Phytotherapy Market Size (2025-2030)

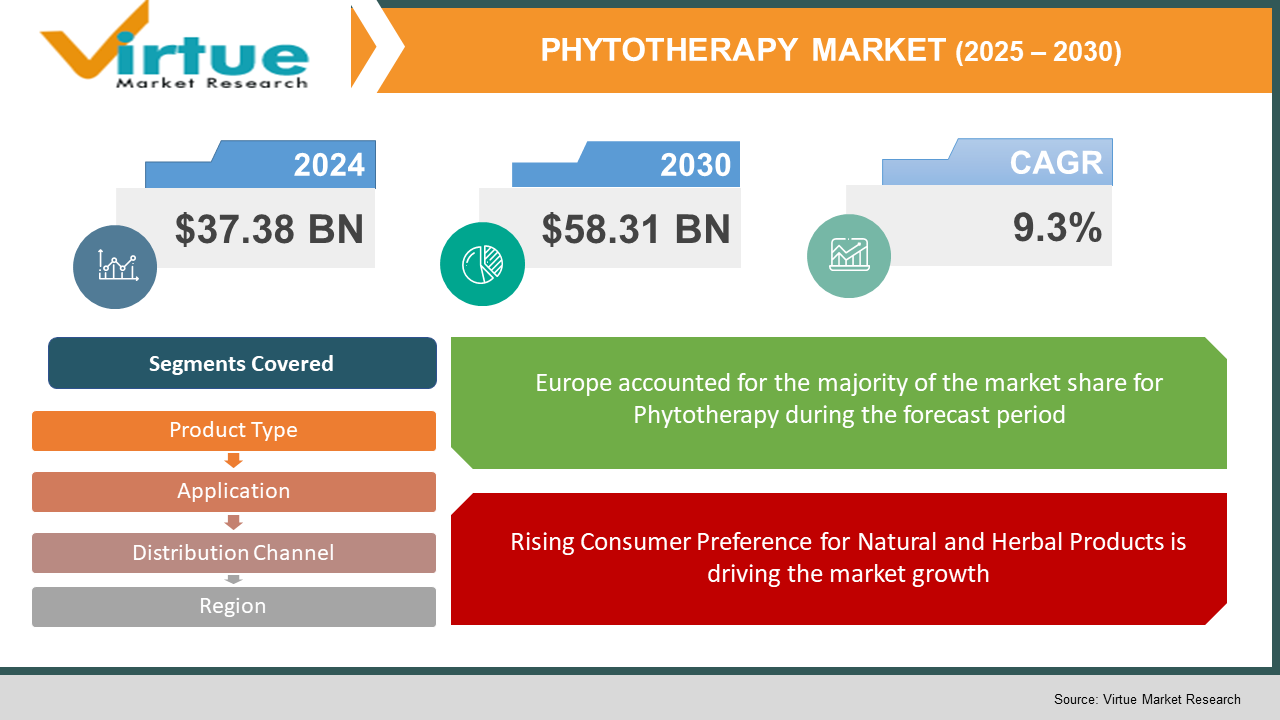

In 2024, the global phytotherapy market was valued at USD 37.38 billion and is projected to reach USD 58.31 billion by 2030, growing at a CAGR of 9.3% during the forecast period, 2025-2030.

The Global Phytotherapy Market is experiencing rapid growth as consumers and healthcare professionals increasingly adopt plant-based treatments for various medical conditions. Phytotherapy, which refers to the use of plant-derived compounds for therapeutic purposes, is gaining traction due to its perceived natural benefits, minimal side effects, and growing consumer preference for herbal medicines over synthetic drugs. The increasing popularity of traditional medicine systems such as Ayurveda, Traditional Chinese Medicine (TCM), and Western herbal medicine is driving market expansion.

The rising awareness of herbal treatments, increasing demand for organic and natural health solutions, and the integration of phytotherapy into mainstream healthcare systems are contributing to market growth. Additionally, regulatory bodies worldwide are recognizing the efficacy of phytotherapy, leading to its greater acceptance and integration into clinical practices.

Key Market Insights:

- Essential oils are gaining traction in aromatherapy and personal care applications, driving demand in the wellness and cosmetics industries.

- Online distribution channels are expanding, with e-commerce platforms offering a broad range of phytotherapy products, enhancing consumer accessibility.

