Petroleum Coke Market Size (2025 – 2030)

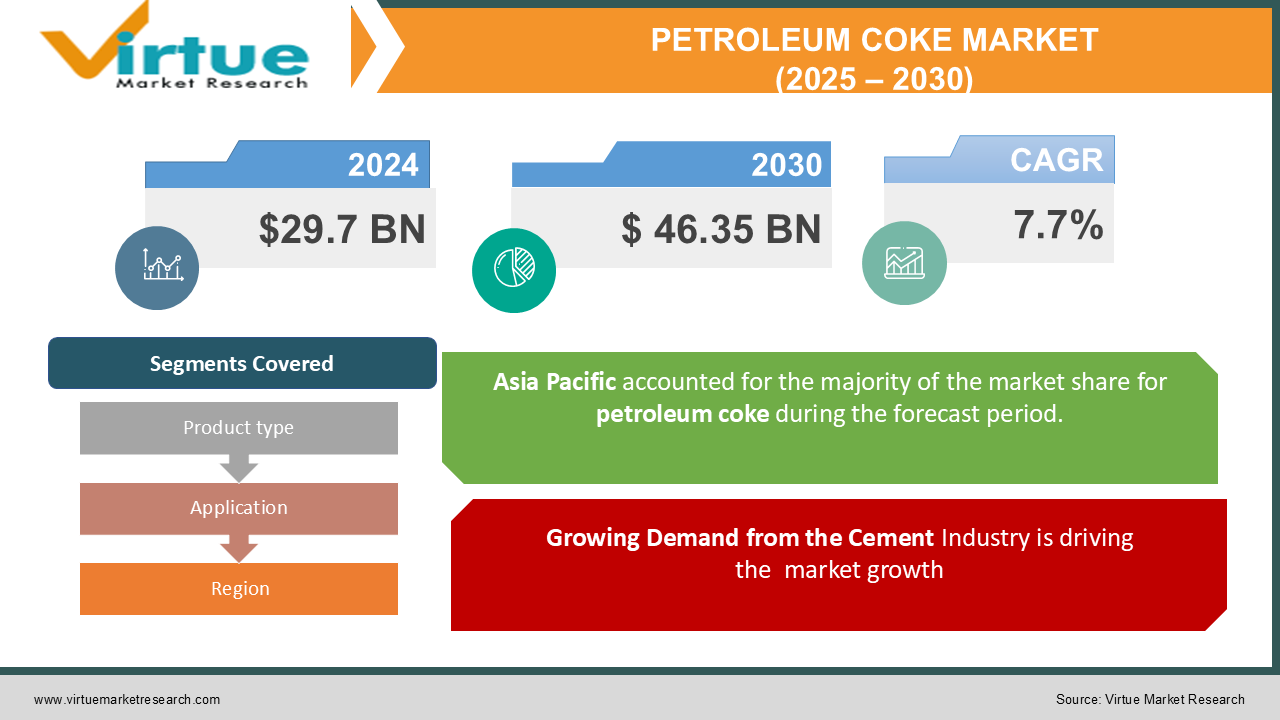

The Global Petroleum Coke Market was valued at USD 29.7 billion in 2024 and is expected to expand significantly, reaching approximately USD 46.35 billion by 2030 at a robust CAGR of 7.7% during the forecast period (2025–2030).

Petroleum coke, a by-product of crude oil refining, is a key industrial material widely used in energy generation and metallurgical processes. Its high calorific value, low ash content, and cost-effectiveness compared to other fuels make it highly desirable across multiple sectors.

Rising energy demand, particularly in emerging economies, and its application in manufacturing industries like aluminum, steel, and cement are driving market growth. With the increasing focus on cost-efficient and high-performance materials, the adoption of petroleum coke is likely to surge. However, environmental concerns regarding emissions and a push toward renewable energy sources could pose challenges to market expansion.

Key Market Insights

-

Fuel-grade petroleum coke accounted for over 75% of the market share in 2024, owing to its wide application in energy production and industrial processes.

-

The cement and aluminum industries are the largest consumers of petroleum coke, collectively contributing to over 50% of the total demand in 2024.

-

The calcined petroleum coke segment is expected to grow at a CAGR of 8.1%, supported by increasing applications in aluminum smelting and manufacturing high-performance materials.

Global Petroleum Coke Market Drivers

Growing Demand from the Cement Industry is driving the market growth

Petroleum coke is a critical fuel source in cement kilns due to its high calorific value and low cost compared to coal. The cement industry, which accounts for over 30% of the total petroleum coke consumption, heavily relies on this material for energy-intensive clinker production. Developing regions, particularly in Asia-Pacific and Latin America, are experiencing a construction boom, fueling cement demand and, in turn, driving the adoption of petroleum coke.

