Pharmaceutical Acidifying Agents Market Size (2024-2030)

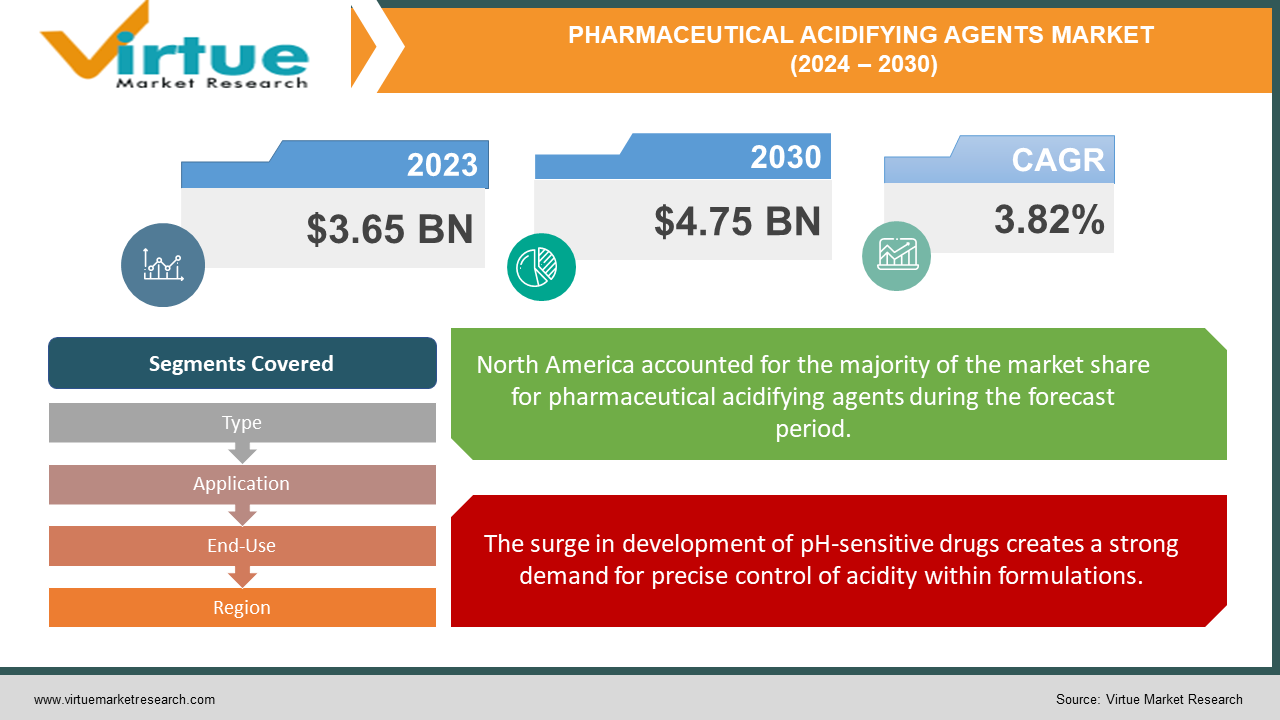

The Pharmaceutical Acidifying Agents Market was valued at USD 3.65 billion in 2023 and is projected to reach a market size of USD 4.75 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 3.82%.

Pharmaceutical acidifying agents play a critical role behind the scenes in many medications. These ingredients help ensure a drug's stability, effectiveness, and safety by creating a specific acidic environment within the formulation. This acidic environment works in a few ways: it prevents the drug from breaking down in solution, hinders the growth of microbes in certain formulations, and improves a drug's ability to dissolve for better absorption in the body.

Key Market Insights:

Pharmaceutical acidifying agents, though unseen ingredients, play a critical role in ensuring the effectiveness and safety of many medications. These workhorses create a specific acidic environment within a drug formulation. This acidity offers a triple benefit: it prevents the drug from breaking down, hinders the growth of harmful microbes in certain medications, and improves a drug's ability to dissolve for better absorption. Common acidifying agents include citric acid (often used to adjust pH and enhance flavor in oral solutions), acetic acid (found in some topical and ear medications), hydrochloric acid (utilized in injectable formulations), and phosphoric acid (used across various formulations).