- The integration of Artificial Intelligence (AI) and biotechnology in phytotherapy research is enhancing product development, ensuring standardized formulations and improved efficacy.

Global Phytotherapy Market Drivers:

Rising Consumer Preference for Natural and Herbal Products is driving the market growth

Consumers are increasingly shifting towards natural remedies due to concerns over the side effects of synthetic drugs and a growing preference for chemical-free treatments. Herbal medicines, plant extracts, and essential oils are being used widely in healthcare, personal care, and nutrition, leading to a surge in phytotherapy product demand. Additionally, social media and digital platforms have boosted awareness regarding the benefits of phytotherapy, influencing consumer purchasing decisions.

Growing Acceptance of Herbal Medicine in Mainstream Healthcare is driving the market growth

Governments and healthcare institutions worldwide are recognizing the efficacy of plant-based treatments, integrating phytotherapy into conventional medical practices. Countries such as Germany, China, and India have long supported herbal medicine as a part of their healthcare systems. Regulatory agencies such as the European Medicines Agency (EMA) and the US FDA are also developing guidelines to ensure the quality, safety, and efficacy of herbal medicines, boosting consumer confidence in phytotherapeutic products.

Expanding Applications in Pharmaceuticals, Nutraceuticals, and Personal Care is driving the market growth

Phytotherapy is no longer limited to traditional medicinal applications; its scope has expanded to pharmaceuticals, dietary supplements, skincare, and wellness products. The rise in nutraceutical products incorporating plant extracts, such as curcumin, ginseng, and ashwagandha, is driving market growth. Additionally, essential oils and plant-based cosmetics are gaining popularity due to their therapeutic benefits, especially in anti-aging and skincare formulations.

Global Phytotherapy Market Challenges and Restraints:

Lack of Standardization and Quality Control is restricting the market growth

One of the major challenges in the phytotherapy market is variability in plant composition, leading to inconsistent product quality. Differences in cultivation, extraction methods, and processing techniques can affect the potency and effectiveness of phytotherapeutic products. Regulatory bodies are working on developing global quality standards, but counterfeit and substandard herbal products continue to pose risks.

Regulatory Complexities and Approval Processes is restricting the market growth

Unlike synthetic drugs, herbal medicines face complex and varied regulatory frameworks across different regions. While some countries have established guidelines for herbal medicine approvals, others lack a structured regulatory framework, limiting market expansion. Stringent clinical testing requirements and long approval timelines can hinder innovation and product commercialization.

Limited Scientific Evidence and Clinical Trials is restricting the market growth

Despite the growing popularity of phytotherapy, scientific validation remains a key challenge. Limited large-scale clinical trials and lack of rigorous scientific research on certain plant-based treatments have led to skepticism among healthcare professionals. The pharmaceutical industry's preference for evidence-based medicine requires more extensive research and investment in validating phytotherapeutic formulations.

Market Opportunities:

The phytotherapy market, a realm where ancient botanical wisdom meets modern scientific advancement, is ripe with lucrative opportunities for those who dare to innovate, research, and expand. A primary avenue for growth lies in the escalating investment in Research & Development (R&D). Pharmaceutical giants and burgeoning biotech firms are recognizing the untapped potential of plant-derived compounds, pouring resources into rigorous scientific investigations aimed at standardizing herbal medicines and substantiating their therapeutic claims. The convergence of biotechnology, artificial intelligence-driven drug discovery, and nanotechnology is proving transformative, enabling the precise optimization of these compounds for pharmaceutical applications. This scientific rigor not only enhances the credibility of phytotherapy but also paves the way for the development of novel, effective treatments. Concurrently, the digital revolution has democratized access to phytotherapy products, with the burgeoning e-commerce landscape and digital platforms facilitating unprecedented online and direct-to-consumer (DTC) sales. Consumers, increasingly discerning and informed, are embracing the convenience of online shopping to procure herbal medicines, essential oils, and supplements, bypassing traditional brick-and-mortar channels. This shift has created a fertile ground for DTC brands to flourish, capitalizing on the growing demand for natural remedies by offering personalized experiences and tailored product recommendations. Further fueling the market's dynamism is the expansion of phytotherapy beyond its traditional medicinal boundaries. The integration of herbal extracts into functional foods, cosmeceuticals, and veterinary applications is unlocking new revenue streams and broadening the consumer base. Companies that embrace diversification, crafting products that cater to diverse needs and preferences, are poised to thrive in this evolving landscape. From herbal-infused beverages that promote wellness to skincare formulations enriched with botanical extracts, and even veterinary supplements that harness the healing power of plants, the possibilities are vast and varied. This multi-faceted growth, driven by scientific advancement, digital accessibility, and product diversification, positions the phytotherapy market as a beacon of opportunity for forward-thinking businesses.

