Photoresist Chemical Market Size (2024 – 2030)

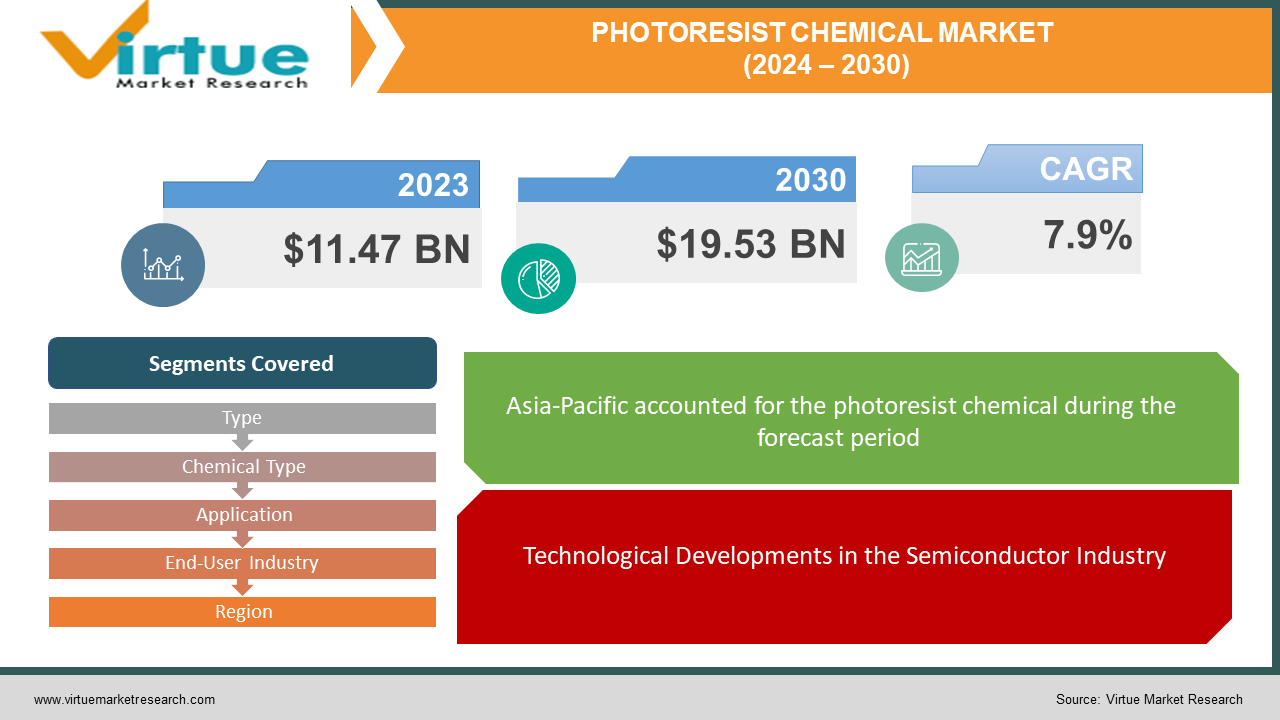

The market for Photoresist Chemicals at the global level is expanding quickly; it was estimated to be worth 11.47 USD billion in 2023 and is expected to increase to USD 19.53 billion by 2030, with a projected compound annual growth rate (CAGR) of 7.9% from 2024 to 2030.

The global market for photoresist chemicals, an essential component of the semiconductor and electronics industries, is dependent on the production of complex electronic components. These substances are required for the photolithography process, which facilitates the transfer of intricate designs onto semiconductor wafers in the process of producing integrated circuits. The market is expected to grow at a promising Compound Annual Growth Rate (CAGR) due to advancements in semiconductor technology and the growing need for more powerful and compact electronic components. This growth is ascribed to further investigation, developments in nanotechnology, and expanding applications in various industries. Increased demand for high-performance electronic devices, the growth of the Internet of Things (IoT), and developments in display technology are some of the reasons propelling the market's rising trajectory concentrating on getting better.

