Phosphate Fertilizer Market Size (2024 – 2030)

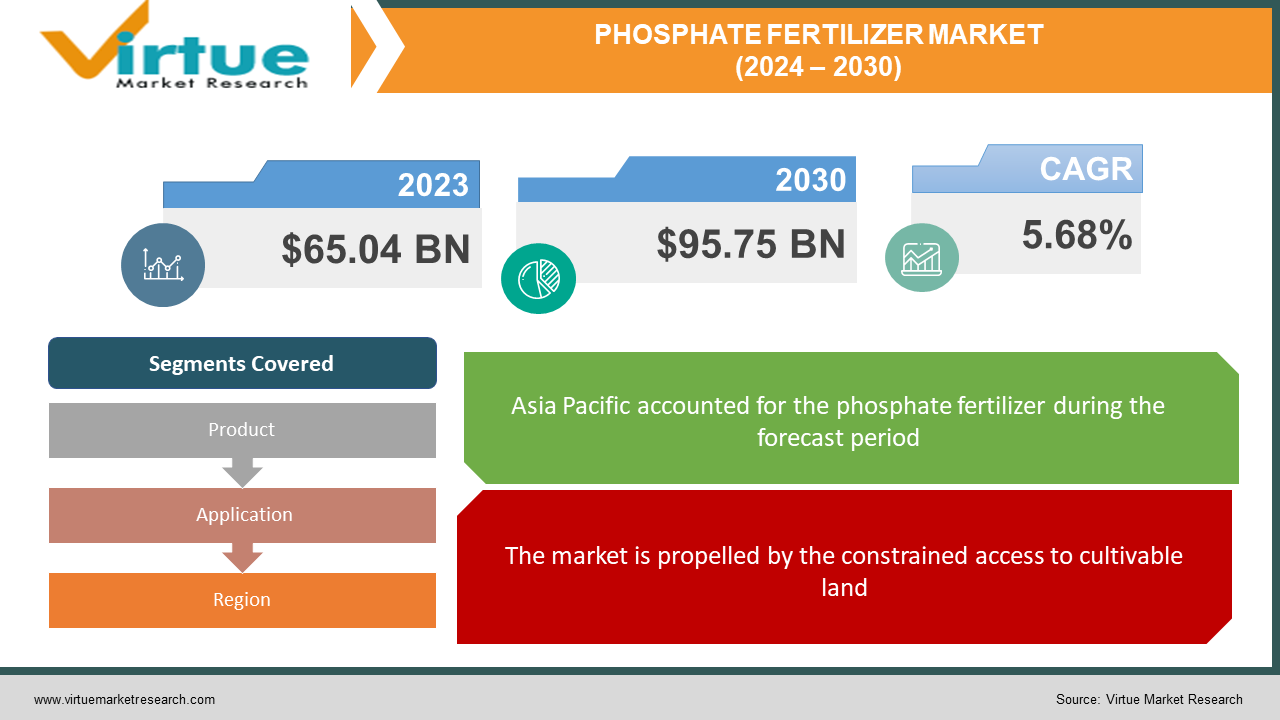

The Global Phosphate Fertilizer Market size was exhibited at USD 65.04 billion in 2023 and is projected to hit around USD 95.75 billion by 2030, growing at a CAGR of 5.68% during the forecast period from 2024 to 2030.

Phosphorus stands as a crucial macronutrient requisite for achieving optimal crop productivity through fertilizer application. The primary origins of phosphorus encompass bone meal, fertilizer, and rock superphosphate, with rock phosphate serving as the predominant raw material in most commercial phosphate fertilizers available. Its significance lies in fostering robust root development and fortifying plants against environmental stressors like drought. This nutrient is indispensable for overall plant growth, encompassing seed and fruit maturation.

To address the deficiency of phosphorus in certain soils, phosphatic fertilizers, including diammonium phosphate (DAP) and monoammonium phosphate (MOP), are applied in diverse forms. Anticipated advancements in ammonia manufacturing technologies, exemplified by green ammonia, are poised to propel the global phosphatic fertilizer market's expansion. Both DAP and MAP prominently feature substantial amounts of phosphorus. Notably, the OCP Group has expressed its commitment to producing green ammonia as a sustainable raw material for fertilizer production. OCP, a leading exporter of phosphate fertilizers, integrates ammonia into various finalized fertilizer products, including DAP and MAP, aligning with its robust dedication to sustainable development.

