Pharmaceutical Excipients Market Size (2025 – 2030)

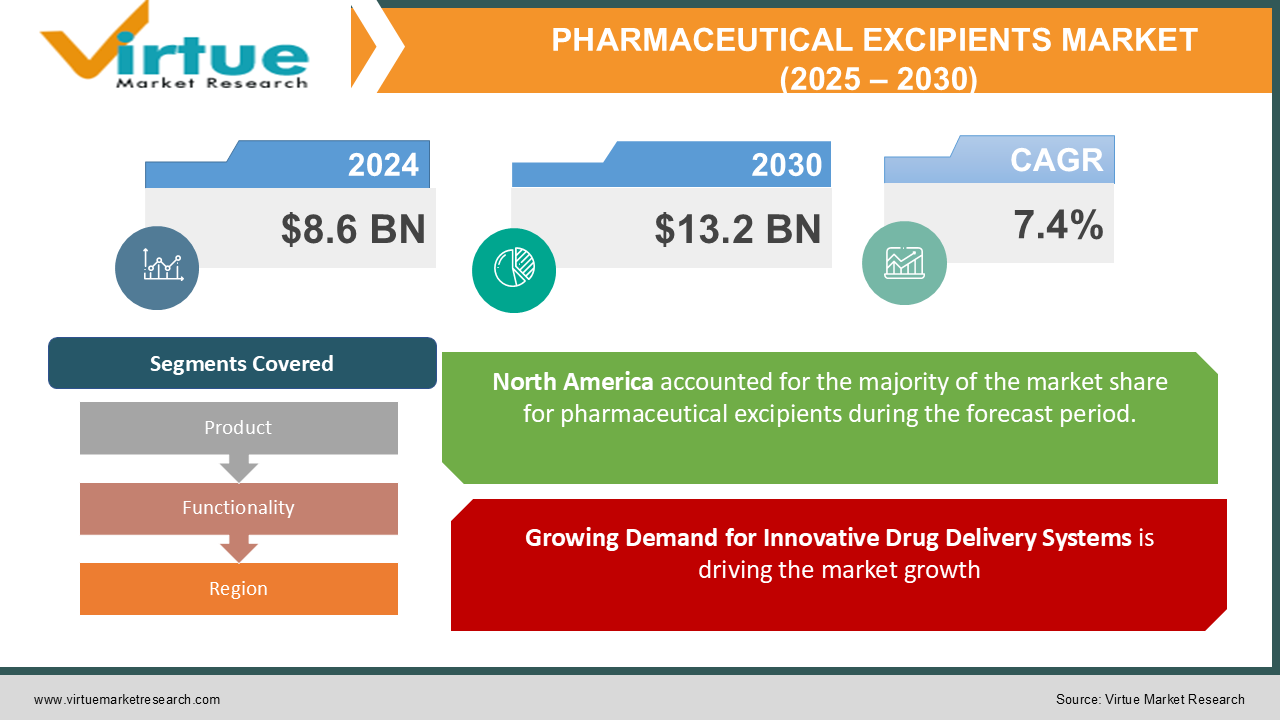

The Global Pharmaceutical Excipients Market was valued at USD 8.6 billion in 2024 and is projected to reach USD 13.2 billion by 2030, growing at a CAGR of 7.4% during the forecast period (2025–2030).

Pharmaceutical excipients are inert substances used in drug formulation to improve drug delivery, stability, and bioavailability. They play a vital role in ensuring the efficacy and safety of pharmaceutical products.

The rising demand for functional excipients, driven by the growing prevalence of chronic diseases and advancements in drug delivery systems, is propelling market growth. Increasing pharmaceutical production, coupled with regulatory initiatives to ensure drug quality, further supports the growth of the market.

Key Market Insights

-

Organic chemicals dominate the market, accounting for over 55% of the product share in 2024, due to their widespread use in drug formulations.

-

Binders emerged as the leading functionality segment, driven by their critical role in ensuring tablet stability and integrity.

-

North America led the global market, holding a revenue share of over 40%, owing to its advanced pharmaceutical manufacturing infrastructure.

-

Rising adoption of biologics and biosimilars is creating new growth avenues for excipients, particularly those compatible with advanced drug delivery systems.

-

The increasing focus on oral drug delivery systems is driving demand for excipients that enhance solubility and absorption.

-

Stringent regulatory requirements for excipient safety and quality are fostering innovation in excipient development.

-

Emerging economies, particularly in Asia-Pacific, are witnessing rapid growth due to expanding pharmaceutical manufacturing and increasing healthcare spending.

Global Pharmaceutical Excipients Market Drivers

Growing Demand for Innovative Drug Delivery Systems is driving the market growth

The pharmaceutical industry is witnessing a shift toward innovative drug delivery systems, such as controlled-release, targeted delivery, and orally disintegrating tablets. These advanced systems require excipients with specific functionalities, such as enhanced solubility, stability, and bioavailability.