Key Market Insights:

Significant market data indicates that important factors are transforming the worldwide photoresist chemical landscape. The market is growing because of the dynamic semiconductor and electronics industry, where these chemicals are necessary for the creation of complex components. A notable rise is attributed to ongoing scientific advancements in semiconductors, which are further supported by the demand for more highly functional, compact electronic gadgets. The Compound Annual Growth Rate (CAGR) indicates that research and development activities together with improvements in nanotechnology are likely to propel the market's growth at a positive rate. The market's resilience is demonstrated by its adaptability to a wide range of industries, such as high-performance electronics, cutting-edge display technologies, and the Internet of Things (IoT). With an emphasis on meeting evolving consumer demands and ensuring product advancements, the Global Photoresist growing at a better rate.

Global Photoresist Chemicals Market Drivers:

Technological Developments in the Semiconductor Industry.

The primary factor propelling the global photoresist chemicals market is the speed at which semiconductor fabrication technology is developing. To enable intricate patterning during the photolithography process—a technique required as the semiconductor industry strives to build smaller and more potent electronic components—photoresist chemicals are crucial. Ongoing developments in lithographic methods, including extreme ultraviolet (EUV) lithography, are driving the need for complex photoresist formulations and have a significant beneficial effect on market growth.

Increasing Demand for Consumer Electronics.

The global need for consumer electronics is one of the primary drivers of the photoresist chemical market. With the increasing popularity of smartphones, tablets, wearable technologies, and other electronic devices, high-performance semiconductors are becoming more and more essential. Photoresist chemicals are vital to the production of these intricate electronic components because they enable the miniaturization and enhanced functionality required in modern consumer devices.

The growth of the Internet of Things (IoT) ecosystem.

The expanding IoT ecosystem is driving growth in the photoresist chemical industry. Smart device, sensor, and networking solution integration across multiple industries require advanced semiconductor technologies. The precise and efficient manufacture of semiconductor components required for Internet of Things applications, like smart homes, connected devices, and industrial automation, is made easier by photoresist chemicals, which in turn spurs market expansion.

Global Photoresist Chemicals Market Restraints and Challenges:

Environmental and Health Concerns.

The production and application of these substances give rise to health and environmental issues, which pose a major obstacle for the worldwide photoresist chemical industry. There are worries that some photoresist formulations may contain dangerous substances that could harm the environment and endanger the health of those working in the semiconductor sector. Because of legislative requirements and the increasing focus on sustainable practices, market actors must overcome obstacles to provide eco-friendly alternatives without compromising performance.

Excessive expenses related to research & development.

The photoresist chemicals sector has a difficult time keeping up its technological leadership because of the high costs of research and development. It is highly expensive to develop formulas that satisfy changing industry standards, such as those for sophisticated lithography methods. In this fast-paced economy, the high cost of research and development discourages competitiveness and innovation, particularly for smaller businesses.

Complexities in the Manufacturing Processes for Semiconductors.

Photoresist chemical manufacturers have difficulties since semiconductor fabrication involves intricate processes. Accurate and effective photoresist solutions are becoming more and more crucial as the industry moves towards smaller nodes and more intricate patterns. To achieve these objectives, market participants must continuously advance and share their expertise to overcome technical obstacles about the resolution, sensitivity, and chemical compatibility of photoresist formulations. Maintaining a competitive edge is severely hampered by navigating these obstacles.

Global Photoresist Chemicals Market Opportunities:

Advancements in nanotechnology and nanolithography.

The development of nanotechnology and nanolithography offers the world market for photoresist compounds tremendous potential. The semiconductor industry's adoption of smaller nodes and more intricate designs has led to an increasing demand for specialized photoresist formulations with high precision and resolution. Companies that invest in the development of nanoscale photoresists stand to gain from the increasing opportunities presented by advanced semiconductor manufacturing methods.

Novel Uses in Biotechnology and Medicine.

