Phablet Market Size (2024 – 2030)

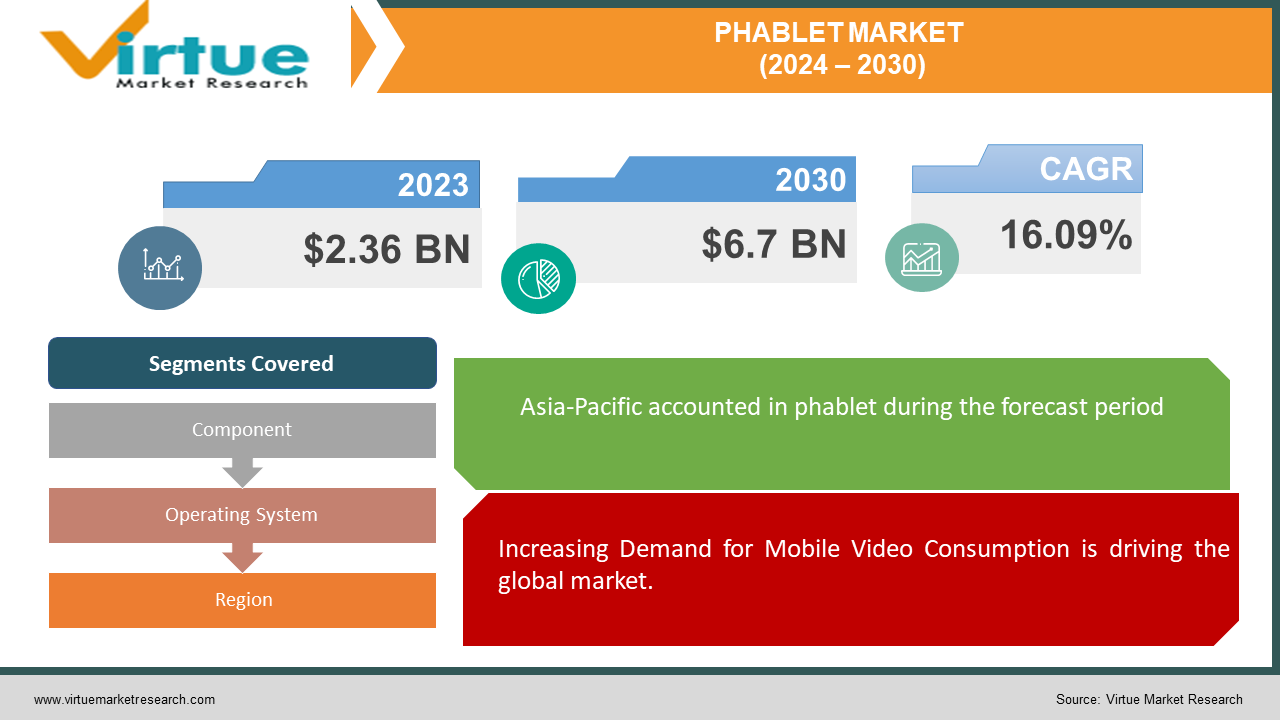

The Phablet Market was valued at USD 2.36 billion in 2023 and is projected to reach a market size of USD 6.7 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16.09%.

A "phablet" is a mobile device that combines the functions of a smartphone and a tablet. It features a screen that is larger than a normal phone screen but smaller than a tablet size. In recent years, the phablet market has grown significantly as consumers have begun to look for smartphones with large screens without sacrificing travel. Mid-range phablets have screens between 5.5 and 6.5 inches, respectable processing power, and passable camera quality. Their prices range from $200 to $500. High-end phablets costing more than $500 have screens larger than 6.5 inches, cutting-edge cameras, and powerful processors. The phablet market has seen rapid growth in recent years, mainly due to explosive growth in mobile video consumption and multitasking devices. Although companies such as Huawei, Xiaomi, and Oppo have made significant progress, Samsung and Apple continue to dominate this market worldwide. It is expected that the need for powerful mobile devices with large screens will continue for the foreseeable future, so it is expected that the phablet market will continue to grow.