PHYTOTHERAPY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.3% |

|

Segments Covered |

By Product Type, application , Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schwabe Group, Arkopharma, Dabur, Himalaya Wellness, Nature’s Way, Bio-Botanica, and Ricola |

Phytotherapy Market Segmentation:

Phytotherapy Market Segmentation By Product Type:

- Herbal Medicines

- Plant Extracts

- Essential Oils

- Dietary Supplements

Herbal medicines hold the largest market share, driven by high consumer trust, increased regulatory support, and the widespread adoption of herbal treatments in mainstream healthcare.

Phytotherapy Market Segmentation By Application:

- Pharmaceuticals

- Nutraceuticals

- Personal Care & Cosmetics

- Others

The nutraceutical segment is expanding rapidly due to the rising demand for plant-based dietary supplements that support immune health, digestion, and mental well-being.

Phytotherapy Market Segmentation By Distribution Channel:

- Pharmacies & Drug Stores

- Online Retail

- Health & Wellness Stores

- Direct Sales

Traditional pharmacy channels remain the primary source for herbal medicines, but online retail is the fastest-growing distribution channel, fueled by e-commerce expansion.

Phytotherapy Market Regional Segmentation:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Europe dominates the global phytotherapy market due to its well-established herbal medicine regulations, high consumer awareness, and strong demand for botanical pharmaceuticals. Germany, France, and the UK lead the market, with over-the-counter herbal medicines widely accepted. Asia-Pacific is witnessing rapid growth due to the strong presence of traditional medicine systems such as Ayurveda and Traditional Chinese Medicine (TCM). Countries like China, India, and Japan are key contributors to the region’s booming phytotherapy industry.

COVID-19 Impact Analysis:

The unprecedented global health crisis triggered by the COVID-19 pandemic acted as a powerful catalyst, dramatically accelerating the adoption of phytotherapy across diverse consumer demographics. Faced with the uncertainties and anxieties surrounding the novel virus, individuals worldwide turned to natural immune-boosting remedies, seeking to fortify their defenses against potential infection. This surge in interest manifested in a significant increase in sales of herbal supplements, plant-based immunity boosters, and essential oils, as consumers actively sought products perceived to enhance their overall well-being and resilience. The pandemic fostered a heightened awareness of the importance of proactive health management, shifting the focus from reactive treatment to preventive measures. This mindset, deeply ingrained during the peak of the crisis, has persisted and evolved, solidifying a long-term trend towards prioritizing preventive healthcare. Even as the immediate threat of the pandemic recedes, the enduring legacy of this experience is a strengthened and sustained demand for phytotherapy products. Individuals, now more than ever, are inclined to incorporate natural remedies into their daily routines, viewing them as integral components of a holistic approach to health maintenance. This shift reflects a broader societal movement towards embracing natural and plant-based solutions, driven by a desire for greater control over one's health and a preference for remedies perceived as gentler and less invasive than conventional pharmaceuticals. The focus has moved beyond mere symptom relief to encompass the promotion of overall vitality and well-being, with consumers actively seeking products that support immune function, reduce stress, and enhance cognitive performance. This enduring trend is reshaping the landscape of the healthcare and wellness industries, creating a fertile ground for innovation and growth in the phytotherapy market.

