuna, cod, salmon, fish fingers, and baked fish. These products are typically crafted to be flavor-neutral, enabling the addition of desired and specific flavors later in the process. The surge in the global population, coupled with increasing pressure on the global food supply chain and the depletion of fish stocks in oceans, has led to the emergence of plant-based seafood. This trend is expected to gain rapid momentum in the forthcoming years, thereby driving the growth of the wheat segment in the global plant-based seafood industry.

Plant-Based Seafood Market Segmentation: By Consumer

-

Vegan

-

Vegetarian

-

Flexitarian

-

Omnivore

The vegan segment is anticipated to experience a high compound annual growth rate (CAGR) in the upcoming years, driven by the increasing health-conscious population worldwide. Plant-based seafood, being a healthier alternative to real seafood with low cholesterol and saturated fats, contributes to the growth of this segment. Furthermore, the escalating incidence of diseases associated with the consumption of traditional processed meat enhances the demand for plant-based meat products in the market, making the vegan segment a key player in the evolving landscape of plant-based seafood.

The omnivore segment is poised to command a significant share of the market, primarily driven by the rapid transition of the omnivore population toward embracing a plant-based diet. Omnivores are individuals who prefer both animal-based and plant-based food diets. In 2023, the omnivore segment accounted for the largest revenue share. Humans, being omnivores, have nutritional needs that are often better met by a combination of plant and animal sources. The increasing awareness of the health benefits associated with plant-based food products is expected to further fuel the growth of this segment. Plant-based foods excel at meeting certain dietary needs, such as magnesium and vitamin C, compared to animal-based foods. Additionally, the rising awareness of the potential risks of gastrointestinal cancer linked to fish consumption contributes to the shift of the omnivore population toward adopting a plant-based diet.

Plant-Based Seafood Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The plant-based seafood market is experiencing significant growth on a global scale, with North America and Europe at the forefront. These regions are driven by strong consumer demand, favorable regulations, and well-established vegan and vegetarian cultures. Asia Pacific is emerging as a promising market, fuelled by increasing awareness of sustainable food choices and a growing demand for plant-based protein alternatives. North America is expected to witness a substantial surge in the global plant-based seafood market share in the coming years, as numerous brands and start-ups offer a diverse range of alternatives tailored to unique consumer preferences.

Various factors contribute to the regional market's growth, including considerations for animal welfare, environmental concerns, and heightened health consciousness. Consumers actively seek plant-based seafood options due to the depletion of marine resources, and concerns about ocean pollution play a crucial role in shaping demand for seafood alternatives. The market's expansion reflects a broader shift towards sustainable and ethical choices in food consumption across different regions.

Europe holds a dominant position in the plant-based seafood market, driven by the continuous launch of products by start-ups. The region's environmental concerns are expected to further propel market growth. Plant-based seafood suppliers are gaining access to food service outlets and introducing new European products to cater to the growing interest in veganism.

The Asia Pacific market is poised to expand rapidly due to increasing awareness of animal cruelty, a rising incidence of obesity, and a growing health-conscious population. With 60% of the global population residing in Asia-Pacific, the region's large youth population, rising employment, disposable income, urbanization, changing food habits, numerous product launches, and evolving government policies are key factors expected to drive the growth of the plant-based seafood market in the region during the forecast period.

COVID-19 Impact Analysis on the Plant-Based Seafood Market:

The COVID-19 pandemic has exerted a dual impact on the plant-based seafood market, with both positive and negative consequences. On the positive side, the pandemic has heightened consumer awareness regarding the environmental and health risks associated with the traditional seafood industry. This increased awareness has fueled a growing interest in plant-based alternatives as consumers actively seek more sustainable and safer food options.

However, the pandemic has also presented challenges for the market. Disruptions in the supply chain, temporary closures of restaurants, and shifts in consumer spending patterns have collectively impacted the overall demand and distribution of plant-based seafood products. Despite these challenges, the market has demonstrated resilience and is anticipated to recover as the situation improves.

