Phenol Resins Market Size (2023 - 2030)

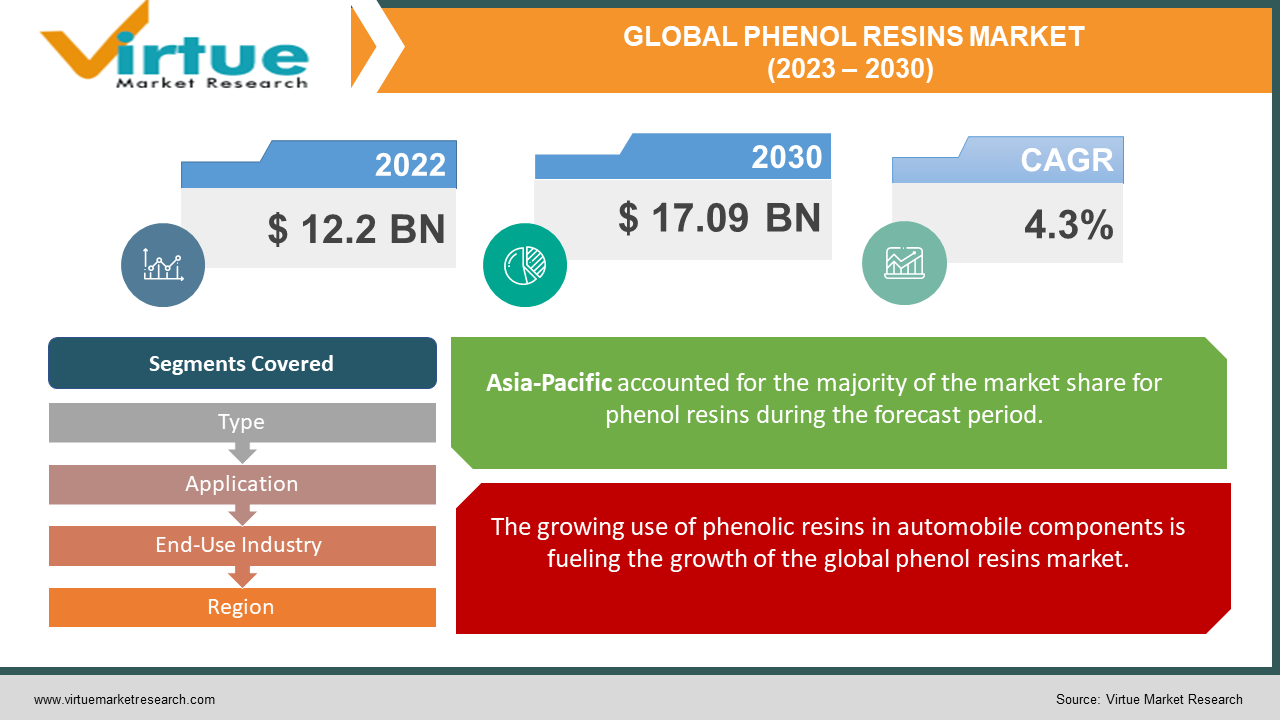

Global Phenol Resins Market was evaluated to be worth USD 12.2 Billion in 2022 and is projected to reach a value of USD 17.09 Billion by the end of 2030, growing at a fast CAGR of 4.3% during the forecast period 2023-2030.

Phenol formaldehyde resins (PF), commonly known as phenolic resins, are synthetic polymers acquired by reacting phenol or substituting phenol with formaldehyde. Phenolic resins served as the foundation for Bakelite, a thermosetting phenol formaldehyde resin, and they were the first synthetic resins (plastics) to be sold commercially. Phenolic resins come in two types, novolacs, and resols, both of which have high stability against high temperatures (up to 300° – 350° C) and chemicals. Novolacs require a curing agent and are catalyzed in acid, while resoles do not require a curing agent and are catalyzed in alkali. These resins are usually dark-colored, ranging from yellow to dark red, and propose a superior price/performance profile. Phenolic resins are largely utilized to produce molded products like billiard balls and laboratory countertops, as well as adhesives and coatings. Phenolic resins have numerous remarkable properties, including high-temperature resistance, hardness, dimensional stability, electrical resistance, and chemical resistance. In spite of their high durability, these resins can be brittle, so they are frequently paired with fillers and reinforcements to enhance their strength. Some of these resins are capable of defying temperatures as high as 550° Fahrenheit and are resistant to steam. As a result, phenolic molding compounds are usually added to formulas to utilize their fire-resistant properties for the final product. Examples of this include glass fiber and specialty mold materials used in pump impellers, which will be subjected to high levels of mechanical and thermal stress.

Global Phenol Resins Market Drivers:

The growing use of phenolic resins in automobile components is fueling the growth of the global phenol resins market.