Latest Trends/Developments:

The biotechnology sector is experiencing a significant transformation driven by innovations in herbal medicine, characterized by the integration of cutting-edge technologies and evolving consumer preferences. A pivotal advancement is the application of AI-driven phytochemical research, which is revolutionizing drug discovery and product standardization within the phytotherapy domain. By leveraging artificial intelligence, researchers can efficiently analyze vast datasets of plant compounds, identify novel therapeutic agents, and optimize extraction and formulation processes. This technological leap not only accelerates the pace of drug development but also ensures consistent quality and efficacy in herbal products, addressing a long-standing challenge in the industry. Simultaneously, there is a notable surge in the popularity of adaptogenic herbs, such as ashwagandha, ginseng, and rhodiola, reflecting a growing consumer interest in natural stress management and holistic wellness solutions. These herbs, renowned for their ability to enhance the body's resilience to stress, are increasingly incorporated into a diverse array of products, from dietary supplements to functional beverages. In response to this expanding market, the industry is witnessing a wave of increased mergers and acquisitions, as companies strategically forge partnerships to bolster their phytotherapy portfolios. These collaborations facilitate the pooling of resources, expertise, and market access, enabling companies to expand their product offerings and strengthen their competitive edge. Furthermore, the integration of herbal extracts into functional foods is emerging as a prominent trend, with beverages, teas, and nutritional bars infused with beneficial plant compounds gaining traction among health-conscious consumers. This convergence of herbal medicine and functional foods caters to the demand for convenient and accessible wellness solutions, providing a seamless way for individuals to incorporate natural remedies into their daily routines. The combined effect of these trends is a dynamic and rapidly evolving landscape where biotechnology and traditional herbal knowledge intersect, fostering innovation and driving growth in the phytotherapy market.

Key Players:

- Schwabe Group

- Himalaya Drug Company

- Arkopharma

- Bio-Botanica Inc.

- Nature’s Way

- Ricola AG

- Blackmores Limited

- Dabur India Ltd.

- Gaia Herbs

- New Chapter, Inc.

Chapter 1. Phytotherapy Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Distribution Channel s

1.5. Secondary Distribution Channel s

Chapter 2. Phytotherapy Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Phytotherapy Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Distribution Channel Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Phytotherapy Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Phytotherapy Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Phytotherapy Market – By Product Type

6.1 Introduction/Key Findings

6.2 Herbal Medicines

6.3 Plant Extracts

6.4 Essential Oils

6.5 Dietary Supplements

6.6 Y-O-Y Growth trend Analysis By Product Type :

6.7 Absolute $ Opportunity Analysis By Product Type :, 2025-2030

Chapter 7. Phytotherapy Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Pharmacies & Drug Stores

7.3 Online Retail

7.4 Health & Wellness Stores

7.5 Direct Sales

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. Phytotherapy Market – By Application

8.1 Introduction/Key Findings

8.2 Pharmaceuticals

8.3 Nutraceuticals

8.4 Personal Care & Cosmetics

8.5 Others

8.6 Y-O-Y Growth trend Analysis Application

8.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Phytotherapy Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Distribution Channel

9.1.3. By Application

9.1.4. By Product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Distribution Channel

9.2.3. By Application

9.2.4. By Product Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Distribution Channel

9.3.3. By Application

9.3.4. By Product Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Distribution Channel

9.4.4. By Product Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Distribution Channel

9.5.4. By Product Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Phytotherapy Market – Company Profiles – (Overview, Packaging Automation Portfolio, Financials, Strategies & Developments)

10.1 Schwabe Group

10.2 Himalaya Drug Company

10.3 Arkopharma

10.4 Bio-Botanica Inc.

10.5 Nature’s Way

10.6 Ricola AG

10.7 Blackmores Limited

10.8 Dabur India Ltd.

10.9 Gaia Herbs

10.10 New Chapter, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2024, the global phytotherapy market was valued at USD 37.38 billion and is projected to reach USD 58.31 billion by 2030, growing at a CAGR of 9.3% during the forecast period, 2025-2030

The market is driven by the growing consumer preference for natural and herbal medicines, increasing awareness of the therapeutic benefits of plant-based treatments, and advancements in botanical extraction technologies.

The market is segmented by: Product Type: Herbal Extracts, Essential Oils, Phytochemicals, Others, Application: Pharmaceuticals, Nutraceuticals, Personal Care, Veterinary, Others

Europe leads with a 38% market share, driven by high adoption of herbal medicines and regulatory support, while Asia-Pacific is the fastest-growing region due to increasing demand for traditional medicine and herbal supplements.

Major players include Schwabe Group, Arkopharma, Dabur, Himalaya Wellness, Nature’s Way, Bio-Botanica, and Ricola.