Pharmaceutical Amino Acid Market Size (2024 – 2030)

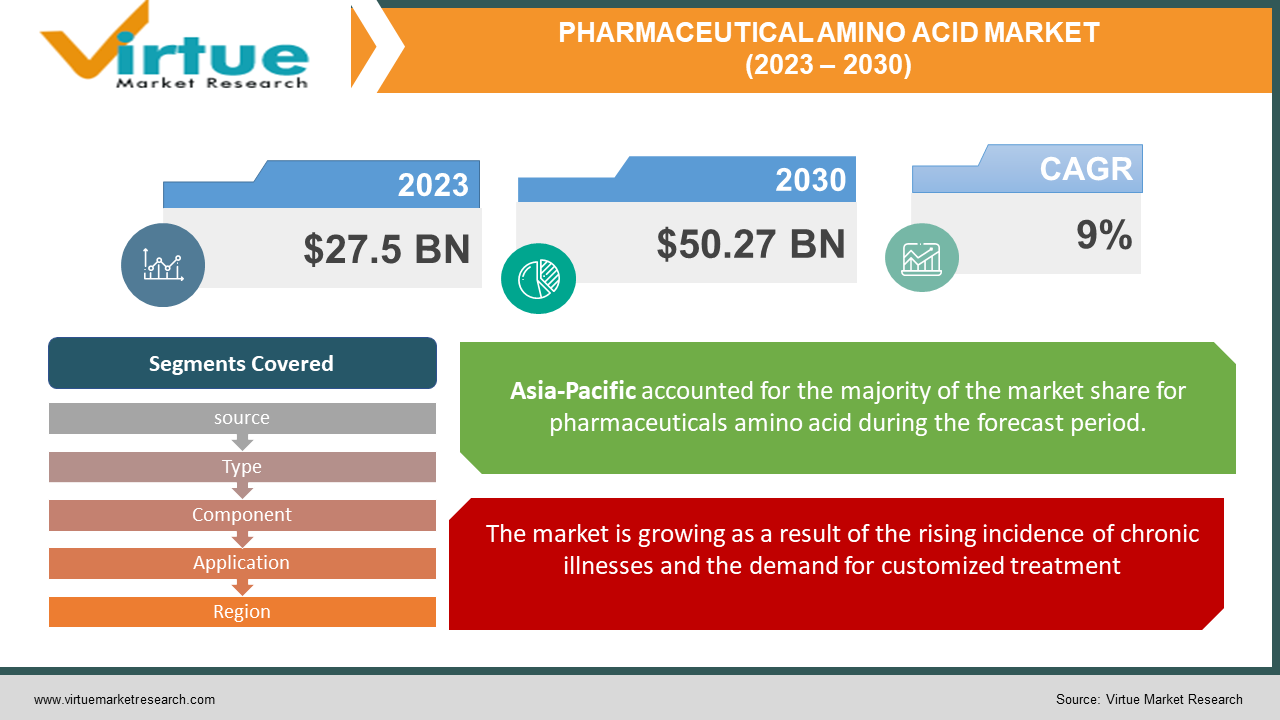

The Pharmaceutical Amino Acid Market was valued at USD 27.5 billion in 2023 and is projected to reach a market size of USD 50.27 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9%.

Pharmaceutical amino acids are a class of chemical substances that are vital components of proteins and are involved in many biological processes in the human body. The pharmaceutical industry uses these amino acids extensively for the manufacture of medications, parenteral nutrition, and nutritional supplements. Amino acids are organic substances that are safe to employ in medicinal settings.

Key Market Insights

The growing demand for supplements and pharmaceuticals containing amino acids is driving significant growth in the pharmaceutical amino acid industry. The creation of novel amino acid-based medications and treatments has resulted from improvements in biotechnology and pharmaceutical manufacturing techniques, which has further fueled market expansion.

