Pipeline Testing and Inspection Services Market Size (2024 –2030)

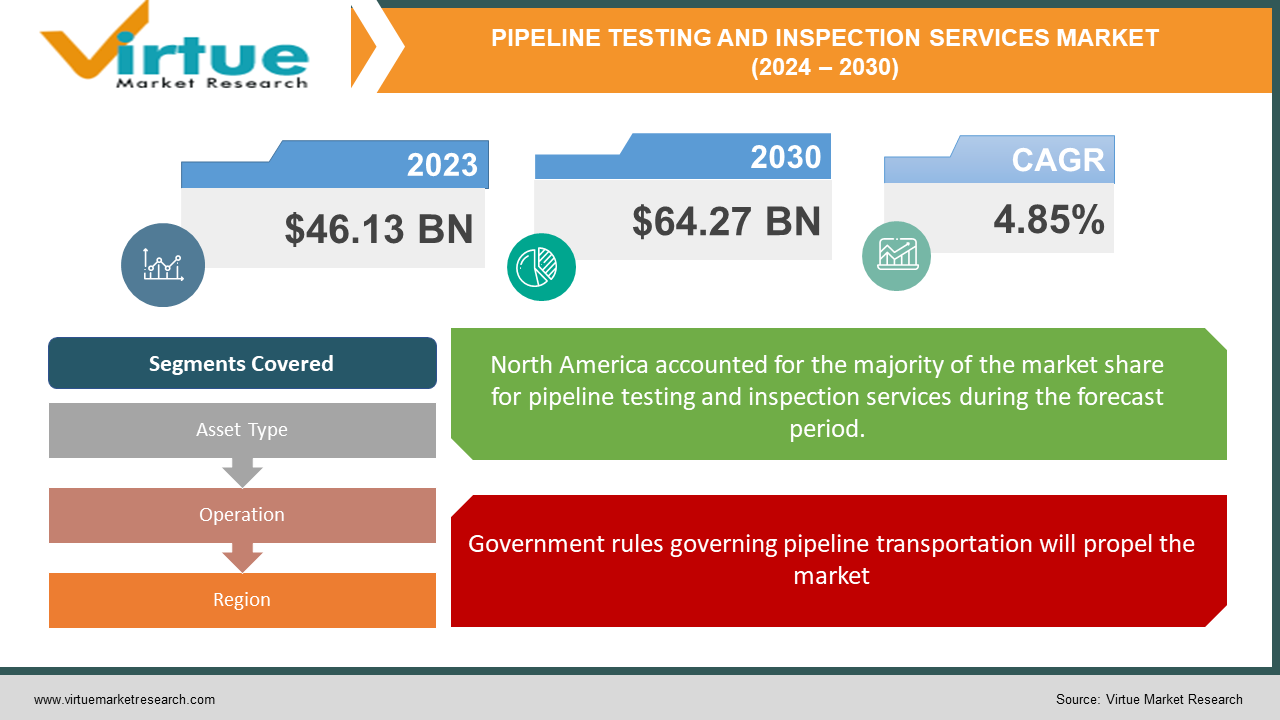

The Global Pipeline Testing and Inspection Services Market size is estimated to grow from USD 46.13 billion in 2023 to USD 64.27 billion by 2030. This market is witnessing a healthy CAGR of 4.85% from 2024 - 2030.

Download FREE Sample PDF Of This Report

Growth in the usage of pipelines to transport many things like gas, liquid, and government regulations is majorly driving the growth of the industry. Approximately 145,353 miles of pipelines were being planned or constructed as of 2021. While 50,580 miles are being built in various stages, the majority of them—roughly 94,773 miles—are still in the planning stages.

The future expansion of the global pipeline services market is anticipated to result from the expansion of natural gas pipelines in tandem with the rising demand for natural gas. However, the growth of this market may be slowed down by other modes of transportation, such as using ships.

Throughout the forecast period, steel pipes are anticipated to grow at a rate of 5.8%, making them the most common type. Urbanization in nations like the United States, France, and Germany is the main driver of this growth. Because of their strength, ease of connection, ability to withstand high pressure, smooth interiors, and favorable hydraulic conditions, steel pipes are widely used. Furthermore, because of their hardness, resistance to corrosion, and capacity to function at high temperatures, stainless steel, alloy steel, and other metals are becoming more and more popular.

