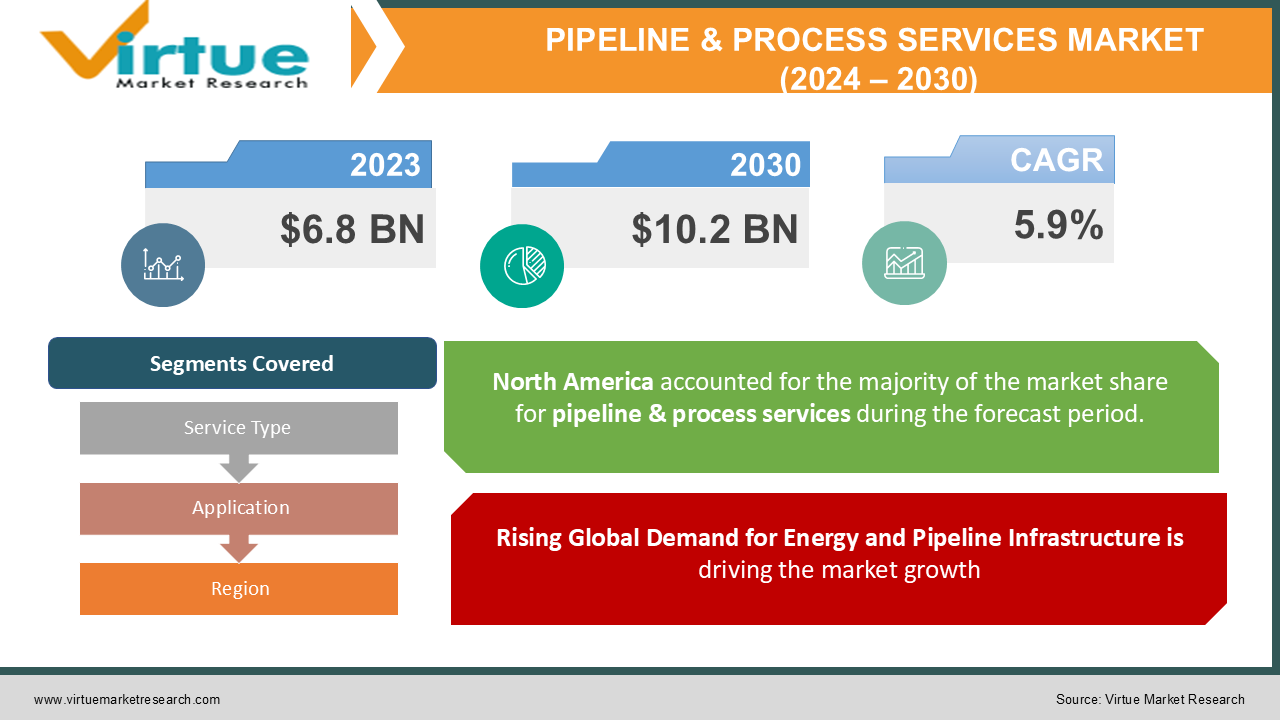

Pipeline & Process Services Market Size (2024–2030)

The Global Pipeline & Process Services Market was valued at USD 6.8 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030, reaching a market value of USD 10.2 billion by 2030.

Pipeline and process services (PPS) are crucial to maintaining the safe and efficient operation of pipelines and process facilities, primarily within the oil & gas, chemical, refining, and water & wastewater industries. These services include pre-commissioning, pipeline cleaning, testing, decommissioning, and integrity management, which ensure the pipelines’ structural integrity, reliability, and operational efficiency.

As global energy demand rises and industries face increasing regulatory pressures for safety, environmental compliance, and operational reliability, the market for pipeline and process services is gaining momentum. The growing investments in pipeline infrastructure, particularly in regions such as North America, Asia-Pacific, and the Middle East, are further boosting the demand for these services. In addition, the focus on optimizing asset performance and ensuring compliance with safety and environmental regulations are key factors driving market growth.

Key Market Insights:

-

The pipeline pre-commissioning service segment holds the largest market share, accounting for 38% of the total market in 2023, driven by the demand for safe and reliable pipeline startup operations in the oil & gas sector.

