Pet DNA Vaccines Market Size (2024 –2030)

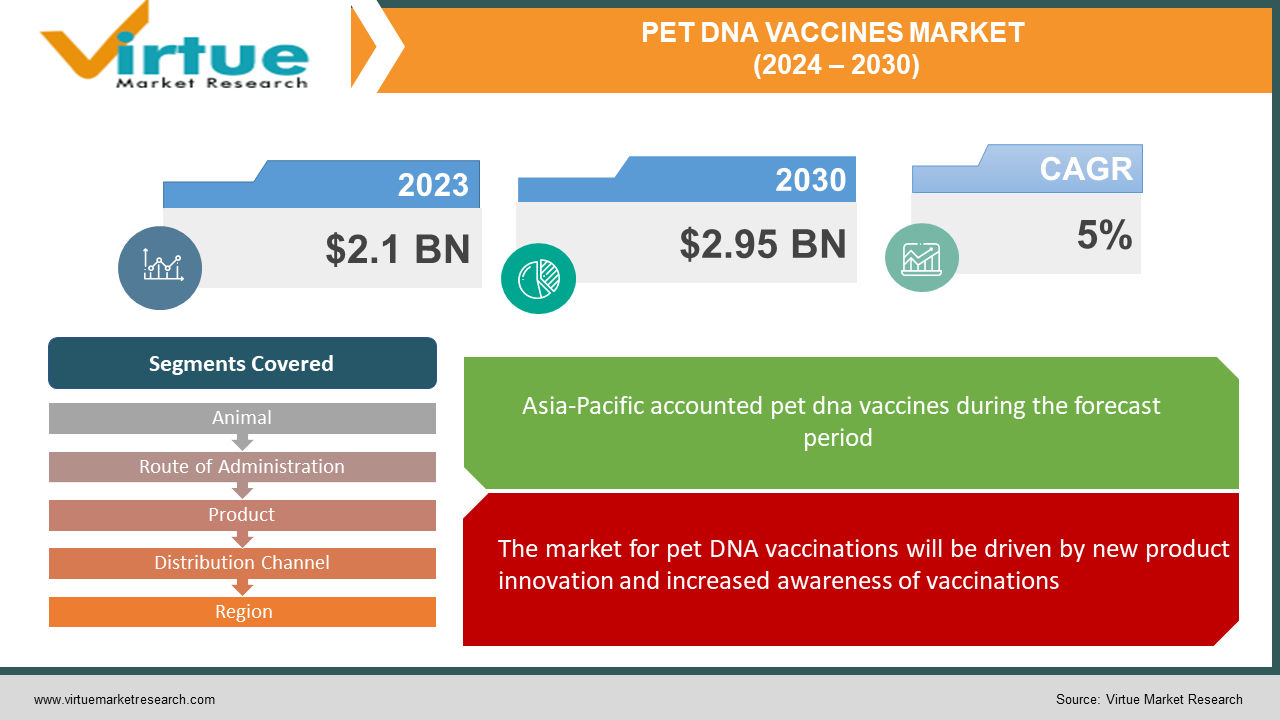

In 2023, the Global Pet DNA Vaccines Market was valued at USD 2.1 billion and is projected to reach a market size of USD 2.95 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

Because humans and animals are interdependent in many ways, it's critical to preserve animal health to preserve a healthy ecosystem. Vaccinating animals is an essential method of keeping them disease-free. These vaccinations support the immune systems that protect animals from disease-causing agents. As more people become aware of the value of providing animals with appropriate care and preventing illness, the market for animal vaccines is expanding. Vaccines are essential in protecting animals from dangerous diseases, and as more people own pets and invest in their upkeep, there is a growing need for high-quality vaccinations.

Key Market Insights:

Because of the spike in pet adoption during the pandemic, there was a significant increase in demand for pet DNA testing. Adoption of pets has increased as a result of lockdowns and heightened pet humanization. Consequently, the market reached 1.9 billion in 2022. Veterinarian clinics hold the biggest market share of 60% because of frequent prompt treatments. North America dominates the market, accounting for a 30 % share in 2023. The robust network of pet NGOs, which aid stray animals with genetic diseases, will also have an impact on the market. As a result, it is anticipated that by 2029, the market will be worth USD 3 billion. The market for pet DNA testing is anticipated to grow faster as a result of developments in DNA testing technology and the digitization of veterinary care.

Global Pet DNA Vaccines Market Drivers:

The market for pet DNA vaccinations will be driven by new product innovation and increased awareness of vaccinations.

There are several significant factors contributing to the rapid growth of the animal vaccine market. First, more people are becoming aware of the benefits of vaccinations for maintaining the health of all animals, including livestock and pets. Second, more animals require vaccinations due to an increase in animal farming and the number of people who own pets. Finally, groups like Bayer are educating the public about vaccines and animal health, enabling pet owners to make wise decisions regarding the health of their animals.

