Phosphorescent Microsphere Market Size (2024 – 2030)

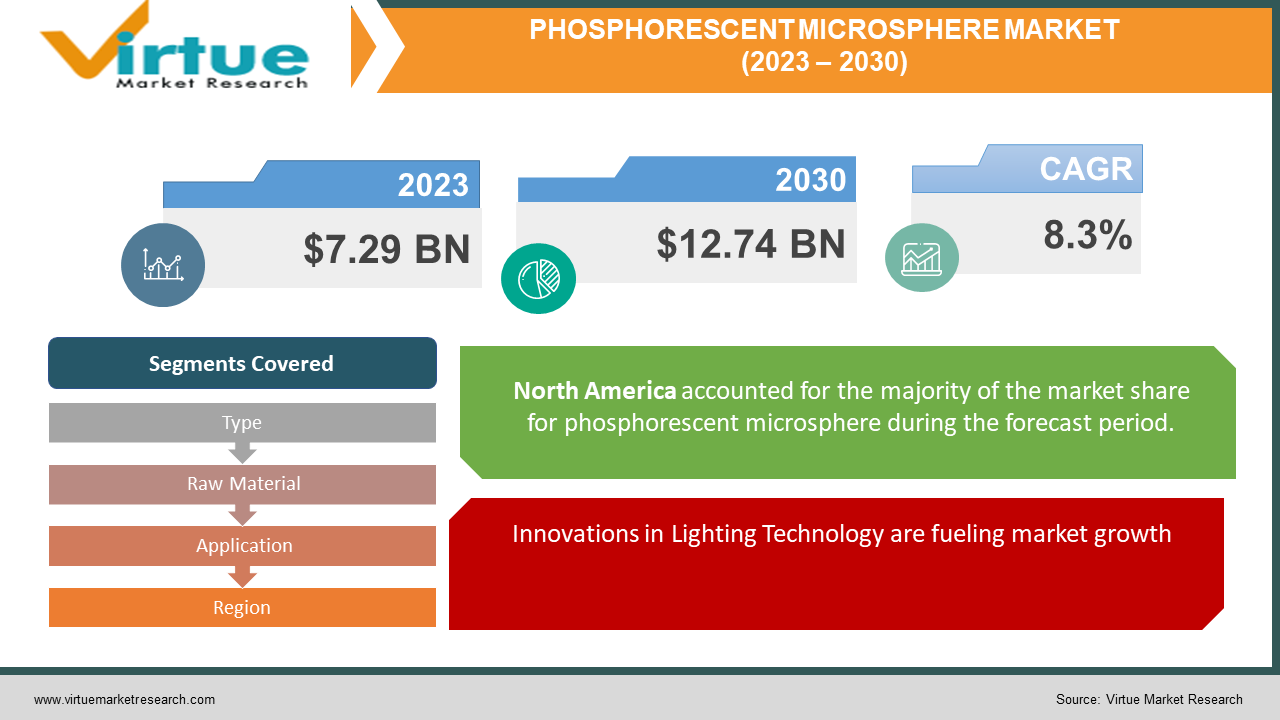

The Global Phosphorescent Microsphere Market was valued at USD 7.29 billion in 2023 and is projected to reach a market size of USD 12.74 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

The global phosphorescent microsphere market presents a dynamic landscape shaped by key drivers, challenges, and notable trends. Innovations in lighting technology, driven by the continuous evolution of lighting solutions, contribute to a growing demand for phosphorescent microspheres, aligning with global sustainability goals. The market witnesses increased applications in security features, particularly in anti-counterfeiting measures across various industries. The rising adoption of phosphorescent microspheres in emerging technologies, medical imaging, and the expanding use of smart devices underscores their versatile applications. However, the market faces challenges such as production costs, limited standardization, and environmental considerations. As the industry navigates these complexities, it capitalizes on trends like sustainability, integration into smart technologies, and advancements in medical applications. Regionally, North America dominates, driven by technological infrastructure, while Asia-Pacific experiences a rising market share. The market has demonstrated resilience post-COVID-19, adapting to new norms and emphasizing sustainability and innovation.

Key Market Insights:

The Global Phosphorescent Microsphere Market is propelled by several key drivers that shape its trajectory. Innovations in lighting technology stand out as a primary driver, with the continuous evolution of lighting technologies fueling a growing demand for phosphorescent microspheres. These microspheres play a pivotal role in the development of advanced lighting solutions, particularly in the context of energy-efficient and environmentally friendly options. Innovations, such as the incorporation of phosphorescent materials in LEDs, contribute to improved efficiency and prolonged luminosity, aligning with the global push towards sustainable technologies. Another significant driver is the growing applications of phosphorescent microspheres in security features, particularly in anti-counterfeiting measures. Industries relying on robust security measures, such as currency, identification cards, and high-value product packaging, leverage the unique properties of phosphorescent materials. This adoption is driven by the increasing need for enhanced security in the face of counterfeit challenges and unauthorized replication.

