Pet Monitoring Camera Market Size (2024 – 2030)

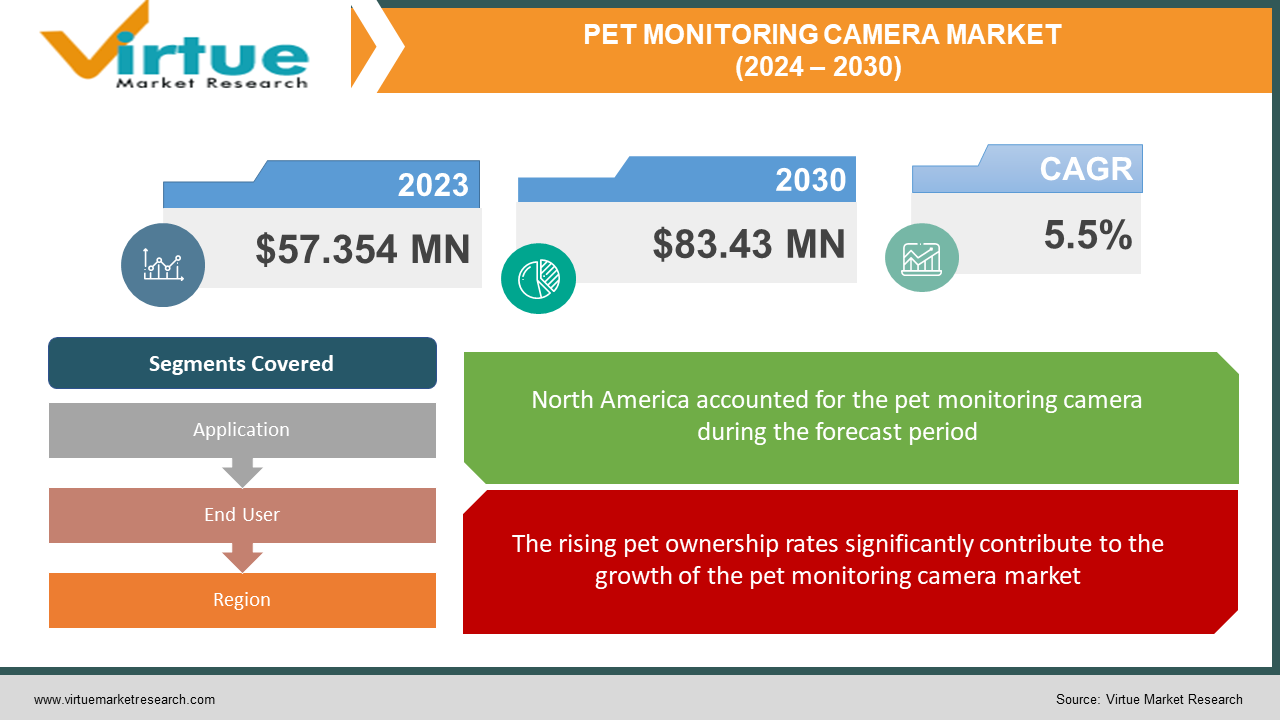

The pet monitoring camera market was valued at USD 57.354 million in 2023 and is projected to reach a market size of USD 83.43 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.5%.

Pet cameras offer real-time video streaming, enabling owners to keep an eye on their pets while they are away from home. Many pet monitoring cameras have built-in microphones and speakers, allowing owners to communicate with their pets remotely. This feature can be comforting for pets and help alleviate separation anxiety. Motion detection technology is often incorporated into these cameras, sending alerts to owners when significant movement is detected. This can be helpful to monitor the pet's activity and behavior. Pet monitoring cameras are typically connected to mobile apps, providing users with convenient access to live feeds and camera controls from their smartphones or tablets. The pet monitoring camera market is experiencing significant growth. The increasing number of pet owners, along with a growing trend toward considering pets as family members, has boosted the demand for pet monitoring solutions. Ongoing advancements in camera technology, connectivity, and mobile apps contributed to the development of more sophisticated and user-friendly pet monitoring cameras. Integration with smart home ecosystems and voice-controlled assistants added another layer of convenience for pet owners.

Key Market Insights:

The increasing number of households with pets has been a significant driver for the pet monitoring camera market. As more people consider pets as integral family members, the demand for technologies that enhance pet care and well-being has risen. Pet owners are becoming more conscious of their pets' health, behavior, and overall well-being. Pet monitoring cameras offer a solution for owners to keep a close eye on their pets even when they are not physically present, addressing concerns such as separation anxiety and behavior monitoring. Pet monitoring cameras are often designed to integrate seamlessly with smart home ecosystems. This integration allows users to control and monitor their pet cameras through voice commands or central smart home hubs, enhancing the overall user experience. Continuous innovation in camera technology has led to the incorporation of advanced features in pet monitoring cameras. Features such as high-definition video, two-way communication, motion detection, night vision, and treat dispensing contribute to the market's growth. Most pet monitoring cameras are accompanied by dedicated mobile applications. These apps provide users with a convenient way to access live video feeds, control camera settings, and receive alerts, fostering greater user engagement. Established brands like Furbo, Petcube, and Pawbo continue to dominate, but new entrants and startups contribute to market dynamism.

