Pet Insurance Market Size (2024 – 2030)

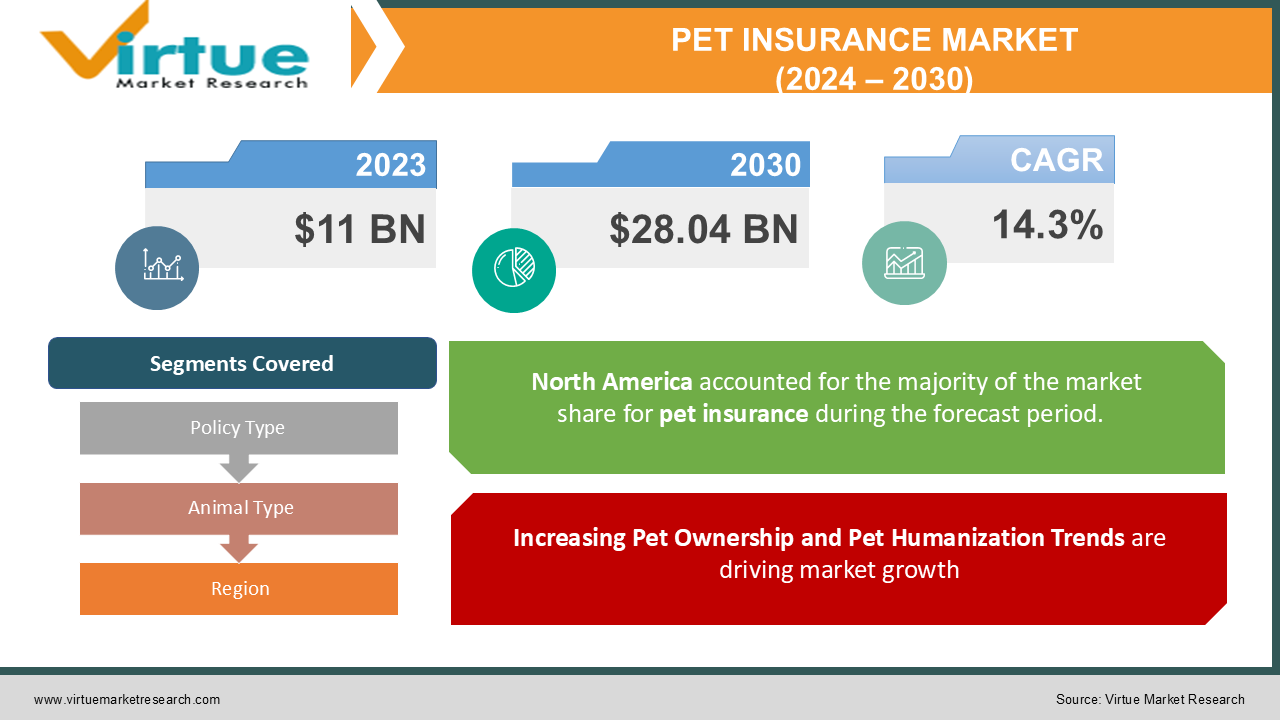

The Global Pet Insurance Market was valued at USD 11 billion in 2023 and is expected to grow at a CAGR of 14.3% from 2024 to 2030. By 2030, the market is projected to reach USD 28.04 billion.

Pet insurance covers veterinary expenses for illness, injuries, and other health-related incidents affecting pets, helping pet owners manage unexpected costs. With the rise in pet ownership globally, especially among millennials and Gen Z, coupled with the growing awareness of pet health and wellness, the demand for pet insurance has increased significantly. The market is also benefiting from advancements in veterinary care, which offer more sophisticated and expensive treatment options. Countries with high pet ownership, such as the U.S., Canada, the U.K., and parts of Europe, have witnessed steady growth in the adoption of pet insurance policies. Additionally, insurers are introducing flexible and customized policies to meet varying customer needs, from accident-only coverage to comprehensive plans that include wellness checkups and preventive care.

Key Market Insights:

Cats are the largest insured pet category and dogs ranked immediately behind. Policies are starting to appear for some exotic pets - birds, reptiles, and others, more commonly.

The Key markets are North America and Europe, for the same reason that Asia Pacific is still in its emergence curve as pet humanization has caught a great trend over here.

Group pet insurance is gaining popularity as employers increasingly embed pet insurance as part of employee benefit packages as a way to enhance job satisfaction.

Global Pet Insurance Market Drivers:

Increasing Pet Ownership and "Pet Humanization" Trends are driving market growth:

The increasing number of pet owners worldwide has contributed to the growing demand for pet insurance. Pets are increasingly treated as family members, leading to a trend called “pet humanization.” This cultural shift has encouraged owners to seek better healthcare and wellness solutions for their pets, including insurance coverage for emergencies and routine checkups. Millennials and Gen Z, who represent a large portion of the pet-owning population, are particularly inclined toward ensuring their pets' well-being and are willing to invest in pet insurance to mitigate risks. This emotional bond between owners and their pets continues to fuel the growth of the pet insurance market.

