Pet Food Mixing and Blending Market Size (2024 – 2030)

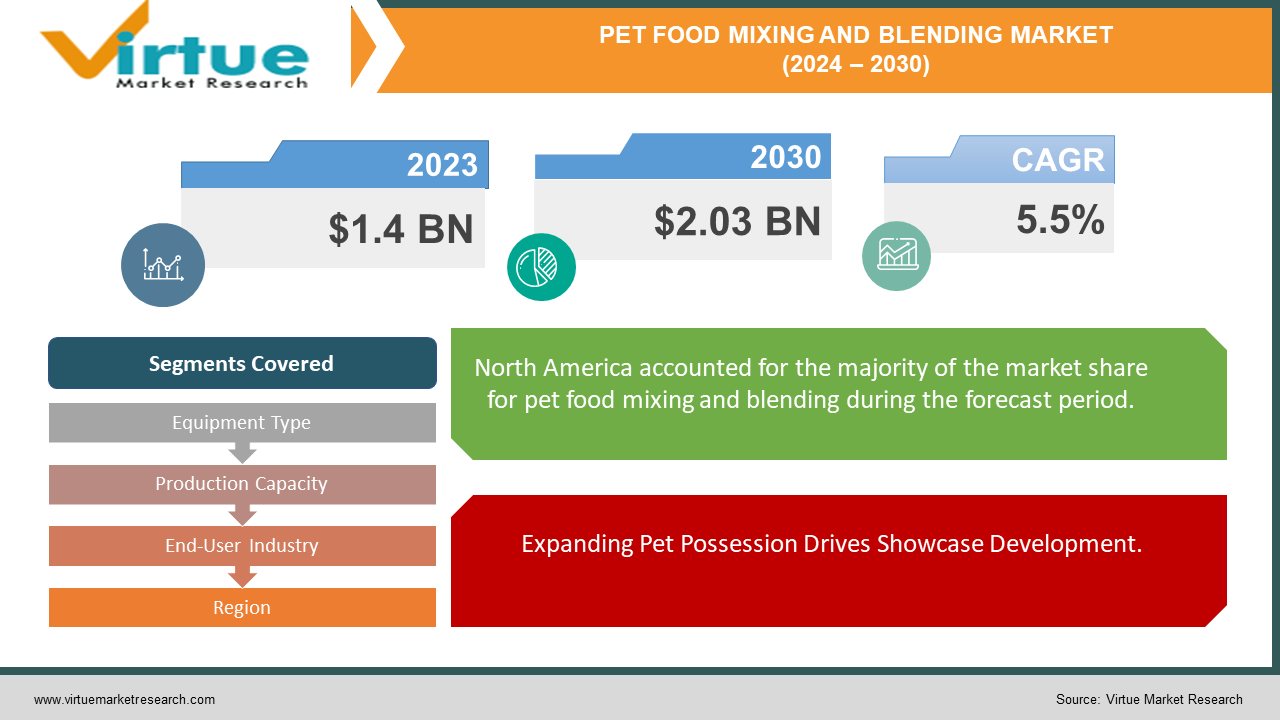

The market for pet food mixing and blending equipment market was estimated to be worth USD 1.4 billion in 2023 and is expected to increase to USD 2.03 billion by 2030, with a projected compound annual growth rate (CAGR) of 5.5% from 2024 to 2030.

The Pet Nourishment Blending and Mixing Hardware Showcase presents an energetic scene driven by the expanding request for high-quality, nutritious pet nourishment items around the world. With a developing pet populace and rising shopper mindfulness concerning pet wellbeing and sustenance, pet nourishment producers are progressively contributing to progressed blending and mixing gear to improve generation proficiency and item quality. These gear encourage the careful blending of fixings, guaranteeing uniform dissemination of supplements and flavors in both dry and damp pet nourishment details. In addition, mechanical progressions in hardware plans, such as computerization, accuracy control frameworks, and clean materials, are empowering producers to optimize generation forms while assembly exacting quality and security guidelines. The advertisement is encouraged moved by the drift towards customization and premiumization in pet nourishment items, driving the selection of specialized blending and mixing hardware custom-made to particular details and dietary necessities.