Key Market Insights:

The surge in demand for phosphate fertilizers, driven by the increasing global population and the imperative for heightened agricultural productivity, constitutes a primary catalyst for market revenue growth. Phosphate fertilizers significantly enhance crop growth and soil fertility, responding to the escalating demand for food globally. The adoption of phosphate fertilizers is on the rise as farmers worldwide seek to boost agricultural yields in tandem with the increasing demand for food. Simultaneously, the shift towards sustainable agricultural practices and the consumer preference for organic food fuels the demand for organic phosphate fertilizers, known for their absence of harmful chemicals and their ability to mitigate soil degradation and pollution.

The market's revenue growth is further fueled by technological advancements in phosphate fertilizer production, spurred by the quest for increased agricultural yield. Manufacturers are heavily investing in Research & Development (R&D) to innovate and create products that cater to the escalating demand. Notably, the development of slow-release fertilizers gains prominence due to their capacity to enhance agricultural yields while minimizing fertilizer usage. The growing application of phosphate fertilizers in the production of biofuels, such as biodiesel, is poised to contribute to market revenue growth. Additionally, government initiatives promoting the use of phosphate fertilizers, aligned with sustainable agricultural methods, are expected to be instrumental in driving market revenue growth. Examples include the establishment of the National Mission for Sustainable Agriculture (NMSA) by the Indian government, emphasizing the utilization of organic fertilizers and sustainable agricultural practices.

Global Phosphate Fertilizer Market Drivers:

The market is propelled by the constrained access to cultivable land.

The decline in arable land per capita in various nations, including but not limited to India, China, and the United States, is a significant factor fueling the demand for phosphorus fertilizers. The imperative to increase agricultural yield arises from the reduction in arable land per person and the concurrent population growth, necessitating enhanced food production. Employing crop protection strategies, farmers widely utilize phosphorus fertilizers to meet the escalating global demand for food. Given the limitations on future agricultural land expansion due to rapid industrialization and urbanization, the demand for phosphorus fertilizers is expected to surge in response to the growing requirements for meat and other food products, offering substantial growth opportunities for the phosphate fertilizer industry, particularly in the Asia-Pacific and Latin American regions.

Global population growth and escalating food demand are compelling factors driving the market for phosphoric fertilizers.

The expanding global population underscores the need for efficient agricultural products and machinery to sustainably feed the growing populace. The reduction in both agricultural production areas and arable land intensifies the demand for high-quality fertilizers, such as phosphatic compound fertilizers (DAP/MAP or NPK). Anticipated innovations in agricultural and irrigation technologies, coupled with the increasing adoption of sprinkler or drip irrigation, are poised to contribute to the growth of phosphatic fertilizers in the phosphate fertilizer market in the forthcoming years.

Moreover, the extraction of phosphorus from the soil with each harvest surpasses the naturally provided amount, necessitating supplementation with additional phosphorus fertilizers. Maintaining and replenishing soil nutrients, including nitrogen and phosphate, are critical for enhancing crop yield and growth. Potassium and magnesium are other essential soil nutrients. The phosphorus content in commercial fertilizers is deliberately made soluble, facilitating easier absorption and utilization by plants. Effective management of phosphorus fertilizers is imperative for cultivating healthy plants, achieving high yields, and ensuring the success of farming operations.

Global Phosphate Fertilizer Market Restraints and Challenges:

Challenges stemming from Stringent Regulations:

The global phosphorus fertilizers market encounters continual shifts in structure and operation due to the absence of comprehensive market and free trade regulations governing phosphate rock's supply and demand. Government regulations and strategies employed by state-owned entities play a pivotal role in managing and controlling these dynamics. Consequently, increased government intervention in response to substantial changes in the global phosphorus fertilizers market adversely impacts both the market itself and the supply of phosphate rock. Issues such as the P2O5 grade of phosphorus, cadmium pollution with adverse effects on human health and the environment, and a growing awareness of inefficient phosphate usage and loss, particularly in the context of urbanization, contribute to the challenges faced by the phosphate fertilizers market.

Market Growth Impeded by Environmental Concerns:

The excessive application of phosphate fertilizers has the potential to result in nutrient runoff, where surplus nutrients, including phosphorus, are washed into water bodies such as streams, lakes, and seas. This phenomenon leads to water contamination and fosters eutrophication, wherein excess nutrients trigger algal blooms, subsequently reducing oxygen levels and negatively impacting aquatic life. Inadequate management of phosphate fertilizer usage can contribute to soil degradation and pH imbalances, adversely affecting soil health and diminishing long-term agricultural productivity. The production processes involved in creating phosphate fertilizers are energy-intensive, leading to greenhouse gas emissions that indirectly contribute to climate change. This environmental impact further disrupts ecosystems and agricultural practices.

