Plant-based Adhesives & Sealants Market Size (2024 – 2030)

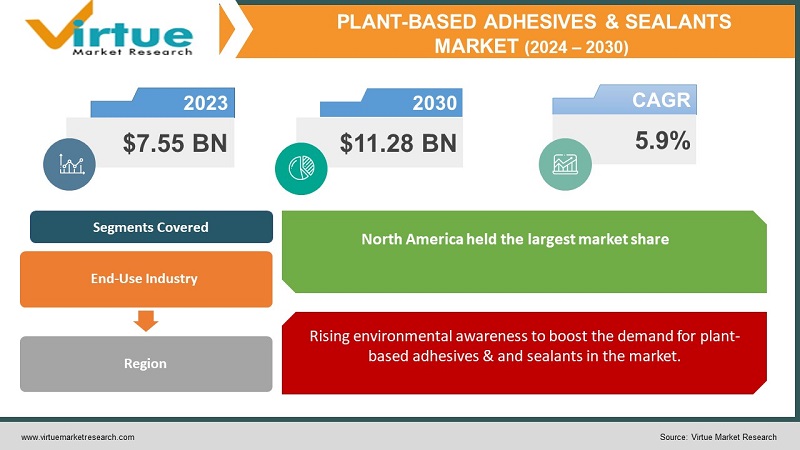

The Global Plant-based Adhesives and Sealants Market was valued at USD 7.13 billion and is projected to reach a market size of USD 11.28 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.9%.

Adhesives and sealants have been increasingly used in various industries, especially construction, packaging, automotive, textiles, and chemicals. However, the increasing environmental degradation due to the use of synthetic adhesives and chemicals has induced manufacturers to produce environment-friendly materials that pose less threat to the environment. This further gave rise to the demand for plant-based adhesives and sealants in the market, especially for food packaging and building materials. The present scenario for the adhesives and sealants market showcases rising consumer demand for non-toxic and green products, such as green-labeled packaged food products and sustainable building materials in the construction industry. Further, some of the most common plant-based adhesives and sealants demanded by consumers are soy-based adhesives, starch-based adhesives, natural rubber adhesives that are widely used in the footwear and construction industries, and tannin-based adhesives. Furthermore, the future holds positive for this market as new technological innovations take place in producing and processing organic adhesives and sealants. These include the use of nanotechnology and 3D printing materials in various industries such as automotive and aerospace.

Key Market Insights:

According to studies, sustainability is a major purchase criterion for 60% of consumers globally and the US shows a slightly higher percentage of about 61%.

Moreover, about 50% of consumers in the USA and 82% globally are willing to pay for sustainable packaging.

According to an international study by Unilever, 33% of 20,000 surveyed consumers prefer brands that are into something environmentally good.

Plant-based Adhesives & Sealants Market Drivers:

Rising environmental awareness to boost the demand for plant-based adhesives & and sealants in the market.

The increase in environmental degradation has increased awareness among the people regarding the rising levels of pollution and its impact on the climate. This has further induced producers and manufacturers to use organic materials that reduce the carbon footprint and offer greater durability to structures and components in many industries. Conventional synthetic and petroleum-based adhesives and sealants are obtained from fossil fuels, which increases carbon emissions during the production process. However, plant-based alternatives such as rubber, lignin, natural resins, vegetable oils, and algae-based adhesives and sealants require less processing due to their natural properties and hence contribute to reducing carbon emissions by utilizing renewable sources such as plants. In addition, these materials are bio-degradable as they reduce wastage and break down easily in the atmosphere.

Technological advancements in the adhesives and sealants industry drive the market demand for plant-based adhesives & and sealants.

Technology has increased the efficiency of plant-based adhesives and sealants making them more sustainable and increasing their performance. Technological advancements such as nanotechnology integration with these materials provide enhanced strength, adhesion, and resistance to structures from heat and moisture. Further, advanced processing techniques to extract plant resins and refine them into high-performing plant resins for applications in various industries have enhanced the adhesive properties of these plant-based materials. In addition, trends in 3D printing of plant-based materials for creating complex structures in the aerospace and automotive industries are witnessing an increase in demand in the market. Moreover, technological formulations of plant-based materials into adhesives and sealants have made it possible for manufacturers to tailor the materials as per their requirements. Additionally, advanced manufacturing techniques have improved the shelf life of these materials and increased their usage in various industries such as in the construction industry for wood bonding, for flooring, paneling, and as a green building material in insulation boards, panels, and insulation materials.