Key Insights:

80% of surveyed manufacturers reported investing in advanced mixing and blending equipment, citing improved production efficiency and product quality as primary drivers for adoption.

North America and Europe accounted for the largest market shares, with 35% and 30% respectively, attributed to established pet care industries and a high proportion of pet-owning households.

Global expenditure on pet food reached $90 billion in 2022, marking a 10% increase from the previous year, driven by higher consumer spending on premium and specialized pet food products.

However, 25% of respondents expressed concerns about the environmental impact of pet food production processes, highlighting the need for sustainable practices and eco-friendly equipment solutions. Implementing energy-efficient equipment designs and promoting recycling initiatives can mitigate environmental concerns while ensuring sustainable growth in the Pet Food Mixing and Blending Equipment market.

Global Pet Food Mixing and Blending Equipment Market Drivers:

Expanding Pet Possession Drives Showcase Development.

The developing drift of pet possession around the world may be a noteworthy driver of the Worldwide Pet Nourishment Blending and Mixing Hardware Advertise. With an extended populace of pets, including dogs, cats, and other companion creatures, there's a rising request for high-quality, nutritious pet nourishment items. This surge in pet possession creates openings for pet nourishment producers to contribute to progressed blending and mixing gear to meet the differing dietary needs and inclinations of pet proprietors, driving advertise development.

Accentuation on Pet Wellbeing and Nourishment Powers Request.

The expanding accentuation on pet well-being and sustenance is another key driver of the Worldwide Pet Nourishment Blending and Mixing Gear Advertisement. Pet proprietors are progressively prioritizing the wellbeing and well-being of their pets, driving a developing request for premium and specialized pet nourishment items. As customers look for pet nourishment definitions that are tailored to meet particular dietary necessities and address well-being concerns, there's a comparing requirement for progressed blending and mixing hardware to guarantee exact fixing control, uniform blending, and reliable item quality.

Mechanical Headways Improve Generation Effectiveness.

Innovative headways in blending and mixing gear are driving development and proficiency within the Global Pet Nourishment Blending and Mixing Hardware Advertise. Producers are progressively contributing to computerization, accuracy control frameworks, and sterile materials to optimize generation forms and progress item quality. Advanced gear plans enable pet nourishment producers to attain higher throughput, decrease generation costs, and improve nourishment security guidelines, in this manner assemble the developing request for high-quality pet nourishment items in a progressively competitive showcase scene.

Global Pet Food Mixing and Blending Equipment Market Restraints and Challenges:

Administrative Compliance Weights Obstruct Advertise Development.

One of the key restrictions confronting the Worldwide Pet Nourishment Blending and Mixing Hardware Advertisement is the expanding weight of administrative compliance. As governments and administrative bodies force stricter benchmarks and rules on nourishment security and cleanliness, pet nourishment producers are required to contribute in gear that meets these rigid necessities. Compliance with controls includes the taking a toll and complexity of hardware obtainment and operation, possibly preventing showcase development, especially for smaller producers with constrained assets.

Fluctuating Crude Fabric Costs Affect Benefit Edges.

Fluctuating crude fabric costs pose a noteworthy challenge to the Worldwide Pet Nourishment Blending and Mixing Hardware Showcase. Pet nourishment producers depend on a wide run of fixings, counting meats, grains, and supplements, the costs of which can shift due to variables such as climate conditions, supply chain disturbances, and advertising requests. These changes in crude fabric costs can affect benefit edges for producers, making it challenging to figure out generation costs precisely and keep up competitive estimating within the advertisement.

Powers Competition from Elective Nourishment Groups.

The powers competition from elective nourishment groups presents a challenge to the Worldwide Pet Nourishment Blending and Mixing Hardware Showcase. With the rise of elective pet nourishment designs such as crude diets, freeze-dried nourishment, and new pet nourishment choices, conventional dry and damp pet nourishment producers confront expanded competition for advertising share. This slant towards elective nourishment groups may require alterations in generation forms and gear capabilities to meet changing customer inclinations and keep up significance within the advancing pet nourishment showcase scene.

Global Pet Food Mixing and Blending Equipment Market Opportunities:

Developing Request for Customized Pet Nourishment Arrangements Drives Showcase Extension.

