Plant-Based Binding Agents & Stabilizers Market Size (2024 – 2030)

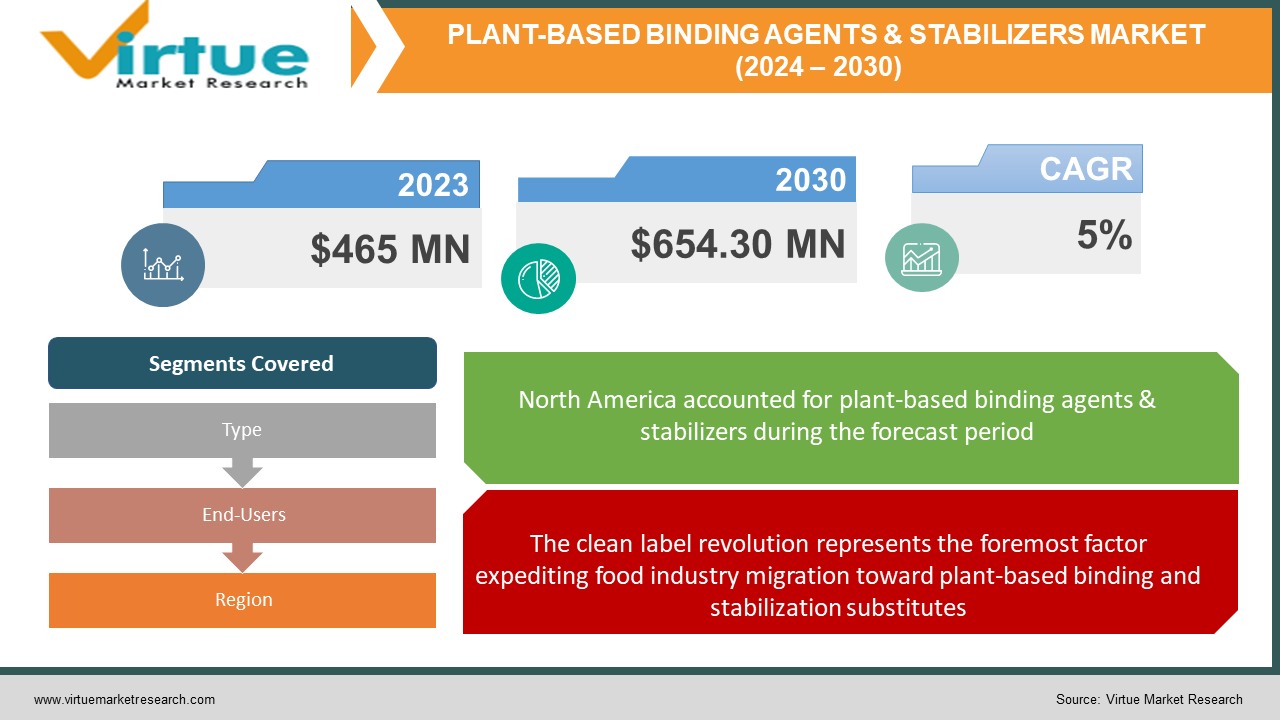

The plant-based binding agents & stabilizers market was valued at USD 465 million in 2023 and is projected to reach a market size of USD 654.30 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

The plant-based binding agents and stabilizers market has witnessed substantial growth in recent years, driven by changing consumer preferences and the food industry's shift towards natural ingredients. This market encompasses a range of natural gums, starch, proteins, fibers, and other ingredients derived from agro-food by-products. They serve dual functionality: as binding agents to provide desired texture and moisture retention and as stabilizers to prevent separation in processed food applications. The most commonly used sources for plant-based binding agents and stabilizers include seeds, seaweed, roots, plant exudates, and trees. Key product categories include guar gum, xanthan gum, pectin, starches from corn, wheat, tapioca, etc., plant proteins like soy, pea, and pulses, as well as fibers derived from fruits, vegetables, and nuts. These natural alternatives are increasingly favored by food manufacturers over gelatin and artificial additives to develop clean-label formulations, aligned with shifting consumer preferences. Despite a strong demand outlook, certain challenges exist around inconsistent supply and quality fluctuations observed for some natural substitutes in comparison with the stable functionality offered by processed alternatives over long shelf lives. Investments in R&D and productive partnerships with farm cooperatives help mitigate sourcing risks. Overall, though, the niche plant-based binding agents and stabilizer applications sphere signal exciting potential as product categories harnessing the health, labeling, and sustainability megatrends transforming food production continue to march into the mainstream.