Phenol formaldehyde (PF) resins are well-suited for use in molded automobile components found under the hood due to their resistance to moisture, chemicals, and high temperatures. These components include engine, transmission, and brake parts. PF resins also have a high resistance to friction, making them useful for creating brake pads, clutches, and automatic transmission parts. Additionally, PF resins can be used to produce decorative laminates for the interior of automobiles. Therefore, this factor drives the demand for phenolic resins.

The rising adoption of phenolic resins in parts of airplanes is another factor contributing to the growth of the global Phenol Resins market.

Phenol formaldehyde (PF) resins play a critical role in the creation of brake pads for airplanes due to their exceptional resistance to friction. In addition, PF resins are used to produce phenol composites that are highly resistant to extreme temperatures and moisture. These composites are frequently used in aircraft interiors, particularly for paneling. Therefore, this factor also drives the demand for phenolic resins.

Global Phenol Resins Market Challenges:

The global phenol resins market is encountering challenges, primarily in terms of environmental regulations and the presence of alternative materials. At room temperature, phenolic resins are a colorless, combustible gas with a potent odor. The two main raw materials used for their manufacturing are formaldehyde and phenol. Phenolic resins are used to manufacture composite wood products, including hardwood, plywood, particleboard, and medium-density fiberboard, as well as paints, coatings, building materials, and paper products. If consumed, inhaled, or absorbed, phenol can poison a person's body due to its corrosive nature. Moreover, there are several alternatives of phenolic resins easily available. One of the prominent alternatives is epoxy resin, which is highly tolerant of continued high-heat exposure including open flames and temperatures above 350° F. Thus, these challenges inhibit the growth of the global phenol resins market.

Global Phenol Resins Market Opportunities:

The development of sustainable and eco-friendly feedstock for phenolic resins presents a lucrative opportunity in the global phenol resins market. Given the rising demand for phenolic resins owing to their superior properties, including high-temperature resistance, hardness, dimensional stability, electrical resistance, and chemical resistance, businesses specializing in the production of phenolic resins can stand to gain significantly from this opportunity by developing sustainable and eco-friendly feedstock for phenolic resins, which will help in reducing environmental pollution to minimize health and safety concerns pertaining to its production. This development will help companies to increase their customer base and boost their overall revenue.

COVID-19 Impact on the Global Phenol Resins Market:

The outbreak of the COVID-19 pandemic substantially impacted the global phenol resins market. The implementation of strict lockdowns, traveling restrictions, and social distancing measures across several nations hindered many companies' manufacturing capacities and caused a shortage of skilled workforce. The pandemic caused disruptions in supply chains and distribution of goods and services, which highly affected the production and distribution of phenolic resins. Moreover, the demand for phenolic resins decreased due to reduced operations of businesses in several manufacturing industries. These factors negatively impacted the growth of the global phenol resins market. Despite these challenges, the global phenol resins market is projected to recover and grow in the coming years owing to its increasing utilization in the automotive, buildings and construction, and electrical and electronics industries.

Global Phenol Resins Market Recent Developments:

-

In July 2022, DIC Corporation, a Japan-based chemical company, unveiled that its wholly-owned subsidiary DIC (China) Co., Ltd., successfully completed the acquisition of Guangdong TOD New Material Co., Ltd., a China-based coating resins manufacturing company.

-

In November 2021, ASK Chemicals Group, a Germany-based global supplier of high-performance industrial resins and materials, completed the acquisition of SI Group, Inc., a US-based company specializing in the development of performance additives and intermediates.

-

In September 2020, Sumito Bakelite Company Limited, a Japan-based company specializing in the manufacturing and selling of semiconductor materials, and circuit and plastic products in Asia, developed and commercialized a solid novolac phenolic resin that uses lignin as a raw material.

PHENOL RESINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Application, End-Use Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kolon Industries, Inc. (South Korea), Sumitomo Bakelite Co., Ltd. (Japan), Hexion Inc. (United States), DIC Corporation (Japan), BASF SE (Germany), Bostik, Inc. (France), Hexcel Corporation (United States), SI Group, Inc. (United States), Georgia-Pacific Chemicals LLC (United States), Hitachi Chemical Co., Ltd. (Japan) |

Global Phenol Resins Market Segmentation: By Type

-

Novolac Resin

-

Resol Resin

In 2022, the novolac resin segment held the highest market share. The growth can be attributed to the advantages that novolac resins offer in contrast to resol resins. Novolac resins offer higher strength, excellent impact resistance, fire resistance, chemical resistance, thermal stability, flexibility, twice more dimensional stability, higher shelf life, and electrical insulating properties, making them ideal for use in various industrial applications, including automotive, buildings and construction, and electrical and electronics.