The market is expanding due to factors such as rising healthcare costs, rising knowledge of the role amino acids play in managing diseases, and an aging population. The market is growing as a result of the rising incidence of chronic illnesses and the demand for customized treatment. Plant-based protein sources are becoming more and more necessary these days because veganism and vegetarianism are becoming more and more popular. Because plant-based proteins often lack one or more essential amino acids, amino acid supplements are used to ensure that those following plant-based diets receive the appropriate amount of nutrition.

The introduction of innovative amino acid formulations and combination therapies to improve medication efficacy and minimize side effects are among the most recent developments in the pharmaceutical amino acid market. Because of their greater efficacy and purity, natural amino acids derived from plant and microbial fermentation methods are becoming increasingly popular, as seen by the market.

Pharmaceuticals Amino Acid market drivers:

The market is growing as a result of the rising incidence of chronic illnesses and the demand for customized treatment.

All living organisms use amino acids as building blocks to create proteins. Twenty distinct amino acids are necessary for your body to function properly. Although the human body produces hundreds of amino acids, it is unable to produce nine of the essential amino acids.

We refer to these as essential amino acids. They have to come from the food people consume. The usage of amino acids in supplements and medications has increased dramatically due to people's deteriorating physical and medical conditions, which necessitates outside help even in situations where the body can synthesize amino acids on its own without outside assistance.

Novel amino acid-based medications and treatments have been developed as a result of developments in biotechnology and pharmaceutical production techniques.

Amino acids contribute to the improvement of medical nutrition products' dependability, quality, and safety. These amino acids offer an effective way to obtain the necessary nutrients for parenteral, enteral, and newborn nutrition. To safeguard, support, or improve the stability and bioavailability of an API, amino acids can also be added to pharmaceuticals. They can also facilitate the definition of a release profile, enhance patient acceptance, and support medication manufacturing.

According to Ambreen et al., 2021, Brunton et al., 2006, Jafari et al., 2021, and Kozma et al., 2016, oral absorption, formulation, and/or bioavailability issues are linked to the low water solubility of certain medications, which is one of the largest obstacles facing the pharmaceutical business. Here, combining medications with highly water-soluble molecules—like AA—represents a potential workaround for the issues associated with poorly soluble pharmaceuticals.

The market is developing due to rising healthcare costs, rising knowledge of the role amino acids play in managing diseases, and expanding geriatric population.

The amino acids aid in the breakdown of food, develop and repair bodily tissue, manufacture neurotransmitters, brain chemicals, and hormones, a source of energy is provided, Keep the nails, skin, and hair healthy, and Build muscle. It also establishes a stronger immune system and maintains a healthy digestive system. People would choose to be safe and save money by consuming different foods that contain amino acids rather than risk contracting an expensive illness that would necessitate more out-of-pocket healthcare expenditures. Such proteins are also essential for the smooth operation of the aging population, which is predicted to be growing.

Amino acids (AA) have gained increasing interest in delivery systems research due to their beneficial characteristics fuelling market demand.

The combination of appropriate molecules is one of the promising approaches in drug delivery system development that is of interest. The ideal structural characteristics of AA, which include side chains, an α-amino group, and α-carboxylate, are ideal for forming drug linkages. As a result, the AA can create a variety of ionic, hydrophobic, and/or hydrogen bonding interactions between molecules (Tilburg et al., 2014). According to Kamei et al. (2017), AA are alternative excipients that have a low molecular weight and bind to the medications' biological receptors. As a result, AA is a useful co-former that can serve as a novel foundation for medication formulations with improved qualities.

The study and creation of medication delivery systems have advanced quickly in the last several years, especially in the domains of distribution routes, transport vehicles, and targeted tactics. When delivering drugs, the target may include entire organs, specific tissue, disease-specific structures, or internal cell structures. Thanks to their advantageous properties, amino acids (AA) have recently attracted more attention in delivery systems research.

Pharmaceuticals Amino Acid Market Restraints and Challenges:

Several issues, such as price volatility, regulatory compliance, side effects, alternative sources, competition from replacements, and low consumer knowledge, could hinder the growth and development of the amino acid industry.

