Pet Medication Market Size (2024 – 2030)

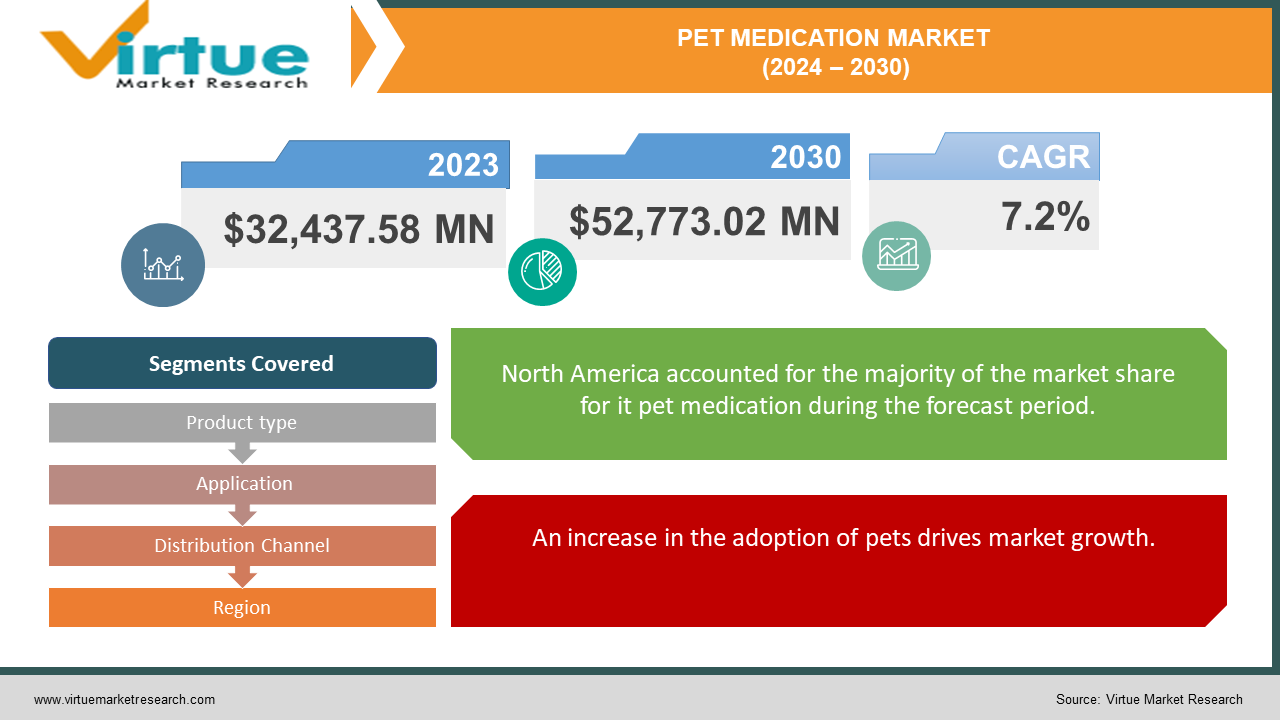

The Pet Medication Market was valued at USD 32,437.58 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 52,773.02 million by 2030, growing at a CAGR of 7.2%.

"Pet Medication" refers to products designed to prevent and treat diseases, as well as to enhance and extend the lives of companion and farm animals. These products encompass parasiticides, vaccines, anti-infectives, medical feed additives, and other related items. The global pet medication market is expected to grow, fueled by the trend of pet humanization and the commercialization of a wide variety of pet care products. This growth is further supported by the increasing focus on food safety and the emphasis on raising healthy livestock.

The global pet medication market is expected to grow, propelled by the trend of pet humanization and the increasing commercialization of a wide array of pet care products. This growth is further supported by a growing emphasis on food safety and an increased focus on raising healthy livestock.

Key Market Insights:

Pet owners are increasingly recognizing the importance of pet healthcare. This growing awareness is significantly driving the expansion of the pet medication market, as they seek accessible and effective healthcare solutions for their beloved companions.

Pet Medication Market Drivers:

An increase in the adoption of pets drives market growth.

The increasing disposable income among middle-income pet owners and the growing trend of nuclear families are major drivers of the pet care market's growth in the coming years. Additionally, the rise in pet adoption and high demand for pet products are propelling the global pet medication market. As more pet owners treat pets as family members, the pet market is expected to experience significant growth shortly.