Photoresist chemicals have fascinating opportunities outside traditional semiconductor applications, particularly in the biology and medical fields. Because of the precision required in microfabrication for devices like lab-on-a-chips, biosensors, and medical implants, photoresists can be employed in novel ways. Because the medical technology sector is always evolving, organizations have a lot of opportunities to research and develop specific formulations to fulfill the demands of this expanding market.

Sustainable & Eco-Friendly Formulations.

The opportunity to create eco-friendly photoresist compositions is presented by the increased emphasis on sustainability and environmental sensitivity. Companies that focus on making products with less toxicity, improved disposal methods, and reduced environmental impact will most likely have an advantage over rivals. By taking care of these problems, companies can improve their standing in the competitive global photoresist chemical market and encourage the development of greener substitutes. This aligns with both market trends and regulatory needs.

PHOTORESIST CHEMICAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type, Chemical Type, Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tokyo Ohka Kogyo Co., Ltd. (TOK), JSR Corporation, Merck Group, Dow Inc., Fujifilm Holdings Corporation, Shin-Etsu Chemical Co., Ltd., SUMCO Corporation, LG Chem, Avantor, Inc., DuPont de Nemours, Inc. |

Photoresist Chemicals Market Segmentation: By Type

-

Positive

-

Negative

Positive and Negative photoresists are identified by type segmentation in the diverse global photoresist chemicals market. Notably, positive photoresists may prove to be the more effective option. Positive photoresists are good at capturing minute patterns and intricate features; this allows for high-resolution photography and precision circuitry assembly. They display improved solubility upon light exposure. Their efficiency is demonstrated by the development of advanced microprocessors, whose intricate designs necessitate extraordinary precision. The versatility and efficiency of positive photoresists support their critical role in semiconductor production as technology develops. The global market is changing due to positive photoresists, which highlight innovation and high-performance applications. This is also propelling ongoing advancements in semiconductor production procedures.

Photoresist Chemicals Market Segmentation: By Chemical Type

-

ArF Immersion Photoresists

-

KrF Photoresists

-

G-line & I-line Photoresists

-

Other Advanced Photoresists

The ArF Immersion Photoresists, KrF Photoresists, G-line & I-line Photoresists, and Other Advanced Photoresists are the main categories that make up the chemical tapestry of the worldwide photoresist chemicals industry. These are divided according to the type of chemical. Of them, ArF Immersion Photoresists are the most well-known and effective. ArF Immersion Photoresists use argon fluoride (ArF) excimer laser technology to enable semiconductor manufacturing with unprecedented precision. Because ArF light has a shorter wavelength, it may produce intricate circuitry that is densely packed while also improving resolution. This efficiency is particularly crucial in contemporary microelectronics, where cutting-edge technologies need peak performance. The continuous developments in semiconductor technology, place ArF Immersion Photoresists at the forefront of the industry and encourage innovation in the market.

Photoresist Chemicals Market Segmentation: By Application

-

Semiconductor & IC Manufacturing

-

Printed Circuit Boards (PCBs)

-

MEMS (Micro-Electro-Mechanical Systems)

-

LED (Light Emitting Diodes)

-

Others

The world market for photoresist chemicals is highly split by application, with key players including printed circuit boards (PCBs), MEMS (Micro-Electro-Mechanical Systems), LED (Light Emitting Diodes), Semiconductor & IC Manufacturing, and Others dominating the market. Among them, Semiconductor & IC Manufacturing is the most prominent and fruitful application. The intricate process of making semiconductors necessitates extremely exact work, and photoresists are essential for developing the intricate patterns needed to build integrated circuits. The semiconductor and integrated circuit production sector is heavily reliant on contemporary photoresist technology because of the ongoing drive for smaller and more efficient electronic devices. As the basis for chopping