Global Phosphate Fertilizer Market Opportunities:

Advancements in Slow-Release Phosphatic Fertilizers and Integration with Precision Agriculture:

The integration of precision agriculture technologies presents a promising avenue for the phosphatic fertilizer market. Innovations such as remote sensing and soil sensors offer opportunities for more accurate and efficient application techniques. Precision agriculture empowers farmers to target the utilization of phosphatic fertilizers, optimizing nutrient distribution and minimizing wastage. Ongoing research and development endeavors in phosphatic fertilizers may lead to the creation of Enhanced Efficiency Fertilizers (EEFs) and Controlled-Release Fertilizers (CRFs). These specialized fertilizers aim to enhance nutrient uptake, reduce losses, and improve overall crop performance. For instance, there is potential in developing slow-release phosphatic fertilizers that gradually release phosphorus according to plants' specific needs. This controlled release mitigates the risk of nutrient leaching and boosts nutrient use efficiency. Tailoring phosphorus release to plant requirements allows farmers to achieve optimal nutrient availability while minimizing environmental impact.

PHOSPHATE FERTILIZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.68% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eurochem Group AG, Agrium Inc., Potash Corp. of Saskatchewan Inc., Yara International ASA, CF Industries Holdings Inc., Israel Chemicals Ltd., Coromandel International Ltd., The Mosaic Co., S.AOCP, PJSC PhosAgro. |

Global Phosphate Fertilizer Market Segmentation: By Product

-

Monoammonium Phosphate (MAP)

-

Diammonium Phosphate (DAP)

-

Single Superphosphate (SSP)

-

Triple Superphosphate (TSP)

-

Others

In 2023, the largest revenue share, approximately 31%, was attributed to the monoammonium phosphate (MAP) segment. This dominance is driven by the cost-effectiveness of MAP and its high phosphorous content. Recognized as a crucial source of nitrogen and phosphorus, MAP holds significance in agricultural applications, serving as a vital granular fertilizer. Its water solubility makes it suitable for direct use or as a raw material in the production of various complex fertilizers like nitrogen phosphate and nitrogen-phosphate-potassium.

The second-largest product segment in 2023, constituting around 17% of the revenue share, was triple superphosphate (TSP). This highly concentrated phosphorus fertilizer contains approximately 46% of diphosphorus pentoxide. The substantial demand for TSP from the global agriculture industry is a key factor propelling the growth of this segment during the forecast period.

Other products encompass Diammonium Phosphate (DAP), Single Superphosphate (SSP), and additional variants. DAP finds application in diverse industrial processes, including metal finishing, and serves roles such as a cheese culture additive in milk and a facilitator of yeast fermentation in wine production. DAP also functions as a fire retardant. With the burgeoning demand for agriculture in emerging economies like Brazil and India, an anticipated rise in DAP usage for agricultural purposes is foreseen over the forecast period.

Global Phosphate Fertilizer Market Segmentation: By Application

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

In 2023, the largest revenue share, approximately 46%, was attributed to the cereals & grains application. This growth is driven by the escalating global demand for major cereals and grains, primarily fueled by the expanding population. This surge in demand has led to an increased need for phosphorous fertilizers in both developing and emerging agrarian economies worldwide.

The oilseeds & pulses segment secured the second-largest market share and is expected to experience a 5.6% Compound Annual Growth Rate (CAGR) in terms of revenue over the forecast period. This growth is attributed to the rising demand for various agricultural products, including soybeans, groundnuts, sesame, and sunflower, among others, in these regions. The product has demonstrated effectiveness in promoting the growth of a diverse range of oilseeds and pulses.

The application of this product in seed treatment is widely recognized for its efficacy in fostering the growth of fruits and vegetables, such as onions, tomatoes, chilies, and other crops. Its utilization in cultivation practices ensures augmented food production, enhanced seed development, and the maturation and root development of plants.

Global Phosphate Fertilizer Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, the Asia-Pacific region secured the largest revenue share, exceeding 61%. This dominance is ascribed to the escalating food production and the growing demand for food products, specifically rice, and vegetables, from import-dependent nations in the Asia-Pacific region. Furthermore, the agricultural sector serves as a pivotal component of the Indian economy, contributing around 18% to the country's GDP and employing 50% of the workforce. Major crops cultivated in India include wheat, rice, pulses, spices, and spice products, making it one of the swiftly growing markets for agro-based industries. Consequently, the demand for the market is expected to witness an upswing over the forecast period.