Looking ahead, the market for pharmaceutical acidifying agents is expected to see continued development. Researchers are exploring new and more potent acidifying agents for precise pH control within medications. There's also a growing interest in natural, bio-based alternatives to traditional acidifiers.

The Pharmaceutical Acidifying Agents Market Drivers:

The surge in development of pH-sensitive drugs creates a strong demand for precise control of acidity within formulations.

The development of new, cutting-edge medications often necessitates specific acidic pH levels for optimal stability and efficacy. These novel drugs can be highly sensitive to even minor fluctuations in pH, potentially leading to degradation or reduced effectiveness. Pharmaceutical acidifying agents play a critical role in creating and maintaining this precise acidic environment within the drug formulation, ensuring the medication remains potent and delivers its intended therapeutic effect.

The rising burden of chronic diseases necessitates long-term medications that require stable and effective formulations, driven by acidifying agents.

The rising prevalence of chronic conditions like diabetes, cancer, and heart disease is leading to a significant increase in patients requiring long-term medication use. These medications often need to be formulated at specific pH levels to maintain their effectiveness over extended periods. Pharmaceutical acidifying agents ensure the medications remain stable and don't break down prematurely, allowing for consistent drug delivery throughout the course of treatment for chronic illnesses.

An aging population's focus on drug tolerability necessitates the use of acidifying agents to create gentler medication formulations.

As the global population ages, there's a growing focus on drug tolerability, particularly for elderly patients who may be more susceptible to medication side effects. Pharmaceutical acidifying agents can play a crucial role in improving drug tolerability by helping to create formulations that are less harsh on the digestive system or other bodily functions. This allows for better adherence to medication regimens and improved overall patient outcomes.

The growing demand for natural and bio-based ingredients extends to acidifying agents, promoting eco-friendly alternatives.

Consumers and pharmaceutical companies alike are increasingly seeking natural and bio-based alternatives to traditional ingredients. This trend extends to pharmaceutical excipients, with a growing demand for eco-friendly acidifying agents derived from natural sources such as organic acids found in fruits and vegetables. This focus on sustainability aligns with growing environmental concerns and consumer preferences for natural products.

The Pharmaceutical Acidifying Agents Market Restraints and Challenges:

The pharmaceutical acidifying agents’ market, though promising, faces a few hurdles. Strict regulations are a major obstacle. Like all new drugs, novel acidifying agents must navigate a rigorous approval process overseen by agencies like the FDA. This lengthy and expensive journey can stifle innovation and delay the introduction of potentially superior options to the market.

Another challenge lies in the specific needs of each medication. While some drugs thrive in acidic environments, others may become unstable or even ineffective at lower pH levels. This limits the applicability of certain acidifying agents, requiring careful selection based on the specific drug formulation. Additionally, even though acidifiers can improve drug tolerability, some acidic ingredients themselves can cause side effects like stomach irritation. Striking the right balance between optimal drug delivery and minimizing side effects remains a critical challenge.

The market landscape also presents some challenges. A few well-established players dominate the production of traditional acidifying agents like citric acid. This dominance can make it difficult for new entrants, particularly those focusing on bio-based alternatives, to gain a foothold and secure market share. Finally, cost considerations play a significant role. Developing and implementing new, potentially more potent acidifying agents can be a costly endeavour. Pharmaceutical companies must carefully balance the pursuit of innovative solutions with maintaining cost-effectiveness in a competitive market.

The Pharmaceutical Acidifying Agents Market Opportunities:

The future of the pharmaceutical acidifying agents’ market is not without its challenges, but it also brims with opportunities. The growing focus on targeted drug delivery systems creates a demand for even more precise control over drug release and absorption. This presents an opportunity for novel acidifying agents to be developed, potentially leading to medications with improved efficacy and reduced side effects. Furthermore, the increasing demand for natural and sustainable ingredients extends to pharmaceutical excipients, opening doors for the development and adoption of bio-based acidifying agents derived from natural sources. Additionally, with patient compliance being a major concern, the market offers an opportunity for the development of acidifying agents that create taste-masked or easier-to-swallow formulations, ultimately improving patient adherence and treatment outcomes. The expansion of the pharmaceutical industry into developing regions also creates new markets for high-quality acidifying agents. Finally, advancements in research and development hold the potential to create even more potent acidifying agents, offering even more precise control over drug formulation pH and potentially leading to the development of a new generation of safer and more effective medications. By capitalizing on these opportunities, the pharmaceutical acidifying agents’ market has the potential for significant growth and continued innovation in the years to come.

