Petroleum Tank Cleaning Market Size (2024 – 2030)

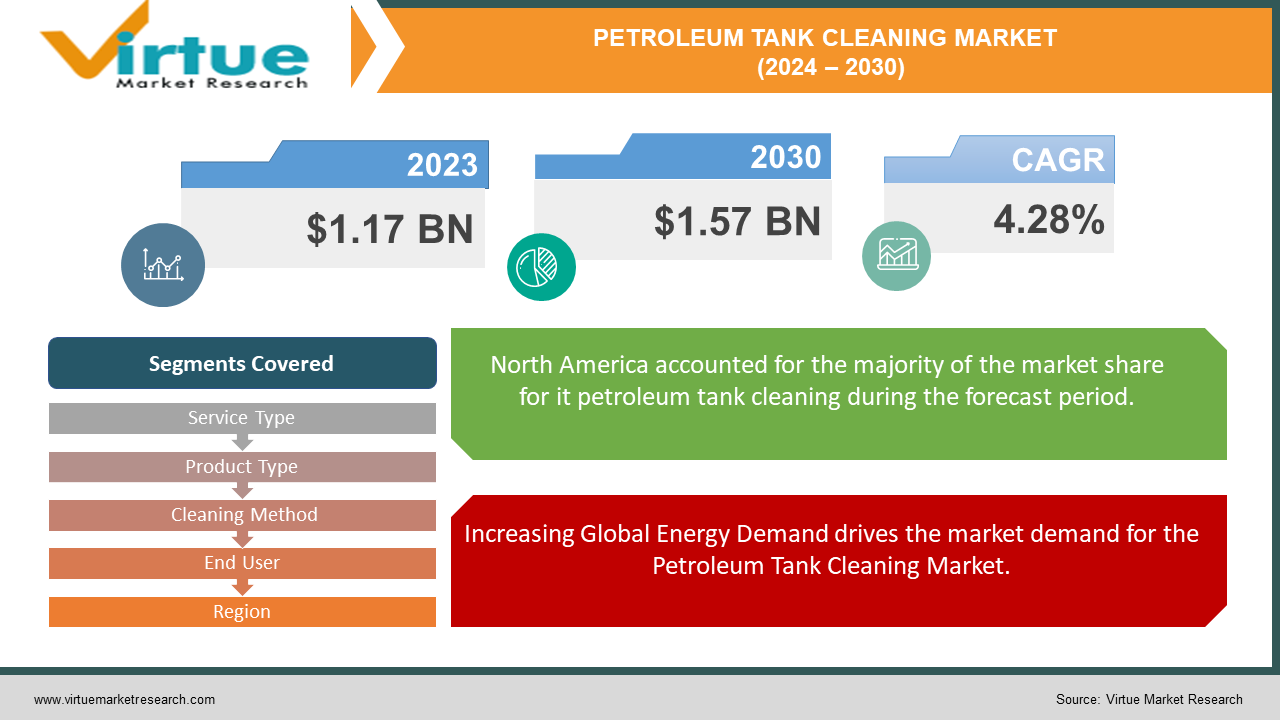

The Global Petroleum Tank Cleaning Market is valued at USD 1.17 Billion and is projected to reach a market size of USD 1.57 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.28%.

One of the most significant long-term drivers of the petroleum tank cleaning market is the increasing demand for oil and gas. As the global population grows and economies expand, the need for energy continues to rise. This demand drives the construction of new storage facilities and the maintenance of existing ones, including the regular cleaning of petroleum tanks to prevent contamination and ensure operational efficiency. An opportunity within this market is the growing adoption of automated cleaning technologies. Traditional tank cleaning methods can be time-consuming, hazardous, and costly. However, advancements in technology have led to the development of automated cleaning systems that can perform the task more efficiently and safely. Companies offering these innovative solutions can gain a competitive edge in the market, attracting clients looking for safer and more cost-effective cleaning methods.