Pet Monitoring Camera Market Drivers:

The rising pet ownership rates significantly contribute to the growth of the pet monitoring camera market.

Pets are valued as companions and are known to provide emotional support to their owners. As more individuals and families recognize the positive impact of pets on emotional well-being, there is a growing inclination to bring pets into their homes. This emotional connection fuels the desire to stay connected with pets, even when owners are away, leading to increased demand for pet monitoring cameras. Urbanization and changing lifestyles often result in smaller living spaces and busier schedules. Despite limited space, people still desire the companionship of pets. In urban settings, where individuals may work long hours or live in apartments, pet monitoring cameras offer a solution to check on and interact with pets remotely. The trend of humanizing pets, treating them as family members rather than mere animals, has become more prevalent. With this humanization comes a heightened sense of responsibility for the well-being of pets, including their health, happiness, and overall quality of life.

Technological advancements play a crucial role in shaping the features and capabilities of pet monitoring cameras.

Improved camera sensors and optics enable pet monitoring cameras to offer high-definition video streaming. This enhancement allows pet owners to view clear and detailed live feeds of their pets, capturing their activities and behaviors in real time. Advanced audio technology, including built-in microphones and speakers, facilitates two-way communication between pet owners and their pets. This feature allows owners to talk to their pets and, in some cases, soothe them remotely, enhancing the interactive experience. Enhanced motion detection capabilities leverage advanced algorithms and sensors to detect movement and trigger alerts. Pet owners receive notifications when significant motion is detected, allowing them to check in on their pets and be alerted to potential issues or unusual behavior. Innovations in night vision technology enable pet monitoring cameras to provide clear visibility in low-light conditions or complete darkness. This is particularly useful for owners who want to monitor their pets during nighttime hours.

Pet Monitoring Camera Market Restraints and Challenges:

Privacy concerns represent a significant challenge in the adoption and acceptance of pet monitoring cameras.

Pet monitoring cameras, by design, capture live footage of the interior of homes. While the primary purpose is to monitor pets, the constant recording raises concerns about potential intrusion into the personal space of individuals and families. Users may worry about unintentionally capturing private moments and activities. Beyond the pet owners themselves, there is potential for family members, such as children or guests, to be captured on camera. This raises ethical considerations and may cause discomfort among those who are unaware or uncomfortable with being recorded, impacting overall household privacy.

The high cost of pet monitoring cameras with advanced features poses a significant challenge for market adoption.

The primary consequence of high costs is that it limits the affordability of advanced pet monitoring cameras for a segment of potential consumers. This is particularly relevant in price-sensitive markets or for individuals with budget constraints, where the perceived value may not justify the premium price. High pricing can lead to market segmentation, where advanced pet monitoring cameras cater primarily to a more affluent consumer base. This limits the accessibility of advanced features to a broader audience, potentially hindering the overall market penetration of these devices. The challenge lies in convincing consumers that the advanced features justify the higher cost.

Pet Monitoring Camera Market Opportunities:

Expanding integration with smart home ecosystems provides an opportunity to enhance the overall user experience. Collaborations with major smart home platforms and voice-activated devices can make pet monitoring cameras a seamless part of the connected home, allowing users to control and monitor devices through centralized hubs. Developing pet monitoring cameras with advanced health monitoring capabilities creates opportunities for addressing the growing emphasis on pet wellness. Integrating features such as activity tracking, behavior analysis, and health metrics allows pet owners to monitor and manage their pets' health proactively. Incorporating artificial intelligence (AI) and machine learning (ML) technologies present opportunities for enhancing the intelligence of pet monitoring cameras. These technologies can enable the cameras to learn and recognize specific pet behaviors, reducing false alarms and providing more accurate insights into the pet's activities. Recognizing the diversity in pet ownership, manufacturers could create specialized pet monitoring cameras tailored to the needs of various pets. For example, cameras with features specifically designed for monitoring small animals, like rodents or birds, can tap into niche markets. Addressing cybersecurity concerns and implementing robust privacy solutions presents a significant opportunity. Manufacturers can differentiate their products by prioritizing security features, encrypting data, and providing transparent privacy policies to build trust among users. Expanding the capabilities of pet monitoring cameras to include environmental monitoring features, such as temperature and air quality sensors, presents opportunities for addressing pet safety and comfort. This can be particularly relevant for pet owners with specific environmental concerns, such as those with reptiles or other temperature-sensitive pets. Offering subscription-based services, such as cloud storage plans, premium features, or extended warranty options, provides an additional revenue stream for manufacturers. This model allows pet monitoring camera companies to build long-term relationships with customers and enhance their overall value proposition. Collaborating with retail partners and exploring diverse distribution channels expands the market's presence. Strategic partnerships with pet supply stores, online retailers, and smart home device distributors can increase product visibility and accessibility. Exploring opportunities for global market expansion allows manufacturers to tap into diverse demographics and pet ownership trends worldwide. Understanding regional preferences and tailoring products to meet specific market needs can drive international growth.