While producers may incur significant costs and time in complying with regulations, the pricing of amino acids is susceptible to swings due to other variables. Certain amino acids have unfavorable side effects when taken in high concentrations, which restricts their application in specific industries. As an alternative to animal-derived amino acids, which may threaten supply, plant-based proteins are more affordable and environmentally friendly. Market expansion may be constrained by stiff competition from alternatives like proteins, peptides, and other supplements that provide comparable advantages. Notwithstanding these obstacles, creativity, technical development, and strict quality control procedures can assist in overcoming these limitations and guaranteeing the usefulness and safety of amino acid products.

The price of raw materials used to produce amino acids, such as corn, wheat, and soybean oilseeds, has fluctuated recently. Due to the limited availability of raw materials for the manufacturing of other foods, which is driving up demand for these resources, it is anticipated that this trend will persist during the projected period. Other obstacles causing a shortage of raw materials for the manufacturing of amino acids include short-term variables like rising energy prices. Manufacturers in developing economies are frequently compelled to produce amino acids using inferior substitute sources like sorghum or cassava.

Pharmaceutical Amino Acid Market Opportunities:

Emerging economies with expanding healthcare facilities and rising disposable income would present substantial development potential for the market. Ongoing research and development initiatives aimed at extending the uses of amino acids in medication creation are also anticipated to be beneficial to the market.

In addition, innovative amino acid formulations and combination therapies to improve medication efficacy and lessen side effects are among the most recent developments in the pharmaceutical amino acid market. An increasing inclination towards natural amino acids obtained from microbial and plant fermentation methods is also evident in the market, due to the higher efficacy and purity of these sources. The market for pharmaceutical amino acids is expected to develop significantly in the upcoming years due to several factors, including rising healthcare costs, improvements in pharmaceutical production techniques, and growing awareness of the role that amino acids play in illness management. Pharmaceutical amino acids should continue to see new developments and increased uses in the market as a result of ongoing research and development initiatives.

PHARMACEUTICAL AMINO ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023- 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By source, Type, Component, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., AMINO GmbH, Bill Barr & Company, IRIS BIOTECH GMBH, BI Nutraceuticals |

Pharmaceutical Amino Acid Market Segmentation: By source

-

Plant-based Amino acid

-

Animal-based Amino acid

-

Chemical synthesis

With a revenue share of 43.7% in 2023, the plant-based in-source category led the market. The increasing awareness of natural and organic products among consumers is credited with this growth. Plants such as soybeans, wheat, corn, potatoes, and peas are the source of the product. Due to their widespread worldwide production and use, soybeans are being employed as a commercial source of amino acids. However, it is well recognized that processing soybeans modifies the product's composition, which raises serious concerns when attempting to obtain amino acids from them. On the other hand, the increased global demand for plant-derived products is anticipated to benefit from the increased social awareness around animal slaughter. Although animal proteins are more easily digested than those derived from plants.

Another market that is expected to expand throughout the projection period is chemical synthesis. A biological mechanism is responsible for producing the majority of amino acids. The majority of the product is created via a synthetic process that starts with α-ketoacids and ends with transamination using another amino acid, usually glutamate. An enzyme called an aminotransferase is responsible for facilitating this transition. In turn, the amination of α-ketoglutarate results in the production of glutamate. Additionally, the substance is produced commercially using mutant microorganisms.

Pharmaceutical Amino Acid Market Segmentation: By Type

-

Essential amino acid

-

Non-essential amino acid

With a revenue share of 52.6% in 2023, the non-essential type category led the market. Their widespread usage in animal feed to give the animals a balanced amino acid profile is the reason behind this. Diets are designed by animal nutritionists to satisfy the dietary demands of animals, especially their protein requirements. Since proteins are composed of amino acids, the animal's diet must have a balanced combination of necessary and non-essential items. This promotes the best possible development, growth, and health. Around the world, the use of essential type segments is also steadily increasing due to factors like the aging population, growing awareness, and the surge in demand for sports nutrition products and dietary supplements. Conditional amino acids include several non-essential amino acids. This implies that they are only deemed necessary when you're sick or under stress. The amino acids arginine, cysteine, glutamine, tyrosine, glycine, ornithine, proline, and serine are conditional.

