Phytosterols Market Size (2025 – 2030)

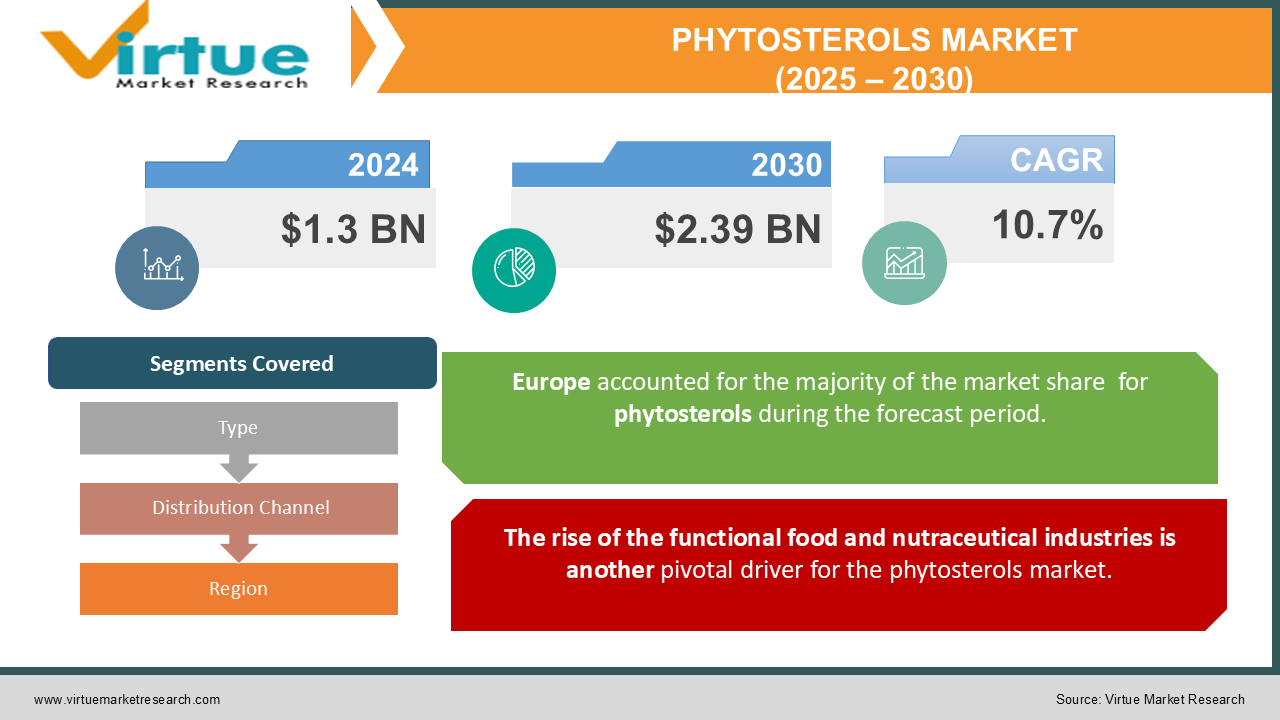

The Phytosterols Market was valued at USD 1.3 Billion in 2024 and is projected to reach a market size of USD 2.39 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.7%.

Phytosterols, also known as plant sterols and stanols, are naturally occurring compounds found in plant cell membranes. Known for their structural similarity to cholesterol, phytosterols effectively lower cholesterol levels by reducing their absorption in the human digestive system. As cardiovascular diseases and lifestyle-related health issues continue to rise globally, the demand for phytosterols is surging due to their cholesterol-lowering properties and overall health benefits. These compounds are extensively used in functional foods, dietary supplements, pharmaceuticals, and cosmetic products, underscoring their versatile applications. The growing awareness about the health benefits of phytosterols is playing a significant role in the market's growth. Consumers are becoming more health-conscious and are actively seeking out functional food products enriched with phytosterols to prevent chronic diseases and maintain a healthy lifestyle. The incorporation of phytosterols in margarine, dairy products, spreads, and beverages has further fueled their demand. Simultaneously, the rise of nutraceuticals and fortified foods is paving the way for innovative product launches that cater to the evolving preferences of health-conscious consumers. The pharmaceutical sector is also a significant contributor to the market's expansion.