PHARMACEUTICAL ACIDIFYING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.82% |

|

Segments Covered |

By Type, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow, DuPont, Eastman Chemical Company, Evonik Industries, Jungbunzlauer Suisse AG, Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC |

Pharmaceutical Acidifying Agents Market Segmentation: By Type

-

Citric Acid

-

Acetic Acid

-

Hydrochloric Acid

-

Phosphoric Acid

-

Other Acidifying Agents

The dominant segment in the pharmaceutical acidifying agents’ market by type is likely Organic Acids. These well-established options like citric acid are cost-effective and suitable for various applications. However, the fastest-growing segment is expected to be Bio-based Acids. Driven by the demand for natural ingredients, bio-based alternatives derived from lactic acid or gluconic acid are gaining traction among consumers and pharmaceutical companies alike.

Pharmaceutical Acidifying Agents Market Segmentation: By Application

-

Oral Medications

-

Topical Medications

-

Injectable Medications

-

Ophthalmic Medications

The dominant segment in the Pharmaceutical Acidifying Agents Market by application is likely Oral Formulations. This segment includes a wide range of medications like syrups, tablets, and capsules, and relies on acidifiers for factors like stability, solubility, and even taste. The fastest-growing segment is expected to be Bio-based Acids (for Oral Formulations). Driven by consumer and environmental concerns, the demand for natural alternatives derived from renewable sources like lactic acid is gaining traction in this application sector.

Pharmaceutical Acidifying Agents Market Segmentation: By End-Use

-

Generic Drug Manufacturers

-

Brand Name Drug Manufacturers

-

Contract Development and Manufacturing Organizations (CDMOs)

The dominant segment in the Pharmaceutical Acidifying Agents Market by End-Use is likely Generic Drug Manufacturers. They prioritize cost-effective and established acidifying agents that ensure quality without driving up production costs. Conversely, the fastest-growing segment is Brand Name Drug Manufacturers. Their focus on innovation and potentially more potent acidifying agents aligns with the development of novel drugs often requiring specific pH levels for optimal efficacy.

Pharmaceutical Acidifying Agents Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America region boasts a mature market with well-established players and a strong focus on innovative drug delivery systems. The presence of leading pharmaceutical companies and research institutions drives the demand for advanced acidifying agents that can optimize drug performance. However, stringent regulations can sometimes hinder the rapid introduction of new options.

European markets prioritize strict quality and patient safety standards. This translates to a focus on established and well-characterized acidifying agents with proven track records. However, there's also a growing interest in bio-based alternatives, driven by environmental concerns and consumer preferences. Regulatory hurdles can be similar to North America, but the market remains receptive to innovative solutions that meet rigorous safety standards.

Asia-Pacific region presents the fastest growth potential due to a rapidly expanding healthcare sector, rising disposable incomes, and increasing demand for affordable and high-quality pharmaceuticals. However, the level of development varies significantly within the region. While some countries boast established pharmaceutical industries, others are still in early stages of development. This creates a diverse market with opportunities for both established and new players offering cost-effective acidifying agents.

COVID-19 Impact Analysis on the Pharmaceutical Acidifying Agents Market:

The COVID-19 pandemic's impact on the pharmaceutical acidifying agents’ market has been a double-edged sword. Short-term disruptions arose from lockdowns and travel restrictions, causing initial hiccups in the supply chain for raw materials and leading to temporary shortages and price fluctuations. Additionally, the initial focus of the pharmaceutical industry shifted towards battling COVID-19, potentially causing a temporary dip in demand for acidifying agents used in non-COVID medications.

However, the long-term outlook appears positive. The pandemic's emphasis on rapid drug development could translate to a long-term rise in demand for novel acidifying agents that optimize the performance of these new medications. Furthermore, the pandemic's exacerbation of chronic conditions highlights the importance of managing chronic diseases, potentially leading to a rise in demand for acidifying agents used in medications for these conditions. Finally, the heightened awareness of sustainability during the pandemic could accelerate the adoption of bio-based acidifying agents, a segment already on the upswing.