PET MONITORING CAMERA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Furbo, Petcube, D-Link, Arlo, Samsung, Wagz, Petzi, Amazon, Skymee |

Pet Monitoring Camera Market Segmentation: By Application

-

Monitoring

-

Communication

-

Real-time Bark Alerts

-

Remote Training

-

Others

Monitoring is the most dominant application, accounting for approximately 40% of the market share in 2023. It allows pet owners to remotely check in on their furry friends through live streaming and recorded footage, providing peace of mind and ensuring their well-being when they're away. Communication is the fastest-growing segment, holding around 25% of the market share. It enables two-way audio communication between pet owners and their pets. This allows for interaction, reassurance, and even basic training remotely. Real-time bark alerts comprise about 15% of the market share and provide instant notifications to pet owners whenever their pet barks excessively. This can help identify potential distress, separation anxiety, or unwanted behavior. Remote training accounts for roughly 10% of the market share and allows pet owners to remotely reward good behavior or deter unwanted actions through audio cues or treat dispensers integrated into the camera. Video and photo capture make up around 5% of the market share and allow pet owners to capture precious moments or document potential incidents involving their pets remotely. Others include emerging applications like air quality monitoring, temperature sensors, and basic health tracking features, which currently hold a small market share of around 5%. These features have the potential for future growth as pet owners become increasingly concerned about their pets' overall health and well-being.

Pet Monitoring Camera Market Segmentation: by End User

-

Individual Pet Owners

-

Professional Pet Care Services

-

Veterinarians

-

Animal Shelters/Breeders

Individual pet owners are the largest and fastest-growing in this market with a share of around 80% in 2023. This segment consists of pet parents using cameras for personal pet monitoring and interaction. This dominance reflects the widespread adoption of pets and the growing desire for remote monitoring solutions. Professional pet care services include pet sitters, dog walkers, and boarding facilities that utilize cameras for remote check-ins, ensure animal welfare, and provide updates to pet owners. The veterinarian segment has applications like remote consultations, post-surgery monitoring, and tracking animal recovery progress driving its growth. The animal shelters and breeders segment currently has a minimal market share but holds potential for future growth. Cameras can help monitor rescued animals, showcase adoptable pets virtually, and provide insights to potential adopters.

Pet Monitoring Camera Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest market share in 2023 (around 32%); this region sees high pet ownership rates, tech adoption, and disposable incomes favoring camera sales. Europe accounts for roughly 28% of the market share in 2023. Stringent data privacy regulations pose challenges, but awareness and demand for pet monitoring solutions are growing. Asia-Pacific holds a significant share of 22% in 2023, with rapid growth potential driven by increasing pet ownership, rising disposable incomes, and urbanization. Countries like China and India showcase promising markets. South America represents a smaller share of around 10%; this region exhibits potential for future growth fueled by rising pet ownership and improving internet infrastructure. North America currently dominates the market due to several factors, such as the high prevalence of tech-savvy pet owners, established distribution channels for smart home devices, a well-developed pet care industry, and strong marketing and promotion of these devices. Asia-Pacific is expected to witness the fastest growth due to, a rapidly growing middle class with rising disposable incomes, increasing pet ownership trends, particularly in China and India, growing internet penetration and tech adoption, and government initiatives promoting smart home technologies.

COVID-19 Impact Analysis on the Global Pet Monitoring Camera Market.