Key Market Insights:

The phablet market is experiencing a significant increase in demand, which is driven by the integration of smartphones and tablets. Key insights reveal a growing interest in large-screen devices, fueled by improved media experiences and increased productivity demands. Additionally, advancements in display technology and 5G connectivity are shaping the market trends.

Phablet Market Drivers:

Increasing Demand for Mobile Video Consumption is driving the global market.

The main driver of the global phablet market is the increasing demand for mobile video consumption. More people stream video content on their mobile devices, increasing demand for devices with large screens that won't compromise motion. Phablets offer a more immersive visual experience than smartphones, even though they are smaller than smartphones. Due to the increasing number of websites that provide video content such as YouTube, Netflix, and Amazon Prime Video, there is now a strong demand for technology that can provide high-quality video content. Phablets with large, high-quality screens are the best option to meet this demand. Although they have smaller screens than smartphones, they can still be used while traveling and provide a superior viewing experience. During the forecast year, this trend is expected to continue as more consumers turn to their mobile devices for entertainment.

Increasing Demand for Multi-tasking Capabilities is fuelling the demand for phablets worldwide.

The growing demand for multitasking capabilities is another important factor driving the global phablet industry. People want a mobile device that can do many activities at the same time as many people use them for personal and professional purposes. Phablets offer large screen sizes that make it easy to use multiple apps at the same time while still being portable. As people increasingly rely on their mobile devices for productivity, the ability to multitask has become essential. More and more people are using their mobile devices as their primary work tools as remote work and flexible work arrangements are becoming more common. Large screens and powerful processors in phablets are ideal for satisfying this demand. Users can easily switch between work-related activities and entertainment with their ability to manage multiple programs at once. In the coming years, this trend is expected to continue, as more people use their mobile devices for work and productivity.

Phablet Market Restraints and Challenges:

The global phablet market is facing a major challenge due to the saturation of the smartphone market. Since these smartphones offer larger screens and more advanced features, consumers may not be able to upgrade to phablets, making it difficult for manufacturers to attract and retain consumers. Additionally, some customers may decide to go with a cheap phone or tablet because high-end phablets can be expensive. Mid-range phablets may not have all the expensive features and functions of high-end models, even if they manage to balance price and performance.

Phablet Market Opportunities:

The growing demand for 5G-enabled devices represents a huge opportunity for the global phablet market. Consumers will be looking for devices that can take advantage of faster download speeds as 5G networks become more common. Phablet makers can take advantage of this trend by offering 5G-enabled smartphones with large screens, which can provide consumers with a more immersive experience when streaming video content or using many applications at the same time.

PHABLET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

16.09% |

|

Segments Covered |

By Component, Operating System, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics Co. Ltd., Apple Inc, Sony Corporation, Motorola, Inc., ASUS, Inc., HTC Corporation, LG Display Co. Ltd., Micromax Ltd., Dell, Inc., Huawei Technologies Co. Ltd., ZTE Corporation |

Phablet Market Segmentation: By Component

-

Hardware

-

Software

-

Services

In 2023, Hardware, software, and services are the three categories into which the global phablet market can be divided. Screen displays, processors, batteries, and cameras are examples of hardware components while operating systems and applications are examples of software components. After-sales services, such as repairs and maintenance, are included in the service category. Due to the significant demand for devices with large screens and powerful processors, the computer hardware segment is expected to hold the market share. Due to the growing need for mobile applications, the software sector is also expected to see a significant increase. As customers look for aftermarket services while maintaining and repairing their appliances, the service sector is expected to grow.

In recent years, hardware advancements have played an important role in the evolution of the global phablet market. One of the main factors that increase is the endless search for improvements in performance and efficiency. Developers continue to push the limits of processing power, combining faster CPUs and GPUs, as well as larger RAM capacity, to meet the demands of increasing speed and multitasking capabilities. In addition, advances in camera technology have become key, and phablets now feature different lens configurations, high megapixel counts, and new image processing algorithms, meeting the emerging trend of mobile photography and videography. These hardware improvements not only improve the user experience but also contribute to market competition as consumers bring devices with higher performance and imaging capabilities. In addition, the integration of advanced sensors, such as fingerprint scanning and facial recognition systems, increases the value and security of phablets, thus promoting their acceptance by different segments of customers. Overall, hardware innovation continues to drive growth and diversification in the global phablet market, thereby driving consumer engagement and market expansion.