Key market Insights:

-

Over 42% of functional food products launched in 2023 included phytosterols as a key ingredient.

-

Global consumption of phytosterol-enriched margarine surpassed 1.5 million tons in 2023.

-

Phytosterols were used in 68% of cardiovascular health supplements introduced in 2023.

-

Approximately 37% of dietary supplements sold in 2023 contained phytosterols as an active component.

-

The cosmetics sector contributed nearly 12% of the total phytosterols demand in 2023.

-

Over 23% of global consumers recognized phytosterols as a cholesterol-lowering agent in 2023.

-

Phytosterol-enriched beverages accounted for 9% of total phytosterol usage in 2023.

-

The retail sales of phytosterol-fortified spreads reached $2.4 billion globally in 2023.

-

More than 3,000 new products containing phytosterols were launched worldwide in 2023.

-

Phytosterols extracted from soybean oil represented 58% of the total market volume in 2023.

Market Drivers:

The increasing prevalence of lifestyle diseases, including obesity, diabetes, and cardiovascular ailments, is one of the most critical factors driving the growth of the phytosterols market.

Sedentary lifestyles, unhealthy dietary habits, and high stress levels have resulted in a surge in non-communicable diseases worldwide. Among these, cardiovascular diseases have emerged as the leading cause of mortality globally. The ability of phytosterols to reduce cholesterol levels and mitigate the risk of heart-related illnesses has made them a preferred choice for preventive healthcare. Consumers are becoming more proactive about their health, seeking natural and scientifically validated solutions for managing chronic conditions. Phytosterols have gained significant attention for their proven efficacy in lowering LDL (bad cholesterol) without affecting HDL (good cholesterol). This has led to a growing demand for products fortified with phytosterols, ranging from functional foods to dietary supplements. The ease of incorporating phytosterols into everyday food products like spreads, dairy, and snacks has further boosted their appeal among health-conscious individuals.

The rise of the functional food and nutraceutical industries is another pivotal driver for the phytosterols market.

As consumers increasingly seek out products that provide both nutrition and therapeutic benefits, manufacturers are focusing on incorporating bioactive compounds like phytosterols into their offerings. Functional foods enriched with phytosterols are particularly popular in the cholesterol management segment, which represents a significant portion of the nutraceuticals market. Innovative product launches have further accelerated the adoption of phytosterols. From plant-based yogurts fortified with sterols to energy bars designed to support cardiovascular health, manufacturers are capitalizing on the versatility of phytosterols to cater to diverse consumer preferences. The emphasis on clean-label, plant-based, and organic products has also aligned well with the naturally derived nature of phytosterols, enhancing their appeal to environmentally and health-conscious consumers.

Market Restraints and Challenges:

Despite its promising growth trajectory, the phytosterols market faces significant restraints and challenges that could impede its development. A primary concern is the high production cost associated with extracting and refining phytosterols. These compounds are naturally present in small quantities in plant oils, cereals, and nuts, requiring substantial raw material processing to produce a usable amount. This extraction process involves sophisticated technology and rigorous quality control, both of which contribute to the elevated production costs. For many manufacturers, balancing affordability with the demand for high-quality phytosterol products remains a constant challenge. Another major restraint is the limited availability of raw materials. While soybeans, rapeseed, and sunflower oil are primary sources of phytosterols, fluctuations in agricultural output due to climate change, pests, or geopolitical issues can disrupt the supply chain. Such disruptions not only inflate prices but also create inconsistencies in product availability, discouraging widespread adoption. Furthermore, consumer skepticism toward fortified or functional foods poses a hurdle. Despite scientific evidence supporting the cholesterol-lowering properties of phytosterols, some consumers remain wary of food additives and supplements. Overcoming this skepticism requires not only marketing but also collaborations with healthcare professionals to validate and promote the benefits of phytosterols. Lastly, competition from alternative cholesterol-lowering solutions, such as statins and other pharmaceuticals, poses a challenge to the phytosterols market. Statins, in particular, are well-established and widely prescribed, offering a competitive edge over functional foods or supplements. Convincing consumers and healthcare providers to choose phytosterols over traditional treatments requires targeted strategies emphasizing their natural origin and fewer side effects.