-

Pipeline integrity management services are projected to witness the highest growth, with a CAGR of 6.3% during the forecast period, as industries increasingly prioritize the long-term health of pipelines due to stringent regulations and aging infrastructure.

-

Oil & gas is the dominant application segment, contributing to over 60% of the total market revenue in 2023. The need for efficient transport of hydrocarbons and the growing number of pipeline projects in key oil-producing regions are key factors driving demand in this sector.

-

Asia-Pacific is expected to be the fastest-growing regional market, with a projected CAGR of 6.1% from 2024 to 2030, driven by ongoing pipeline construction projects and increasing industrial activities in countries like China and India.

Global Pipeline & Process Services Market Drivers:

Rising Global Demand for Energy and Pipeline Infrastructure is driving the market growth The increasing global demand for energy is one of the primary drivers of the pipeline & process services market. With the world’s energy consumption continuing to rise, there is a corresponding need to transport oil, gas, and other hydrocarbons safely and efficiently across vast distances. Pipelines play a critical role in fulfilling this demand by providing a cost-effective and reliable means of transporting these resources. As the oil & gas industry expands to meet the growing energy needs of both developing and developed economies, the construction of new pipelines and the extension of existing infrastructure have become essential. Countries such as China, India, and the United States are investing heavily in pipeline projects to transport energy resources efficiently. For example, the Trans-Anatolian Natural Gas Pipeline (TANAP) and the Nord Stream projects are part of a global trend to enhance energy security and supply.

Stringent Environmental and Safety Regulations are driving the market growth The global pipeline and process services market is significantly driven by stringent environmental and safety regulations. Governments and regulatory bodies around the world are enforcing strict compliance standards to ensure the safe and environmentally responsible operation of pipelines and process facilities. These regulations are particularly critical in industries such as oil & gas, where the risk of accidents, spills, and environmental damage is high. For instance, in the United States, the Pipeline and Hazardous Materials Safety Administration (PHMSA) has introduced stringent regulations that require pipeline operators to conduct regular inspections, integrity management, and risk assessments to prevent accidents. Similarly, the European Union’s environmental regulations mandate pipeline operators to maintain high standards of safety and environmental protection throughout the lifecycle of their pipelines.

Technological Advancements and Automation in Pipeline Monitoring are driving the market growth Technological advancements and the adoption of automation and digitalization are transforming the pipeline and process services industry. The integration of Internet of Things (IoT) sensors, machine learning, and AI-driven predictive maintenance technologies are revolutionizing the way pipelines are monitored, maintained, and operated. Traditional pipeline inspection and monitoring methods often relied on manual inspections and scheduled maintenance, which were time-consuming, labor-intensive, and subject to human error. Today, advanced technologies such as remote monitoring systems, robotic pigging, and real-time data analytics are allowing pipeline operators to monitor their assets in real time and detect potential issues before they escalate into major problems. Predictive maintenance is one of the key benefits of these technological advancements. By analyzing historical and real-time data, pipeline operators can identify trends and patterns that indicate the likelihood of equipment failure, corrosion, or leaks. This proactive approach enables companies to schedule maintenance activities more efficiently, reduce downtime, and extend the lifespan of their pipelines.

Global Pipeline & Process Services Market Challenges and Restraints:

High Initial Investment and Operational Costs are restricting the market growth One of the significant challenges facing the global pipeline & process services market is the high initial investment and operational costs associated with pipeline construction, maintenance, and decommissioning activities. Constructing new pipelines requires substantial capital investment in materials, labor, equipment, and regulatory compliance, which can pose financial challenges for companies, especially smaller players. Similarly, the maintenance of existing pipeline infrastructure, particularly in the oil & gas sector, requires regular investment in inspection, cleaning, integrity management, and repair services. These activities often involve the use of specialized equipment, such as pigs and inspection robots, which can be expensive to procure and operate. Additionally, conducting maintenance activities can result in pipeline downtime, leading to potential revenue losses for pipeline operators. The cost of decommissioning pipelines and process facilities, particularly in mature oilfields, is another financial burden for companies. Decommissioning activities require compliance with strict environmental regulations, including the safe removal of hazardous materials and the proper disposal of pipeline infrastructure. These activities are not only expensive but also time-consuming, which can further strain the financial resources of companies operating in this market.