Plant-based Adhesives & Sealants Market Restraints and Challenges:

Redundant performance can reduce the demand for plant-based adhesives & and sealants in the market. Since plant-based materials are prepared from natural and organic raw materials with minimal processing, they lack in delivering consistent performance as opposed to synthetic adhesives and sealants that provide quick results to manufacturers and producers.

Moreover, difficulty in sourcing raw materials is another deterrent to the growth of plant-based adhesives & and sealants in the market, as plant-based ingredients are affected by seasonal variations and perishability, leading to an increase in transport costs during the production process

Plant-based Adhesives & Sealants Market Opportunities:

The Global plant-based adhesives & and sealants Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, the growing demand for eco-friendly and sustainable packaging materials is predicted to develop the market for plant-based adhesives & and sealants and enhance its future growth opportunities.

PLANT-BASED ADHESIVES & SEALANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

H.B. Fuller, Henkel AG & Co. KGaA, 3M Company, Ashland, Permabond, Jowat Adhesives, Bostik, Weiss Chemie, Follmann & Co., ChemPoint |

Plant-based Adhesives & Sealants Market Segmentation: By End-Use Industry

-

Building & Construction

-

Automotive

-

Electronics

-

Renewable Energy

-

Healthcare

-

Aerospace

-

Others

In 2022, based on market segmentation by end-use industry, building, and construction occupy the highest share of 25.46% in the market. Plant-based adhesives and sealants are increasingly used in building construction and sectors for various purposes due to their excellent resistance to heat, moisture, extreme temperature, and enhanced strength. They are widely used for sealing gaps, bonding wooden materials and structures, installing flooring, sealing roofs, bonding and sealing pre-fabricated components together, and others. Furthermore, trends in green building materials have increased the demand for natural adhesives and sealants in the construction industry.

The packaging segment is the fastest-growing segment during the forecast period. Plant-based adhesives and sealants are excessively used in the packaging industry, due to rising consumer demand for eco-friendly packaging, especially packaging of food products. These adhesives and sealants are used for label adhesion, box sealing, recyclable plastic wrapping, and other materials. Moreover, eco-friendly packaging and labeling of food products have further increased the demand for plant-based adhesives and sealants in the market. These include plant-based film coatings that are used to extend the shelf life of packaged food products, plant-based hot melt adhesives that are used for sealing cardboard boxes and cartons, cellulose-based sealings and adhesives for bonding paperboard materials and label adhesion in food products, and others.

Plant-based Adhesives & Sealants Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, North America occupies the highest share of 28% in the market. Stringent government regulations regarding conventional adhesives and promotion to increase the usage of plant-based alternatives; and growing environmental awareness to reduce the carbon footprint have contributed to the growth of plant-based adhesives and sealants in the region.

Asia-Pacific is the fastest-growing region during the forecast period. Rapid urbanization, increasing trends in green building and construction for sustainable infrastructure development, and an increase in demand for sustainable consumer goods have boosted the demand for plant-based adhesives and sealants in the market.

COVID-19 Impact Analysis on the Global Plant-based Adhesives & Sealants Market:

The pandemic hurt the plant-based adhesives & and sealants market. Due to the nationwide lockdown, supply chains were disrupted, which caused delays in sourcing of raw materials, production, and distribution of adhesives and sealants, leading to a decline in demand for plant-based adhesives & and sealants in the market. Further, the closure of major industries such as construction, automotive, packaging, and other major industries decreased the demand for these materials during the pandemic.

Latest Trends/ Developments:

The global Plant-based Adhesives and sealants Market is reasonably split and fragmented with the existence of several global companies. These players are motivated to achieve higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Government regulations and standards regarding volatile organic compound emissions have increased the demand for plant-based adhesives & and sealants in the market. Moreover, these materials contain less or zero chemicals, which induced companies to incorporate them into their production and manufacturing process. Further, trends in green labeling on products have led to the development of soy-based or starch-based sealants and label cohesions that facilitate recycling and contribute towards sustainable packaging methods. For instance, Alter Eco is a confectionary company that uses sustainable packaging solutions to pack their chocolates. They use a laminated-stand pouch that is made up of plant-based compostable materials, specially made for their quinoa products. For their chocolates, they use compostable eucalyptus and birch trees-based wrappers.