The Worldwide Pet Nourishment Blending and Mixing Hardware Advertise presents noteworthy openings driven by the developing request for customized pet nourishment arrangements. As pet proprietors progressively look for personalized and specialized diets for their fuzzy companions, there's a comparing requirement for pet nourishment producers to contribute to flexible blending and mixing hardware. Hardware able to take care of a wide run of fixings and details empowers producers to offer customized pet nourishment items custom-fitted to meet particular dietary necessities, inclinations, and well-being concerns, in this manner capitalizing on developing advertise sections and driving advertise extension.

Development into Developing Markets Offers Development Prospects.

Extension into rising markets presents profitable openings for the Worldwide Pet Nourishment Blending and Mixing Gear Advertise. As pet proprietorship rates rise in creating districts such as Asia-Pacific, Latin America, and Africa, there's a developing request for high-quality pet nourishment items. Producers can use this drift by contributing to showcase inquiries, building up key associations, and adjusting their gear offerings to meet the one-of-a-kind needs and inclinations of buyers in developing markets. By tapping into undiscovered advertising potential, producers can extend their client base, increment advertise share, and drive income development.

Innovative Developments Fuel Item Advancement and Separation.

Innovative advancements in blending and mixing gear offer openings for item improvement and separation within the Worldwide Pet Nourishment Blending and Mixing Hardware Advertise. Manufacturers can separate their offerings by joining progressed highlights such as robotization, exactness control frameworks, and clean plan components into their gear plans. Moreover, headways in materials science and designing empower the development of gear that's more solid, effective, and naturally economical. By grasping innovative developments, producers can upgrade generation effectiveness, progress item quality, and remain competitive in a quickly advancing advertising scene.

PET FOOD MIXING AND BLENDING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Equipment Type, Production Capacity, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GEA Group AG, Bühler Group, Wenger Manufacturing Inc., Clextral, Baker Perkins, FAMSUN Co., Ltd., Hosokawa Micron Powder Systems, SPX FLOW Inc., Andritz AG, JBT Corporation, KSE Process Technology B.V., FPE Food Processing Equipment B.V. |

Pet Food Mixing and Blending Equipment Market Segmentation: By Equipment Type

-

Mixers

-

Blenders

-

Coaters

-

Others

Among the gear sorts within the Pet Nourishment Blending and Mixing Hardware Market, mixers rise as the foremost viable segment due to their flexibility and fundamental parts within the pet food manufacturing preparation. Blenders play a significant part in mixing different fixings to form homogeneous blends, guaranteeing uniform dispersion of supplements, flavors, and surfaces in pet nourishment definitions. With a wide run of mixer sorts accessible, counting level blenders, vertical blenders, lace blenders, and paddle blenders, producers can select the foremost reasonable choice based on generation capacity, fixing characteristics, and prepare prerequisites. Blenders offer adaptability in dealing with distinctive sorts of fixings, counting dry kibble, damp meat, and fluid-added substances, making them vital hardware for pet nourishment producers looking for proficient and steady blending arrangements. Additionally, advancements in blender innovation, such as computerization, variable speed controls, and sterile plan highlights, advance improve their viability, empowering producers to attain ideal blending execution while guaranteeing nourishment security and quality compliance. Generally, blenders speak to a foundation of the Pet Food Mixing and Mixing Hardware Showcase, advertising flexible and solid arrangements for pet nourishment producers to meet the assorted needs of pet proprietors and keep up competitiveness within the showcase.

Pet Food Mixing and Blending Equipment Market Segmentation: By Production Capacity

-

Small-scale Equipment

-

Medium-scale Equipment

-

Large-scale Equipment

Among the portions of the Pet Nourishment Blending and Mixing Hardware Showcase based on generation capacity, medium-scale gear rises as the foremost compelling alternative for numerous producers. Medium-scale hardware strikes an adjustment between generation capacity, effectiveness, and adaptability, making it well-suited for a wide run of pet nourishment fabricating operations. With medium-scale hardware, producers can accomplish adequate generation volumes to meet requests while keeping up operational nimbleness and cost-effectiveness. This fragment offers to producers looking to scale up a generation without committing to the higher capital venture and space necessities related to large-scale hardware. Also, medium-scale hardware offers flexibility in taking care of different group sizes and generation runs, permitting producers to oblige variances in request and adjust to changing advertise conditions. By contributing to medium-scale gear, pet nourishment producers can optimize their generation forms, progress operational proficiency, and position themselves for economic development within the energetic and competitive pet nourishment advertising scene.