Europe, ranking as the second-largest regional segment in terms of revenue in 2023, anticipates expansion at a Compound Annual Growth Rate (CAGR) of 6.1% in the upcoming years. This growth is attributed to the robust agricultural production of countries within the region. Notably, Germany stands as the fourth-largest agricultural producer, and France holds the sixth position, accounting for nearly one-third of the total agricultural land within the European Union.

COVID-19 Impact on the Global Phosphate Fertilizer Market:

The COVID-19 pandemic has had a substantial impact on various global sectors related to agriculture, including agricultural inputs, fertilizers, and more. Given that many countries in the Asia-Pacific region heavily rely on agrarian economies, any slowdown in their agricultural activities or temporary interruptions in cross-border trade significantly affects the operations of agricultural companies and farmers within the region.

This, in turn, leads to disruptions in the overall agricultural sector across major countries in the region. In 2020, amid the COVID-19 pandemic, primary raw material prices such as ammonia and sulfur experienced a sharp increase due to supply restrictions and refinery curtailments.

Recent Trends and Innovations in the Global Phosphate Fertilizer Market:

In February 2022, EuroChem Group AG, a prominent global fertilizer manufacturer, acquired the Serra do Salitre phosphate project in Brazil. This acquisition encompasses the advanced mine and factory located in Minas Gerais. The project boasts facilities for phosphoric acid and sulfuric acid manufacturing, along with a storage facility for urea and potassium chloride. The mine and processing facility currently produce 500 KMT per year of phosphate rock. The strategic acquisition is aimed at expanding market presence in South America.

During May 2022, Coromandel International, a leading fertilizer manufacturer, expressed plans to acquire a 45% stake in Baobab Mining and Chemicals Corporation (BMCC), a rock phosphate mining firm based in Senegal, Africa. The transaction is valued at $19.6 million (approximately $150 crore).

In the same month, Indian Potash Ltd entered into a five-year agreement with Israel Chemical Ltd to import 0.6-0.65 million tonnes of potash muriate annually. This strategic partnership aims to strengthen the supply chain for essential fertilizers.

Key Players:

-

Eurochem Group AG

-

Agrium Inc.

-

Potash Corp. of Saskatchewan Inc.

-

Yara International ASA

-

CF Industries Holdings Inc.

-

Israel Chemicals Ltd.

-

Coromandel International Ltd.

-

The Mosaic Co.

-

S.AOCP

-

PJSC PhosAgro.

Chapter 1. Phosphate Fertilizer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Phosphate Fertilizer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Phosphate Fertilizer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Phosphate Fertilizer Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Phosphate Fertilizer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Phosphate Fertilizer Market – By Product

6.1 Introduction/Key Findings

6.2 Monoammonium Phosphate (MAP)

6.3 Diammonium Phosphate (DAP)

6.4 Single Superphosphate (SSP)

6.5 Triple Superphosphate (TSP)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Phosphate Fertilizer Market – By Application

7.1 Introduction/Key Findings

7.2 Cereals & Grains

7.3 Oilseeds & Pulses

7.4 Fruits & Vegetables

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Phosphate Fertilizer Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Phosphate Fertilizer Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Eurochem Group AG

9.2 Agrium Inc.

9.3 Potash Corp. of Saskatchewan Inc.

9.4 Yara International ASA

9.5 CF Industries Holdings Inc.

9.6 Israel Chemicals Ltd.

9.7 Coromandel International Ltd.

9.8 The Mosaic Co.

9.9 S.A OCP

9.10 PJSC PhosAgro.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Phosphate Fertilizer Market size is valued at USD 65.04 billion in 2023.

The worldwide Global Phosphate Fertilizer Market growth is estimated to be 5.68% from 2024 to 2030.

The Global Phosphate Fertilizer Market is segmented By Product (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), and Others), By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others).

The Global Phosphate Fertilizer Market is poised for growth as sustainable agriculture gains traction, driving demand for eco-friendly fertilizers. Innovations in phosphate extraction technologies, precision farming, and nutrient management solutions present opportunities for industry players. Additionally, rising global population and food security concerns further underscore the market's potential expansion.

The COVID-19 pandemic disrupted the Global Phosphate Fertilizer Market, causing supply chain disruptions, labor shortages, and fluctuating demand. Economic uncertainties and logistical challenges impeded production, distribution, and increased operational costs. However, the industry demonstrated resilience, adapting to new norms while experiencing shifts in consumption patterns and market dynamics.