The increased usage of phosphorescent microspheres in emerging technologies is also a notable driver. The rise of technologies like the Internet of Things (IoT) and smart infrastructure has created a demand for advanced materials, including phosphorescent microspheres. These microspheres find applications in sensors and actuators, contributing to the development of responsive and energy-efficient technologies. As industries embrace the Fourth Industrial Revolution, the integration of phosphorescent microspheres becomes crucial in enhancing the performance and functionality of IoT devices and smart systems. Furthermore, expanding use in medical imaging applications adds another dimension to the market's growth. Phosphorescent microspheres, with their unique optical properties, are gaining prominence in diagnostics and imaging techniques. They offer improved visibility and sensitivity, serving as contrast agents and markers in various imaging modalities. This expanding utility in medical diagnostics and research aligns with the growing emphasis on precision medicine and non-invasive imaging techniques.

In terms of applications, lighting and illumination command the majority of the market share, holding approximately 40%. The widespread adoption of phosphorescent microspheres in energy-efficient lighting solutions contributes to this dominance. Security and anti-counterfeiting applications are witnessing a surge in market share, currently at around 25%, driven by the increasing need for robust security measures and advancements in anti-counterfeiting technologies.

Global Phosphorescent Microsphere Market Drivers:

Innovations in Lighting Technology are fueling market growth.

The continuous evolution of lighting technologies has led to a growing demand for phosphorescent microspheres. These microspheres are integral in the development of advanced lighting solutions that offer improved efficiency and prolonged luminosity. Innovations, such as the incorporation of phosphorescent materials in light-emitting diodes (LEDs), contribute to energy-efficient and environmentally friendly lighting options. This driver is particularly significant in the context of the global push towards sustainable and energy-efficient technologies.

Growing Applications in Security Features is boosting market expansion.

Phosphorescent microspheres play a vital role in enhancing security features, especially in anti-counterfeiting measures. Industries such as currency, identification cards, and high-value product packaging leverage the unique properties of phosphorescent materials to create visible and invisible security markers. The increasing need for robust security measures in the face of counterfeit challenges and unauthorized replication drives the adoption of phosphorescent microspheres in various applications.

Increased Usage in Emerging Technologies is augmenting market demand for phosphorescent microspheres.

The rise of emerging technologies, including Internet of Things (IoT) devices and smart infrastructure, has created a demand for advanced materials like phosphorescent microspheres. These microspheres find applications in sensors and actuators, contributing to the development of responsive and energy-efficient technologies. As industries embrace the Fourth Industrial Revolution, the integration of phosphorescent microspheres becomes crucial in enhancing the performance and functionality of IoT devices and smart systems.

Expanding Use in Medical Imaging is propelling market expansion.

Phosphorescent microspheres are gaining prominence in medical imaging applications due to their unique optical properties. In diagnostics and imaging techniques, these microspheres offer improved visibility and sensitivity. They are utilized as contrast agents and markers in various imaging modalities, contributing to advancements in medical diagnostics and research. The growing emphasis on precision medicine and non-invasive imaging techniques further propels the demand for phosphorescent microspheres in the medical field.

Global Phosphorescent Microsphere Market Restraints and Challenges:

Cost and Production Challenges are hampering market growth.

A significant challenge faced by the phosphorescent microsphere market is associated with the cost of production and manufacturing challenges. The production of high-quality phosphorescent microspheres often involves sophisticated materials and processes, contributing to elevated production costs. Additionally, ensuring consistency in production and meeting quality standards can pose challenges, affecting the overall affordability and accessibility of phosphorescent microspheres for manufacturers and end-users.

Limited Standardization and Regulation is slowing down market growth.

The lack of standardized specifications and regulations for phosphorescent microspheres can impede the market growth. The absence of universally accepted standards makes it challenging for manufacturers to ensure product quality and compatibility across different applications. Furthermore, the regulatory landscape for phosphorescent materials may vary globally, leading to uncertainties and compliance challenges for companies operating in multiple regions.

Technological Complexity and R&D Hurdles.