As infrastructure projects, including roads, bridges, and housing, accelerate, the need for reliable and economical energy sources like petroleum coke will continue to rise. For example, in countries like India, ongoing initiatives like Smart Cities Mission and affordable housing projects contribute to cement production growth, boosting petroleum coke demand.

Rising Energy Demand in Emerging Economies is driving the market growth

Rapid industrialization and urbanization in emerging markets are driving the demand for energy, particularly in regions like Asia-Pacific and Africa. Petroleum coke, being a cost-efficient and abundant energy source, is extensively used in power generation. As these economies focus on building their industrial base, petroleum coke has emerged as a preferred choice due to its affordability and high energy output.

For instance, China and India are significant consumers of fuel-grade petroleum coke in power plants and heavy industries. In these regions, petroleum coke complements the energy mix, supporting industrial growth while maintaining cost-efficiency.

Increasing Use in Aluminum Smelting is driving the market growth

The growing aluminum industry, particularly in sectors like construction, transportation, and packaging, is another key driver for the petroleum coke market. Calcined petroleum coke (CPC) is a vital raw material in aluminum smelting, where it is used as an anode. The expansion of global aluminum production, coupled with rising investments in renewable energy infrastructure and electric vehicles, is propelling the demand for CPC.

Countries like Bahrain, China, and Norway, which are leading aluminum producers, are witnessing increased consumption of calcined petroleum coke. This trend is expected to persist as aluminum continues to play a pivotal role in the transition to sustainable energy systems.

Global Petroleum Coke Market Challenges and Restraints

Environmental Concerns and Regulatory Challenges is restricting the market growth

The combustion of petroleum coke emits significant amounts of carbon dioxide (CO2), sulfur dioxide (SO2), and particulate matter, contributing to air pollution and greenhouse gas emissions. These environmental concerns have led to stricter regulations worldwide, particularly in developed regions like Europe and North America. For instance, the European Union Emission Trading System (EU ETS) imposes strict limits on industrial emissions, impacting the adoption of petroleum coke in energy and manufacturing sectors.

Governments are also encouraging the use of cleaner fuels and renewable energy sources to mitigate climate change, reducing petroleum coke's market share. While technological advancements in emissions control can alleviate some concerns, compliance with environmental regulations remains a significant challenge for market players.

Competition from Alternative Energy Sources is restricting the market growth

The global push toward sustainable energy solutions, such as solar, wind, and natural gas, is posing a threat to the petroleum coke market. Renewable energy technologies are becoming increasingly cost-competitive, challenging petroleum coke's position as an affordable energy source. Additionally, the availability of cleaner alternatives like liquefied natural gas (LNG) and low-sulfur coal is reducing petroleum coke's appeal in certain industries.

As countries invest in renewable energy infrastructure to meet their Net Zero goals, the demand for petroleum coke may face long-term constraints. This competition necessitates innovation and adaptation by petroleum coke producers to remain relevant in the evolving energy landscape.

Market Opportunities

The development of advanced refining technologies presents a significant opportunity for the petroleum coke market. These technologies improve the quality of petroleum coke, enabling its use in high-value applications like carbon products and advanced materials. For instance, innovations in coking processes can produce low-sulfur petroleum coke, which is more environmentally friendly and suitable for use in regions with stringent emission regulations. Another opportunity lies in emerging markets, where rapid industrialization and urbanization are creating a high demand for affordable energy sources. Countries in Africa and Southeast Asia are expanding their industrial and manufacturing capacities, driving the consumption of petroleum coke in power generation and heavy industries. The increasing adoption of petroleum coke in non-metallic applications, such as manufacturing carbon electrodes and graphite, also holds promise. These materials are essential in energy storage technologies like lithium-ion batteries, aligning with the global shift toward renewable energy and electric mobility.

PETROLEUM COKE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.7% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil Corporation, Chevron Corporation, Indian Oil Corporation, Reliance Industries Limited, BP plc, Saudi Aramco, Valero Energy Corporation, Shell plc, Phillips 66, Marathon Petroleum Corporation |

Petroleum Coke Market Segmentation - By Product Type

-

Fuel-Grade Petroleum Coke

-

Calcined Petroleum Coke

Fuel-grade petroleum coke dominates the market, driven by its extensive application in power generation and industrial processes. This type of coke, known for its high energy density and low moisture content, is a preferred fuel source for various industries, including cement production, steelmaking, and power plants. Its ability to generate high temperatures and consistent heat output makes it an efficient and cost-effective fuel option. As the global demand for energy continues to rise, coupled with increasing environmental regulations, fuel-grade petroleum coke is poised to remain a key player in the energy landscape, providing a reliable and affordable energy source.

