PFAS Chemicals Market Size (2025 – 2030)

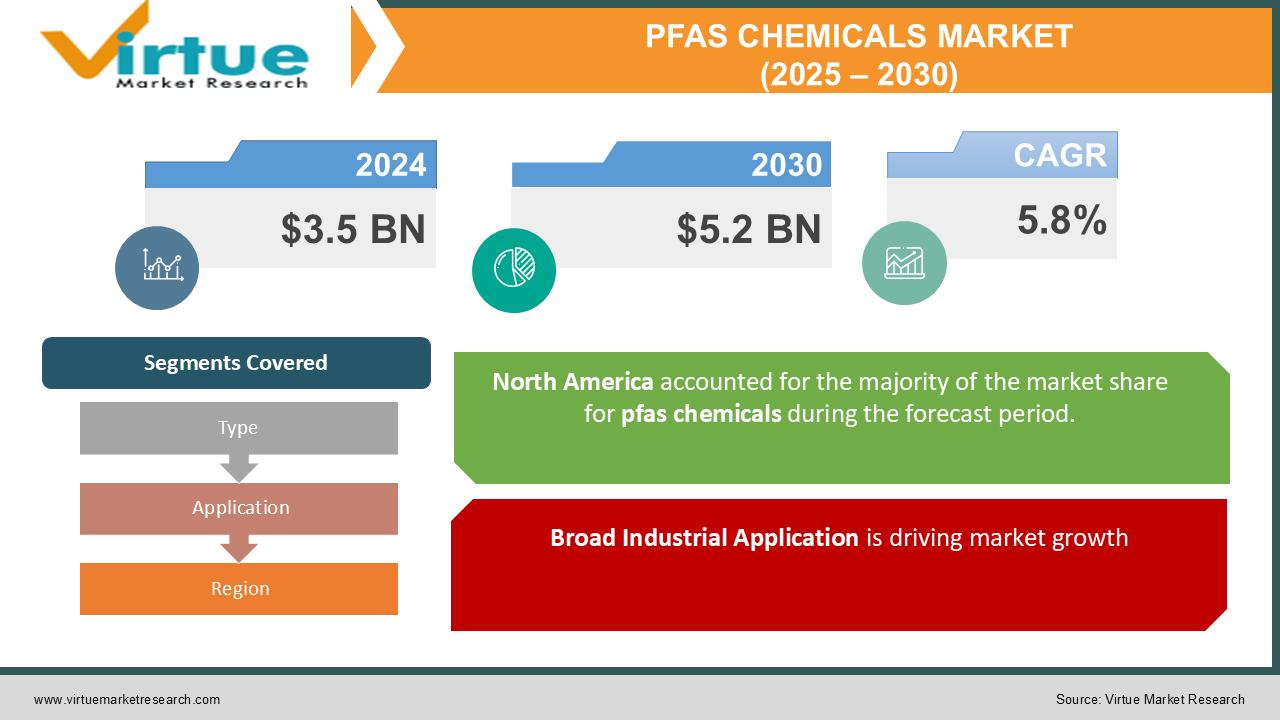

The Global PFAS Chemicals Market was valued at USD 3.5 billion in 2024 and will grow at a CAGR of 5.8% from 2025 to 2030. The market is expected to reach USD 5.2 billion by 2030.

PFAS (Per- and Polyfluoroalkyl Substances) Chemicals Market focuses on a group of synthetic compounds used in industrial applications for their unique properties, including water and oil repellency, temperature resistance, and chemical stability. These chemicals are extensively utilized in industries such as textiles, packaging, electronics, and firefighting. However, increasing regulatory scrutiny and growing environmental concerns are shaping the market dynamics.

Key Market Insights:

-

The packaging industry utilizes PFAS chemicals for grease-proof paper and cardboard, representing 18% of the market share.

-

Rising demand from the automotive sector, particularly for temperature-resistant materials, is projected to contribute to a CAGR of 6.2% during the forecast period.

-

Growing awareness regarding the environmental impact of PFAS is driving investment in alternative and biodegradable chemicals, expected to account for 15% of market growth by 2030.

-

North America holds the largest market share of 38%, with strong contributions from the U.S. due to its advanced industrial sector.

-

Asia-Pacific is the fastest-growing region, with a CAGR of 7%, driven by increasing demand in the textile and electronics industries.

-

Firefighting foam applications account for 12% of total market revenue, with a trend toward fluorine-free solutions reshaping this segment.

