Petro-Based Surfactant EOR Market Size (2024 – 2030)

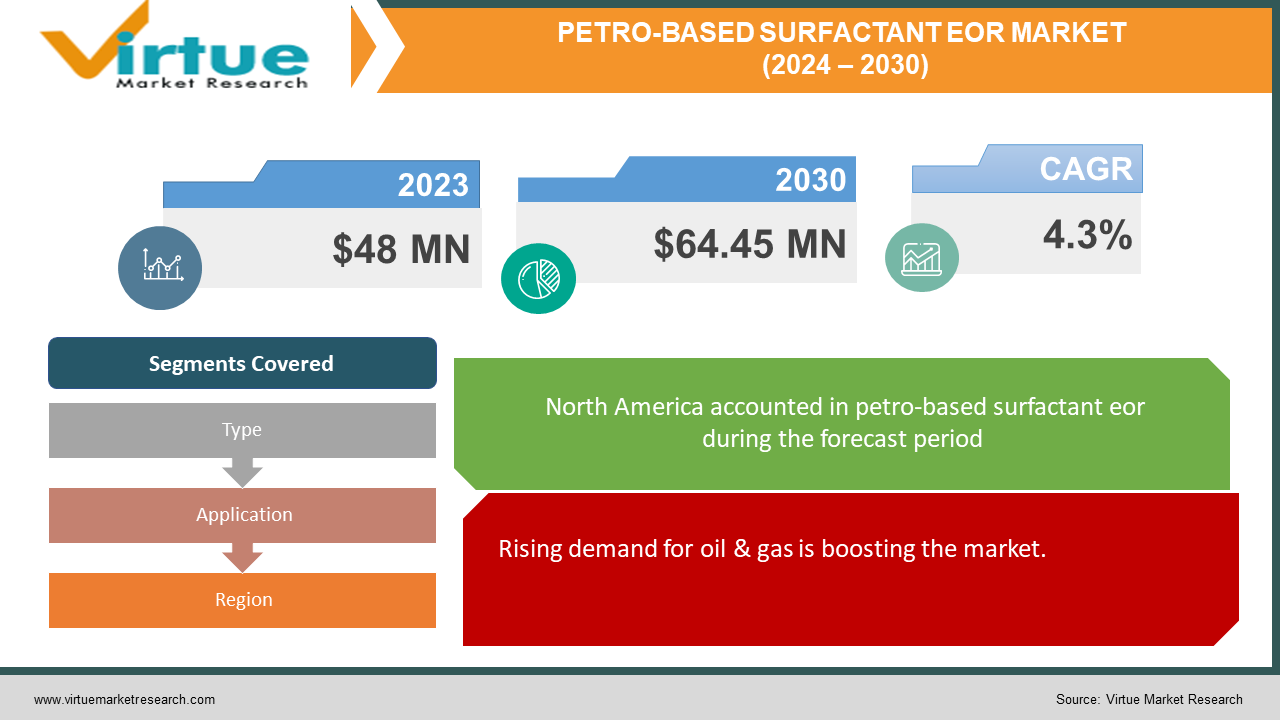

The global petro-based surfactant EOR market was valued at USD 48 million in 2023 and will grow at a CAGR of 4.3% from 2024 to 2030. The market is expected to reach USD 64.45 million by 2030.

Enhancing the recovery of crude oil from reservoirs by the application of surfactants produced from petroleum or petrochemical sources is known as petro-based surfactant EOR (Enhanced Oil Recovery). Surface-active agents, or surfactants, are chemical substances that can lessen the interfacial tension that exists between the surfaces of water, rock, and oil in a reservoir. This property makes it easier to mobilize and displace trapped oil.

Petro-based surfactant-enhanced oil recovery (EOR) involves injecting these surfactants into the reservoir with water or other fluids to modify the fluid's characteristics and boost the effectiveness of oil recovery procedures.

Key Market Insights:

The market has potential, but several obstacles prevent it from expanding. Significant obstacles that must be overcome for long-term market expansion include tight regulatory requirements, volatile oil prices hurting project economics, and environmental issues regarding the usage of petro-based surfactants.

Despite obstacles, there are plenty of chances for creativity. To lessen the effects on the environment, creating environmentally friendly formulations of petro-based surfactants is becoming more and more important. Furthermore, focused research efforts and technological developments are propelling the creation of surfactants suited for severe reservoir conditions.

