Pharmaceuticals and Food Anti-Counterfeiting Technologies Market Size (2024 – 2030)

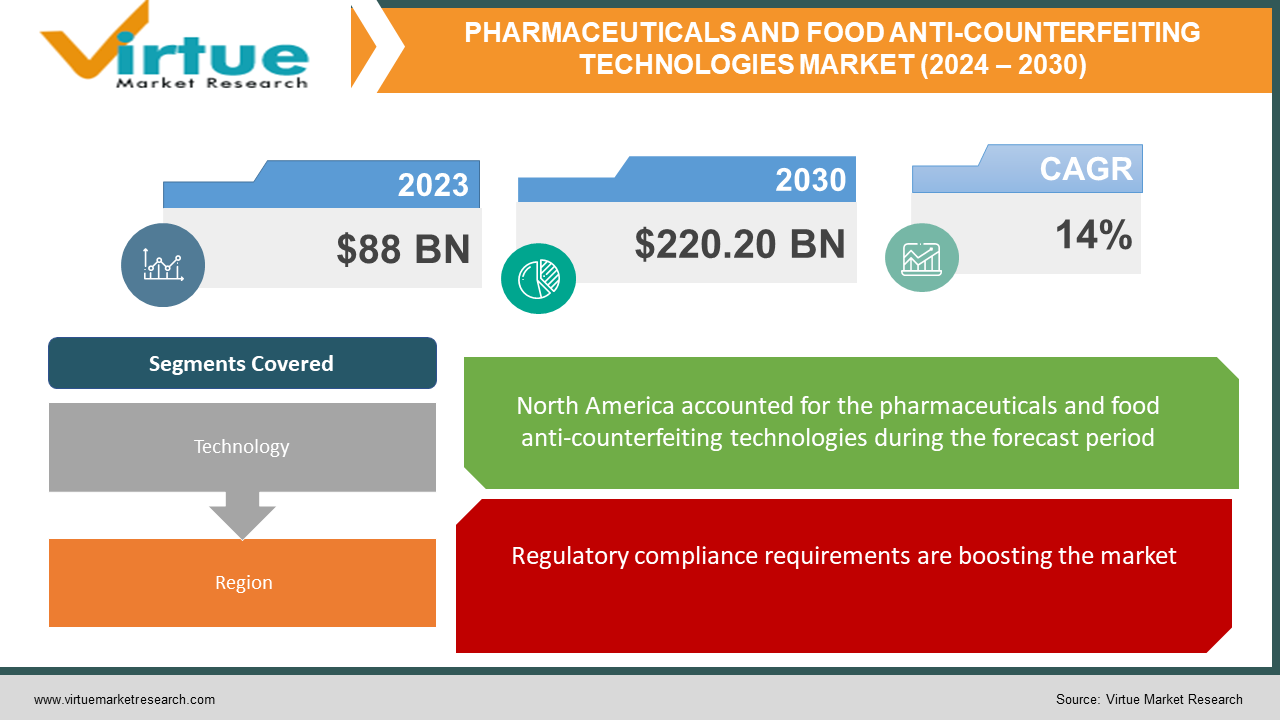

The global pharmaceuticals and food anti-counterfeiting technologies market was valued at USD 88 billion and is projected to reach a market size of USD 220.20 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 14%.

Technologies known as anti-counterfeiting techniques guard against product imitation or replication. These technologies, which can be physical or digital, include qualities that make it harder for product counterfeiters to recreate a fake. Anti-counterfeiting technology can be used on items and authentication certificates. Technology to monitor, trace, and confirm an item's authenticity from beginning to finish is frequently used in these procedures. In the past, solutions like holograms, barcodes, and QR codes were mainly used. However, their presence was limited as these technologies were not that advanced and provided basic security. Presently, the market has seen a notable expansion due to rapid adoption and technological innovations. In the future, with a focus on customized solutions and the integration of advanced methods, the market is anticipated to witness good growth.

Key Market Insights:

The food traceability industry brought in $5.82 billion in revenue in 2022, according to Statista. According to industry estimates, 11% of US hospitals presently use RFID technology in conjunction with prescription drugs. According to Technavio, the pharmaceutical traceability market's barcode sector will expand by $17,917.78 million at a compound annual growth rate (CAGR) of 23% between 2023 and 2028. CYBRA reports that suppliers and manufacturers who integrate RFID technology into their supply chain see an 80% increase in picking and shipping accuracy.

The greatest criminal trade in the world, according to the National Crime Prevention Council, is the sale of counterfeit goods to consumers for $2 trillion a year. These figures have increased the demand for this technology significantly. To avoid such problems, governmental agencies have been enforcing stricter laws and deploying advanced technologies. Additionally, traceability systems are being implemented.

Pharmaceuticals and Food Anti-Counterfeiting Technologies Market Drivers:

Regulatory compliance requirements are boosting the market.