Photoresist Chemicals Market Segmentation: By End-User Industry

-

Electronics

-

Automotive

-

Aerospace

-

Medical Devices

-

Telecommunications

-

Others

According to the detailed market segmentation of the global market for photoresist chemicals by end-user industry, electronics is the most significant and successful industry. The fast pace of technological advancement in electrical devices makes photoresists indispensable in this setting, requiring intricate and accurate production processes. Photoresist chemicals are essential to the electronics industry, which uses them in everything from semiconductor fabrication to the production of advanced electronic components, as they enable complex patterning and circuits at the microscopic level. Because the electronics industry is always in need of more powerful, quicker, and smaller devices, photoresistors are critical to the industry's quest for innovation. The global market is impacted by the efficiency of photoresists in the electronics sector, which is the cornerstone of modern technological advancements.

Photoresist Chemicals Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The market share of various regions illustrates the varying strengths and contributions of the dynamic global photoresist chemicals landscape. Asia-Pacific is dominant, as seen by its commanding 45% of the market. The Asia-Pacific region is widely acknowledged as a center of technology, with key players in the semiconductor industry including South Korea, Taiwan, Japan, and others. This has led to a demand for advanced photoresist chemicals. North America is far behind with a 25% market share, indicating its technological prowess and significant contributions to the semiconductor and electronics industries.

Europe uses its manufacturing prowess and technological infrastructure to win a noteworthy 15% market share. With 8% and 7% of the worldwide photoresist market, respectively, South America the Middle East, and Africa are starting to take the stage. These regional differences highlight the industry's global reach, as each location makes a distinct contribution to the development and invention of photoresist technology.

COVID-19 Impact Analysis on the Global Photoresist Chemicals Market:

Without a doubt, the COVID-19 pandemic has created a variety of opportunities as well as issues that will permanently change the global market for photoresist chemicals. The semiconductor industry, which uses a lot of photoresist chemicals, had supply chain and industrial problems due to manpower shortages, travel restrictions, and lockdowns. These issues delayed manufacturing schedules and impacted the demand for photoresist chemicals in general. However, other developments, like the growing demand for gadgets and the increasing reliance on technology for remote employment, were also accelerated by the epidemic. A counterbalance was offered by this surge in the semiconductor sector, particularly for goods like computers, tablets, and communication equipment. The market for photoresist materials is anticipated to expand as people become used to the new normal and these materials continue to advance.

Latest Trends/ Developments:

The sector has recently been shaped by several noteworthy trends and advancements in the constantly changing worldwide market for photoresist chemicals. One significant change is the growing requirement for advanced photoresists to satisfy the continuous performance and miniaturization demands of the semiconductor industry. More precise and effective semiconductor manufacturing is now possible because of advancements in photoresist formulations spurred by the advent of extreme ultraviolet (EUV) lithography technology. Sustainability is a key subject as eco-friendly formulations and techniques are becoming more and more crucial to satisfy global environmental goals.

Another noteworthy advance in photoresist research and development is the application of artificial intelligence (AI) and machine learning (ML) to optimize formulations and production processes for greater accuracy and efficiency. Moreover, the industry is seeing a boom in the use of cutting-edge technology like sophisticated sensors and 5G infrastructure, suggesting that photoresists are being applied in ways that go beyond conventional semiconductor applications. Together, these patterns show the industry's dedication to sustainability, innovation in technology, and satisfying the demands of growing customer bases.

Key Players:

-

Tokyo Ohka Kogyo Co., Ltd. (TOK)

-

JSR Corporation

-

Merck Group

-

Dow Inc.

-

Fujifilm Holdings Corporation

-

Shin-Etsu Chemical Co., Ltd.

-

SUMCO Corporation

-

LG Chem

-

Avantor, Inc.

-

DuPont de Nemours, Inc.

The global market for photoresist chemicals is defined by leading companies at the forefront of innovation and technological advancements. Tokyo Ohka Kogyo Co., Ltd. (TOK), a leading corporation, is renowned for its cutting-edge photoresist technology. With a large selection of state-of-the-art materials, JSR Corporation, another major player, significantly influences the market. Through their extensive R&D efforts, Dow Inc. and the Merck Group have significantly contributed to the advancement of science. With its expertise in imaging and semiconductor materials, Fujifilm Holdings Corporation sets the standard, even though Shin-Etsu Chemical Co., Ltd. plays a crucial role in providing the semiconductor industry with high-quality photoresists.