The development of phosphorescent microspheres with advanced functionalities often involves intricate technological processes and significant research and development (R&D) efforts. Technological complexity can result in longer product development cycles and higher R&D expenditures. Companies in the industry face the challenge of staying at the forefront of technological advancements to meet evolving market demands, requiring substantial investments in research and innovation.

Environmental Concerns and Sustainability.

Despite the environmental benefits of phosphorescent materials in terms of energy efficiency, concerns related to sustainability and environmental impact may act as restraints. The production and disposal of phosphorescent microspheres may involve materials that are not easily biodegradable or recyclable, leading to potential environmental consequences. As sustainability becomes a key focus globally, manufacturers may face pressure to adopt eco-friendly alternatives or improve the recyclability of phosphorescent microsphere products.

PHOSPHORESCENT MICROSPHERE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Type, Raw Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nano-Care Deutschland AG, I-TECH AB, 3M Company, Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Saint-Gobain Performance Ceramics & Refractories, Bodycote plc, DuPont de Nemours, Inc.,Axalta Coating Systems |

Phosphorescent Microsphere Market Segmentation: By Type

-

Solid Phosphorescent Microspheres

-

Hollow Phosphorescent Microspheres

Solid Phosphorescent Microspheres dominate the market, holding a significant majority market share of approximately 65% in 2023. This dominance is attributed to the widespread use of solid phosphorescent microspheres in lighting and illumination applications, where their durability and consistent glow make them a preferred choice. Industries such as electronics, automotive, and consumer goods heavily contribute to the demand for solid phosphorescent microspheres.

Hollow Phosphorescent Microspheres are experiencing a rising market share, currently accounting for around 35%. The increasing adoption is primarily fueled by advancements in security and anti-counterfeiting applications. Hollow microspheres offer unique properties suitable for intricate security features in currency, identification cards, and high-value product packaging. As industries intensify efforts to enhance security measures, the demand for hollow phosphorescent microspheres is on the rise.

Phosphorescent Microsphere Market Segmentation: By Raw Material

-

Glass-based Phosphorescent Microspheres

-

Polymer-based Phosphorescent Microspheres

-

Ceramic-based Phosphorescent Microspheres

-

Others

Glass-based Phosphorescent Microspheres lead the market with a substantial majority share of approximately 50% in 2023. The dominance is driven by the excellent optical properties and versatility of glass-based microspheres, making them ideal for applications in lighting, consumer goods, and electronics.

Polymer-based Phosphorescent Microspheres are gaining traction and currently represent a growing market share of around 30%. The increasing use of polymers is driven by their flexibility, durability, and compatibility with various manufacturing processes. Industries such as healthcare and packaging contribute to the rising demand for polymer-based phosphorescent microspheres.

Phosphorescent Microsphere Market Segmentation: By Application

-

Lighting and Illumination

-

Security and Anti-Counterfeiting

-

Consumer Goods

-

Healthcare and Medical Imaging

-

Others

Lighting and Illumination applications command the majority market share, holding approximately 40% in 2023. The widespread adoption of phosphorescent microspheres in energy-efficient lighting solutions for residential, commercial, and industrial purposes contributes to this dominance.

Security and Anti-Counterfeiting applications are witnessing a surge in market share, currently at around 25%. The increasing need for robust security measures in various industries, coupled with advancements in anti-counterfeiting technologies, propels the demand for phosphorescent microspheres in this segment.

Phosphorescent Microsphere Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the phosphorescent microsphere market, holding the majority market share at approximately 40% in 2023. The advanced technological infrastructure, significant investments in research and development, and a robust consumer electronics market contribute to the high demand for phosphorescent microspheres in this region.

Asia-Pacific is experiencing an increasingly rising market share, currently at around 30%. The region's rapid industrialization, expanding consumer electronics sector, and growing focus on energy-efficient lighting solutions drive the demand for phosphorescent microspheres. Additionally, the adoption of advanced security features in various industries further propels the market growth in Asia-Pacific.

COVID-19 Impact Analysis on the Global Phosphorescent Microsphere Market:

The COVID-19 pandemic has significantly impacted the global phosphorescent microsphere market. During the initial phases of the outbreak, disruptions in the supply chain and manufacturing processes led to a temporary slowdown in production and distribution. Lockdowns, travel restrictions, and workforce limitations created challenges for the industry, affecting the timely delivery of phosphorescent microspheres to end-users.

However, as the world adapted to the new normal, the market demonstrated resilience and began to recover. The increasing demand for energy-efficient lighting solutions, coupled with the growing emphasis on security features, propelled the market forward. The pandemic highlighted the importance of phosphorescent microspheres in applications such as anti-counterfeiting measures, contributing to their sustained relevance. Moreover, the shift towards remote work and increased reliance on electronic devices stimulated the demand for phosphorescent microspheres in the electronics and display technologies sector. The industry witnessed a surge in innovation, with companies exploring new applications and technologies to address emerging challenges.