Rising demand for pet insurance policies increases market growth.

Market expansion is expected to be driven by the increasing adoption of pet health insurance to cover veterinary services in developed countries. The pet health insurance market is flourishing in Canada, the United Kingdom, and Sweden. In China, the use of pet health insurance has risen rapidly. Two key factors contributing to the growth of pet healthcare insurance are the increasing popularity of pets and the growing awareness and understanding of pet health.

Livestock Population drives market growth.

The global livestock population has been rapidly growing over the past few decades, particularly in developing economies where demand for livestock products is on the rise. According to the 19th Animal Census Report, India had a livestock population of approximately 512 million. Concerns about food security and the rise in animal husbandry occupations are driving the demand for veterinary pharmaceuticals and vaccines for livestock. The increasing demand for animal products has intensified livestock production worldwide. Additionally, factors such as changing food preferences due to evolving lifestyle habits and population growth are further boosting the demand for livestock products.

Pet Medication Market Restraints and Challenges:

High cost related to veterinary medicines hinders market growth.

However, the market for veterinary pharmaceuticals is expected to experience a slower growth rate due to the high cost of these products. The industry's growth will also be impeded by the rising prevalence of infections and the increasing number of counterfeit medications. Additionally, the COVID-19 outbreak and lack of awareness, coupled with the emergence of unfavorable conditions, will present further challenges for the industry during the projected period.

Pet Medication Market Opportunities:

The development of pet care store infrastructure in various countries worldwide is expected to boost the consumption of pet-related products, thereby increasing opportunities in the market. Additionally, the rise of specialized online platforms offering curated pet care products and subscription-based services presents a significant opportunity, enhancing convenience and accessibility within the pet care industry.

PET MEDICATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zoetis, Taconic Biosciences, Elanco, Merck, Aratana Therapeutics, Merial, Kindred Biosciences, Entest Biomedical, Bayer, Boehringer |

Pet Medication Market Segmentation: By Product Type

-

Antibiotics

-

Antimicrobials

-

Antiparasitics

-

Chemotherapeutics

Antibiotics lead the pet medication market segment. When a veterinary surgeon identifies a high risk of disease, preventative (prophylactic) use of antibiotics is necessary to prevent bacterial infections in individual animals or groups, ensuring their welfare.

Antiparasitics represents the fastest-growing segment in the market. When an animal is treated with an antiparasitic drug, susceptible parasites die, while resistant parasites survive and pass on resistance genes to their offspring.

Pet Medication Market Segmentation: By Application

-

Cat

-

Dog

-

Horse

-

Fish

-

Other

The production animal market segment held the top position, accounting for over 55.0% of global revenue. This segment includes subcategories such as fish, swine, cattle, poultry, sheep, and goats. The increasing global demand for dietary protein drives the dominance of production animals in the market.

The widespread acceptance of production animals is also attributed to rising spending on animal healthcare, especially in developed nations. The USDA's National Agricultural Statistics Service previously estimated the total value of eggs, broilers, turkey, and chicken sales at USD 35.5 billion.

Due to the increase in chronic conditions, the companion animal segment is expected to grow at the highest CAGR over the forecast period. These factors are anticipated to drive market expansion during the projected period.

Pet Medication Market Segmentation: By Distribution Channel

-

Pharmacy

-

Pet Specialty

The pharmaceuticals segment accounted for the largest revenue share, making up 67.58% of the market. This segment primarily includes anti-inflammatory drugs, parasiticides, anti-infectives, and others. The biologics segment is anticipated to experience the fastest market growth from 2024 to 2030. This growth can be attributed to increasing animal health expenditure, availability of veterinary medicines, R&D activities, product launches by key companies, and the rising prevalence of diseases in animals. For example, in April 2022, Boehringer Ingelheim introduced RenuTend, a novel stem cell therapy for horses designed to treat tendon and suspensory ligament injuries.

According to estimates by the American Pet Products Association, Inc., pet owners spent approximately USD 136.8 billion on their companion animals in 2022, marking a significant increase from the USD 123.6 billion spent in 2021. Of the total expenditure in 2022, around USD 35.9 billion was allocated to veterinary care and product sales, encompassing routine veterinary services, pharmaceutical sales, and other clinic-related products, as well as surgical procedures. This upward trend is anticipated to persist in the future, thereby stimulating growth in the veterinary medicines market.