SUMCO Corporation's contributions to the silicon wafer market are recognized for their influence on the photoresist sector. LG Chem, Avantor, Inc., and DuPont de Nemours, Inc. further improve the competitive environment; their diverse skill sets and global presence contribute to the market's dynamism. Collectively, these significant businesses shape the market for photoresist chemicals by encouraging innovation and adjusting to the shifting demands of the semiconductor and electronics industries.

Chapter 1. Photoresist Chemical Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Photoresist Chemical Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Photoresist Chemical Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Photoresist Chemical Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Photoresist Chemical Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Photoresist Chemical Market – By Application

6.1 Introduction/Key Findings

6.2 Semiconductor & IC Manufacturing

6.3 Printed Circuit Boards (PCBs)

6.4 MEMS (Micro-Electro-Mechanical Systems)

6.5 LED (Light Emitting Diodes)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Photoresist Chemical Market – By Type

7.1 Introduction/Key Findings

7.2 Positive

7.3 Negative

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Photoresist Chemical Market – By Chemical Type

8.1 Introduction/Key Findings

8.2 ArF Immersion Photoresists

8.3 KrF Photoresists

8.4 G-line & I-line Photoresists

8.5 Other Advanced Photoresists

8.6 Y-O-Y Growth trend Analysis By Chemical Type

8.7 Absolute $ Opportunity Analysis By Chemical Type, 2024-2030

Chapter 9. Photoresist Chemical Market – By End-User Industry

9.1 Introduction/Key Findings

9.2 Electronics

9.3 Automotive

9.4 Aerospace

9.5 Medical Devices

9.6 Telecommunications

9.7 Others

9.8 Y-O-Y Growth trend Analysis By End-User Industry

9.9 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 10. Photoresist Chemical Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Application

10.1.2.1 By Type

10.1.3 By Chemical Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Application

10.2.3 By Type

10.2.4 By Chemical Type

10.2.5 By End-User Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Application

10.3.3 By Type

10.3.4 By Chemical Type

10.3.5 By End-User Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Application

10.4.3 By Type

10.4.4 By Chemical Type

10.4.5 By End-User Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Application

10.5.3 By Type

10.5.4 By Chemical Type

10.5.5 By End-User Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Photoresist Chemical Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Tokyo Ohka Kogyo Co., Ltd. (TOK)

11.2 JSR Corporation

11.3 Merck Group

11.4 Dow Inc.

11.5 Fujifilm Holdings Corporation

11.6 Shin-Etsu Chemical Co., Ltd.

11.7 SUMCO Corporation

11.8 LG Chem

11.9 Avantor, Inc.

11.10 DuPont de Nemours, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for Photoresist Chemicals at the global level is expanding quickly; it was estimated to be worth 11.47 USD billion in 2023 and is expected to increase to USD 19.53 billion by 2030, with a projected compound annual growth rate (CAGR) of 7.9% from 2024 to 2030.

The development of semiconductor manufacturing technology, the rising need for high-performance electronics, and the spread of applications in cutting-edge technologies like 5G and IoT are the main factors propelling the global photoresist chemical market.

The primary challenge facing the worldwide photoresist chemical industry is the challenge of developing materials that meet the increasingly stringent requirements for precision and downsizing in the semiconductor manufacturing process.

In 2023, Asia-Pacific held the largest share of the Global Photoresist Chemical Market.

Tokyo Ohka Kogyo Co., Ltd. (TOK), JSR Corporation, Merck Group, Dow Inc., Fujifilm Holdings Corporation, Shin-Etsu Chemical Co., Ltd., SUMCO Corporation, LG Chem, Avantor, Inc., DuPont de Nemours, Inc. Are the main players.