A notable trend observed in the petroleum tank cleaning industry is the increasing emphasis on environmental sustainability. There is a growing awareness of the environmental impact of petroleum storage and the importance of sustainable practices. As a result, many companies are adopting eco-friendly cleaning agents and methods that minimize environmental harm. This trend is likely to continue as regulatory pressures and public awareness of environmental issues increase.

Key Market Insights:

The Petroleum Tank Cleaning Market is projected to expand at a compound annual growth rate of over 4.28% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Alfa Laval (Sweden), Veolia Environment S.A. (France), and Clean Harbors, Inc. (USA) are some examples of the Petroleum Tank Cleaning Market.

North America & Asia-Pacific accounts for approximately 75-80 % of the Petroleum Tank Cleaning Market, driven by Increasing Demand for Energy-Efficient Heating Solutions.

Petroleum Tank Cleaning Market Drivers:

Increasing Global Energy Demand drives the market demand for the Petroleum Tank Cleaning Market.

One of the primary drivers of the petroleum tank cleaning market is the rising global demand for energy. As the world's population grows and economies expand, the need for energy continues to surge. Petroleum remains a major source of energy, and its storage requires meticulous maintenance to ensure safety and efficiency. Regular cleaning of storage tanks is crucial to prevent contamination and degradation of stored products, ensuring a steady supply of clean and usable petroleum. This ongoing demand for energy thus fuels the need for frequent tank cleaning services, driving market growth.

Stringent Environmental Regulations drive the market demand for the Petroleum Tank Cleaning Market.

Environmental regulations play a significant role in driving the petroleum tank cleaning market. Governments and environmental agencies across the globe have implemented strict regulations to minimize the environmental impact of petroleum storage and handling. These regulations often mandate regular inspection and cleaning of storage tanks to prevent leaks, spills, and contamination of soil and water resources. Non-compliance can result in hefty fines and legal repercussions, compelling petroleum companies to invest in regular tank cleaning services to meet regulatory standards and avoid penalties.

Technological Advancements in Cleaning Methods drive the market demand for Petroleum Tank Cleaning Market.

Technological advancements have introduced more efficient, safer, and cost-effective methods for cleaning petroleum tanks, driving market growth. Traditional cleaning methods can be labor-intensive, time-consuming, and hazardous. However, new technologies, such as automated cleaning systems, robotic cleaners, and advanced chemical cleaning agents, have revolutionized the process. These innovations offer several benefits, including reduced downtime, lower operational risks, and enhanced cleaning effectiveness. Companies that adopt these advanced technologies can improve their operational efficiency and reduce cleaning costs, making the market more attractive and dynamic.

Focus on Operational Efficiency and Safety drives the market demand for the Petroleum Tank Cleaning Market.

Operational efficiency and safety are paramount concerns for petroleum companies, and these concerns drive the demand for regular tank cleaning. Clean storage tanks are essential for maintaining the quality and safety of stored petroleum products. Contaminants and residues in tanks can lead to product degradation, corrosion, and potential safety hazards, such as explosions or fires. Regular cleaning ensures that tanks remain in optimal condition, reducing the risk of accidents and operational disruptions. This focus on safety and efficiency drives petroleum companies to invest in reliable tank cleaning services, sustaining market demand.

Petroleum Tank Cleaning Market Restraints and Challenges:

Despite the numerous drivers propelling the growth of the petroleum tank cleaning market, the industry also faces significant challenges and restraints. One of the primary restraints is the high cost associated with cleaning operations. Petroleum tank cleaning is a complex and labor-intensive process that requires specialized equipment, trained personnel, and often the use of advanced technologies. These factors contribute to substantial operational costs, making regular tank cleaning a significant financial burden for many companies.

The high cost of tank cleaning is further exacerbated by the need to halt operations during the cleaning process. This downtime can lead to a temporary loss of production and revenue, which is particularly challenging for companies operating on tight margins. Small and medium-sized enterprises (SMEs) in the petroleum sector may find it especially difficult to afford frequent cleaning services, leading them to delay or skip necessary maintenance. This can result in long-term issues such as increased risk of contamination, corrosion, and potential safety hazards, ultimately impacting the overall efficiency and safety of their operations.