Pet Food Mixing and Blending Equipment Market Segmentation: By End-User Industry

-

Dry Pet Food

-

Wet Pet Food

-

Treats and Snacks

-

Others

Among the portions of the Pet Nourishment Blending and Mixing Hardware Advertise based on end-user industry, dry pet nourishment fabricating rises as one of the foremost viable sections. Dry pet nourishment generation speaks to a noteworthy parcel of the pet nourishment showcase universally, owing to its comfort, long rack life, and cost-effectiveness. Producers of dry pet nourishment depend intensely on blending and mixing hardware to effectively combine different fixings such as grains, meats, vitamins, and minerals into uniform details. The request for dry pet nourishment proceeds to develop due to variables such as pet owners' inclination for helpful bolstering choices, the development of the pet nourishment showcase in developing economies, and headways in definition innovation to address pet wellbeing and sustenance concerns. As a result, the fragment presents profitable openings for gear producers catering to dry pet nourishment makers, advertising specialized arrangements to upgrade generation productivity, and item quality, and advertise competitiveness. Moreover, dry pet nourishment producers frequently require hardware that can handle tall throughput volumes, assorted fixing compositions, and rigid quality control benchmarks, making this section a key driver of innovation and venture within the Pet Nourishment Blending and Mixing Gear Advertise.

Pet Food Mixing and Blending Equipment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The dissemination of the Pet Nourishment Blending and Mixing Gear Showcase over distinctive districts highlights North America as the prevailing player, capturing 35% of the showcase share. With a developed pet care industry, tall pet proprietorship rates, and a solid accentuation on pet wellbeing and sustenance, North America brags a vigorous request for blending and mixing gear. Taking after closely behind, Europe holds a noteworthy share of 27%, driven by exacting administrative guidelines, expanding pet humanization patterns, and a developing advertisement for premium pet nourishment items. In the meantime, the Asia-Pacific locale develops as a quickly developing showcase, capturing 23% of the showcase share. With rising expendable livelihoods, urbanization, and a burgeoning pet populace, the Asia-Pacific locale presents profitable openings for gear producers looking to tap into rising markets. South America and the Center East and Africa locales hold smaller offers of 9% and 6%, separately, but offer the undiscovered potential for advertising extension. As pet proprietorship rates rise and shopper inclinations advance, these locales display openings for producers to broaden their topographical impression and capitalize on the developing request for pet nourishment blending and mixing hardware.

COVID-19 Impact Analysis on the Global Pet Food Mixing and Blending Equipment Market:

The COVID-19 widespread has essentially affected the Worldwide Pet Nourishment Blending and Mixing Gear Showcase, displaying both challenges and openings for producers and partners. At first, the widespread driven disturbances in supply chains, generation operations, and dispersion channels, caused delays in gear obtainment and establishment. Additionally, lockdown measures and social separating conventions obstructed the show and selection of unused gear, influencing deals and income streams for producers. In any case, as pet proprietorship surged amid lockdowns, fueled by companionship needs and expanded time went through at domestic, there was a comparing rise in requests for pet nourishment items, counting premium and specialized details. This surge in requests has given a silver lining for the pet nourishment gear showcase, driving speculations in gear overhauls, robotization, and development to meet advancing shopper inclinations and guarantee continuous generation. Moreover, as the pet nourishment industry adjusted to the "modern ordinary," producers grasped digitalization and further observed arrangements to optimize operations, improve effectiveness, and moderate future disturbances. Looking ahead, COVID-19 is anticipated to take off an enduring effect on the Pet Nourishment Blending and Mixing Hardware Showcase, quickening patterns towards robotization, digitalization, and maintainability while cultivating strength and versatility within the confront of future challenges.