According to a 2020 survey by McKinsey, nearly 70% of respondents indicated an intention to spend more time and money on purchasing safer and more eco-friendly products. Additionally, almost 60% expressed a heightened inclination toward adopting healthier eating practices post-pandemic. These trends underscore the potential for continued growth and recovery within the plant-based seafood market as consumers increasingly prioritize sustainability, safety, and health considerations in their purchasing decisions.

Latest Trends/ Developments:

On May 4, 2023, ISH, a plant-based food product manufacturer, launched a new product named "Salmonish Burgers." These burgers are made entirely from plant-based ingredients, which contain high protein and low saturated fat. Additionally, this burger is a great source of omega-3 fatty acids.

Key Players:

-

Beyond Meat, Inc.

-

Impossible Foods, Inc.

-

Quorn Foods

-

Good Catch Foods

-

Ocean Hugger Foods, Inc.

-

Sophie’s Kitchen

-

New Wave Foods

-

Gathered Foods Corporation (Good Catch)

-

Atlantic Natural Foods, LLC

-

Gardein Protein International (Conagra Brands, Inc.)

Chapter 1. PLANT-BASED SEAFOOD MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PLANT-BASED SEAFOOD MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PLANT-BASED SEAFOOD MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PLANT-BASED SEAFOOD MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PLANT-BASED SEAFOOD MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PLANT-BASED SEAFOOD MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Fish Products

6.3 Prawn and Shrimp Products

6.4 Crab Products

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. PLANT-BASED SEAFOOD MARKET – By Source

7.1 Introduction/Key Findings

7.2 Lentils

7.3 Canola

7.4 Peas

7.5 Soy

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Source

7.8 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. PLANT-BASED SEAFOOD MARKET – By Distribution

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Convenience Stores

8.4 Online and Others

8.5 Y-O-Y Growth trend Analysis By Distribution

8.6 Absolute $ Opportunity Analysis By Distribution, 2024-2030

Chapter 9. PLANT-BASED SEAFOOD MARKET – By Consumer

9.1 Introduction/Key Findings

9.2 Vegan

9.3 Vegetarian

9.4 Flexitarian

9.5 Omnivore

9.6 Y-O-Y Growth trend Analysis By Consumer

9.7 Absolute $ Opportunity Analysis By Consumer, 2024-2030

Chapter 10. PLANT-BASED SEAFOOD MARKET , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Source

10.1.3 By Distribution

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Source

10.2.4 By Distribution

10.2.5 By Consumer

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Source

10.3.4 By Distribution

10.3.5 By Consumer

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Source

10.4.4 By Distribution

10.4.5 By Consumer

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Source

10.5.4 By Distribution

10.5.5 By Consumer

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. PLANT-BASED SEAFOOD MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Beyond Meat, Inc.

11.2 Impossible Foods, Inc.

11.3 Quorn Foods

11.4 Good Catch Foods

11.5 Ocean Hugger Foods, Inc.

11.6 Sophie’s Kitchen

11.7 New Wave Foods

11.8 Gathered Foods Corporation (Good Catch)

11.9 Atlantic Natural Foods, LLC

11.10 Gardein Protein International (Conagra Brands, Inc.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The plant-based seafood market was valued at USD 81.4 million in 2023 and is projected to reach a market size of USD 497.18 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 29.5%.

The popularity of veganism, advancements in food processing technologies, online and offline availability, health and wellness trends, and supportive government regulations.

Europe is the most dominant region for the plant-based seafood market.

Beyond Meat, Inc., Impossible Foods, Inc., Quorn Foods, Good Catch Foods, Ocean Hugger Foods, Inc., Sophie's Kitchen, New Wave Foods, Gathered Foods Corporation (Good Catch), Atlantic Natural Foods, LLC, and Gardein Protein International (Conagra Brands, Inc.).

Product diversification: Developing a broader range of plant-based seafood options, including different flavors and varieties, can attract a more extensive consumer base and is an emerging trend in the industry.