Pet Medication Market Segmentation- by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, North America led the market with a dominant revenue share of 32.23%. This leadership is driven by the presence of key companies, high expenditure on pets, increasing pet humanization, and growing awareness of animal diseases. Key market leaders like Zoetis, Merck & Co., Inc., Elanco Animal Health, and Vetbiologics, based in the U.S., are actively pursuing strategic initiatives to bolster their market footprint. For instance, in September 2023, Elanco introduced Varenzi-CA1, a product conditionally approved by the U.S. FDA, designed to manage non-regenerative anemia in cats suffering from chronic kidney disease (CKD).

Meanwhile, the Asia-Pacific region is projected to emerge as the fastest-growing market for pet medication over the forecast period. This growth is attributed to factors such as the expanding affluent middle-class population with a strong inclination towards fostering functional and emotional bonds with pets to fulfill relationship needs. The rise of anthropomorphism, influencing attitudes towards animal welfare and protection, and an increase in pet care spending equivalent to family healthcare spending further drive this trend.

COVID-19 Pandemic: Impact Analysis

The market experienced a subdued growth rate during 2019-2020, primarily due to the impact of COVID-19 and veterinary diseases like African Swine Fever. However, the market rebounded in 2021 as veterinary care services were recognized as essential in key countries, leading to increased pet adoption, veterinary visits, and pet humanization trends. In 2022, macroeconomic challenges such as high input costs and inflation, compounded by ongoing COVID-19 impacts in certain markets like China, adversely affected the market. For instance, Elanco reported disruptions in its global supply chain, increased freight costs, less reliable transportation schedules, and shortages of components or raw materials.

Latest Trends/ Developments:

- In June 2023, Bayer announced the establishment of its Crop Science Division, aimed at seizing opportunities in regenerative agriculture and expanding into adjacent markets alongside its core business of seeds, traits, crop protection, and digital solutions.

- In February 2023, Bayer cautioned that its operating earnings would decline due to high costs and the reversal of last year's price increases for its weedkillers, impacting both its agriculture and healthcare segments.

- In June 2022, the FDA approved Vetmedin-CA1 (pimobendan) chewable tablets as an initial therapy for delaying the onset of congestive heart failure in canines with Stage B2 preclinical myxomatous mitral valve disease.

Key Players:

These are the top 10 players in the Pet Medication Market: -

-

Zoetis

-

Taconic Biosciences

-

Elanco

-

Merck

-

Aratana Therapeutics

-

Merial

-

Kindred Biosciences

-

Entest Biomedical

-

Bayer

-

Boehringer

Chapter 1. Pet Medication Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pet Medication Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pet Medication Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pet Medication Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pet Medication Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pet Medication Market – By Product Type

6.1 Introduction/Key Findings

6.2 Antibiotics

6.3 Antimicrobials

6.4 Antiparasitics

6.5 Chemotherapeutics

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Pet Medication Market – By Application

7.1 Introduction/Key Findings

7.2 Cat

7.3 Dog

7.4 Horse

7.5 Fish

7.6 Other

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Pet Medication Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Pharmacy

8.3 Pet Specialty

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Pet Medication Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Pet Medication Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Zoetis

10.2 Taconic Biosciences

10.3 Elanco

10.4 Merck

10.5 Aratana Therapeutics

10.6 Merial

10.7 Kindred Biosciences

10.8 Entest Biomedical

10.9 Bayer

10.10 Boehringer

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Pet owners are increasingly recognizing the importance of pet healthcare. This growing awareness is significantly driving the expansion of the pet medication market, as they seek accessible and effective healthcare solutions for their beloved companions.

The top players operating in the Pet Medication Market are - Zoetis, Taconic Biosciences, Elanco, Merck, Aratana Therapeutics, Merial, Kindred Biosciences, Entest Biomedical, Bayer, and also Boehringer.

The market experienced a subdued growth rate during 2019-2020, primarily due to the impact of COVID-19 and veterinary diseases like African Swine Fever. However, the market rebounded in 2021 as veterinary care services were recognized as essential in key countries, leading to increased pet adoption, veterinary visits, and pet humanization trends.

The development of pet care store infrastructure in various countries worldwide is expected to boost the consumption of pet-related products, thereby increasing opportunities in the market.

The Asia-Pacific region is projected to emerge as the fastest-growing market for pet medication over the forecast period. This growth is attributed to factors such as the expanding affluent middle-class population with a strong inclination towards fostering functional and emotional bonds with pets to fulfill relationship needs.