Environmental Concerns and Public Opposition Restricting the market growth Environmental concerns and public opposition to pipeline projects represent another significant challenge for the pipeline & process services market. Pipeline leaks, spills, and accidents can have devastating environmental consequences, including the contamination of water sources, soil degradation, and harm to local wildlife. As a result, pipelines, particularly those transporting oil and gas, are often subject to intense scrutiny from environmental groups and the public. High-profile pipeline accidents, such as the Deepwater Horizon oil spill and the Keystone Pipeline spill, have raised awareness about the environmental risks associated with pipeline infrastructure. These incidents have fueled public opposition to new pipeline projects and led to calls for stricter regulatory oversight of pipeline operations.

Market Opportunities:

The global pipeline & process services market presents significant opportunities, particularly in the context of the ongoing energy transition and the shift towards cleaner, more sustainable energy sources. As the world moves away from fossil fuels and embraces renewable energy, pipelines will continue to play a critical role in transporting energy resources, albeit in a more diversified manner. For example, natural gas, which is viewed as a transition fuel in the shift towards renewable energy, will continue to be transported via pipelines. The increasing focus on reducing carbon emissions and the need to transport cleaner fuels such as hydrogen and biofuels are creating new opportunities for the market. Hydrogen pipelines, in particular, are expected to become a key component of the energy infrastructure in the coming decades, as governments and industries invest in the development of a hydrogen economy. In addition to new pipeline construction, the market for pipeline retrofitting and recommissioning services is expected to grow as operators seek to convert existing infrastructure to accommodate the transportation of hydrogen and other cleaner fuels. This trend presents opportunities for companies specializing in pipeline integrity management, as retrofitting pipelines for hydrogen transport requires comprehensive assessments of pipeline materials, corrosion resistance, and safety measures.

PIPELINE & PROCESS SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Service Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Baker Hughes, Halliburton, Schlumberger, EnerMech Ltd., IKM Testing, Hydratight Limited, Altus Intervention, Techfem S.p.A., Stork Technical Services, Intertek Group Plc |

Pipeline & Process Services Market Segmentation: By Service Type

-

Pipeline Pre-Commissioning

-

Process Decommissioning

-

Pipeline Integrity Management

-

Pipeline Cleaning

-

Decommissioning Services

The pipeline pre-commissioning service type dominates the market, contributing 38% of the total revenue in 2023. This segment is driven by the demand for safe and efficient pipeline startup operations, particularly in the oil & gas sector, where pre-commissioning services such as cleaning, testing, and drying are critical to ensuring that pipelines are ready for full operation.

Pipeline & Process Services Market Segmentation: By Application

-

Oil & Gas

-

Chemicals

-

Water & Wastewater

-

Refining

-

Power Generation

The oil & gas application segment is the largest contributor to the global pipeline & process services market, accounting for 60% of the total market revenue in 2023. The demand for pipeline services in the oil & gas industry is driven by the need to transport hydrocarbons over long distances, often across international borders, as well as the ongoing construction of new pipelines in key oil-producing regions.