Pharmaceutical Amino Acid Market Segmentation: By Component

-

Lysine

-

Glutamic acid

-

Valine

-

Leucine

-

Isoleucine

Glutamic Acid in the non-essential segment dominated the market with a revenue share of 42.3% in 2023. It is also involved in the production of energy and is an important neurotransmitter in the brain. It plays a role in the regulation of neurotransmitters in the brain, and it also has neuroprotective effects. Over the course of the projection period, growth is also expected for lysine in the essential type category. The global market expansion for dietary supplements is the primary factor driving the demand for lysine. In addition to being consumed by humans, this is a common addition to animal feed. It is widely employed in the body's protein deposition process. The amount of lysine that an animal consumes daily affects its growth. Animal growth and feed quality are improved by changing the dietary lysine concentration in animal feed. Over the course of the projection period, it is anticipated that the global demand for lysine will increase due to the growing need for protein from animal feed manufacturers as well as the rising usage of dietary supplements.

Pharmaceutical Amino Acid Market Segmentation: By application

-

Health-care products

-

Medicine

-

Others

Pharmaceutical amino acids are used in a wide range of industries. They are utilized in the production of functional meals and nutritional supplements for the healthcare products industry, which advances general health and wellness. In the medical industry, they are utilized in the formulation of pharmaceuticals and medications for the treatment of various illnesses and ailments. Furthermore, they are used in other markets for the manufacturing of animal feed, cosmetics, and a variety of industrial applications like biotechnology and agriculture due to their adaptability. Pharmaceutical amino acids are used in these markets, which emphasizes their importance and broad reach. In 2023, the amino acid market was dominated by the pharma-grade category, which held a 39.1% revenue share. The reason for this growth is that pharmaceutical grades are among the most expensive and premium grades of these acids. Strict quality control procedures are used during manufacturing to guarantee the products' safety and purity. They are essential for many biological functions carried out by the human body, including the synthesis of proteins, cell signaling, and neurotransmitter production.

Pharmaceutical Amino Acid Market Segmentation: By Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market for pharmaceutical amino acids is anticipated to expand significantly in several regions, including China, North America, Europe, Asia Pacific (APAC), and the United States (USA). With a revenue share of 46.1% in 2023, Asia Pacific led the market. It's anticipated that China's growing hog consumption will propel market expansion there. The demand for amino acids is predicted to increase in China as a result of growing health concerns and rising personal medical costs. These factors are also likely to drive China's demand for dietary supplements. North America is anticipated to lead the global market. Factors contributing to the region's supremacy include the existence of well-established pharmaceutical corporations and rising R&D expenditures. In North America, the need for pharmaceutical amino acids is driven by strict regulatory requirements and the rising incidence of chronic illnesses. It is anticipated that this region will have a substantial market share valuation; however, precise numbers cannot be given without a comprehensive market analysis. In terms of dominance and market share percentage valuation, North America is expected to lead the pharmaceutical amino acids market. North America commanded the greatest market share in 2020, and the region's market is anticipated to grow more slowly than Asia's. The increasing usage of amino acid analyzers in food quality testing, drug discovery research, and raising public health awareness are the main factors driving the market's expansion in North America.

COVID-19 Impact Analysis on the Pharmaceutical Amino Acid Market:

The amino acid market was very stable during the whole duration of the pandemic one of the reasons was amino acid is a natural ingredient and it is induced in essential products and is still working such as agriculture, pharma, and others, which kept the market in good shape. The market faced certain challenges during the COVID-19 epidemic due to supply chain disruptions brought on by the mandatory shutdown of manufacturing sectors. This resulted in unstable supply and demand for products containing these proteins. The market for products containing amino acids increased as a result of people seeking therapies that increased protection as the virus spread. A surge in the demand for foods, medications, and health supplements that boost immunity as a preventative measure as well as a therapeutic intervention was observed during the COVID-19 pandemic. Through various pathways, the amount of necessary and conditional amino acids increased.