Petroleum Coke Market Segmentation - By Application

-

Power Plants

-

Cement Industry

-

Aluminum Smelting

-

Steel Industry

-

Others

The cement industry has emerged as the largest consumer of petroleum coke, fueled by the global surge in infrastructure development projects. Petroleum coke, a byproduct of oil refining, offers a cost-effective and energy-dense fuel source for cement kilns. Its high calorific value and consistent quality make it an ideal substitute for traditional fuels like coal. As countries worldwide invest in building roads, bridges, and housing, the demand for cement has soared, driving the consumption of petroleum coke. Additionally, the increasing focus on energy efficiency and reducing carbon emissions has prompted cement manufacturers to explore alternative fuels, further boosting the demand for petroleum coke.

Petroleum Coke Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific is the largest market for petroleum coke, accounting for 45% of global revenue in 2024. The region's dominance is attributed to rapid industrialization, urbanization, and increasing energy demands in countries like China, India, and Indonesia. The availability of crude oil refining capacities and lower production costs also contribute to the region's leadership in the petroleum coke market. Meanwhile, North America and Europe are witnessing steady growth, supported by technological advancements and industrial applications. The Middle East & Africa region is emerging as a key market, driven by its expanding industrial base and growing infrastructure projects.

COVID-19 Impact Analysis

The COVID-19 pandemic disrupted the global petroleum coke market, with supply chain interruptions, reduced industrial activity, and lower energy consumption impacting demand. Key end-use industries like cement and steel experienced production slowdowns due to lockdowns and restrictions, directly affecting petroleum coke consumption. However, the post-pandemic recovery has been robust, with infrastructure development and industrial growth resuming at a fast pace. Governments worldwide are investing heavily in infrastructure projects to stimulate economic growth, boosting the demand for petroleum coke in cement and power generation. Additionally, the pandemic underscored the importance of cost-effective and reliable energy sources, reinforcing petroleum coke's position in emerging markets.

Latest Trends/Developments

The petroleum coke market is undergoing a significant transformation, driven by a growing emphasis on sustainability, technological advancements, and increasing demand from key industries. Manufacturers are focusing on producing low-sulfur petroleum coke to comply with stringent environmental regulations and expand their market reach. Advanced refining processes are being integrated to enhance product quality and efficiency, enabling the production of high-value petroleum coke for specialized applications. The expansion of industries in emerging markets, particularly in Southeast Asia and Africa, is driving the demand for petroleum coke as a critical input for various manufacturing processes. To address environmental concerns, companies are exploring Carbon Capture and Storage (CCS) technologies to mitigate emissions from petroleum coke combustion. Furthermore, the surge in demand for aluminum, fueled by the automotive and renewable energy sectors, is driving the consumption of calcined petroleum coke in aluminum smelting processes. These factors collectively contribute to the growth and evolution of the petroleum coke market.

Key Players

-

ExxonMobil Corporation

-

Chevron Corporation

-

Indian Oil Corporation

-

Reliance Industries Limited

-

BP plc

-

Saudi Aramco

-

Valero Energy Corporation

-

Shell plc

-

Phillips 66

-

Marathon Petroleum Corporation

Chapter 1. Petroleum Coke Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Petroleum Coke Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Petroleum Coke Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Petroleum Coke Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Petroleum Coke Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Petroleum Coke Market – By Product

6.1 Introduction/Key Findings

6.2 Fuel-Grade Petroleum Coke

6.3 Calcined Petroleum Coke

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Petroleum Coke Market – By Application

7.1 Introduction/Key Findings

7.2 Power Plants

7.3 Cement Industry

7.4 Aluminum Smelting

7.5 Steel Industry

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Petroleum Coke Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Petroleum Coke Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ExxonMobil Corporation

9.2 Chevron Corporation

9.3 Indian Oil Corporation

9.4 Reliance Industries Limited

9.5 BP plc

9.6 Saudi Aramco

9.7 Valero Energy Corporation

9.8 Shell plc

9.9 Phillips 66

9.10 Marathon Petroleum Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 29.7 billion in 2024 and is expected to reach USD 46.35 billion by 2030, growing at a CAGR of 7.7%.

Key drivers include rising demand from the cement industry, increasing energy needs in emerging economies, and growing use in aluminum smelting.

Segments include Product Type (Fuel-Grade Petroleum Coke, Calcined Petroleum Coke) and Application (Power Plants, Cement, Aluminum, Steel, Others).

Asia-Pacific leads the market, accounting for 45% of revenue in 2024, driven by industrial growth and energy demand.

Major players include ExxonMobil Corporation, Chevron Corporation, Indian Oil Corporation, and Reliance Industries Limited.