Global Phenol Resins Market Segmentation: By Application

-

Abrasives

-

Adhesives & Binding

-

Coatings

-

Felt Bonding

-

Foam

-

Foundry

-

Friction

-

Substrate Saturation

-

Others

In 2022, the adhesive and binding segment held the highest market share. The growth can be attributed to the wide use of phenolic resins as binding agents for moisture and water-resistant wood-based panels like particleboard, plywood, hardboard, wafer board, and oriented strand board (OSB). Phenolic resins have the ability to easily penetrate and attach themselves to various types of fillers and reinforcements, both organic and inorganic. Once they are cross-linked throughout these fillers and reinforcements, they exhibit remarkable properties of mechanical strength, thermal resistance, and chemical resistance.

Global Phenol Resins Market Segmentation: By End-Use Industry

-

Automotive

-

Buildings & Construction

-

Electrical & Electronics

-

Furniture

-

Others

In 2022, the electrical and electronics segment held the highest market share. The growth can be attributed to the large use of phenolic resins in various applications of the electrical and electronics industry. Phenolic resins have the ability to saturate and bind various substrates utilized in the production of electrical laminates. These laminates are employed in a variety of applications, ranging from electronic components in printed circuit boards to insulation materials utilized in transformers, generators, and electrical equipment. Additionally, they are used as potting compounds to protect electronic components from moisture and environmental contaminants.

Global Phenol Resins Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, the region of Asia-Pacific held the largest share of the global phenol resins market. The growth can be attributed to the increasing utilization of phenolic resins in a variety of industries, including the automotive industry, buildings and construction industry, electrical and electronics, furniture, and oil and gas industry, and the presence of a favorable regulatory environment in nations, such as China and India, which makes it an attractive site for businesses willing to set up manufacturing plants. Additionally, the region is home to several significant market players, including Kolon Industries, Inc., Sumitomo Bakelite Co., Ltd., DIC Corporation, Hitachi Chemical Co., Ltd., and Jinan Shengquan Group Share Holding Co., Ltd. Due to the rapid construction and infrastructure development in nations, such as the United States and Mexico, and the strong presence of major market players, including Hexion Inc., Hexcel Corporation, and Georgio-Pacific Chemicals LLC, the region of North America is anticipated to expand at the fastest rate over the forecast period.

Global Phenol Resins Market Key Players:

-

Kolon Industries, Inc. (South Korea)

-

Sumitomo Bakelite Co., Ltd. (Japan)

-

Hexion Inc. (United States)

-

DIC Corporation (Japan)

-

BASF SE (Germany)

-

Bostik, Inc. (France)

-

Hexcel Corporation (United States)

-

SI Group, Inc. (United States)

-

Georgia-Pacific Chemicals LLC (United States)

-

Hitachi Chemical Co., Ltd. (Japan)

Chapter 1. PHENOL RESINS MARKET - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PHENOL RESINS MARKET - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. PHENOL RESINS MARKET - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. PHENOL RESINS MARKET - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. PHENOL RESINS MARKET - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PHENOL RESINS MARKET - By Type

6.1 Novolac Resin

6.2 Resol Resin

Chapter 7. PHENOL RESINS MARKET - By Application

7.1 Abrasives

7.2 Adhesives & Binding

7.3 Coatings

7.4 Felt Bonding

7.5 Foam

7.6 Foundry

7.7 Friction

7.8 Substrate Saturation

7.9 Others

Chapter 8. PHENOL RESINS MARKET - By End-Use Industry

8.1 Automotive

8.2 Buildings & Construction

8.3 Electrical & Electronics

8.4 Furniture

8.5 Others

Chapter 9. PHENOL RESINS MARKET – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. PHENOL RESINS MARKET – Company Profiles – key players

10.1 Kolon Industries, Inc. (South Korea)

10.2 Sumitomo Bakelite Co., Ltd. (Japan)

10.3 Hexion Inc. (United States)

10.4 DIC Corporation (Japan)

10.5 BASF SE (Germany)

10.6 Bostik, Inc. (France)

10.7 Hexcel Corporation (United States)

10.8 SI Group, Inc. (United States)

10.9 Georgia-Pacific Chemicals LLC (United States)

10.10 Hitachi Chemical Co., Ltd. (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Phenol Resins Market was evaluated to be worth USD 12.2 Billion in 2022 and is projected to reach a value of USD 17.09 Billion by the end of 2030, growing at a fast CAGR of 4.3% during the forecast period 2023-2030.

The Global Phenol Resins Market Drivers are the Growing Use of Phenolic Resins in the Automobile Components and the Rising Adoption of Phenolic Resins in Parts of Airplanes.

Based on the Type, the Global Phenol Resins Market is segmented into Novolac Resin and Resol Resin.

Japan is the most dominating country in the region of Asia-Pacific for the Global Phenol Resins Market.

Kolon Industries, Inc., Sumitomo Bakelite Co., Ltd., and Hexion Inc. are the top players in the Global Phenol Resins Market.