The surfactant industry is undergoing notable technological progress and digitalization endeavors to enhance surfactant utilization and production procedures. The utilization of real-time data analytics is being employed to optimize productivity, reduce waste, and simplify processes. In the changing market scenario, these innovations are essential to preserving sustainability and competitiveness.

Global Petro-Based Surfactant EOR Market Drivers:

Rising demand for oil & gas is boosting the market.

The world's insatiable thirst for energy, fueled by a burgeoning population and economic growth, is putting immense pressure on existing oil and gas reserves. To meet this growing demand, the oil and gas industry is increasingly turning to Enhanced Oil Recovery (EOR) techniques, and petro-based surfactants are playing a critical role in this strategy. As readily available reserves dwindle, extracting every drop from existing fields becomes crucial. EOR utilizes advanced methods to coax more oil out of mature fields, and petro-based surfactants excel in this role. Their ability to lower the interfacial tension between oil and water allows for better oil mobilization, essentially making the oil flow more easily toward the well. This translates to a significant increase in oil production from existing wells, delaying the need to tap into more ecologically disruptive new exploration sites. While concerns about environmental impact are driving research into bio-based alternatives, the effectiveness and established track record of petro-based surfactants make them the current go-to solution for maximizing oil recovery and meeting global energy demands.

Maturing oil fields is accelerating the growth rate.

As existing oil fields reach their twilight years, a sense of urgency ripples through the oil and gas industry. With readily accessible reserves dwindling, maximizing production from these mature fields becomes paramount. These molecules act like microscopic janitors, clearing blockages and coaxing out the remaining oil. They can reduce interfacial tension, the energetic barrier between oil and water. Traditionally, oil clings stubbornly to rock surfaces within the reservoir. Petro-based surfactants disrupt this resistance, allowing water to penetrate the rock and sweep the trapped oil toward the well. This enhanced mobility translates to a significant boost in oil well productivity. The impact is far-reaching. By extending the lifespan of existing fields, petro-based surfactants delay the need to explore pristine areas, potentially reducing the environmental footprint of the oil and gas industry. However, their effectiveness comes with a caveat: their petroleum origin raises environmental concerns. This has spurred research into bio-based alternatives, but for now, petro-based surfactants remain the dominant solution in the fight to extract every last drop from aging oil fields.

The focus on heavy oil reserves is enabling the development.

Unlike conventional, lighter crude, heavy oil boasts a thicker, more viscous consistency that stubbornly resists flowing. Here's where petro-based surfactants shine. They can reduce interfacial tension, essentially weakening the bond between the heavy oil and the rock formations within the reservoir. This reduction in surface tension allows water injected during EOR processes to better penetrate the rock and mobilize the sluggish oil, enabling it to flow more freely towards the well. This enhanced mobility translates to a significant increase in the recovery rate of heavy oil reserves. The significance is amplified by the growing importance of these reserves in countries like Canada and Venezuela. As conventional oil sources become depleted, these heavy oil deposits offer a substantial alternative, and petro-based surfactants are the key to unlocking their potential. While concerns exist regarding their environmental footprint, their effectiveness in extracting heavy oil makes them a crucial tool for maximizing resource utilization and mitigating the need for further exploration in ecologically sensitive areas.

Global Petro-Based Surfactant EOR Market Challenges and Restraints:

Environmental issues are a major barrier.

A shadow looms over the utility of petro-based surfactants: their environmental impact. These chemical lifesavers for aging oil fields can be toxic to aquatic life, disrupting ecosystems if not properly managed. Their very nature, designed to break down barriers between oil and water, can also lead to unintended consequences. Improper disposal or spills can contaminate water sources, harming fish, plants, and the organisms that depend on them. The long-term effects on entire ecosystems are still being studied, but the potential for bioaccumulation and disruption of delicate food chains raises serious concerns. Furthermore, the production process for petro-based surfactants itself can generate harmful byproducts, adding another layer of environmental burden. This environmental tightrope walk necessitates strict regulations and responsible handling practices to ensure these benefits don't come at the cost of ecological damage.

Volatile oil prices create hindrances.