Software development plays an important role in the evolution of the global phablet market, affecting both consumer demand and device capabilities. One of the biggest drivers of growth is the development of sophisticated mobile applications designed to take advantage of the large screen and processing power of phablets. From productivity tools to media content creation tools, software systems continue to expand, providing users with diverse and immersive experiences. In addition, the integration of artificial intelligence (AI) and machine learning algorithms enhances the performance of phablets, from intelligent voice assistants to automatic camera optimization, increasing user interaction. These software innovations are not only appealing to consumers but also differentiate phablets from traditional phones, offering a segment of users looking for productivity and media capabilities. As a result, software innovations have a significant impact on the global phablet market, increasing adoption rates and influencing purchasing decisions.

Phablet Market Segmentation: By Operating System

-

Android

-

IOS

-

Windows

-

Others

In 2023, By operating the system, the global phablet market can be segmented into Android, iOS, Windows, and other segments. Due to the variety of devices available from different manufacturers at different price points, Android is gaining market share among phablet operating systems. Apple's iPhone Plus and Max models dominate iOS, the second largest segment in the market. Due to the small number of devices, Windows has a small market share, while less well-known operating systems such as Tizen and Sailfish are included in the "other" category. Looking ahead, Android and iOS are expected to continue to dominate, with other operating systems likely struggling to gain traction.

Android, the mobile operating system used worldwide, continues to have a significant impact on the global phablet market. Its open and flexible nature has contributed to the proliferation of phablets at different prices, allowing manufacturers to offer different devices that cater to different consumer preferences. One of the key factors in growing Android's influence in the phablet market is its strong ecosystem of applications and services, giving users access to a wide variety of tools, entertainment options, and experiences. new. In addition, Android compatibility with a wide variety of hardware configurations makes innovation in phablet design easy, allowing manufacturers to push the boundaries of performance, display technology, and connectivity features. As a result, Android-powered phablets have become synonymous with different capabilities, affordability, and high-end power, taking a significant share of the global smartphone market and driving the expansion of the segment. The phablet continues.

iOS, Apple's operating system for mobile devices, continues to shape the landscape of the global phablet market with its unique blend of user-centered design, robust security features, and seamless add-ons. One of the key factors driving the growth of iOS in the phablet market is Apple's relentless commitment to innovation, as evidenced by constant software updates and the introduction of innovative hardware technologies. The strong environmental connection between the devices promotes loyalty among consumers, thereby boosting the demand for iPhones and iPads, especially in the high-end segments. This loyalty translates into market share for iOS phablets, affecting industry trends and consumer preferences. In addition, the large selection of high-quality applications in the App Store is optimized for large screens that strengthen the user experience, strengthening the influence of iOS in the global phablet market as a player. Innovation is shaping market change.

Phablet Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region serves as the main source of the global phablet market, with several key factors driving both growth and innovation. With a rapidly growing middle class and urbanization, the region is seeing a huge demand for affordable and feature-rich mobile devices, positioning it as the primary battleground for phablet manufacturers. In addition, the penetration of Internet connections is growing, and the rise of digitalization across the region is increasing the acceptance of phablets as important tools for communication, entertainment, and productivity. In addition, the environment in manufacturing is strong and technical and technical contributes to the development of expensive phablet models that are tailored to the needs of different customers. As a result, Asia Pacific is not only developing an important market for phablets but also influencing global trends, shaping design aesthetics, strategies, and pricing strategies across the industry.

North America is an important region in the global phablet market, exhibiting significant growth factors shaping the industry's global landscape. With a growing number of technologists and strong consumer spending power, the region is a hotbed of innovation and adoption of innovative mobile technologies. Factors such as the increasing demand for large-screen devices, and the growing interest in multimedia consumption, production, and gaming, are driving the growth of the phablet market in North America. In addition, the arrival of 5G technology and its subsequent deployment in the region accelerates the adoption of phablets, while users are looking for devices that can combine the power of high-speed connectivity. In addition, the impact of North American technology giants and setting global trends and standards are increasing the region's influence on the phablet market as innovation and product offerings are exceedingly high, shaping consumer preferences and market dynamics. 'all over the world.