Rising Veterinary Costs and Sophisticated Treatment Options are driving market growth:

Veterinary care has become more advanced, offering complex surgeries, diagnostics, and treatments such as chemotherapy, organ transplants, and advanced imaging. However, these services come at a high cost, making pet insurance a practical solution for managing expenses. Without insurance, pet owners often face difficult decisions when their pets require expensive medical care. Insurers are also offering policies that cover hereditary and chronic conditions, ensuring long-term care for pets. As veterinary costs continue to rise, pet insurance is becoming an essential service for many households, helping them manage unpredictable healthcare expenses for their pets.

Increasing Availability of Customized Insurance Plans is driving market growth:

Pet insurance providers are introducing flexible and customizable plans to suit the specific needs of individual pet owners. In addition to standard accident and illness coverage, insurers offer wellness plans that cover routine care, vaccinations, dental cleanings, and preventive treatments. Optional add-ons, such as behavioral therapy and prescription food coverage, are also gaining popularity. Insurers are focusing on simplifying policy terms, enhancing transparency, and offering easy reimbursement processes, which encourage pet owners to adopt insurance policies. The ability to tailor coverage ensures that policies align with the pet's breed, age, and health status, increasing consumer satisfaction and market adoption.

Global Pet Insurance Market Challenges and Restraints:

High Premium Costs and Lack of Awareness are restricting market growth:

One of the main challenges in the pet insurance market is the high cost of premiums, which can deter potential customers, particularly in developing regions. Comprehensive insurance plans covering chronic and hereditary conditions tend to be expensive. Furthermore, many pet owners are still unaware of the benefits of pet insurance or do not fully understand policy terms, leading to hesitation in purchasing coverage. Education and awareness campaigns are essential to overcome these barriers. Pet insurance providers need to strike a balance between offering affordable policies and ensuring adequate coverage to appeal to a broader customer base.

Limited Coverage for Older Pets and Pre-Existing Conditions is restricting market growth:

A significant limitation of many pet insurance policies is the exclusion of pre-existing conditions and restrictions on coverage for older pets. This presents a challenge for pet owners whose pets develop chronic illnesses or age-related health issues over time. Additionally, insurers often impose waiting periods before coverage begins, creating inconvenience for pet owners. While some companies are exploring ways to offer coverage for pre-existing conditions or specialized plans for senior pets, these policies are still limited. The challenge lies in developing sustainable products that cover a wide range of pets' health needs without significantly increasing premium costs.

Market Opportunities:

Many opportunities arise for the pet insurance market as there is a shift in consumers' behavior, with a growing list of technologies being adopted and new innovative products being introduced in the industry. The most critical one is the incorporation of technology in pet insurance services. Wearable health monitoring devices and pet health applications monitor the health status of pets in real-time. This information is of utmost value to insurers, enabling them to issue custom-fit policies according to the pet's health condition and lifestyle. Another rapidly growing area is pet telemedicine services, especially in the aftermath of the COVID-19 pandemic. The value addition in policies with virtual veterinary consultations and 24/7 helplines increases customer satisfaction. Employer-sponsored pet insurance plans are promising areas, as such insurance is increasingly being offered in the benefit packages of employees. This provides the opportunity for the insurer to expand its market size and tap into the corporate sector. The Asia-Pacific region is a growth market as a result of increasing disposable income, increasing pet ownership, and a shift in attitude toward pet care. Companies that design low-cost micro-products suited to local markets will likely increase their share of these emerging economies.

PET INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.3% |

|

Segments Covered |

By Policy Type, Animal Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Trupanion, Inc., Nationwide Mutual Insurance Company, Petplan (Allianz), Embrace Pet Insurance, Healthy Paws Pet Insurance LLC, ASPCA Pet Health Insurance, PetFirst Healthcare, LLC, Direct Line Group, Figo Pet Insurance, Pets Best Insurance Services, LLC |

Pet Insurance Market Segmentation: By Policy Type

-

Accident and Illness Coverage

-

Accident-Only Coverage

-

Wellness and Preventive Care Plans

Accident and Illness Coverage dominates the market, offering comprehensive protection against a wide range of veterinary expenses, making it the preferred choice for pet owners.

Pet Insurance Market Segmentation: By Animal Type

-

Dogs

-

Cats

-

Exotic Pets (Birds, Rabbits, Reptiles, etc.)

Dogs are the most insured pets, accounting for the largest share due to the higher healthcare costs associated with canine care and the emotional bond between owners and their dogs.