Key Players:

-

H.B. Fuller

-

Henkel AG & Co. KGaA

-

3M Company

-

Ashland

-

Permabond

-

Jowat Adhesives

-

Bostik

-

Weiss Chemie

-

Follmann & Co.

-

ChemPoint

- In September 2020, Toyochem Co., Ltd launched biodegradable Polyurethane adhesives that are pressure-sensitive adhesives. The product is suitable for applications in packaging, construction, agriculture, and other industries.

- In September 2020, Effetto Mariposa launched a plant-based sealant – Dubbed Vegetalex. It is made of finely ground olive stones, and cellulose fibers and is held together by xanthan gum. The product is free of ammonia and other aggressive chemicals and can fill gaps up to 5mm. Moreover, it is suitable for the inner tube of the tire and CO2 cartridges applications.

Chapter 1. Plant-based Adhesives & Sealants Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Filling Machines Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant-based Adhesives & Sealants Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant-based Adhesives & Sealants MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant-based Adhesives & Sealants Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant-based Adhesives & Sealants Market -BY END-USE INDUSTRY

6.1 Introduction/Key Findings

6.2 Building & Construction

6.3 Automotive

6.4 Electronics

6.5 Renewable Energy

6.6 Healthcare

6.7 Aerospace

6.8 Others

6.9 Y-O-Y Growth trend Analysis BY END-USE INDUSTRY

6.10 Absolute $ Opportunity Analysis BY END-USE INDUSTRY, 2024-2030

Chapter 7. Plant-based Adhesives & Sealants Market, By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.2 BY END-USE INDUSTRY

7.3 Countries & Segments - Market Attractiveness Analysis

7.4 Europe

7.4.1 By Country

7.4.1.1 U.K.

7.4.1.2 Germany

7.4.1.3 France

7.4.1.4 Italy

7.4.1.5 Spain

7.4.1.6 Rest of Europe

7.5 BY END-USE INDUSTRY

7.6 Countries & Segments - Market Attractiveness Analysis

7.7 Asia Pacific

7.7.1 By Country

7.7.1.1 China

7.7.1.2 Japan

7.7.1.3 South Korea

7.7.1.4 India

7.7.1.5 Australia & New Zealand

7.7.1.6 Rest of Asia-Pacific

7.8 BY END-USE INDUSTRY

7.9 Countries & Segments - Market Attractiveness Analysis

7.10 South America

7.10.1 By Country

7.10.1.1 Brazil

7.10.1.2 Argentina

7.10.1.3 Colombia

7.10.1.4 Chile

7.10.1.5 Rest of South America

7.11 BY END-USE INDUSTRY

7.12 Countries & Segments - Market Attractiveness Analysis

7.13 Middle East & Africa

7.13.1 By Country

7.13.1.1 United Arab Emirates

7.13.1.2 Saudi Arabia

7.13.1.3 Qatar

7.13.1.4 Israel

7.13.1.5 South Africa

7.13.1.6 Nigeria

7.13.1.7 Kenya

7.13.1.8 Egypt

7.13.1.9 Rest of MEA

7.14 BY END-USE INDUSTRY

7.15 Countries & Segments - Market Attractiveness Analysis

Chapter 8. Plant-based Adhesives & Sealants Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 H.B. Fuller

8.2 Henkel AG & Co. KGaA

8.3 3M Company

8.4 Ashland

8.5 Permabond

8.6 Jowat Adhesives

8.7 Bostik

8.8 Weiss Chemie

8.9 Follmann & Co.

8.10 ChemPoint

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Plant-based Adhesives & Sealants Market was valued at USD 7.55 Billion and is projected to reach a market size of USD 11.28 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Rising environmental awareness and Technological advancements in the adhesives & and sealants industry are the market drivers of the Global Plant-based Adhesives and sealants Market.

Building & Construction, Automotive, Electronics, Renewable Energy, Healthcare, Aerospace, and Others are the segments under the Global Plant-based Adhesives and Sealants Market by end-user industry.

North America is the most dominant region for the Global Plant-based Adhesives & Sealants Market.

Asia-Pacific is the fastest-growing region in the Global Plant-based Adhesives & Sealants Market.