Petroleum Tank Cleaning Market Opportunities:

One of the most promising opportunities in the petroleum tank cleaning market is the increasing adoption of automated cleaning technologies. Traditional cleaning methods are often labor-intensive, time-consuming, and hazardous, requiring manual intervention and extensive safety precautions. Automated cleaning systems, including robotic cleaners and advanced mechanical devices, offer a safer, faster, and more efficient alternative. These technologies can navigate the complex interior of storage tanks, effectively removing sludge, residues, and contaminants with minimal human intervention.

The benefits of automation in tank cleaning are manifold. Automated systems reduce the need for manual labor, thereby minimizing the risk of accidents and exposure to hazardous materials. They also significantly cut down on cleaning time, reducing operational downtime and associated revenue losses for petroleum companies. Furthermore, the precision and consistency of automated cleaning ensure that tanks are thoroughly cleaned, maintaining high standards of safety and product quality. Companies that invest in and develop these advanced cleaning technologies can gain a competitive edge, attracting clients looking for more reliable and cost-effective solutions.

PETROLEUM TANK CLEANING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.28% |

|

Segments Covered |

By Service Type, Product Type, Cleaning Method, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alfa Laval (Sweden),Veolia Environnement S.A. (France), Clean Harbors, Inc. (USA), Ecorse Tank Services (USA), Tradebe Refinery Services (UK), BakerCorp (USA) , NCH Corporation (USA), Butterworth, Inc. (USA), HydrochemPSC (USA), SWS Environmental Services (USA) |

Petroleum Tank Cleaning Market Segmentation: By Service Type

-

Manual Cleaning

-

Automated Cleaning

Manual cleaning remains the largest segment in the petroleum tank cleaning market. Despite advancements in technology, many facilities still rely on manual methods due to their effectiveness in handling complex cleaning tasks that require human judgment and flexibility. Manual cleaning is often preferred for smaller tanks or facilities where investment in automated systems is not justified. This method provides thorough cleaning, especially in hard-to-reach areas, ensuring that all residues and contaminants are effectively removed.

Automated cleaning is the fastest-growing segment, driven by technological advancements and the need for increased safety and efficiency. Automated systems, including robotic cleaners and advanced mechanical devices, reduce the need for human intervention, lowering the risk of accidents and exposure to hazardous materials. These systems also shorten cleaning times and minimize operational downtime, making them an attractive option for large-scale facilities and companies looking to optimize their maintenance processes.

Petroleum Tank Cleaning Market Segmentation: By Product Type

-

Crude Oil Tanks

-

Refined Product Tanks

-

Gasoline Tanks

-

Diesel Tanks

-

Aviation Fuel Tanks

Crude oil tanks represent the largest segment by product type. These tanks are crucial for storing raw petroleum extracted from oil fields before it is processed into refined products. Due to the sheer volume and number of crude oil tanks globally, the demand for regular cleaning and maintenance is substantial. Keeping these tanks clean is essential to prevent contamination and ensure the quality of the crude oil, driving continuous demand for cleaning services.

Aviation fuel tanks are the fastest-growing segment, reflecting the rapid expansion of the aviation industry. The stringent safety standards in aviation fuel storage necessitate regular and thorough cleaning to maintain fuel quality and prevent contamination. As global air travel continues to grow, the demand for maintaining aviation fuel storage tanks is increasing, propelling the growth of this segment.

Petroleum Tank Cleaning Market Segmentation: By Cleaning Method

-

Mechanical Cleaning

-

Chemical Cleaning

-

Hydro-blasting

-

Robotic Cleaning

Mechanical cleaning is the largest segment by cleaning method. This traditional method involves the use of physical force to remove sludge, residues, and contaminants from tanks. Mechanical cleaning is widely used due to its effectiveness and applicability across various tank sizes and types, making it a staple in the industry.