Market Opportunities:

The phytosterols market holds immense potential for growth, driven by several emerging opportunities across various sectors. A key opportunity lies in the expanding global trend toward preventive healthcare. As consumers become increasingly proactive about managing their health, the demand for natural, plant-based solutions like phytosterols is expected to surge. These compounds align perfectly with the rising consumer preference for functional foods that provide therapeutic benefits while catering to everyday dietary needs. The pharmaceutical industry is another area ripe for exploration. Beyond their cholesterol-lowering benefits, phytosterols possess anti-inflammatory and antioxidant properties, making them suitable for a range of medical applications. Ongoing research into their potential use in cancer prevention, arthritis treatment, and immune system support could open up new avenues for market expansion. Collaborations between pharmaceutical companies and phytosterol producers could lead to the development of innovative therapies that address pressing health concerns. In the cosmetics sector, the use of phytosterols in anti-aging and skin-rejuvenation products is gaining momentum. Their ability to promote skin elasticity and reduce inflammation makes them a sought-after ingredient in premium skincare formulations. With the global cosmetics industry continuing to grow, the demand for phytosterol-based products is expected to rise, offering lucrative opportunities for manufacturers. Emerging markets also represent untapped potential. Countries in Asia, Latin America, and Africa are witnessing rising disposable incomes, urbanization, and health awareness. As consumers in these regions begin to prioritize functional nutrition, phytosterol-enriched products can gain a strong foothold. Tailoring marketing strategies to local tastes and preferences will be key to capturing these markets. Lastly, partnerships with food and beverage giants can accelerate market growth. By collaborating with established brands, phytosterol manufacturers can ensure wider distribution and visibility for their products. Joint ventures focusing on product innovation and marketing can help overcome consumer skepticism and drive adoption at a faster pace.

PHYTOSTEROLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Arboris, LLC, Cargill, Incorporated, DuPont de Nemours, Inc., ADM (Archer Daniels Midland Company), Kao Corporation, Phytogen Life Sciences, Raisio Group, Unilever PLC, Lipid Nutrition B.V., Tate & Lyle PLC, Gustav Parmentier GmbH, Enzymotec Ltd., Avesta Scandinavia AB, Vitae Caps S.A. |

Phytosterols Market Segmentation: By Type

-

β-sitosterol

-

Campesterol

-

Stigmasterol

-

others

Among these, β-sitosterol is the most dominant type, accounting for the majority of the market share. Its widespread application in functional foods and pharmaceuticals stems from its strong cholesterol-lowering efficacy and availability in large quantities from plant sources.

The fastest-growing segment is stigmasterol, driven by its increasing use in the pharmaceutical and cosmetics industries. Known for its anti-inflammatory properties, stigmasterol is being incorporated into a growing range of skincare products, boosting its demand across multiple markets.

Phytosterols Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Pharmacies and Drug Stores

-

Online Stores

-

Specialty Stores

Among these, supermarkets and hypermarkets dominate the distribution landscape, providing consumers with easy access to phytosterol-enriched products. However, the online store segment is witnessing the fastest growth, driven by the convenience of e-commerce and the rising popularity of health-focused digital platforms. Online channels also offer consumers access to a broader range of products, along with personalized recommendations and reviews, fueling their growth.

Phytosterols Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

In 2023, Europe emerged as the most dominant region, accounting for approximately 35% of the total market share. The region's stringent regulations promoting heart health and the high prevalence of functional foods have positioned it as a leader in phytosterol consumption. Additionally, the presence of major food and beverage manufacturers and pharmaceutical companies contributes to its strong market performance.