Growth in the Pet DNA Vaccine Market Will Be Driven by Increasing Need for Innovative and Effective Immunization Products.

The adoption of animal vaccines has also been significantly influenced by advancements in technology and the introduction of novel animal products. Research and development have made improvements to animal vaccines over time. By preventing illness, these vaccinations contribute to the health of both people and animals. Recombinant vaccines, a relatively new class of vaccines, provide additional advantages such as avoiding animal exposure to the disease. This promotes public health by halting the transmission of diseases from animals to humans.

Pet DNA Vaccines Market Challenges and Restraints:

Approximately 600–900 million smallholder farmers in developing nations such as Africa, Asia, and Latin America tend to their livestock. But when it comes to administering vaccines to animals, these farmers encounter difficulties. They might not be aware of the advantages of vaccinations, think they are too costly or have difficulty obtaining them due to supply chain issues. Consequently, numerous animals suffer from illnesses and pass away, leading to financial difficulties for the farmers. Governments and organizations are trying to find ways to lower the cost, increase accessibility, and provide more vaccines to support these farmers.

Pet DNA Vaccines Market Opportunities:

The rising incidence of diseases in animals, like bovine tuberculosis, which affects cattle and other mammals, is driving up demand for veterinary vaccines. The market for veterinary vaccines is driven by the fact that, in England alone, a sizable number of new TB herd incidents have been discovered. Though vaccines are essential to prevent tuberculosis, antibiotics are a useful treatment option. Furthermore, research and development activities are in progress to produce efficacious vaccinations for farm and companion animals, presenting encouraging prospects for market expansion. The market for veterinary vaccines has room to grow due to several factors, including rising livestock populations in developing nations, growing markets, and technological developments in vaccine development.

PET DNA VACCINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Animal, Route of Administration, Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Elanco, HIPRA, Boehringer Ingelheim International GmbH, Virbac, MSD Animal Health, Zoetis, Ceva, NEOGEN CORPORATION, Hester Biosciences Limited,Biogénesis Bag6 |

Global Pet DNA Vaccines Market Segmentation: By Animal

-

Companion

-

Livestock

Livestock and companion animals make up the two primary segments of the animal vaccine market. It is anticipated that the companion animal industry, which includes pets like dogs and cats, will expand more quickly. This is because an increasing number of people globally are adopting pets, and numerous organizations are promoting pet adoption. Veterinarians frequently vaccinate pets, a practice made popular by rising pet owner awareness. However, because livestock animals are essential for the production of meat and other products, the industry surrounding livestock vaccinations is also receiving more attention. As a result of government restrictions on the use of antibiotics in animals raised for food, livestock producers are turning to vaccines to maintain the health of their animals, which is predicted to fuel market growth.

Global Pet DNA Vaccines Market Segmentation: By Route of Administration

-

Oral

-

Parenteral

-

Others

Based on how the vaccines are administered to animals, the market for animal vaccines can be divided into three primary categories: injectable, oral, and other. The parenteral segment—which includes injections into the skin, into muscles, or under the skin—is anticipated to generate the highest revenue out of all of these. For animal vaccinations, this approach is well-recognized and extensively utilized, and its expansion is anticipated to be fueled by improvements in delivery systems. The oral phase, in which vaccinations are administered orally, is also significant, particularly for the investigation and creation of novel vaccination delivery strategies. However, because oral vaccines occasionally don't elicit as strong of an immune response as injected ones, they might not bring in as much money. By 2030, the parenteral segment is anticipated to lead the rapidly expanding animal vaccine market overall.

Global Pet DNA Vaccines Market Segmentation: By Product

-

Inactivated

-

Live Attenuated

-

Recombinant

-

Others

The market for animal vaccines can be divided into several product categories, such as recombinant, live attenuated, inactivated, and others. Due to their widespread use and familiarity, the more conventional live attenuated and inactivated vaccines are anticipated to hold the largest market share. The recombinant category, however, is anticipated to expand at the fastest rate. Producers are working to improve and lower the cost of these vaccines, which are thought to be safer and more effective. Recombinant vaccines are even more effective than conventional vaccinations because they also encourage the body to produce more antibodies against particular antigens.

Global Pet DNA Vaccines Market Segmentation: By Distribution Channel

-

Veterinary Hospitals

-

Veterinary Clinics

-

Pharmacies & Drug Stores

-

Others

The distribution channels for animal vaccines include veterinary clinics, hospitals, pharmacies, and other establishments. Veterinarian clinics hold the biggest market share because they frequently offer prompt treatments. Next are veterinary hospitals, which provide more sophisticated care. Additionally important are pharmacies and pharmacy shops, particularly in light of the growing trend of these businesses sponsoring online sales of veterinary vaccines.