Large corporations provide stainless steel pipes for a range of applications. Prosaic Steel and Alloys, for instance, offers ASTM A123 stainless steel pipes in sizes ranging from 12" to 24" that are utilized in heat exchangers, plates, sheets, and steel boilers. It is anticipated that each of these elements will support the market expansion for pipeline construction.

Key Market Insights:

- Non-Destructive Testing (NDT) services account for around 60% of the pipeline testing and inspection services market, as they allow for the evaluation of pipeline integrity without causing damage or disruption.

- The oil and gas industry constitutes approximately 45% of the demand for pipeline testing and inspection services, owing to the extensive network of pipelines used for transportation and distribution.

- In terms of region, North America holds a significant market share of around 30% in the pipeline testing and inspection services market, attributed to the well-established energy infrastructure and stringent regulatory requirements.

- The adoption of advanced technologies, such as smart pig inspection and inline inspection tools, is growing at a rate of approximately 12% annually, driven by the need for more accurate and efficient pipeline monitoring and maintenance.

Global Pipeline Testing and Inspection Services Market Drivers:

The market is expanding due to the need for pipelines to carry goods like gas and liquid.

The global population growth and swift industrialization are driving up the demand for oil and other energy resources. The Energy Information Administration (EIA)'s International Energy Outlook states that non-OECD nations like Argentina, Brazil, India, Malaysia, Singapore, South Africa, and Thailand are primarily responsible for the world's energy demand. These nations' rapid economic and population growth is fueled by their increased energy requirements.

Government rules governing pipeline transportation will propel the market.

Globally, pipelines are a common means of moving gas and oil. Any type of leak, though, has the potential to seriously endanger lives and bring about monetary losses. For instance, the FRACTRACKER report estimates that there were roughly 614 pipeline incidents in the US in 2019. These incidents resulted in damages of $259 million and approximately 35 injuries. Government organizations have put in place stringent regulations to guard against incidents like this and guarantee the safe operation of pipelines. To ensure pipeline safety, the National Energy Board Act (NEB Act) and the Onshore Pipeline Regulations (OPR) in the United States mandate routine supervision and advanced pressure testing.

Unlock Market Insights: Get A FREE Sample Report Today!

Pipeline Testing and Inspection Services Market Challenges and Restraints:

Europe's oil consumption is predicted to decrease as the continent transitions from conventional fossil fuels to renewable energy sources. By 2024, renewable energy sources are predicted to provide 29% of the EU's energy needs, according to the BP Outlook 2019. The principal objective is to cut carbon emissions from 2017 levels by 36% by 2040. The transition to renewable energy sources is causing the growth rate of oil production to slow down and well-drilling operations to decrease. The pipeline and process services (PPS) market's growth is therefore probably going to be impacted. As a significant energy user, Europe's adoption of renewable energy will have a detrimental effect on the oil and gas production industry, which will then hurt the pipeline and process services market.

Pipeline Testing and Inspection Services Market Opportunities:

The market for pipeline testing and inspection services offers a wealth of chances for expansion and creativity. Businesses can use technological breakthroughs to create and apply creative inspection methods that guarantee pipeline integrity and safety. Service providers that specialize in regulatory compliance and adherence to safety standards are in high demand due to stringent regulations.

Comprehensive testing and inspection services are becoming more and more available as pipeline networks expand, particularly in emerging markets. Proactive testing services and predictive maintenance solutions are necessary because of the focus on preventive maintenance. Approaches to holistic integrity management look for all-inclusive solutions that address risk assessment, data analysis, testing, and inspection. Advanced data management and analysis solutions become possible with the adoption of data analytics and digitalization.