Global PFAS Chemicals Market Drivers:

Broad Industrial Application is driving market growth:

PFAS chemicals are indispensable across a wide range of industries due to their unique properties such as chemical stability, hydrophobicity, and temperature resistance. The chemical’s usage in non-stick cookware, automotive components, and firefighting foams ensures a steady demand. Additionally, the rise in disposable incomes has spurred growth in consumer goods that utilize PFAS chemicals, such as stain-resistant fabrics and high-performance electronics. The industrial application sector contributes significantly to the overall revenue, accounting for over 45% of the market share. Technological advancements are expected to further diversify the applications of PFAS chemicals, creating sustained growth opportunities.

Advancements in Consumer Goods is driving market growth:

The integration of PFAS chemicals into everyday consumer products has expanded their market penetration. These chemicals are critical for producing high-performance textiles, grease-proof packaging, and water-resistant outdoor gear. Growing consumer preference for premium, durable, and functional products in sectors like fashion, food, and healthcare is driving demand. Innovations such as fluoropolymer coatings in electronics, which enhance product lifespan and performance, are further propelling market growth. This diversification highlights the market's adaptability and resilience, contributing to its expansion at a steady pace.

Emerging Markets in Asia-Pacific is driving market growth:

Rapid industrialization and urbanization in Asia-Pacific regions have led to an increased demand for PFAS chemicals in textiles, electronics, and packaging. Countries like China and India are experiencing a surge in manufacturing activities, boosting market growth. Additionally, the presence of low-cost manufacturing facilities and supportive government policies for industrial growth are encouraging international players to invest in the region. The Asia-Pacific market is projected to grow at a CAGR of 7.5% during the forecast period, offering substantial opportunities for market expansion.

Global PFAS Chemicals Market Challenges and Restraints:

Regulatory Pressures and Environmental Concerns is restricting market growth:

The PFAS Chemicals Market faces significant challenges due to stringent environmental regulations. Increasing awareness about the health and environmental risks associated with PFAS chemicals, such as groundwater contamination and bioaccumulation, has led to bans and restrictions in several regions. Regulatory bodies like the EPA in the U.S. and the EU have enforced limits on PFAS usage, compelling manufacturers to explore alternatives. The cost and time required for transitioning to sustainable or non-PFAS chemicals are substantial, impacting market profitability.

Competition from Sustainable Alternatives is restricting market growth:

The growing shift towards eco-friendly solutions is presenting challenges for traditional PFAS chemicals. Biodegradable and non-toxic alternatives are gaining traction in industries such as textiles, packaging, and firefighting. While these alternatives promise lower environmental impact, their high cost and limited availability pose initial barriers to adoption. Nonetheless, with increasing research and government incentives, these sustainable solutions are anticipated to gain a significant market share, challenging conventional PFAS products.

Market Opportunities:

The PFAS Chemicals Market is poised for transformative growth through innovation and sustainability initiatives. Emerging research into fluorine-free and biodegradable chemicals presents significant opportunities for market players. Industries such as electronics and automotive are exploring advanced applications for PFAS chemicals, including semiconductors and temperature-resistant coatings, broadening the market’s scope. Additionally, investments in recycling technologies for PFAS-based products are gaining momentum, addressing environmental concerns while creating cost-effective supply chains. Collaborative efforts between governments, academia, and private sectors to establish global guidelines and promote responsible usage will also open doors to untapped opportunities in the market.

PFAS CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chemours, 3M, Arkema, Solvay, Daikin Industries, Dongyue Group, Gujarat Fluorochemicals Limited |

PFAS Chemicals Market Segmentation: By Type

-

Perfluorooctanoic Acid (PFOA)

-

Perfluorooctanesulfonic Acid (PFOS)

-

Polytetrafluoroethylene (PTFE)

-

Others

Polytetrafluoroethylene (PTFE) dominates the product segment, accounting for over 40% of the market due to its extensive use in electronics and automotive applications. PTFE’s exceptional thermal and chemical resistance makes it indispensable in these sectors.

PFAS Chemicals Market Segmentation: By Application

-

Textiles and Apparel

-

Food Packaging

-

Electronics

-

Automotive

-

Firefighting Foams

The electronics segment leads in applications, driven by the growing demand for PFAS chemicals in high-performance semiconductors and coatings. This segment holds 30% of the market share, underscoring its critical role in advancing technology.

PFAS Chemicals Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the PFAS Chemicals Market, contributing 38% to global revenue. This is attributed to the region's robust industrial base, significant advancements in electronics, and strict regulatory frameworks promoting sustainable practices. The U.S., in particular, is at the forefront, with continuous research and innovation in PFAS alternatives driving market evolution.