Pipeline & Process Services Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

Latin America

-

Middle East & Africa

North America holds the largest share of the global pipeline & process services market, accounting for 35% of the total revenue in 2023. The region’s dominance is driven by the extensive network of oil and gas pipelines in the United States and Canada, as well as the ongoing investment in new pipeline projects such as the Permian Basin pipelines and Canadian LNG pipelines. The region also benefits from stringent regulatory requirements for pipeline safety and environmental compliance, which drive demand for integrity management and decommissioning services.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a notable impact on the global pipeline & process services market, particularly during the initial phases of the pandemic when oil prices plummeted, and pipeline construction projects were delayed or canceled. The pandemic caused significant disruptions to the global oil & gas industry, with reduced demand for energy leading to decreased investment in new pipeline projects and a slowdown in maintenance and integrity management activities. However, as the world began to recover from the pandemic and energy demand rebounded, the pipeline & process services market experienced a gradual recovery. The need for reliable and efficient energy transportation became even more critical as industries ramped up production to meet post-pandemic demand. Additionally, the pandemic highlighted the importance of remote monitoring and automation in pipeline operations, leading to increased investment in digital pipeline solutions and predictive maintenance technologies. In the post-pandemic era, the pipeline & process services market is expected to witness steady growth, driven by the recovery of the oil & gas sector, ongoing pipeline construction projects, and the increasing focus on decarbonization and energy transition initiatives. The adoption of digitalization and automation technologies, which gained prominence during the pandemic, will continue to shape the future of the market, enabling pipeline operators to enhance efficiency, reduce operational costs, and ensure safety and compliance.

Latest Trends/Developments:

Several key trends are shaping the future of the global pipeline & process services market. One of the most significant trends is the increasing adoption of digitalization and automation in pipeline operations. Technologies such as the Internet of Things (IoT) sensors, real-time monitoring, and AI-driven predictive maintenance are revolutionizing the way pipelines are inspected and maintained. These technologies enable pipeline operators to monitor their assets quickly, detect potential issues before they escalate, and optimize maintenance schedules to minimize downtime and operational costs. Another important trend is the growing focus on pipeline integrity management in response to stringent environmental and safety regulations. Governments and regulatory bodies are imposing stricter requirements for pipeline operators to conduct regular inspections, risk assessments, and maintenance activities to prevent accidents and leaks. This has led to increased demand for advanced pipeline integrity management services, including smart pigging, corrosion monitoring, and non-destructive testing. The energy transition and the shift towards cleaner fuels are also driving significant changes in the pipeline & process services market. As the world moves towards renewable energy sources, pipelines will play a critical role in transporting cleaner fuels such as natural gas, biofuels, and hydrogen. The growing interest in hydrogen pipelines presents new opportunities for pipeline service providers, particularly in terms of retrofitting existing pipelines and ensuring the safe transportation of hydrogen.

Key Players:

-

Baker Hughes

-

Halliburton

-

Schlumberger

-

EnerMech Ltd.

-

IKM Testing

-

Hydratight Limited

-

Altus Intervention

-

Techfem S.p.A.

-

Stork Technical Services

-

Intertek Group Plc

Chapter 1. Pipeline & Process Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pipeline & Process Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pipeline & Process Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pipeline & Process Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pipeline & Process Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pipeline & Process Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Pipeline Pre-Commissioning

6.3 Process Decommissioning

6.4 Pipeline Integrity Management

6.5 Pipeline Cleaning

6.6 Decommissioning Services

6.7 Y-O-Y Growth trend Analysis By Service Type

6.8 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Pipeline & Process Services Market – By Application

7.1 Introduction/Key Findings

7.2 Oil & Gas

7.3 Chemicals

7.4 Water & Wastewater

7.5 Refining

7.6 Power Generation

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Pipeline & Process Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pipeline & Process Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Baker Hughes

9.2 Halliburton

9.3 Schlumberger

9.4 EnerMech Ltd.

9.5 IKM Testing

9.6 Hydratight Limited

9.7 Altus Intervention

9.8 Techfem S.p.A.

9.9 Stork Technical Services

9.10 Intertek Group Plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Pipeline & Process Services Market was valued at USD 6.8 billion in 2023 and is projected to reach USD 10.2 billion by 2030, growing at a CAGR of 5.9%.

Key drivers include the rising global demand for energy, increasing investments in pipeline infrastructure, and stringent environmental and safety regulations driving the need for regular pipeline maintenance and integrity management services.

The market is segmented by service type (pipeline pre-commissioning, process decommissioning, pipeline integrity management) and application (oil & gas, chemicals, water & wastewater, refining, power generation).

North America is the dominant region, accounting for 35% of the market share in 2023, driven by extensive pipeline networks and regulatory requirements for pipeline safety.

Leading players include Baker Hughes, Halliburton, Schlumberger, EnerMech Ltd., and IKM Testing.