PIPELINE TESTING AND INSPECTION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.85% |

|

Segments Covered |

By Asset Type, Operation, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Altus Intervention, CR Asia Group, Eunisell Limited, Alphaden Energy, Cypress Pipeline, Tech fem, Enermech, BGS Energy Services, Hydratight, IPEC, Pipeline and process and IKM Group |

CUSTOMIZE THIS FULL STUDY AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Pipeline Testing and Inspection Services Market- By Asset Type:

-

Pipeline

-

Process

The pipeline segmentation became the most common asset type in 2023. The surge in offshore exploration and drilling activities has been fueled by the growing demand for crude oil, which in turn has fueled the growth of transmission pipeline services.

Furthermore, there is a growing need for distribution pipeline services due to the acceleration of industrialization and urbanization. Because planned offshore oil and gas projects are expected to come online during the forecast period, pipeline services are expected to present profitable opportunities in regions like Europe, Asia Pacific, and the Middle East.

The 1,900-kilometer Cyprus-Greece Gas Pipeline is one noteworthy project that will be able to transport sixteen billion cubic meters annually. This pipeline will link Greece's possible gas reserves with the offshore gas reserves in the Levantine Basin. This project, which is expected to be finished by 2030, is a prime example of the important advancements propelling the pipeline and process services industry, especially in areas with abundant offshore oil and gas resources.

Pipeline Testing and Inspection Services Market - By Operation:

-

Commissioning

-

Decommissioning

-

Maintenance

Throughout the forecast period, maintenance offerings are anticipated to retain the largest share of the operation segment. This is because equipment for the oil and gas industry ages over time and that improper maintenance poses a major risk of harm to the environment, equipment failure, and injury. To reduce the risk of failure, increase profitability, and extend the life of these assets, timely maintenance and repair must be performed on them.

Pipeline internal surface modifications can have a big impact on throughput and energy needs to keep desired flow rates. A clean pipeline increases media flow capacity and prolongs equipment life, which enhances system reliability and lowers maintenance risks. In the end, pipeline operators and owners benefit financially from this. The significance of maintenance services is highlighted by the growing focus on sustaining profitability, especially in the wake of the drop in crude oil prices. Businesses can maximize asset performance, lower downtime, and eventually increase operational efficiency and profitability by investing in routine maintenance.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Pipeline Testing and Inspection Services Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Exploration and production efforts are shifting more and more toward harsh environments as the need for power in North America grows. The potential for producing energy has been further expanded by the recent breakthroughs in extraction techniques, which have opened up several oil and gas shale regions in extremely remote areas.

Pipelines are essential for the transportation of crude oil and petroleum products in the United States, where they are used to ship about 70% of these resources. Texas and New Mexico are expected to contribute the most to this higher production. Thanks to developments in the extraction of hydrocarbons from low-permeability shale formations, the United States has emerged as one of the world's top producers of both gas and oil.

Pipelines are essential for the transportation of natural gas and petroleum products in Canada, where they are used to ship about 97% of these resources. In the upcoming years, it is anticipated that the region's overall pipeline market will be driven by the transportation of natural gas and crude oil from remote locations.

COVID-19 Impact on the Global Pipeline Testing and Inspection Services Market:

The COVID-19 pandemic has had a serious negative effect on the energy sector, especially on operations related to the production and exploration of oil and gas. The International Energy Agency (IEA) reports that the pandemic has caused major supply chain and project construction disruptions. These disruptions have been exacerbated by the lockdowns, worker social distancing policies, and economic hardships that major nations have experienced. Even though oil prices started to rise again in July 2020 and stabilized at USD 35–40, the industry has been severely impacted overall. Many pipeline projects have experienced delays and temporary shutdowns as a result of the pandemic. Lockdowns intended to contain the virus's spread have also impeded the flow of petrochemicals from refineries to final consumers. Throughout 2020, these disruptions had a detrimental impact on the downstream oil and gas industry, which may have resulted in the closure of numerous small refineries. In addition, the suspension of international trade and transportation has resulted in various obstacles for the supply chain. Numerous planned maintenance and development initiatives have either been severely delayed or completely abandoned. As a result, the effects of COVID-19 have severely halted the market's growth for pipeline and process services.