During lockdowns and social distancing measures, there was a notable surge in pet adoption as people sought companionship. The increased number of pets in households likely led to a growing interest in pet-related products, including pet monitoring cameras. With more people working from home, the demand for solutions to monitor and interact with pets remotely likely increased. Pet monitoring cameras, offering features like live video streaming and two-way communication, became valuable tools for pet owners working away from home. The pandemic accelerated the shift towards online shopping. Pet owners, looking for convenient ways to purchase pet-related products, may have increasingly turned to online platforms to buy pet monitoring cameras, contributing to the growth of e-commerce in this market. The heightened focus on health and well-being during the pandemic extended to pets. Pet owners may have been more inclined to invest in technologies that enhance their ability to care for and monitor the health of their pets, including the use of pet monitoring cameras. The pet tech industry, like many others, experienced disruptions in the supply chain due to global lockdowns and restrictions. Manufacturing delays, shipping challenges, and shortages of components could have impacted the availability of pet monitoring cameras in the market. Economic uncertainties during the pandemic may have influenced consumer spending patterns. While some pet owners may have invested in premium pet monitoring cameras with advanced features, others might have opted for more budget-friendly options or delayed non-essential purchases.

Latest Trends/ Developments:

The integration of artificial intelligence (AI) and machine learning (ML) in pet monitoring cameras has been a growing trend. This allows the cameras to better recognize and interpret pet behaviors, reducing false alarms and providing more accurate insights into a pet's activities. Manufacturers have been focusing on incorporating health monitoring features into pet cameras. This includes tracking a pet's activity levels, monitoring vital signs, and providing insights into overall health and wellness. Some cameras are designed to detect abnormal behaviors that may indicate health issues. Mobile applications accompanying pet monitoring cameras have become more sophisticated. These apps allow pet owners to not only view live video feeds but also interact with their pets' use of features like treat dispensing, two-way communication, and even playing games remotely. Pet monitoring cameras are increasingly designed to integrate seamlessly with smart home ecosystems. This allows users to control and monitor their pet cameras alongside other smart home devices, creating a more cohesive and interconnected home environment. Some pet cameras now come equipped with 360-degree monitoring capabilities, or PTZ features, allowing users to remotely pan, tilt, and zoom the camera lens for a comprehensive view of their pet's surroundings. This enhances the flexibility and coverage of monitoring. Pet monitoring cameras incorporate environmental sensors, such as temperature and air quality sensors. This trend addresses the need for pet owners to ensure that their pets are in a comfortable and safe environment, especially when monitoring pets in different areas of the home. Many pet monitoring cameras offer cloud storage for recorded footage, providing users with the ability to access historical data. Some manufacturers are also introducing subscription-based services, offering additional features, extended cloud storage, or premium support as part of subscription packages. Given the increasing awareness of cybersecurity and privacy concerns, manufacturers are prioritizing security features in pet monitoring cameras. This includes encryption of data, secure login procedures, and features that allow users to customize privacy settings and control access to the camera. Pet monitoring camera brands are actively engaging with users through social media platforms. Some cameras allow users to easily share photos or video clips of their pets directly from the app. Manufacturers are also fostering user communities where pet owners can share experiences and tips.

Key Players:

-

Furbo

-

Petcube

-

D-Link

-

Arlo

-

Samsung

-

Wagz

-

Petzi

-

Amazon

-

Skymee

Chapter 1. PET MONITORING CAMERA MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PET MONITORING CAMERA MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PET MONITORING CAMERA MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PET MONITORING CAMERA MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PET MONITORING CAMERA MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PET MONITORING CAMERA MARKET – By Application

6.1 Introduction/Key Findings

6.2 Monitoring

6.3 Communication

6.4 Real-time Bark Alerts

6.5 Remote Training

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. PET MONITORING CAMERA MARKET – By End User

7.1 Introduction/Key Findings

7.2 Individual Pet Owners

7.3 Professional Pet Care Services

7.4 Veterinarians

7.5 Animal Shelters/Breeders

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. PET MONITORING CAMERA MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Application

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Application

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Application

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Application

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. PET MONITORING CAMERA MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Furbo

9.2 Petcube

9.3 D-Link

9.4 Arlo

9.5 Samsung

9.6 Wagz

9.7 Petzi

9.8 Amazon

9.9 Skymee

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Rising pet ownership rates and disposable incomes, increased anxiety about leaving pets alone due to busy lifestyles, advancements in technology, like AI-powered features and integration with smart home ecosystems, and focus on pet health and wellness, with features like air quality monitoring and temperature sensors are the key factors.

Privacy concerns regarding data security and the ethical use of pet data are crucial considerations. Complexities in setup and user interface can deter non-tech-savvy users. High-speed internet requirements can limit accessibility in some areas.

Established players like Furbo, Petcube, D-Link, and Samsung hold significant market share. Innovative startups like Wagz, Petzi, YI Technology, Skymee, and PetChatz are bringing unique features and functionalities.

The market is expected to see continued growth in the coming years, driven by rising pet ownership, increasing disposable incomes, and technological advancements. Focusing on responsible use, data privacy, and user-friendly design will be key to sustained success.

Increasing adoption of AI-powered features like pet recognition and behavior analysis. Subscription-based services offer additional value like cloud storage and veterinary consultations.