Key Market Insights:

The plant-based binding agents and stabilizers domain display upbeat prospects as product segments enable the creation of quality food formulations aligned with multiple priority attributes around health, sustainability, and transparency sought by modern consumers. Confectionery and bakery applications, including cakes, pastries, and candies, generate the highest demand, together accounting for 35% of the market share. Binding agents like guar gum, tapioca starch, and fibers enable achieving appropriate dough elasticity and moisture retention properties suited to various baking requirements. Dairy and frozen foods, along with convenience, functionality, and plant-based beverages, are other leading applications, aided by stabilizers that prevent sedimentation and separation as well as maintain desired texture and mouthfeel. Guar gum commands the largest share currently, favored by its cost-effectiveness and versatility across both cold and hot foods. Key trends involve shifting towards clean-label starches like tapioca and rice rather than chemically modified versions.

Plant-Based Binding Agents & Stabilizers Market Drivers:

The clean label revolution represents the foremost factor expediting food industry migration toward plant-based binding and stabilization substitutes.

The predominant factor steering the rising adoption of plant-based binding and stabilization alternatives is the industry-wide clean label movement promoted by changing consumer preferences favoring recognizable, chemical-free ingredients on product labels. For decades, processed foods relied extensively on artificial additives like carrageenan, calcium chloride, and sulfur dioxide to enhance texture and appearance. However, negative consumer perceptions around synthetic or unpronounceable additives perceived as denoting excess processing are catalyzing demand for simple, nature-based kitchen cupboard ingredients like guar gum, starches, and pectin instead. Food majors are reformulating portfolios blending these natural functional substitutes to promote labels highlighting terms like no-additives, preservative-free, etc. that buyers increasingly seek out as markers of safety and quality. The transparency afforded by plant-sourced ingredients in allowing brands to completely disclose component information without references to ambiguous E-numbers or ‘flavorings’ also fosters consumer trust. Furthermore, the health halo effect generated by invoking botanical, organic origins rather than lab-developed synthetic additives offers marketing differentiation. Through clean labels and radical transparency facilitated by plant-based additives, food manufacturers are catering to purchase motivations beyond just taste, pivoting around lifestyle, ethics, and safety.

The emphasis on sustainability is facilitating the expansion.

The renewable, abundant, and often upcycled nature of most natural binding and stabilizing alternatives also allows manufacturers to credibly highlight sustainability merits by targeting eco-conscious consumer segments. Agro-waste materials like orange peels and mushroom stalk fibers repurposed via innovation into functional ingredients embody prime examples of total crop usage that prevent food losses through circular approaches. Compared to animal and petroleum derivatives requiring intensive resources for commercial production, renewable botanical sources entail lower carbon footprints from cradle to factory gate in alignment with net zero emissions goals targeted across food production ecosystems. By allowing brands to narrate compelling sustainability stories while ensuring reliable functionality, plant-based additives enable the realization of environmental priorities in conjunction with financial and sensory performance yardsticks. With consumers actively assessing embedded lifetime emissions, including processing footprints, promoting sustainability merits also offers differentiation for brands. Calling out upcycled botanical sources in natural colorants, flavor modifiers or stabilizers allows marketers to highlight emission savings against alternate ingredients for the same function. Such messaging and ingredient pivots ultimately enable closer alignment with younger and more eco-literate consumer priorities, which increasingly scrutinize every facet of delivered products.

Plant-Based Binding Agents & Stabilizers Market Restraints and Challenges:

Overcoming supply and distribution uncertainties remains imperative for furthering the reliability credentials of plant-based additives as viable substitutes for traditional artificial binding and stabilization agents.

Despite strong functional properties, the reliability of some renewable botanical additive sources faces limitations in assuring year-round uniformity and availability—pivotal prerequisites for food-grade ingredients incorporated into commercial formulations sold by hundreds of millions of units annually. Agro-based products like corn, tapioca, and wheat starches often grapple with fluctuating harvests impacted by unpredictable weather events spanning droughts, floods, or frosts. Sporadic raw material shortages subsequently throttle processors' inventory build-up abilities required to sufficiently meet uninterrupted orders during future lean crop periods. Unfavorable agriculture economics also periodically compel farmers to shy away from dedicating acres for dedicated starch crop cultivation given lower realizations over main cereal varieties, tightening supply. Logistical barriers amplify vulnerabilities given the heavy reliance of most natural stabilizers on agricultural raw materials with limited shelf-life compared to synthetic alternatives based on minerals, petrochemicals, etc. Remote production locations with underdeveloped last-mile infrastructure especially struggle with timely port connectivity, climate-controlled warehousing shortages, and the absence of direct market linkages, leading to losses and eroding yield realizations. Strategic initiatives like establishing consolidated supplier entities via horizontal integration of local networks to assure sufficient scale, developing agriculture partnerships with technical assistance provisions to elevate farming sophistication, designing futures hedging solutions, and expanding downstream value-added ingredient processing closer to cultivation hubs can strengthen supply chain robustness.