The rollercoaster of oil prices throws a wrench into the economic viability of EOR projects, thereby impacting the demand for petro-based surfactants. When oil prices soar, extracting that extra bit of oil using EOR becomes highly profitable. The additional oil recovered thanks to petro-based surfactants translates to a much better return on investment for oil companies. However, this rosy picture can turn bleak when oil prices plummet. Suddenly, the cost of EOR processes, including the petro-based surfactants themselves, starts to outweigh the value of the additional oil extracted. This economic seesaw effect discourages oil companies from investing in EOR, leading to a drop in demand for petro-based surfactants specifically designed for this purpose. This creates a precarious situation for the market, as it hinges on a factor outside its control: the global oil price.

Stringent regulations increase the complexity.

A tightening regulatory noose is another hurdle for the petro-based surfactant EOR market. Governments, increasingly concerned about environmental protection, are enacting stricter regulations on the oil and gas industry. These regulations can target two key areas impacting this market. Firstly, specific petro-based surfactants with particularly harmful environmental profiles might be banned or restricted. This could force companies to switch to less effective or more expensive alternatives, impacting profitability. Secondly, stricter regulations often translate to increased compliance costs. Oil companies might need to invest in additional infrastructure or procedures to ensure proper handling and disposal of petro-based surfactants. This can eat into their margins, making EOR projects with these surfactants less attractive. As regulations evolve, the market needs to adapt by developing more environmentally friendly petro-based options or finding cost-effective ways to comply with stricter environmental standards.

Global Petro-Based Surfactant EOR Market Opportunities:

The global petro-based surfactant EOR market presents exciting opportunities despite facing some challenges. Firstly, the ever-growing demand for oil and gas, fueled by population growth and economic development, necessitates maximizing output from existing reserves. Petro-based surfactants play a critical role in enhanced oil recovery (EOR) by enhancing oil well productivity in mature fields. This translates to extracting more oil before needing to explore ecologically sensitive areas. Secondly, the increasing importance of heavy oil reserves, particularly in regions like Canada and Venezuela, creates a tailor-made opportunity for petro-based surfactants. Their effectiveness in reducing interfacial tension allows for better mobilization of this viscous oil, significantly increasing recovery rates. Furthermore, advancements in technology are leading to the development of more targeted and efficient petro-based surfactants. For instance, research is ongoing to create formulations that are more resistant to harsh reservoir conditions like high temperatures and salinity, broadening their applicability. However, the environmental impact of petro-based surfactants cannot be ignored. This concern presents an opportunity for innovation in two key areas. Eco-friendly formulations that are biodegradable and less toxic can be used. By optimizing processes to minimize waste and ensure proper handling and disposal, the environmental footprint can be mitigated. Overall, the petro-based surfactant EOR market offers a unique solution for balancing the need for increased oil production with environmental responsibility. Through technological advancements, a focus on sustainability, and responsible use practices, this market can ensure efficient oil recovery while minimizing its environmental impact.

PETRO-BASED SURFACTANT EOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, The Dow Chemical Company, Halliburton Company, Chevron Corporation, Schlumberger Inc., Huntsman Corporation, Lubrizol Corporation, Sasol Ltd, Shell Chemicals, Solvay S.A. |

Petro-Based Surfactant EOR Market Segmentation: By Type

-

Anionic Surfactants

-

Cationic Surfactants

-

Non-Ionic Surfactants

Anionic surfactants are the largest and fastest-growing type due to their effectiveness and affordability. Internal olefin sulfonates (IOS) and sodium dodecyl sulfate (SDS) lower interfacial tension and boost oil recovery. To improve oil recovery rates, anionic surfactants are frequently more effective at lowering the interfacial tension between water and oil. They are also extensively employed since they are less expensive than other surfactant varieties and can be used in a variety of reservoir conditions.

Petro-Based Surfactant EOR Market Segmentation: By Application

-

Onshore EOR

-

Offshore EOR

Onshore EOR is the largest and fastest-growing application. Onshore, they shine due to their cost-effectiveness. Transportation is simpler, and infrastructure is readily available, making them the economically preferred choice. Onshore projects may be able to grow more quickly since they are subject to fewer environmental and regulatory constraints. In comparison to offshore EOR, onshore EOR technologies, including the use of surfactants, may be more developed and proven. EOR techniques on onshore fields may be adopted and implemented more quickly as a result of this maturity.