Latest Trends/ Developments:

Ambition, the first-ever amino acid biostimulant, was launched by Bayer AG in China in January 2022. The object promotes photosynthesis and the growth of plants. Ambition helps crops reach their maximum potential by enhancing plant defenses, controlling nutrient efficiency, and enhancing crop output.

CJ Chilean Corp. announced the release of Flavor-rich Master C in April 2021. This is the world's first naturally occurring cysteine, satisfying consumer desire for transparent, natural flavorings derived from plants. This has helped the company expand the range of products it offers.

Key Players:

The number of companies active in the worldwide product market is significant, which leads to the industry being deemed fragmented. Market share is maximized by leaders and other emerging players in the nation, such as small manufacturers, dealers, and participants at the local level. To keep their place in the market, businesses are expanding and introducing new products. Several well-known companies in the amino acid market are:

-

Ajinomoto Co., Inc.

-

KYOWA HAKKO BIO CO., LTD.

-

AMINO GmbH

-

Bill Barr & Company

-

IRIS BIOTECH GMBH

-

BI Nutraceuticals

Chapter 1. Pharmaceutical Amino Acid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pharmaceutical Amino Acid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pharmaceutical Amino Acid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pharmaceutical Amino Acid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pharmaceutical Amino Acid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pharmaceutical Amino Acid Market – By source

6.1 Introduction/Key Findings

6.2 Plant-based Amino acid

6.3 Animal-based Amino acid

6.4 Chemical synthesis

6.5 Y-O-Y Growth trend Analysis By source

6.6 Absolute $ Opportunity Analysis By source, 2024-2030

Chapter 7. Pharmaceutical Amino Acid Market – By Type

7.1 Introduction/Key Findings

7.2 Essential amino acid

7.3 Non-essential amino acid

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Pharmaceutical Amino Acid Market – By Application

8.1 Introduction/Key Findings

8.2 Health-care products

8.3 Medicine

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Pharmaceutical Amino Acid Market – By Component

9.1 Introduction/Key Findings

9.2 Lysine

9.3 Glutamic acid

9.4 Valine

9.5 Leucine

9.6 Isoleucine Y-O-Y Growth trend Analysis By Component

9.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 10. Pharmaceutical Amino Acid Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.1.4 By source

10.1.1.5 By Component

10.1.2 By Application

10.2 By Type

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By source

10.3.3 By Type

10.3.4 By Application

10.3.5 By Component

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By source

10.4.3 By Type

10.4.4 By Application

10.4.5 By Component

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By source

10.5.3 By Type

10.5.4 By Application

10.5.5 By Component

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By source

10.6.3 By Type

10.6.4 By Application

10.6.5 By Component

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Pharmaceutical Amino Acid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ajinomoto Co., Inc.

11.2 KYOWA HAKKO BIO CO., LTD.

11.3 AMINO GmbH

11.4 Bill Barr & Company

11.5 IRIS BIOTECH GMBH

11.6 BI Nutraceuticals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Pharmaceutical Amino Acid Market was valued at USD 27.5 billion in 2023.

The market is projected to grow at a CAGR of 9%.

The market is growing as a result of the rising incidence of chronic illnesses and the demand for customized treatment, developments in biotechnology and pharmaceutical production techniques rising healthcare costs, rising knowledge of the role amino acids play in managing diseases, and expanding geriatric population.

The key players are Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD, AMINO GmbH, Bill Barr & Company, and IRIS BIOTECH GMBH.

Several issues, such as price volatility, regulatory compliance, side effects, alternative sources, competition from replacements, and low consumer knowledge, could hinder the growth and development of the amino acid industry.