Global Photovoltaic Skylight Market Size (2024 - 2030)

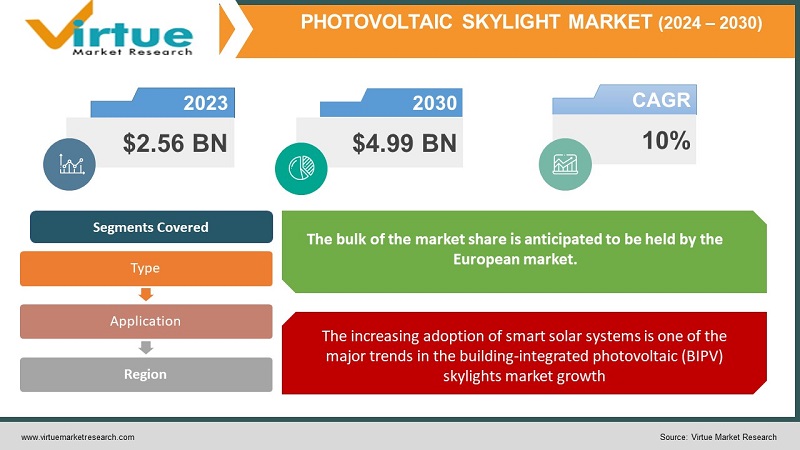

According to our research report, the Global photovoltaic skylight market was valued at USD 2.56 billion and is projected to reach a market size of USD 4.99 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

Industry Overview

In the industrial, residential, and commercial sectors, photovoltaic devices are widely used. A window incorporated into a roof to let light shine on a building's surface is called a photovoltaic skylight. Buildings are increasingly installing photovoltaic skylights because they allow for optimum ventilation, assist save energy, and facilitate the removal of smoke from structures. Additionally, a building-integrated photovoltaic skylight is a photovoltaic application that entails adding photovoltaic materials to a building's facades, curtain walls, canopies, roofs, and walls.

Due to considerable expansion all over the world and growing investments in solar development projects, BIPV skylight demand is expanding. Throughout the anticipated term, the market for BIPV skylights will continue to expand steadily. Many nations are investing in the numerous technologies and goods that make up this sector, which is still in its infancy. The environment's carbon footprint is being reduced by these smart energy solutions. Additionally, they are enhancing customer comfort and enabling energy and money savings.

The majority of BIPV skylights' end users are in the commercial sector. Office complexes, warehouses, dining establishments, and shopping centres are all part of this area. On average, commercial buildings waste roughly 23.45% of the energy they utilise. Therefore, commercial building developers are using EMS (energy management system) and BIPV technologies to boost the total building efficiency in response to growing government incentives. This market covers the demand for BIPV skylights from residential buildings, including as condominiums, bungalows, retirement communities, single-family houses, student housing, and sheltered housing. Presently, only a tiny portion of the world market for BIPV skylights comes from the residential sector. This is due to the fact that BIPV skylight systems are more expensive than the average homeowner can comfortably afford.

Impact of Covid-19 on the industry

Our analysis indicates that the market growth during and after the COVID-19 timeframe has been negatively impacted. Building-integrated photovoltaic skylight sales are rising mostly because to the need to save energy costs, yet market expansion may be hampered by things like the lack of BIPV-specific standards. The building-integrated photovoltaic skylights sector has been affected by both the COVID-19 epidemic and the major market drivers that our research analysts have identified after studying historical data. To achieve a competitive edge, end goals may be determined and marketing strategies can be improved with the aid of a comprehensive analysis of the drivers.

Market Drivers

The need to reduce energy costs is one of the major drivers of the building-integrated photovoltaic (BIPV) skylights market growth

The most energy-intensive end users are factories, commercial buildings, and healthcare institutions since they must run nonstop and employ a variety of equipment to maintain their internal operations. As a result, these facilities have a high demand for power and a high electricity consumption rate. The cost of energy for the construction industry is rising due to the increase in the number of commercial buildings with vast floor plans. The continual increase in power prices has also raised the cost of operating these facilities, which has a direct effect on the bottom-line costs of the facility. The worldwide commercial construction industry is attempting to lower energy costs.

A building may reduce its energy usage by 10%–20% by putting energy management strategies in place, and it can go up to 30% with a thorough energy strategy. For instance, the BIPV skylight has demonstrated to be a very cost-effective solution that reduces energy consumption and offers cost savings in healthcare institutions.

The increasing adoption of smart solar systems is one of the major trends in the building-integrated photovoltaic (BIPV) skylights market growth

The intermittent nature of solar energy sources is one of the main barriers to their adoption. Energy storage fills the gap and is also employed in hybrid systems to boost the share of renewable energy. Standard PV systems may generate 20% to 30% of the required energy; however, by including energy storage (battery), solar PV systems can provide up to 60% to 70% of the required energy. The term "renewable penetration" refers to the percentage of renewable energy that can be added to the system output; for example, a 20% penetration rate indicates that 200 kW of renewable energy may be added for every 1 MW of installed generator capacity. The usual PV penetration level in a hybrid system with specialised software for power management and an energy storage system is shown in the chart below.