Globally, governments and regulatory agencies are enforcing more rigorous laws to curb the sale of fake food and medicine. The pharmaceutical and food industries must implement anti-counterfeiting solutions to comply with these rules. Many products cannot be commercialized on the market unless they have followed all the guidelines that are imposed. To guarantee the integrity and authenticity of pharmaceutical products, laws like the Falsified Medicines Directive (FMD) in Europe and the Drug Supply Chain Security Act (DSCSA) in the United States require the use of serialization, track-and-trace systems, and tamper-evident packaging. Furthermore, consumers have become more aware of falsified products and are looking out only for those goods that have been certified by agencies. The food and pharmaceutical industries are thereby adhering to these rules and implementing anti-counterfeiting solutions for their profits as well as for public safety.

The rising incidence of counterfeiting has been accelerating the growth rate.

Effective anti-counterfeiting solutions are in high demand due to the serious health and safety dangers posed by the growth of counterfeit food and pharmaceutical items. Counterfeit pharmacies may include dangerous materials, dosage errors, or no active medicines at all, endangering patient health and eroding confidence in respectable healthcare systems. Similar to fake goods, adulterated or contaminated food items can be harmful to health and cause mistrust among consumers. To safeguard customers and brand integrity, there is a growing demand for strong anti-counterfeiting measures that include technologies like serialization, authentication labels, and track-and-trace systems.

Pharmaceuticals and Food Anti-Counterfeiting Technologies Market Restraints and Challenges:

Associated costs, technological limitations, consumer education, and regulatory hurdles are the main issues that the market is currently facing.

The initial investments that are required to implement authentic solutions are very high. Additionally, maintenance and other operations charges add up. Smaller firms can be drained financially because of this. Secondly, even though there have been many advancements, products are still susceptible to danger. Many solutions are not foolproof. Few technologies can have poor features and authentication methods that can cause huge losses for the company. Thirdly, many consumers lack knowledge about identifying good products. They may go for options that have a lower price. It is essential to spread the right knowledge about verifying the products and encouraging their adoption. Furthermore, pharmaceutical and food firms have a great deal of difficulty adhering to the various and constantly changing regulatory requirements in various countries. Implementation efforts are complicated by country-specific regulations about product authenticity, traceability, and serialization. It can be difficult to ensure compliance with these requirements while still functioning efficiently, especially for global corporations that operate in several different jurisdictions.

Pharmaceuticals and Food Anti-Counterfeiting Technologies Market Opportunities:

Emerging computer science fields like artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and blockchain have been providing numerous possibilities. By integrating these fields into this technology, it is possible to gain insights for a deeper understanding. They can enhance traceability and authentication by providing various features. Every transaction in the supply chain is recorded with the aid of these fields. Vast amounts of data that are generated help in improving detection capabilities. Besides, they help in predictive analysis by analyzing potential threats. Furthermore, IoT sensors are employed that continuously monitor the environment, humidity, temperature, and other factors. This helps prevent substitution and other adulteration of medicine and food. Blockchain technology helps in verifying sustainability certifications and sourcing techniques. This helps highlight sustainability. Digital solutions are being employed through mobile applications and cloud-based solutions. They provide real-time data, helping with making informed decisions. Apart from this, customization has been beneficial. Technologies and features are tailored as per the needs of the client. This can include specifications in packaging, product labeling, and other verification designs.

PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14% |

|

Segments Covered |

By Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Authentix, SICPA, TruTag Technologies, Avery Dennison Corporation, AlpVision, Impinj, Inc., Zebra Technologies Corporation, Applied DNA Sciences, Inc., IBM Corporation, Thermo Fisher Scientific, Inc. |

Pharmaceuticals and Food Anti-Counterfeiting Technologies Market Segmentation: By Technology

-

Mass Encoding

-

RFID

-

Holograms

-

Bar Code

-

Tamper Evidence

-

Forensic Markers

-

Others

Based on technology, mass encoding is the largest growing segment. Pharmaceutical packaging uses mass encoding as a strategy to track and keep an eye on individual products throughout their supply chain. Using this method, a lot of information is immediately embedded into the package. It is especially helpful for items that are in great demand and require careful tracking of a large number of packets, such as over-the-counter drugs. During the production process, food producers can provide individual food items or batches with unique identities, such as product IDs or serial numbers, by using mass encoding. This makes traceability possible from farm to fork in the supply chain. Stakeholders may facilitate quality control, recall management, and regulatory compliance by tracking the origin, processing, and distribution of food goods through the scanning of these encoded IDs.

RFID is the fastest-growing segment. Radio waves are used in radio-frequency identification (RFID) to track and identify items that have tags attached to them. RFID operates by connecting an RFID tag to the appropriate asset and programming it with information such as ID, quantity, condition, and position. The data is then gathered in an asset tracking system by an RFID reader, which uses the radio waves from the tag to read the recorded data. The pharmaceutical business uses radio frequency identification (RFID) technology to monitor and identify items at every stage of the supply chain. Real-time visibility and traceability provided by this technology can aid in asset identification, replenishment, and inventory management. RFID may also be used to handle medication recalls, stop counterfeiting, and enhance patient safety. The food business uses radio frequency identification (RFID) technology to boost process profitability, decrease food waste, and enhance inventory management. Products may be identified with the use of RFID tags, which can also provide weights and other details like expiration dates. Additionally, they may be equipped with sensors to keep an eye on the temperature and quality of the food, minimizing spoilage. RFID can also help minimize waste by up to 20% by assisting in the alignment of inventory with changeable demand across different locations.