Robotic cleaning is the fastest-growing segment, driven by innovations in automation and robotics. Robotic systems offer precise and efficient cleaning capabilities, significantly reducing the need for manual labor and enhancing safety. The ability to operate in hazardous environments and perform detailed cleaning tasks makes robotic cleaning an increasingly popular choice among petroleum companies.

Petroleum Tank Cleaning Market Segmentation: By End User

-

Oil & Gas Industry

-

Petrochemical Industry

-

Power Generation Industry

-

Others

The oil and gas industry is the largest end-user segment. This sector relies heavily on storage tanks for crude oil, refined products, and other petroleum derivatives, necessitating regular cleaning and maintenance to ensure operational efficiency and safety. The sheer scale of storage infrastructure in this industry underpins its dominant position in the market.

The petrochemical industry is the fastest-growing end-user segment. As demand for petrochemical products rises, so does the need for clean and well-maintained storage facilities. The growth of this sector, driven by increasing applications of petrochemicals in various industries, fuels the demand for advanced tank cleaning services to maintain high standards of product quality and safety.

Petroleum Tank Cleaning Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America stands as the largest region in the petroleum tank cleaning market. This dominance can be attributed to several factors. Firstly, North America, particularly the United States, is one of the largest producers and consumers of petroleum products globally. The region has a vast network of storage facilities, including refineries, terminals, and tank farms, all requiring regular maintenance and cleaning. Additionally, stringent environmental regulations in the U.S. and Canada necessitate regular inspection and cleaning of petroleum storage tanks to prevent leaks and contamination, driving the demand for tank cleaning services. Moreover, the presence of major oil and gas companies in North America, such as ExxonMobil, Chevron, and ConocoPhillips, further bolsters the market. These companies have significant investments in maintaining their storage infrastructure to ensure operational efficiency and compliance with regulatory standards. The advanced technological landscape in North America also supports the adoption of innovative cleaning solutions, such as automated and robotic cleaning systems, enhancing the market's growth in the region.

The Asia-Pacific region is the fastest-growing market for petroleum tank cleaning services. This rapid growth is driven by the region's burgeoning energy demand, fueled by rapid industrialization, urbanization, and economic development in countries like China, India, and Southeast Asian nations. As these economies expand, their consumption of petroleum products increases, necessitating the construction and maintenance of additional storage facilities. Furthermore, the Asia-Pacific region is witnessing significant investments in refining and petrochemical infrastructure. Many new refineries and storage facilities are being built to cater to the rising demand for petroleum products. This expansion requires regular maintenance and cleaning services to ensure the smooth operation and longevity of these facilities. Another factor contributing to the fast growth in the Asia-Pacific market is the increasing awareness and implementation of environmental regulations. Governments in the region are becoming more conscious of the environmental impact of petroleum storage and are enforcing stricter regulations to prevent contamination and ensure safety. This regulatory push drives the demand for regular tank cleaning services.

COVID-19 Impact Analysis on Petroleum Tank Cleaning Market:

During the height of the pandemic, global oil demand plummeted as countries imposed lockdowns, restricted travel, and halted industrial activities. This sudden drop in demand led to a significant reduction in oil production. With less oil being produced and stored, the need for petroleum tank cleaning services declined sharply. Many oil companies delayed or canceled scheduled maintenance and cleaning activities to cut costs amidst the economic uncertainty. This downturn in demand resulted in a temporary contraction of the market.

The financial strain caused by the pandemic forced many companies to reassess their budgets and prioritize essential operations. Non-essential activities, including routine tank cleaning and maintenance, were often postponed. This cost-cutting measure, although necessary for short-term financial stability, posed long-term risks such as increased contamination, corrosion, and potential safety hazards in petroleum storage facilities. The deferred maintenance could lead to higher costs and operational disruptions in the future.