Market Restraints

The absence of BIPV-specific standards is one of the major challenges to the building-integrated photovoltaic (BIPV) skylights market growth

The International Electrotechnical Commission and Underwriters Laboratory's design and qualification requirements are now applicable to all PV modules, including BIPV. As a structural component, BIPV could need to satisfy additional requirements, and this could restrict the market. For instance, all 50 US states and Washington, D.C. have ratified the International Code Council's comprehensive International Building Codes. In order to determine BIPV's performance in terms of durability, fire safety, stability, and wind resistance, standards have been devised. The implementation of BIPV might be hampered by even something as basic as measuring standards.

Cost of photovoltaic technology will challenge the market growth

Buildings may become energy producers by utilising photovoltaic technology that is incorporated into the structure. And in order to do so, building-integrated photovoltaics technology must be combined with construction technology. Utilizing building-integrated photovoltaics for curtain walls and other parts of industrial, commercial, and residential structures is a costly strategy. Costs remain high because solar panels are still a young product compared to building-integrated solar technology. Additionally, building-integrated photovoltaic cell efficiencies are inferior to solar panel efficiencies. As a result, consumers will probably pay more for less solar power output. Therefore, the increased expenses might impede market expansion.

PHOTOVOLTAIC SKYLIGHT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AGC Inc. (Japan), Autonic (India), Ertex Solar (Austria), Kingspan Group (SKYCO Skylights) [Ireland], Metsolar (Lithuania), ML SYSTEM S.A. (Poland), Norsk Hydro ASA (Norway), Onyx Solar Group LLC (Spain), Polysolar Ltd (UK), Super Sky Products Enterprises, LLC (US) |

This research report on the global photovoltaic skylight market has been segmented and sub-segmented based on, type, application, and Geography & region.

Global Photovoltaic Skylight Market- By Type

- Crystalline Panel

- Thin Film Panel

It is divided into crystalline panel and thin film panel categories based on kind. The market for thin film panels is expanding more quickly as a result of the quickening pace of technological development that has prompted the release of cutting-edge goods. In situations where the building faces severe weight restrictions, thin film panels are easily utilised. When this occurs, the weight of crystalline silicon integration cannot be supported by the building envelope, which creates a significant demand for thin film integrated installations. Thin film is advantageous because, thanks to its increased flexibility, it may be applied to curved surfaces. Thus, the thin film panel segment's many advantages fuel the market's expansion.

Global Photovoltaic Skylight Market- By Application

- Residential

- Commercial

- Industrial

It is divided into three categories based on application: residential, commercial, and industrial. In 2021, it's anticipated that the business sector will control a sizable portion of the market. The increase in retrofit projects is projected to increase demand for skylights with integrated photovoltaic systems in the business sector. Additionally, the business sector in particular places a lot of value on the visual attractiveness of solar energy-harvesting systems, which is anticipated to increase demand for these products.

Global Photovoltaic Skylight Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America, Europe, Asia Pacific, and the rest of the world are the regions where it is researched. In 2021, the bulk of the market share is anticipated to be held by the European market. The use of building-integrated photovoltaic skylights will aid in encouraging European industrial growth because Germany and Italy are supporting the usage of solar energy. This is as a result of more competitors in the market gravitating toward them. The governments of Europe have also promoted growth by enacting different restrictions. This in turn increases demand in the European region for photovoltaic skylights.

Global Photovoltaic Skylight Market- By Companies

- AGC Inc. (Japan)

- Autonic (India)

- Ertex Solar (Austria)

- Kingspan Group (SKYCO Skylights) [Ireland]

- Metsolar (Lithuania)

- ML SYSTEM S.A. (Poland)

- Norsk Hydro ASA (Norway)

- Onyx Solar Group LLC (Spain)

- Polysolar Ltd (UK)

- Super Sky Products Enterprises, LLC (US)

NOTABLE HAPPENINGS IN THE GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET IN THE RECENT PAST:

- Business Expansion: - In 2021, The new Punggol campus of the Singapore Institute of Technology, slated to open in 2024, has chosen AGC Inc.'s solar glass, according to an announcement made by the company.

- Product Installation: - In 2021, A deal between the Spanish company Onyx Solar and Sterling Bank, a major bank in Nigeria, called for the installation of 6,500 square metres of crystalline silicon photovoltaic glass spandrels at the bank's headquarters building in Lagos. The project is being carried out in coordination with Nigeria's energy company Privida and is slated to become the largest PV integration development in Africa.

Chapter 1.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– By Type

6.1. Crystalline Panel

6.2. Thin Film Panel

Chapter 7.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– By Application

7.1. Residential

7.2. Commercial

7.3. Industrial

Chapter 8.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.GLOBAL PHOTOVOLTAIC SKYLIGHT MARKET-– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1.AGC Inc. (Japan)

9.2. Autonic (India)

9.3. Ertex Solar (Austria)

9.4. Kingspan Group (SKYCO Skylights) [Ireland]

9.5. Metsolar (Lithuania)

9.6. ML SYSTEM S.A. (Poland)

9.7. Norsk Hydro ASA (Norway)

9.8. Onyx Solar Group LLC (Spain)

9.9. Polysolar Ltd (UK)

9.10. Super Sky Products Enterprises, LLC (US)

Download Sample

Choose License Type

2500

4250

5250

6900