Petro-Based Surfactant EOR Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America reigns supreme with its mature oil fields in the US and Canada, driving demand for these recovery boosters. The region's impressive market expansion is attributed to various factors, including but not limited to technical advancements, favorable government policies, and substantial investments in oil and gas exploration and production. Asia-Pacific, however, boasts the fastest growth, fueled by rising oil needs and a focus on maximizing existing reserves, with China and India leading the charge. The requirement for enhanced oil recovery techniques to maximize output from mature and marginal oil fields is driven by rapid industrialization, urbanization, and infrastructural development. This has resulted in a greater adoption of petro-based surfactants. Europe presents a mature market with steady demand, but stringent environmental regulations may push innovation towards eco-friendly petro-based options or bio-based alternatives. While Latin America holds promise with its abundant heavy oil reserves, particularly in Venezuela, political and economic instability can act as a hurdle. Finally, the Middle East & Africa emerge as promising markets due to vast oil reserves and government efforts to boost production, but investment in infrastructure and technology will be crucial to unlocking their full potential.

COVID-19 Impact Analysis on the Global Petro-Based Surfactant EOR Market

The COVID-19 pandemic threw a curveball at the global petro-based surfactant EOR market. The initial shockwaves caused a drastic drop in oil demand, plummeting oil prices. This economic downturn made EOR projects, which rely on oil price viability, less attractive. This led to a decline in demand for petro-based surfactants specifically used in EOR. Supply chains also faced disruptions due to lockdowns and travel restrictions, impacting the production and transportation of these surfactants. However, as the global economy started to recover, oil demand rebounded, sending prices back up. This renewed focus on maximizing production from existing reserves, along with the inherent advantages of petro-based surfactants in EOR (effectiveness, established technology), is leading to a resurgence in demand. Looking ahead, the long-term impact of COVID-19 remains to be seen. The market's future hinges on a delicate balance: oil price stability, the development of more eco-friendly petro-based options to address environmental concerns, and navigating a potential shift towards bio-based alternatives.

Latest Trends/Developments

The petro-based surfactant EOR market is innovating on multiple fronts. Eco-friendly formulations aim to reduce environmental impact, while targeted surfactants are being developed for harsh environments and heavy oil. Digitalization and cost optimization are also playing a role, with real-time data used to optimize surfactant use and production processes streamlined to minimize waste. This focus on innovation ensures the continued viability of petro-based surfactants in the face of environmental concerns and a fluctuating oil price.

Key Players:

-

BASF SE

-

The Dow Chemical Company

-

Halliburton Company

-

Chevron Corporation

-

Schlumberger Inc.

-

Huntsman Corporation

-

Lubrizol Corporation

-

Sasol Ltd

-

Shell Chemicals

-

Solvay S.A.

Chapter 1. PETRO-BASED SURFACTANT EOR MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PETRO-BASED SURFACTANT EOR MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PETRO-BASED SURFACTANT EOR MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PETRO-BASED SURFACTANT EOR MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PETRO-BASED SURFACTANT EOR MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PETRO-BASED SURFACTANT EOR MARKET – By Type

6.1 Introduction/Key Findings

6.2 Anionic Surfactants

6.3 Cationic Surfactants

6.4 Non-Ionic Surfactants

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. PETRO-BASED SURFACTANT EOR MARKET – By Application

7.1 Introduction/Key Findings

7.2 Onshore EOR

7.3 Offshore EOR

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. PETRO-BASED SURFACTANT EOR MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. PETRO-BASED SURFACTANT EOR MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 The Dow Chemical Company

9.3 Halliburton Company

9.4 Chevron Corporation

9.5 Schlumberger Inc.

9.6 Huntsman Corporation

9.7 Lubrizol Corporation

9.8 Sasol Ltd

9.9 Shell Chemicals

9.10 Solvay S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global petro-based surfactant EOR market was valued at USD 48 million in 2023 and will grow at a CAGR of 4.3% from 2024 to 2030. The market is expected to reach USD 64.45 million by 2030.

Rising demand for oil & gas, maturing oil fields, and a focus on heavy oil reserves are the reasons that are driving the market.

Based on application, the market is divided into onshore EOR and offshore EOR.

North America is the most dominant region for the global petro-based surfactant EOR market.

BASF SE, The Dow Chemical Company, Halliburton Company, Chevron Corporation, Schlumberger Inc., Huntsman Corporation, Lubrizol Corporation, Sasol Ltd, and Shell Chemicals, Solvay S.A are the major players in the global petro-based surfactant EOR market.