Latest Trends/ Developments:

One of the most significant trends in the petroleum tank cleaning market is the increasing adoption of automated and robotic cleaning systems. These advanced technologies offer several benefits over traditional manual cleaning methods, including enhanced safety, efficiency, and cost-effectiveness. Robotic cleaners can navigate the interior of storage tanks, removing sludge and contaminants with precision and minimal human intervention. This reduces the risk of accidents and exposure to hazardous materials, making the cleaning process safer for workers. Additionally, automated systems can operate continuously, reducing downtime and increasing operational efficiency.

Key Players:

-

Alfa Laval (Sweden)

-

Veolia Environnement S.A. (France)

-

Clean Harbors, Inc. (USA)

-

Ecorse Tank Services (USA)

-

Tradebe Refinery Services (UK)

-

BakerCorp (USA)

-

NCH Corporation (USA)

-

Butterworth, Inc. (USA)

-

HydrochemPSC (USA)

-

SWS Environmental Services (USA)

Chapter 1. Petroleum Tank Cleaning Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Petroleum Tank Cleaning Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Petroleum Tank Cleaning Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Petroleum Tank Cleaning Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Petroleum Tank Cleaning Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Petroleum Tank Cleaning Market – By Service

6.1 Introduction/Key Findings

6.2 Manual Cleaning

6.3 Automated Cleaning

6.4 Y-O-Y Growth trend Analysis By Service

6.5 Absolute $ Opportunity Analysis By Service, 2024-2030

Chapter 7. Petroleum Tank Cleaning Market – By Product Type

7.1 Introduction/Key Findings

7.2 Crude Oil Tanks

7.3 Refined Product Tanks

7.4 Gasoline Tanks

7.5 Diesel Tanks

7.6 Aviation Fuel Tanks

7.7 Y-O-Y Growth trend Analysis By Product Type

7.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Petroleum Tank Cleaning Market – By Cleaning Method

8.1 Introduction/Key Findings

8.2 Mechanical Cleaning

8.3 Chemical Cleaning

8.4 Hydro-blasting

8.5 Robotic Cleaning

8.6 Y-O-Y Growth trend Analysis By Cleaning Method

8.7 Absolute $ Opportunity Analysis By Cleaning Method, 2024-2030

Chapter 9. Petroleum Tank Cleaning Market – By End-User

9.1 Introduction/Key Findings

9.2 Oil & Gas Industry

9.3 Petrochemical Industry

9.4 Power Generation Industry

9.5 Others

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Petroleum Tank Cleaning, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Service

10.1.2.1 By Product Type

10.1.3 By Cleaning Method

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Service

10.2.3 By Product Type

10.2.4 By Cleaning Method

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Service

10.3.3 By Product Type

10.3.4 By Cleaning Method

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Service

10.4.3 By Product Type

10.4.4 By Cleaning Method

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Service

10.5.3 By Product Type

10.5.4 By Cleaning Method

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Petroleum Tank Cleaning Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Alfa Laval (Sweden)

11.2 Veolia Environnement S.A. (France)

11.3 Clean Harbors, Inc. (USA)

11.4 Ecorse Tank Services (USA)

11.5 Tradebe Refinery Services (UK)

11.6 BakerCorp (USA)

11.7 NCH Corporation (USA)

11.8 Butterworth, Inc. (USA)

11.9 HydrochemPSC (USA)

11.10 SWS Environmental Services (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Petroleum Tank Cleaning Market is valued at USD 1.17 Billion and is projected to reach a market size of USD 1.57 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.28%.

Focus on Operational Efficiency and Safety, Technological Advancements in Cleaning Methods, Stringent Environmental Regulations & Increasing Global Energy Demand are the major drivers of the Petroleum Tank Cleaning Market.

Manual Cleaning & Automated Cleaning are the segments under the Petroleum Tank Cleaning Market by service type.

North America is the most dominant region for the Petroleum Tank Cleaning Market.

Asia-Pacific is the fastest-growing region in the Petroleum Tank Cleaning Market.