Limited diversity is a major barrier that can create losses for the market.

While the current plant-based additives domain relies strongly on decades-old staples like guar gum, corn starch, and xanthan gum commanding billionaire dollar market values, future growth prospects lie in expanding portfolio diversity and harnessing alternative botanical waste streams, marine vegetables, or niche cultural crops via innovation. However, unclear regulatory pathways often impede commercial translation of such novel ingredients lacking extensive human consumption histories, despite strong techno-functional merits demonstrated in lab settings. In contrast, synthetic additives like calcium chloride, despite concerns around endocrine impacts, obtain renewals relatively faster due to their established history of usage, tilting scales towards existing chemical ingredients. But sustainable substitution requires popularizing safer or nutritionally beneficial alternatives aligned with current consumer mindsets, a transition impeded when emerging native or botanical sources lacking extensive track records get typecast as unreliable without exploring their potential. While scientific prudence around public safety remains imperative, finding solutions to accelerate regulatory assessments is crucial so risk-averse food majors have access to such novel ingredients that often originate from unstructured supply environments like coastal gatherers. Constructive policy dialogue around designing priority review pathways for sustainability-centric additive sources could help address this quandary.

Plant-Based Binding Agents & Stabilizers Market Opportunities:

While conventional baked goods, confectionery, and dairy applications currently account for the majority of revenues for plant-based stabilizers and binding ingredients, the actively evolving plant-based foods and beverages domains represent a high-potential category poised for rapid growth. From fast food chains to high-end culinary ventures, plant-based meat alternatives are making serious inroads. This internationalization translates into large-scale growth opportunities for suppliers of plant-based binding and stabilizing ingredients. Plant-based yogurts, cheeses, ice creams, and creamy desserts all see escalating demand. While many early entrants in this arena focused on flavor, attention is now shifting to achieving better, creamier, and more realistic textures. Stabilizers will play a vital role in matching the richness, melt, and stretch consumers experience with conventional dairy products. The use of naturally derived starches, gums, and plant-protein ingredients gives plant-based foods a 'clean label' appeal, further encouraging growth in this sector, in parallel with consumer demand for recognizable ingredient lists. The future lies in customized formulations using blends of ingredients, each contributing a specific aspect like texture, gelling, or moisture retention. Ingredient pairings to enhance functionality and achieve precise end-product qualities will continue to be a key focus in research and development.

PLANT-BASED BINDING AGENTS & STABILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ingredion Incorporated, Archer Daniels Midland Company (ADM), Cargill, Incorporated, DuPont Nutrition & Biosciences, Tate & Lyle, Roquette, The Emsland Group, CP Kelco, Agrana, Cosucra |

Plant-Based Binding Agents & Stabilizers Market Segmentation: By Type

-

Starch and Flour

-

Gums and Hydrocolloids

-

Plant Proteins

-

Others

Gums and hydrocolloids hold the largest market share by product types in 2023. They represent a significant and continuously growing portion of the market. As these are highly effective in mimicking texture and mouthfeel, demand increases exponentially across all plant-based applications. Starch and flour are also extensively used due to their accessibility, well-established use, affordability, and wide range of functional profiles. These play a foundational role in many plant-based foods and are unlikely to be displaced completely due to cost advantages. Plant proteins are the fastest-growing type, owing to the surging popularity of plant-based meat alternatives. Proteins isolated from diverse sources (soy, pea, etc.) gain significant ground as technology improves flavor and functionality. It is indispensable for adding binding power, meat-like texture, and emulsification in vegan burgers, sausages, and ground meat analogs.

Plant-Based Binding Agents & Stabilizers Market Segmentation: By End-Users

-

Food and Beverages

-

Bakery

-

Confectionery

-

Dairy Products

-

Beverages

-

Sauces & Dressings

-

Others

-

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Others

Based on end-users, the food and beverage industry is both the largest and fastest-growing segment. They are mostly used in confectionery and bakery products. They are used in many food products, like meat, cakes, pastries, and other desserts, to improve the texture of the food. They help in the thickening of the food product and therefore provide better taste. Furthermore, they act as agents that can tolerate freezing to make the food chewy.

Plant-Based Binding Agents & Stabilizers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With an estimated 40% share of the market in 2023, North America is the most dominant power. This dominance is a result of consumer health consciousness, a well-established vegan food product business, and increased awareness of plant-based options. Europe comes in second with a 30% market share, driven by an increasingly flexitarian population, ethical concerns about food, and sustainability among consumers. With a 20% market share, Asia-Pacific is the market that is developing at the fastest rate. Rapid urbanization has led to a rising middle class with higher incomes. Besides, the growing acceptance of plant-based diets among younger people led to a marked interest in Western diet trends, specifically plant-based diets, which has led to massive investments in creating new products, ingredients, and infrastructure for the Asian plant-based markets. Latin America and other regions, despite being a smaller portion, have the potential for significant growth due to the surging interest in plant-based options.