The rising prevalence of chronic conditions like diabetes, cardiovascular diseases, and cancer is driving demand for medications that offer improved efficacy and patient compliance. Functional excipients are integral to achieving these goals, thereby boosting their adoption in modern drug formulations.

Increasing Pharmaceutical Production is driving the market growth

The global pharmaceutical industry is expanding significantly, fueled by growing healthcare demands, aging populations, and rising access to healthcare in developing regions. As pharmaceutical production increases, so does the demand for high-quality excipients that can meet stringent regulatory requirements.

Additionally, the rise of generic drugs, biosimilars, and over-the-counter (OTC) products has further driven the need for excipients, as they are essential in ensuring consistency, stability, and manufacturability of these products.

Regulatory Focus on Drug Safety and Quality is driving the market growth

Regulatory authorities, including the U.S. FDA and EMA, emphasize the importance of excipient quality and safety in drug formulations. These regulations have encouraged manufacturers to invest in the development of novel excipients that meet strict compliance standards.

The introduction of guidelines for the use of multifunctional and co-processed excipients has also paved the way for innovation in the market. These excipients, offering enhanced functionality and compatibility, are gaining traction among pharmaceutical manufacturers.

Global Pharmaceutical Excipients Market Challenges and Restraints

High Development Costs of Advanced Excipients is restricting the market growth

The development of advanced excipients with specific functionalities is a complex and expensive process. It involves significant R&D investments, regulatory approvals, and extensive testing to ensure safety and compatibility with active pharmaceutical ingredients (APIs). For small and mid-sized excipient manufacturers, these high costs can pose a significant barrier to entry. Additionally, pharmaceutical companies may hesitate to adopt new excipients due to concerns about regulatory approval timelines and potential reformulation costs.

Supply Chain Disruptions and Raw Material Dependency is restricting the market growth

The production of pharmaceutical excipients often relies on raw materials sourced from multiple regions. Disruptions in the supply chain, caused by factors such as geopolitical tensions, trade restrictions, or natural disasters, can impact the availability of these raw materials.

Such disruptions can lead to price volatility and supply shortages, posing challenges for excipient manufacturers and pharmaceutical companies alike. Ensuring a stable and reliable supply chain is critical to addressing this issue and maintaining market growth.

Market Opportunities

The global pharmaceutical excipients market presents significant growth opportunities, driven by advancements in pharmaceutical technologies and the growing emphasis on patient-centric drug development. Emerging markets in Asia-Pacific, Latin America, and Africa are becoming key areas of focus, owing to their expanding pharmaceutical industries and increasing healthcare spending. The development of multifunctional and co-processed excipients is a promising avenue for innovation. These excipients offer multiple functionalities, such as binding, disintegration, and controlled release, in a single product, reducing the complexity of drug formulations and manufacturing processes. Moreover, the rise of biologics and biosimilars presents opportunities for excipients that can enhance the stability and delivery of these complex molecules. Collaborations between excipient manufacturers and pharmaceutical companies can further accelerate the development of novel solutions tailored to specific therapeutic needs.

PHARMACEUTICAL EXCIPIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.4% |

|

Segments Covered |

By Product, Functionality, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Evonik Industries AG, Dow Chemical Company, Ashland Global Holdings Inc., Roquette Frères, Colorcon, Inc., Kerry Group PLC, Lubrizol Corporation, Croda International PLC, Avantor, Inc. |

Pharmaceutical Excipients Market Segmentation - By Product

-

Organic Chemicals

-

Polymers

-

Sugars

-

Alcohols

-

-

Inorganic Chemicals

-

Calcium Phosphate

-

Calcium Carbonate

-

Others

-

-

Others

Organic chemicals represent the largest segment within the pharmaceutical excipient market, owing to their versatility and widespread use in various drug formulations. These chemicals serve as the building blocks for a wide range of excipients, including diluents, disintegrants, lubricants, and binders. Their ability to enhance the physical and chemical properties of dosage forms, such as solubility, bioavailability, and stability, makes them indispensable in pharmaceutical manufacturing. Organic chemicals are extensively used in oral, injectable, and topical drug formulations. For instance, in oral solid dosage forms, they are employed as fillers, binders, and disintegrants to ensure proper drug release and absorption. In injectable formulations, organic chemicals are used as solvents, cosolvents, and stabilizers to maintain product integrity and enhance patient safety. Additionally, they play a crucial role in topical formulations, acting as penetration enhancers and emollients to improve drug delivery to the skin. The growing demand for pharmaceutical products, coupled with the increasing complexity of drug formulations, is driving the demand for organic chemicals, reinforcing their dominant position in the excipient market.