Global Pet DNA Vaccines Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Several regions comprise the veterinary vaccines market: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. With $4.43 billion in sales in 2020, North America is predicted to overtake Europe shortly to take the lead in the market. The region's increased vaccination of animals and the widespread use of cutting-edge products—especially in the United States where pet ownership is on the rise—will be the main drivers of this growth. Growing awareness of preventive animal healthcare and rising disposable incomes are expected to drive the fastest market growth in the Asia Pacific region. The region's market is expanding as a result of nations like China, Japan, and India vaccinating both companion and livestock animals more frequently.

COVID-19 Impact on the Global Pet DNA Vaccines Market:

It's unclear how the COVID-19 pandemic will affect the market for animal vaccinations in 2020. The market saw a slight uptick during the year, but it was still less than it had been in years before the pandemic. The primary cause of this decline was the decline in veterinary visits during the pandemic's height. In April 2020, for instance, 92% of veterinarians surveyed by the American Veterinary Medical Association reported that they had seen a decline in client visits. But after June 2020, there was a rise in customer traffic, which somewhat made up for the losses. According to a different survey conducted by the same association, June 2020 saw a rise in client visits for 59% of veterinary clinics over June 2019. A 10% to 50% increase in client visits was reported by about 55% of these clinics. All things considered, the COVID-19 pandemic had less of an effect on animal health companies than it did on companies that provided healthcare to people.

Latest Trend/Development:

Advances in vaccine technology, a greater emphasis on personalized medicine, and a growing interest in pet preventive healthcare are some of the most recent trends and developments in the pet DNA vaccines market. The creation of DNA vaccines, which use pathogen genetic material to boost a pet's immune system, is one noteworthy trend. Compared to conventional vaccinations, these have several benefits, such as increased efficacy, safety, and ease of manufacture. Another trend is the tailoring of vaccines to each pet's unique genetic composition, which enables more focused and efficient disease prevention. Furthermore, pet owners are placing a greater emphasis on preventive healthcare, which is driving up demand for vaccinations and other preventive measures to keep animals healthy and disease-free. All things considered, these patterns are influencing the market for pet DNA vaccines and propelling innovation and expansion within the sector.

Key Players:

-

Elanco

-

HIPRA

-

Boehringer Ingelheim International GmbH

-

Virbac

-

MSD Animal Health

-

Zoetis

-

Ceva

-

NEOGEN CORPORATION

-

Hester Biosciences Limited

-

Biogénesis Bag6

Chapter 1. Pet DNA Vaccines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pet DNA Vaccines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pet DNA Vaccines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pet DNA Vaccines Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pet DNA Vaccines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pet DNA Vaccines Market – By Animal

6.1 Introduction/Key Findings

6.2 Companion

6.3 Livestock

6.4 Y-O-Y Growth trend Analysis By Animal

6.5 Absolute $ Opportunity Analysis By Animal, 2024-2030

Chapter 7. Pet DNA Vaccines Market – By Route of Administration

7.1 Introduction/Key Findings

7.2 Oral

7.3 Parenteral

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Route of Administration

7.6 Absolute $ Opportunity Analysis By Route of Administration, 2024-2030

Chapter 8. Pet DNA Vaccines Market – By Product

8.1 Introduction/Key Findings

8.2 Inactivated

8.3 Live Attenuated

8.4 Recombinant

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Product

8.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 9. Pet DNA Vaccines Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Veterinary Hospitals

9.3 Veterinary Clinics

9.4 Pharmacies & Drug Stores

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Pet DNA Vaccines Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Animal

10.1.3 By Distribution Channel

10.1.4 By Product

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Animal

10.2.3 By Route of Administration

10.2.4 By Product

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Animal

10.3.3 By Route of Administration

10.3.4 By Product

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Animal

10.4.3 By Route of Administration

10.4.4 By Product

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Animal

10.5.3 By Route of Administration

10.5.4 By Product

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Pet DNA Vaccines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Elanco

11.2 HIPRA

11.3 Boehringer Ingelheim International GmbH

11.4 Virbac

11.5 MSD Animal Health

11.6 Zoetis

11.7 Ceva

11.8 NEOGEN CORPORATION

11.9 Hester Biosciences Limited

11.10 Biogénesis Bag6

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The animals are exposed to several disease-causing hazards because of various internal and external causes, such as disease-causing substances. The injection of veterinary vaccinations is one of the most important methods for avoiding infections in animals.

In 2023, Pet DNA Vaccines Market was valued at $ 2.21 Billion, and is projected to reach a market size of $ 3.11Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 5%.

Increased Awareness and Innovation of New Inoculation Products and Rising Demand for Advanced and Effective Immunization Products are driving the growth of the Global Pet DNA Vaccines Market.

Absence of vaccination Smallholder farmer adoption in developing nations might impede market expansion.

The oral route of administration is the fastest growing in the Global Pet DNA Vaccines Market.