COVID-19 Impact Analysis on the Phablet Market:

The impact of the COVID-19 pandemic on the global phablet market is contradictory. In contrast, the economic downturn caused by the pandemic led to a reduction in consumer spending on non-essential goods such as electronic devices such as phablets. In some regions, this has led to a decline in phablet demand. Fortunately, the pandemic has increased reliance on virtual organizations and remote working, which has increased demand for devices with larger screens and better multitasking capabilities, such as phablets. This pandemic has increased the reliance on e-commerce, which has led to an increase in online sales of products such as phablets.

Latest Trends/ Developments:

Growing demand for phosphatidylserine is expected to drive market growth:

The phablet market continues with rapid technological advancements and changing consumer preferences. What is notable is the combination of a reduced plan previously only for high-end smartphones in the middle and budget system, thus democratizing the high-end plans. Democratization has fueled widespread adoption, especially in emerging markets, where consumers are looking for affordable and versatile devices. Additionally, manufacturers are pioneering improved display technologies, such as OLED and AMOLED displays, to deliver immersive experiences that support emerging trends such as augmented reality (AR) and virtual reality (VR). In addition, there is a focus on sustainability, where manufacturers are increasingly adding environmental and energy-efficient components to phablet designs to reduce environmental impact. Another important development is the expansion of 5G connectivity in phablet models, making data speeds faster and unlocking the full potential of cloud-based services and content streaming. Additionally, the rise of flexible phablets represents a paradigm shift in innovation, giving users the ability to seamlessly switch between phone and tablet models. Overall, the latest trends and developments in the global phablet market promise increased efficiency, better user experience, and access to advanced technology for consumers around the world.

Key Players:

-

Samsung Electronics Co. Ltd

-

Apple Inc

-

Sony Corporation

-

Motorola, Inc.

-

ASUS, Inc.

-

HTC Corporation

-

LG Display Co. Ltd.

-

Micromax Ltd.

-

Dell, Inc.

-

Huawei Technologies Co. Ltd.

-

ZTE Corporation

-

In October 2022, Apple released the iPhone 14 Plus, the first phablet iPhone, featuring a 6.7-inch display and A15 Bionic chip. It lacks a telephoto camera lens and LiDAR sensor but comes with an upgraded dual-camera system, Crash Detection, Emergency SOS via satellite, and the best battery life ever in an iPhone.

-

In February 2023, Samsung released the new Galaxy S23 series in India, featuring the Galaxy S23 Ultra with a built-in S Pen and a 200MP adaptive pixel rear camera. It also has Dual Pixel autofocus technology and Nightography for improved low-light photography. The Galaxy S23 series promises faster focus, clearer images, and epic details.

Chapter 1. PHABLET MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PHABLET MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PHABLET MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PHABLET MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PHABLET MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PHABLET MARKET – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. PHABLET MARKET – By Operating System

7.1 Introduction/Key Findings

7.2 Android

7.3 IOS

7.4 Windows

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Operating System

7.7 Absolute $ Opportunity Analysis By Operating System, 2024-2030

Chapter 8. PHABLET MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Component

8.1.3 By Operating System

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Component

8.2.3 By Operating System

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Component

8.3.3 By Operating System

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Component

8.4.3 By Operating System

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Component

8.5.3 By Operating System

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. PHABLET MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Samsung Electronics Co. Ltd

9.2 Apple Inc

9.3 Sony Corporation

9.4 Motorola, Inc.

9.5 ASUS, Inc.

9.6 HTC Corporation

9.7 LG Display Co. Ltd.

9.8 Micromax Ltd.

9.9 Dell, Inc.

9.10 Huawei Technologies Co. Ltd.

9.11 ZTE Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Phablet Market was valued at USD 2.36 billion and is projected to reach a market size of USD 6.70 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 16.09%.

The Global Phablet Market is driven by the increasing Demand for Mobile Video Consumption is the main driving factor of the Phablet Market.

Based on the Operating System, the Phablet Market is segmented into Android, IOS, and Windows.

Asia-Pacific is the most dominant region for the Phablet Market.

Apple Inc., Samsung, and Sony Corporation are the three major leading players in the Global Phablet Market.