COVID-19 Impact Analysis on the PFAS Chemicals Market:

Initially, supply chain disruptions and reduced manufacturing activities hindered market growth, as the global economy faced significant slowdowns. Many industries, particularly those dependent on regular manufacturing cycles, saw a decline in demand. However, the pandemic also spurred a surge in demand for personal protective equipment (PPE), medical textiles, and packaging solutions, which provided a counterbalance to these challenges. PFAS chemicals played a critical role in ensuring the quality and durability of these products, particularly in the healthcare sector, where performance and reliability were paramount. PFAS chemicals are known for their water- and stain-resistant properties, making them essential in creating durable, high-performance products, especially in medical and protective gear. This led to increased use of PFAS in the production of items like PPE, which were in high demand during the pandemic. As the world moved toward post-pandemic recovery, efforts to strengthen supply chains and improve manufacturing resilience were prioritized. These investments have paved the way for a strong market rebound, with a renewed focus on the essential role of PFAS chemicals in a variety of industries. From healthcare to packaging, the ongoing demand for these versatile chemicals underscores their significance in meeting the needs of a rapidly changing global landscape. Moving forward, the PFAS chemicals market is poised for growth, driven by innovation, regulatory adjustments, and continued demand across key sectors.

Latest Trends/Developments:

The PFAS Chemicals Market is undergoing a significant shift towards sustainability and innovation as companies respond to growing regulatory and environmental concerns. In an effort to reduce the environmental impact of these chemicals, many manufacturers are investing in the development of fluorine-free alternatives and recycling technologies. These innovations are crucial for meeting stricter regulations and minimizing the harmful effects of PFAS chemicals on ecosystems. Additionally, partnerships between manufacturers and research institutions are accelerating the development of advanced PFAS applications in industries such as electronics and automotive. These collaborations are paving the way for the next generation of PFAS solutions, enabling more efficient and sustainable uses in high-tech industries that require specialized performance features. A key trend shaping the future of the PFAS chemicals market is the rise of digital platforms designed to monitor and manage PFAS usage in manufacturing processes. These platforms enhance transparency and ensure compliance with increasingly stringent regulations, helping companies track their environmental impact and mitigate risks associated with PFAS. Moreover, the emergence of biodegradable and eco-friendly PFAS products is expected to redefine market dynamics in the coming years. As consumer and regulatory pressures mount, the demand for environmentally friendly PFAS solutions is likely to increase, leading to a more sustainable future for the industry. This shift towards green practices, combined with technological innovations, positions the PFAS chemicals market for long-term growth and transformation.

Key Players:

-

Chemours

-

3M

-

Arkema

-

Solvay

-

Daikin Industries

-

Dongyue Group

-

Gujarat Fluorochemicals Limited

Chapter 1. PFAS Chemicals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PFAS Chemicals Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PFAS Chemicals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PFAS Chemicals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PFAS Chemicals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PFAS Chemicals Market – By Type

6.1 Introduction/Key Findings

6.2 Perfluorooctanoic Acid (PFOA)

6.3 Perfluorooctanesulfonic Acid (PFOS)

6.4 Polytetrafluoroethylene (PTFE)

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. PFAS Chemicals Market – By Application

7.1 Introduction/Key Findings

7.2 Textiles and Apparel

7.3 Food Packaging

7.4 Electronics

7.5 Automotive

7.6 Firefighting Foams

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. PFAS Chemicals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. PFAS Chemicals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Chemours

9.2 3M

9.3 Arkema

9.4 Solvay

9.5 Daikin Industries

9.6 Dongyue Group

9.7 Gujarat Fluorochemicals Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global PFAS Chemicals Market was valued at USD 3.5 billion in 2024 and is projected to reach USD 5.2 billion by 2030, growing at a CAGR of 5.8%.

Key drivers include broad industrial applications, advancements in consumer goods, and emerging markets in Asia-Pacific

By product: Perfluorooctanoic Acid, Perfluorooctanesulfonic Acid, Polytetrafluoroethylene, and Others. By application: Textiles, Food Packaging, Electronics, Automotive, and Firefighting Foams.

North America, contributing 38% of the market share, driven by advancements in electronics and robust regulatory frameworks.

Key players include Chemours, 3M, Arkema, Solvay, Daikin Industries, Dongyue Group, and Gujarat Fluorochemicals Limited.