Pharmaceutical Excipients Market Segmentation - By Functionality

-

Binders

-

Coatings

-

Fillers and Diluents

-

Disintegrants

-

Lubricants and Glidants

-

Others

Binders play a crucial role in the pharmaceutical industry, particularly in the formulation of solid dosage forms like tablets and capsules. They act as adhesives, binding the active pharmaceutical ingredient (API) and other excipients together to form cohesive and stable dosage forms. This ensures product integrity and prevents premature disintegration, enhancing drug delivery and efficacy. The demand for binders is driven by the increasing production of generic and branded drugs, as well as the growing focus on developing innovative dosage forms. Binders offer a wide range of functionalities, including granulation, film coating, and controlled release. Their ability to improve the physical and chemical properties of dosage forms, such as hardness, disintegration time, and dissolution rate, makes them indispensable in pharmaceutical manufacturing. As the pharmaceutical industry continues to evolve, the demand for high-quality binders is expected to remain strong, driving market growth and innovation.

Pharmaceutical Excipients Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America led the global pharmaceutical excipients market in 2024, contributing to over 40% of the revenue share, supported by its advanced pharmaceutical manufacturing infrastructure and high investment in R&D. The United States is the primary contributor, with significant demand for excipients driven by the production of high-value drugs and biologics.

Europe closely follows, driven by the region's strong pharmaceutical industry and stringent regulatory standards. Meanwhile, Asia-Pacific is expected to witness the fastest growth during the forecast period, fueled by rising pharmaceutical production in countries like China and India, increasing healthcare spending, and growing adoption of advanced drug delivery systems.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the pharmaceutical excipients market. On the one hand, the surge in demand for pharmaceutical products, including vaccines, antiviral drugs, and over-the-counter medications, boosted the demand for excipients. Excipients played a critical role in ensuring the stability and delivery of COVID-19 vaccines and therapeutics. However, supply chain disruptions, labor shortages, and restrictions on manufacturing activities posed challenges during the initial phases of the pandemic. Despite these obstacles, the industry demonstrated resilience, with manufacturers adapting to the changing landscape through innovations and strategic partnerships. Post-pandemic, the market is expected to benefit from heightened awareness of drug safety and quality, increased R&D activities, and the growing adoption of advanced excipients in new drug formulations.

Latest Trends/Developments

The pharmaceutical excipient market is undergoing significant transformation, driven by several key trends. 1 Multifunctional excipients, offering combined functionalities such as binding and controlled release, are gaining traction due to their efficiency and cost-effectiveness. 2 There is a growing emphasis on sustainable and natural excipients, aligning with environmental concerns and consumer preferences. 3 Co-processed excipients, which enhance compatibility and performance, are emerging as a preferred choice for pharmaceutical manufacturers. 4 The surge in biologics and biosimilars is driving demand for excipients tailored to their unique stability and delivery requirements. 5 Additionally, regional expansion strategies are being implemented by companies to capitalize on the growing demand for pharmaceutical products and excipients in emerging markets. 6 These trends are collectively shaping the future of the excipient market, driving innovation and product development to meet the evolving needs of the pharmaceutical industry.

Key Players

-

BASF SE

-

Evonik Industries AG

-

Dow Chemical Company

-

Ashland Global Holdings Inc.

-

Roquette Frères

-

Colorcon, Inc.

-

Kerry Group PLC

-

Lubrizol Corporation

-

Croda International PLC

-

Avantor, Inc.

Chapter 1. Pharmaceutical Excipients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pharmaceutical Excipients Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pharmaceutical Excipients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pharmaceutical Excipients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pharmaceutical Excipients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pharmaceutical Excipients Market – By Product

6.1 Introduction/Key Findings

6.2 Organic Chemicals

6.3 Polymers

6.4 Sugars

6.5 Alcohols

6.6 Inorganic Chemicals

6.7 Calcium Phosphate

6.8 Calcium Carbonate

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Product

6.11 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Pharmaceutical Excipients Market – By Functionality

7.1 Introduction/Key Findings

7.2 Binders

7.3 Coatings

7.4 Fillers and Diluents

7.5 Disintegrants

7.6 Lubricants and Glidants

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Functionality

7.9 Absolute $ Opportunity Analysis By Functionality, 2025-2030

Chapter 8. Pharmaceutical Excipients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Functionality

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Functionality

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Functionality

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Functionality

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Functionality

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pharmaceutical Excipients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Evonik Industries AG

9.3 Dow Chemical Company

9.4 Ashland Global Holdings Inc.

9.5 Roquette Frères

9.6 Colorcon, Inc.

9.7 Kerry Group PLC

9.8 Lubrizol Corporation

9.9 Croda International PLC

9.10 Avantor, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 8.6 billion in 2024 and is projected to reach USD 13.2 billion by 2030, growing at a CAGR of 7.4%.

Key drivers include the growing demand for innovative drug delivery systems, increasing pharmaceutical production, and regulatory focus on drug safety and quality.

Segments include Product (Organic Chemicals, Inorganic Chemicals, Others) and Functionality (Binders, Coatings, Fillers, Others).

North America dominates the market, contributing to over 40% of revenue, supported by advanced manufacturing infrastructure and R&D investments.

Key players include BASF SE, Evonik Industries AG, Dow Chemical Company, and others.