Latest Trend/Development:

EnerMech recently achieved a noteworthy milestone in the oil and gas industry by securing a significant 12-month contract in the Southern North Sea. EnerMech will offer a wide range of specialized services under this contract that are customized to the project's requirements. These services include bolting and flange management, nitrogen services, pipework removal, and purging of all project-related assets. Furthermore, EnerMech will be essential in performing leak testing, carefully supervised bolting operations, and the installation of extra pipes as needed. This contract demonstrates EnerMech's proficiency and ability to provide comprehensive solutions for challenging projects in the oil and gas industry. Concurrently, IKM Group has also managed to land a big contract for a range of services associated with the Johan Castberg project. N2/He leakage testing, PSV calibration, bolt work, chemical cleaning, hot oil flushing, drying, flange machining, pipe cutting, and pipe wedge machining are some of the services covered under this contract. This agreement demonstrates IKM Group's standing as a reliable supplier of a broad range of services to the oil and gas sector. Their capacity to provide all-encompassing solutions demonstrates their dedication to attending to the various needs of their clients and assisting in the accomplishment of significant projects. The fierce competition among top players in the oil and gas sector to offer cutting-edge and novel goods and services is reflected in these contract victories. To stay ahead of the competition, businesses are spending more money on process automation and research and development (R&D). Subterranean transportation relies heavily on pipelines, so maintaining their efficiency and integrity is vital. To improve the efficiency and dependability of pipeline systems, businesses are constantly creating and deploying new technologies. These patterns point to a dynamic and changing environment in the oil and gas industry, where businesses are working to innovate and adapt to meet new challenges.

Key Players:

-

Altus Intervention

-

CR Asia Group

-

Eunisell Limited

-

Alphaden Energy

-

Cypress Pipeline

-

Tech fem

-

Enermech

-

BGS Energy Services

-

Hydratight

-

IPEC

-

Pipeline and process and IKM Group

Market News:

-

Neptune Energy awarded Oceaneering and Stork a USD 6.5 million contract in January 2022 for integrity management and fabric upkeep. Services including erosion control, pipeline management, pressure system maintenance, structural support, and offshore inspection services are covered under the contract.

-

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Pipeline Testing and Inspection Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pipeline Testing and Inspection Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pipeline Testing and Inspection Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pipeline Testing and Inspection Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pipeline Testing and Inspection Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pipeline Testing and Inspection Services Market – By Asset Type

6.1 Introduction/Key Findings

6.2 Pipeline

6.3 Process

6.4 Y-O-Y Growth trend Analysis By Asset Type

6.5 Absolute $ Opportunity Analysis By Asset Type, 2024-2030

Chapter 7. Pipeline Testing and Inspection Services Market – By Operation

7.1 Introduction/Key Findings

7.2 Commissioning

7.3 Decommissioning

7.4 Maintenance

7.5 Y-O-Y Growth trend Analysis By Operation

7.6 Absolute $ Opportunity Analysis By Operation, 2024-2030

Chapter 8. Pipeline Testing and Inspection Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Asset Type

8.1.3 By Operation

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Asset Type

8.2.3 By Operation

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Asset Type

8.3.3 By Operation

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Asset Type

8.4.3 By Operation

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Asset Type

8.5.3 By Operation

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pipeline Testing and Inspection Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Altus Intervention

9.2 CR Asia Group

9.3 Eunisell Limited

9.4 Alphaden Energy

9.5 Cypress Pipeline

9.6 Tech fem

9.7 Enermech

9.8 BGS Energy Services

9.9 Hydratight

9.10 IPEC

9.11 Pipeline and process and IKM Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Pipeline Testing and Inspection Services Market size is estimated to grow from USD 46.13 billion in 2023 to USD 64.27 billion by 2030.

The market is expanding due to the need for pipelines to carry goods like gas and liquid and Government rules governing pipeline transportation will propel the market.

The growing need for crude oil and Natural gas is restraining the growth of the market.

The Global Pipeline Testing and Inspection Services Market is dominated by North America.

Altus Intervention, CR Asia Group, Eunisell Limited, Alphaden Energy, Cypress Pipeline, Tech fem, Enermech, BGS Energy Services, Hydratight, IPEC, Pipeline and Process and IKM Group