Meanwhile, Asia-Pacific is the fastest-growing region, with a market share of about 28% in 2023. Rapid urbanization, rising disposable incomes, and increasing awareness about health and wellness among consumers are driving the demand for phytosterols in countries like China, India, and Japan. The expanding nutraceutical and functional food industries in these countries further bolster market growth.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly influenced the phytosterols market, creating both challenges and opportunities. The heightened focus on health and immunity during the pandemic drove consumer interest in functional foods and dietary supplements. As a result, phytosterol-enriched products witnessed increased demand, particularly in the nutraceutical and pharmaceutical sectors. Supply chain disruptions, however, posed challenges during the early phases of the pandemic. Lockdowns and restrictions affected the availability of raw materials and delayed production schedules. Additionally, the economic uncertainty caused by the pandemic led to reduced consumer spending on non-essential items, impacting the demand for premium phytosterol-based products. On the positive side, the pandemic accelerated the adoption of online retail channels, providing a lifeline for phytosterol manufacturers. E-commerce platforms played a crucial role in ensuring product availability and reaching a broader consumer base during the lockdowns. The pandemic also highlighted the importance of preventive healthcare, reinforcing the relevance of phytosterols in managing cholesterol levels and promoting cardiovascular health. Post-pandemic, this awareness is expected to sustain the market's growth momentum.

Latest Trends and Developments:

Recent developments in the phytosterols market reflect the industry's adaptability and innovation. One notable trend is the rise of personalized nutrition, where manufacturers are offering customized phytosterol-enriched products tailored to individual health needs. This approach is gaining traction among health-conscious consumers seeking targeted solutions for cholesterol management and cardiovascular health. The incorporation of phytosterols into plant-based and vegan products is another significant trend. As consumers shift toward ethical and sustainable diets, manufacturers are leveraging the plant-based origin of phytosterols to cater to this growing segment. Products like plant-based butter, yogurt, and cheese fortified with phytosterols are becoming increasingly popular. In the pharmaceutical sector, research into the broader health benefits of phytosterols is leading to innovative applications. Studies exploring their potential role in reducing cancer risk and supporting immune health are paving the way for new product development. Similarly, the cosmetics industry is capitalizing on the anti-aging properties of phytosterols, incorporating them into premium skincare formulations. Advancements in extraction technologies are also shaping the market. Techniques that enhance the yield and purity of phytosterols while reducing production costs are gaining traction. Sustainable sourcing practices, such as extracting phytosterols from agricultural waste, are becoming a priority for manufacturers aiming to align with environmental goals.

Key Players in the Market:

-

BASF SE

-

Arboris, LLC

-

Cargill, Incorporated

-

DuPont de Nemours, Inc.

-

ADM (Archer Daniels Midland Company)

-

Kao Corporation

-

Phytogen Life Sciences

-

Raisio Group

-

Unilever PLC

-

Lipid Nutrition B.V.

-

Tate & Lyle PLC

-

Gustav Parmentier GmbH

-

Enzymotec Ltd.

-

Avesta Scandinavia AB

-

Vitae Caps S.A.

Chapter 1. Phytosterols Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Phytosterols Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Phytosterols Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Phytosterols Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Phytosterols Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Phytosterols Market – By Type

6.1 Introduction/Key Findings

6.2 β-sitosterol

6.3 Campesterol

6.4 Stigmasterol

6.5 others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Phytosterols Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3 Pharmacies and Drug Stores

7.4 Online Stores

7.5 Specialty Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Phytosterols Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Phytosterols Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Arboris, LLC

9.3 Cargill, Incorporated

9.4 DuPont de Nemours, Inc.

9.5 ADM (Archer Daniels Midland Company)

9.6 Kao Corporation

9.7 Phytogen Life Sciences

9.8 Raisio Group

9.9 Unilever PLC

9.10 Lipid Nutrition B.V.

9.11 Tate & Lyle PLC

9.12 Gustav Parmentier GmbH

9.13 Enzymotec Ltd.

9.14 Avesta Scandinavia AB

9.15 Vitae Caps S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Phytosterols are well-known for their ability to lower LDL (bad cholesterol) levels, reducing the risk of heart disease. With cardiovascular conditions being one of the leading global health concerns, consumers are increasingly seeking natural solutions to manage cholesterol.

Extracting and refining phytosterols from natural sources such as vegetable oils and wood pulp involves complex and costly processes. Advanced techniques like supercritical fluid extraction, while efficient, require significant capital investment, making the end products expensive for manufacturers and consumers.

BASF SE, Arboris, LLC, Cargill, Incorporated, DuPont de Nemours, Inc., ADM (Archer Daniels Midland Company).

Europe currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.