Pet Insurance Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America holds the largest share of the pet insurance market, driven by high pet ownership rates, advanced veterinary care facilities, and greater awareness about pet insurance.

COVID-19 Impact Analysis on the Pet Insurance Market:

The COVID-19 pandemic has significantly impacted the global market for pet insurance. Lockdowns and working from home led to an increase in the adoption of pets, as people had time to spend with pets during isolation. The high number of pets increased the demand for pet insurance. The pandemic further brought to light the need for virtual healthcare solutions, which incorporated telemedicine services into the pet insurance market. This change made access to vet care more convenient with the changing preferences of consumers who access more services from afar. It, however, interfered with the veterinary services as most veterinary clinics only worked out a small percentage to delay the usual surgery care. The challenge led the insurers to adopt extended policy benefits and relaxed claim procedures that ultimately ensured customer loyalty during the trying times. The reliance on e-commerce platforms for more sales also made the selling of pet insurance policies online easier, thus ensuring that the market continued to grow even in the face of the pandemic. However, these changes did more than enhance accessibility for customers by even streamlining purchasing easier: thus, they got themselves more easily protected as far as pet owners were concerned. Above all, whereas challenges characterize the pandemic's aspects; still, chances or leeways to change have increased because of opportunities made towards the growth of pets on pet insurance.

Latest Trends/Developments:

Some of the trends are shaping up in the future of the pet insurance market. Insurance companies are spending big on mobile applications, AI usage for claim processing, and secure data management through blockchains, and all these attributes of digital transformation make a major difference in customers which simplifies policy management and accelerates settlement. Another important trend includes the personalization of insurance products. Insurers offer customized plans based on a pet's breed, age, and medical history to the owner so that the owner can choose the most suitable coverage for his needs. There are also agreements between pet insurers and veterinary clinics. These agreements promote integrated healthcare solutions and privileged discounts for policyholders while making pet care more affordable and accessible. Subscription models are also becoming popular. This will allow pet owners to pay premiums on a monthly basis and to receive continuous coverage, along with other benefits, and thus make insurance plans more attractive. Overall, these trends reflect a dynamic change in the pet insurance market, focusing on enhanced customer experience, personalized coverage, and collaborative healthcare solutions.

Key Players:

-

Trupanion, Inc.

-

Nationwide Mutual Insurance Company

-

Petplan (Allianz)

-

Embrace Pet Insurance

-

Healthy Paws Pet Insurance LLC

-

ASPCA Pet Health Insurance

-

PetFirst Healthcare, LLC

-

Direct Line Group

-

Figo Pet Insurance

-

Pets Best Insurance Services, LLC

Chapter 1. Pet Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pet Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pet Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pet Insurance Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pet Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pet Insurance Market – By Policy Type

6.1 Introduction/Key Findings

6.2 Accident and Illness Coverage

6.3 Accident-Only Coverage

6.4 Wellness and Preventive Care Plans

6.5 Y-O-Y Growth trend Analysis By Policy Type

6.6 Absolute $ Opportunity Analysis By Policy Type, 2024-2030

Chapter 7. Pet Insurance Market – By Animal Type

7.1 Introduction/Key Findings

7.2 Dogs

7.3 Cats

7.4 Exotic Pets (Birds, Rabbits, Reptiles, etc.)

7.5 Y-O-Y Growth trend Analysis By Animal Type

7.6 Absolute $ Opportunity Analysis By Animal Type, 2024-2030

Chapter 8. Pet Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Policy Type

8.1.3 By Animal Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Policy Type

8.2.3 By Animal Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Policy Type

8.3.3 By Animal Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Policy Type

8.4.3 By Policy Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Policy Type

8.5.3 By Animal Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pet Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Trupanion, Inc.

9.2 Nationwide Mutual Insurance Company

9.3 Petplan (Allianz)

9.4 Embrace Pet Insurance

9.5 Healthy Paws Pet Insurance LLC

9.6 ASPCA Pet Health Insurance

9.7 PetFirst Healthcare, LLC

9.8 Direct Line Group

9.9 Figo Pet Insurance

9.10 Pets Best Insurance Services, LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Pet Insurance Market was valued at USD 11 billion in 2023 and is projected to reach USD 28.04 billion by 2030, growing at a CAGR of 14.3%.

Key drivers include increasing pet ownership, rising veterinary costs, and the availability of customized insurance plans.

The market is segmented By Policy Type (Accident and Illness Coverage, Accident-Only Coverage, Wellness and Preventive Care Plans) and By Animal Type (Dogs, Cats, Exotic Pets).

North America is the dominant region, driven by high pet ownership and advanced veterinary services.

Leading players include Trupanion, Nationwide Mutual Insurance, Petplan (Allianz), Embrace Pet Insurance, and Healthy Paws.