Latest Trends/ Developments:

The Pet Nourishment Blending and Mixing Hardware Showcase is seeing a wave of development and adjustment driven by the most recent patterns and advancements within the industry. One conspicuous drift is the expanding request for customized and specialized pet nourishment arrangements, reflecting pet owners' developing accentuation on pet wellbeing, wellness, and dietary inclinations. Producers are reacting to this slant by contributing to flexible blending and mixing hardware competent in taking care of a wide extent of fixings and definitions, permitting precise customization and separation within the showcase. Moreover, there's a developing center on supportability and natural duty, with producers consolidating eco-friendly materials and energy-efficient plans, and squandering decreased activities into their hardware offerings. Mechanical progressions, such as mechanization, counterfeit insights, and information analytics, are moreover reshaping the pet nourishment gear scene, empowering producers to optimize generation forms, make strides in effectiveness, and improve item quality. Moreover, the COVID-19 widespread has quickened digitalization and further observing arrangements, enabling producers to adjust to inaccessible work situations and guarantee operational progression amid disturbances. As the pet nourishment industry proceeds to advance, producers must remain adjusted to these most recent patterns and advancements to stay competitive and meet the advancing needs of pet proprietors and shoppers around the world.

Key Players:

-

GEA Group AG

-

Bühler Group

-

Wenger Manufacturing Inc.

-

Clextral

-

Baker Perkins

-

FAMSUN Co., Ltd.

-

Hosokawa Micron Powder Systems

-

SPX FLOW Inc.

-

Andritz AG

-

JBT Corporation

-

KSE Process Technology B.V.

-

FPE Food Processing Equipment B.V.

Chapter 1. Pet Food Mixing and Blending Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Pet Food Mixing and Blending Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pet Food Mixing and Blending Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pet Food Mixing and Blending Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pet Food Mixing and Blending Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pet Food Mixing and Blending Equipment Market – By Equipment Type

6.1 Introduction/Key Findings

6.2 Mixers

6.3 Blenders

6.4 Coaters

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Equipment Type

6.7 Absolute $ Opportunity Analysis By Equipment Type, 2024-2030

Chapter 7. Pet Food Mixing and Blending Equipment Market – By Production Capacity

7.1 Introduction/Key Findings

7.2 Small-scale Equipment

7.3 Medium-scale Equipment

7.4 Large-scale Equipment

7.5 Y-O-Y Growth trend Analysis By Production Capacity

7.6 Absolute $ Opportunity Analysis By Production Capacity, 2024-2030

Chapter 8. Pet Food Mixing and Blending Equipment Market – By End-Use

8.1 Introduction/Key Findings

8.2 Dry Pet Food

8.3 Wet Pet Food

8.4 Treats and Snacks

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-Use

8.7 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Pet Food Mixing and Blending Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Equipment Type

9.1.3 By Production Capacity

9.1.4 By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Equipment Type

9.2.3 By Production Capacity

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Equipment Type

9.3.3 By Production Capacity

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Equipment Type

9.4.3 By Production Capacity

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Equipment Type

9.5.3 By Production Capacity

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Pet Food Mixing and Blending Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 GEA Group AG

10.2 Bühler Group

10.3 Wenger Manufacturing Inc.

10.4 Clextral

10.5 Baker Perkins

10.6 FAMSUN Co., Ltd.

10.7 Hosokawa Micron Powder Systems

10.8 SPX FLOW Inc.

10.9 Andritz AG

10.10 JBT Corporation

10.11 KSE Process Technology B.V.

10.12 FPE Food Processing Equipment B.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for pet food mixing and blending equipment market was estimated to be worth USD 1.4 billion in 2023 and is expected to increase to USD 2.03 billion by 2030, with a projected compound annual growth rate (CAGR) of 5.5% from 2024 to 2030.

The essential drivers of the worldwide pet nourishment blending and mixing gear advertise incorporate the expanding request for customized and specialized pet nourishment definitions to meet the differing dietary needs and inclinations of pets.

The key challenges confronting the worldwide pet nourishment blending and mixing hardware advertise incorporate administrative compliance weights, fluctuating crude fabric costs, and forces competition from elective nourishment groups.

In 2023, North America held the largest share of the global pet food mixing and blending equipment market.

GEA Group AG, Bühler Group, Wenger Manufacturing Inc., Clextral, Baker Perkins, FAMSUN Co., Ltd., Hosokawa Micron Powder Systems, SPX FLOW Inc., Andritz AG, JBT Corporation, KSE Process Technology B.V., FPE Food Processing Equipment B.V. are the main players.