Despite the initial setbacks, the pandemic acted as a catalyst for technological advancements and a renewed focus on sustainability. As industries recalibrated their strategies in response to changing consumer behaviors, the phosphorescent microsphere market positioned itself as a crucial component in various applications, adapting to the evolving demands of a post-pandemic landscape.

Latest Trends/ Developments:

Recent trends and developments in the phosphorescent microsphere market have shaped its trajectory, indicating notable shifts in industry dynamics. A prominent trend is the increasing integration of phosphorescent microspheres in smart technologies, aligning with the rise of the Internet of Things (IoT). This integration enhances the responsiveness and functionality of smart devices, fostering their adoption across various industries. Additionally, there is a growing emphasis on sustainable practices within the industry. This trend aligns with global initiatives for greener technologies and resonates with consumers' increasing preference for sustainable products.

The market is witnessing a surge in research and development activities, leading to the introduction of novel applications for phosphorescent microspheres. Advancements in medical imaging, where these microspheres contribute to improved diagnostics, underscore their versatility and expanding utility in the healthcare sector. Furthermore, the demand for phosphorescent microspheres in security applications has intensified. Innovations in anti-counterfeiting technologies, especially in currency and high-value product packaging, showcase the crucial role played by phosphorescent microspheres in enhancing security measures.

The electronics and display technologies segment continues to be a focal point of development, with ongoing efforts to improve the efficiency of phosphorescent microspheres in these applications. This aligns with the persistent demand for vibrant and energy-efficient displays in consumer electronics.

Key Players:

-

Nano-Care Deutschland AG

-

I-TECH AB

-

3M Company

-

Akzo Nobel N.V.

-

PPG Industries, Inc.

-

The Sherwin-Williams Company

-

Saint-Gobain Performance Ceramics & Refractories

-

Bodycote plc

-

DuPont de Nemours, Inc.

-

Axalta Coating Systems

Chapter 1. Phosphorescent Microsphere Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Phosphorescent Microsphere Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Phosphorescent Microsphere Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Phosphorescent Microsphere Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Phosphorescent Microsphere Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Phosphorescent Microsphere Market – By Type

6.1 Introduction/Key Findings

6.2 Solid Phosphorescent Microspheres

6.3 Hollow Phosphorescent Microspheres

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Phosphorescent Microsphere Market – By Application

7.1 Introduction/Key Findings

7.2 Lighting and Illumination

7.3 Security and Anti-Counterfeiting

7.4 Consumer Goods

7.5 Healthcare and Medical Imaging

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Phosphorescent Microsphere Market – By Raw Material

8.1 Introduction/Key Findings

8.2 Glass-based Phosphorescent Microspheres

8.3 Polymer-based Phosphorescent Microspheres

8.4 Ceramic-based Phosphorescent Microspheres

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Raw Material

8.7 Absolute $ Opportunity Analysis By Raw Material, 2024-2030

Chapter 9. Phosphorescent Microsphere Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By By Raw Material

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Raw Material

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Raw Material

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Raw Material

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Raw Material

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Phosphorescent Microsphere Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nano-Care Deutschland AG

10.2 I-TECH AB

10.3 3M Company

10.4 Akzo Nobel N.V.

10.5 PPG Industries, Inc.

10.6 The Sherwin-Williams Company

10.7 Saint-Gobain Performance Ceramics & Refractories

10.8 Bodycote plc

10.9 DuPont de Nemours, Inc.

10.10 Axalta Coating Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Phosphorescent Microsphere Market was valued at USD 7.29 billion in 2023 and is projected to reach a market size of USD 12.74 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

The key drivers of the Global Phosphorescent Microsphere Market include innovations in lighting technology, growing applications in security features, increased usage in emerging technologies, and expanding use in medical imaging.

The segments under the Global Phosphorescent Microsphere Market By Application include Lighting and Illumination, Security and Anti-Counterfeiting, Consumer Goods, Healthcare and Medical Imaging, and Others.

North America is the most dominant region for the Global Phosphorescent Microsphere Market, holding approximately 40% of the market share.

The leading players in the Global Phosphorescent Microsphere Market include Nano-Care Deutschland AG, I-TECH AB, 3M Company, Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Saint-Gobain Performance Ceramics & Refractories, Bodycote plc, DuPont de Nemours, Inc., and Axalta Coating Systems.