COVID-19 Impact Analysis on the Plant-Based Binding Agents & Stabilizers Market.

Supply chain disruptions, especially during the initial lockdowns, affected the production and transportation of some raw materials like guar gum from India. This increased prices. Reduced demand from industrial food services, and restaurants during the peak pandemic as footfall declined. This mainly impacted the starch market segment. Import and export restrictions affected international trade flows and availability in some regions, temporarily leading to spikes in prices. Increased retail demand spike from panic buying drove strong sales of packaged/shelf-stable foods using binding agents like starches, pectin, etc. Household consumption offsets declines elsewhere. Plant proteins like soy proteins saw heightened demand as meat shortages led to greater adoption of plant-based meat alternatives using these binding agents. eCommerce food ordering as well as increased health consciousness and demand for functional foods further benefited segments like gum and vegetable proteins. Overall, the market displayed resilience and quick recovery tendencies. While the starch segment was impacted early on, pre-pandemic growth levels were restored across most regions by mid-2022.

Latest Trends/ Developments:

The focus is shifting away from heavily modified starches, instead investigating less processed, whole-food options. Techniques to harness the full functional potential of native starches extracted by gentler methods are seeing exciting gains. Research explores underutilized grain varieties like sorghum, millet, and buckwheat. These offer potential as novel sources of proteins and starches with functional binding properties. With an increased focus on digestive health, interest in fiber-rich sources for their potential stabilizing and gelling abilities has intensified. Ingredients like citrus fiber or extracts from certain seeds and legumes are emerging as multi-purpose powerhouses for improved texture and nutritional value in plant-based products. Projects targeting plant protein isolate development select varieties of peas, lentils, and other promising plant proteins with even better textures and taste qualities compared to established ingredients. Innovations in protein isolation and formulation methods unlock protein functionality that rivals and even surpasses animal-based counterparts in certain categories. This expands potential beyond meat products and allows protein-based ingredients to enhance textures in dairy alternatives, sauces, and baked goods. Ongoing research turns to plants not traditionally seen as food sources. Discovering unique structural polysaccharides in leaves, roots, or less widely cultivated crops may unveil entirely new stabilization and functionality solutions.

Key Players:

-

Ingredion Incorporated

-

Archer Daniels Midland Company (ADM)

-

Cargill, Incorporated

-

DuPont Nutrition & Biosciences

-

Tate & Lyle

-

Roquette

-

The Emsland Group

-

CP Kelco

-

Agrana

-

Cosucra

Chapter 1. Plant-Based Binding Agents & Stabilizers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plant-Based Binding Agents & Stabilizers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant-Based Binding Agents & Stabilizers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant-Based Binding Agents & Stabilizers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant-Based Binding Agents & Stabilizers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant-Based Binding Agents & Stabilizers Market – By End-Users

6.1 Introduction/Key Findings

6.2 Food and Beverages

6.3 Bakery

6.4 Confectionery

6.5 Dairy Products

6.6 Beverages

6.7 Sauces & Dressings

6.8 Others

6.9 Pharmaceuticals

6.10 Cosmetics & Personal Care

6.11 Others

6.12 Y-O-Y Growth trend Analysis By End-Users/End User

6.13 Absolute $ Opportunity Analysis By End-Users/End User , 2024-2030

Chapter 7. Plant-Based Binding Agents & Stabilizers Market – By Type

7.1 Introduction/Key Findings

7.2 Starch and Flour

7.3 Gums and Hydrocolloids

7.4 Plant Proteins

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Plant-Based Binding Agents & Stabilizers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Users

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Users

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Users

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Users

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Users

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plant-Based Binding Agents & Stabilizers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ingredion Incorporated

9.2 Archer Daniels Midland Company (ADM)

9.3 Cargill, Incorporated

9.4 DuPont Nutrition & Biosciences

9.5 Tate & Lyle

9.6 Roquette

9.7 The Emsland Group

9.8 CP Kelco

9.9 Agrana

9.10 Cosucra

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The clean label revolution and growing emphasis on sustainability are the main drivers in this market.

Supply chain and distribution uncertainties, coupled with a lack of diversity, are the main concerns in this market.

Ingredion Incorporated, Archer Daniels Midland Company (ADM), Cargill, Incorporated, DuPont Nutrition & Biosciences, Tate & Lyle, and Roquette are the major players.

North America currently holds the largest market share, estimated at around 40%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.