Pharmaceuticals and Food Anti-Counterfeiting Technologies Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the market, with a share of around 34%. The United States and Canada are the two leading countries. Some of the factors driving this market include the FDA's stringent and thorough regulations, as well as the existence of advanced healthcare & food infrastructure that facilitates the adoption of these technologies. North American manufacturers are concentrating on creating environmentally friendly anti-counterfeit packaging solutions that adhere to local laws. Asia-Pacific is the fastest-growing market. Countries like China, India, and Japan are at the forefront. This is because these nations have quickly developed healthcare and technological infrastructure, as well as significant rates of consumption of counterfeit goods. To take advantage of the potential, a growing number of international market players are now entering this region. The food and pharmaceutical sectors in the Asia-Pacific area are expanding quickly due to several causes, including urbanization, population expansion, and shifting customer tastes. Food and pharmaceutical items are produced, distributed, and consumed more often as these businesses grow, which gives counterfeiters more opportunity to enter the market.

COVID-19 Impact Analysis on the Global Pharmaceuticals and Food Anti-Counterfeiting Technologies Market:

The outbreak of the virus hurt the market. The new norms included social isolation, movement restrictions, and lockdowns. This led to a lot of disruptions in the supply chain, transportation, and logistics. Import-export trade activities were severely affected. Economic uncertainty prevailed. There was a shortage of raw materials, including plastic and labeling paper. People took advantage of the shortage and started to sell adulterated food products and medicine. Online sales saw an increase in counterfeiting activity. As per a report by the National Institute of Health, because of people's desperation, the illicit market for fake COVID-19 vaccines expanded up to 400%. Post-pandemic, the market picked up rapidly. Governmental bodies started enforcing stricter regulations. Technologies like artificial intelligence and blockchain have gained prominence. The pandemic played a crucial role in raising awareness through news and social media. Consumers became more aware of the importance of verifying the authenticity of the product.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

The food and pharmaceutical sectors can benefit from the novel approaches that nanotechnology offers for tamper-evident packaging and product verification. Product packaging is made difficult to replicate by embedding nano-sized tags, coatings, and markers. They can detect any sort of change, like pathogens, chemical contaminants, and other toxic compounds. By improving product security and authenticity verification, nanotechnology helps to prevent counterfeiters and safeguard customer safety.

Key Players:

-

Authentix

-

SICPA

-

TruTag Technologies

-

Avery Dennison Corporation

-

AlpVision

-

Impinj, Inc.

-

Zebra Technologies Corporation

-

Applied DNA Sciences, Inc.

-

IBM Corporation

-

Thermo Fisher Scientific, Inc.

In March 2023, the first purpose-built software solution for testing for counterfeit drugs in the industry, PharmaDefense, was launched by InVita Healthcare Technologies, a leading provider of software solutions for healthcare, blood centers, public health, and public safety organizations. By using PharmaDefense, they will be able to uncover illicit producers by constructing legally sound cases, assisting with discovery requests, and exchanging data with all testing labs throughout the globe.

In November 2022, Holostik India unveiled its most recent anti-counterfeiting security goods, which included safety holograms, optically variable devices (OVDs), and other track-and-trace gadgets. At Propak Mumbai 2023, Holostik India also displayed its anti-counterfeiting solutions. The physical and digital security company Holostik India has introduced Optashield, a new anti-counterfeiting tool.

Chapter 1. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET – By Technology

6.1 Introduction/Key Findings

6.2 Mass Encoding

6.3 RFID

6.4 Holograms

6.5 Bar Code

6.6 Tamper Evidence

6.7 Forensic Markers

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Technology

6.10 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Technology

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Technology

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Technology

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Technology

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Technology

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. PHARMACEUTICALS AND FOOD ANTI-COUNTERFEITING TECHNOLOGIES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Authentix

8.2 SICPA

8.3 TruTag Technologies

8.4 Avery Dennison Corporation

8.5 AlpVision

8.6 Impinj, Inc.

8.7 Zebra Technologies Corporation

8.8 Applied DNA Sciences, Inc.

8.9 IBM Corporation

8.10 Thermo Fisher Scientific, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global pharmaceuticals and food anti-counterfeiting technologies market was valued at USD 88 billion and is projected to reach a market size of USD 220.20 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 14%.

Regulatory compliance requirements and the rising incidence of counterfeiting are the main factors propelling the global pharmaceuticals and food anti-counterfeiting technologies market.

Based on technology, the global pharmaceuticals and food anti-counterfeiting technologies market is segmented into mass encoding, RFID, holograms, bar codes, tamper evidence, forensic markers, and others.

North America is the most dominant region for the global pharmaceuticals and food anti-counterfeiting technologies market.

Authentix, SICPA, and TruTag Technologies are the key players operating in the global pharmaceuticals and food anti-counterfeiting technologies market.