While the COVID-19 pandemic caused some temporary disruptions, the focus on drug development, chronic disease management, and sustainability is expected to propel the pharmaceutical acidifying agents’ market forward in the coming years. The impact itself may vary depending on the region and its healthcare infrastructure, and the development of new COVID-19 treatments might create a need for specific acidifying agents suited for these formulations. As the situation continues to evolve, market players can adapt their strategies and capitalize on emerging trends to navigate this dynamic landscape.

Latest Trends/ Developments:

The pharmaceutical acidifying agents’ market is buzzing with innovation. The demand for natural and sustainable ingredients is driving the development of bio-based acidifying agents derived from organic sources. This eco-friendly approach aligns with growing environmental concerns. Additionally, advancements in drug delivery systems necessitate precise control over drug release. Novel acidifying agents are being developed to optimize these targeted systems, leading to potentially more effective treatments with fewer side effects. Furthermore, the rise of novel therapies like gene therapy creates a demand for specialized acidifying agents compatible with these unique drug delivery methods. Safety remains paramount, with research focused on developing acidifying agents that offer enhanced safety profiles and minimize side effects. Technological advancements in material science and analytical techniques are also playing a role, leading to the creation of more potent acidifying agents for even more precise control over drug formulation pH. This, in turn, has the potential to unlock a new generation of safer and more effective medications. Finally, the growth of the pharmaceutical industry in developing regions creates new markets for acidifying agent manufacturers. However, navigating regional regulations and preferences for specific acidifying agents is becoming increasingly important for market players to consider. By staying ahead of these trends and developments, manufacturers can position themselves for success in this dynamic and ever-evolving market.

Key Players:

-

BASF SE

-

Dow

-

DuPont

-

Eastman Chemical Company

-

Evonik Industries

-

Jungbunzlauer Suisse AG

-

Archer Daniels Midland Company

-

Cargill, Incorporated

-

Ingredion Incorporated

-

Tate & Lyle PLC

Chapter 1. Pharmaceutical Acidifying Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pharmaceutical Acidifying Agents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pharmaceutical Acidifying Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pharmaceutical Acidifying Agents Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pharmaceutical Acidifying Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pharmaceutical Acidifying Agents Market – By Type

6.1 Introduction/Key Findings

6.2 Citric Acid

6.3 Acetic Acid

6.4 Hydrochloric Acid

6.5 Phosphoric Acid

6.6 Other Acidifying Agents

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Pharmaceutical Acidifying Agents Market – By Application

7.1 Introduction/Key Findings

7.2 Oral Medications

7.3 Topical Medications

7.4 Injectable Medications

7.5 Ophthalmic Medications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Pharmaceutical Acidifying Agents Market – By End-Use

8.1 Introduction/Key Findings

8.2 Generic Drug Manufacturers

8.3 Brand Name Drug Manufacturers

8.4 Contract Development and Manufacturing Organizations (CDMOs)

8.5 Y-O-Y Growth trend Analysis By End-Use

8.6 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Pharmaceutical Acidifying Agents Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Pharmaceutical Acidifying Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Dow

10.3 DuPont

10.4 Eastman Chemical Company

10.5 Evonik Industries

10.6 Jungbunzlauer Suisse AG

10.7 Archer Daniels Midland Company

10.8 Cargill, Incorporated

10.9 Ingredion Incorporated

10.10 Tate & Lyle PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Pharmaceutical Acidifying Agents Market was valued at USD 3.65 billion in 2023 and is projected to reach a market size of USD 4.75 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 3.82%.

Surge in Innovative, pH-Sensitive Drugs, Chronic Disease Burden and Long-Term Medication Needs, Aging Population Focus on Drug Tolerability and Side Effects, Natural and Bio-based Trend for Sustainable Excipients.

Citric Acid, Acetic Acid, Hydrochloric Acid, Phosphoric Acid, Other Acidifying Agents.

The most dominant region for the Pharmaceutical Acidifying Agents Market is currently North America, boasting established players and a strong focus on innovative drug delivery systems.

BASF SE, Dow, DuPont, Eastman Chemical Company, Evonik Industries, Jungbunzlauer Suisse AG, Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC.