PET-CT Scanner Devices Market Size (2024 – 2030)

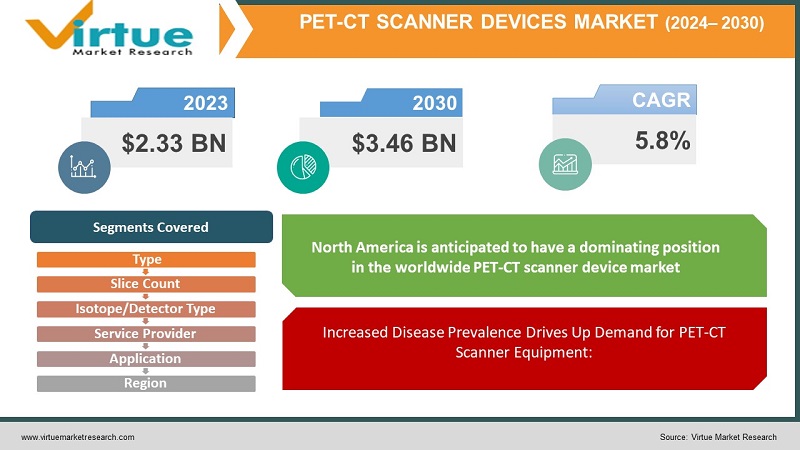

In 2023, the Global PET-CT Scanner Devices Market was valued at $2.33 billion, and is projected to reach a market size of $3.46 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 5.8%.

Nuclear imaging uses positron emission tomography, or PET scan, to examine the composition and functionality of bodily tissues and cells. The PET-CT employs a camera, a computer, and trace quantities of radioactive chemicals known as radiopharmaceuticals or radiotracers to offer information on the activities of the organs and tissues. PET-CT scans are useful for identifying aberrant metabolic activity in the body. Compared to the two scans displayed independently, the combined PET-CT scans can reveal a more accurate diagnosis. These tools are frequently used to diagnose a wide range of illnesses, including neurological, gastrointestinal, endocrine, and cardiac conditions. By combining the capabilities of two technologies, the PET-CT scanner helps to more accurately diagnose, localize, and monitor the illness. The gadgets capture photographs in a brief amount of time as well. The medical industry's continued technical advancements are anticipated to drive an increase in the demand for PET scanning instruments.

Key Market Insights:

- GE Healthcare and the American Swiss biotechnology company SOPHiA GENETICS worked together. To effectively target and match medicines to each patient's genetic profile and cancer kind, the two firms would focus on developing cancer care after the agreement was established. This would help to provide the most effective and customized therapy possible.

- The acquisition of MOLECUBES NV, a dynamic developer in benchtop preclinical nuclear molecular imaging (NMI) systems, has been announced by Bruker Corporation today. Scalable benchtop tools for the NMI preclinical research community are now part of our offering thanks to the purchase of MOLECUBES. Worldwide NMI clients are anticipated to gain from the synergies between our research and development, applications, and support teams with MOLECUBES.

- Leading developer of in-vivo neurology and cancer biomarkers that help enable more individualized treatment, Zionexa was acquired by GE Healthcare. Additionally, the business would create and market Zionexa pipeline biomarkers as well as Cerianna (fluoro estradiol F-18), a recently FDA-approved imaging agent that is used in conjunction with biopsy to identify estrogen receptor (ER) positive lesions in patients with recurrent or metastatic breast cancer and aid in treatment decision-making.

Global PET-CT Scanner Devices Market Drivers:

Increased Disease Prevalence Drives Up Demand for PET-CT Scanner Equipment:

Globally, the prevalence and incidence of illnesses like cancer, Alzheimer's, and cardiovascular disorders are rising, which is driving up demand for medical equipment like PET-CT scanners. Innovations aimed at increasing the mobility of PET-CT scanners are driving strong demand in developed nations. Additionally, anatomic and operational data are provided by PET-CT scanners, which are recognized as important for the treatment of cancer patients. In 2020, the market share of PET-CT scanners used in oncology was estimated to be above 85%. To fully grasp the oncology industry, manufacturers are concentrating on creating products, which will help the PET-CT scanner devices market in the approaching years. The market for PET-CT scanner equipment in the hospital segment is expanding at a considerable rate due to an increase in the number of people visiting hospitals for testing. The market for PET-CT scanner equipment is predicted to reach US$ 300 million (system only) by 2030 as a result of all these factors, with a compound annual growth rate (CAGR) of 3.1% from 2021 to 2031.

Stationary/Portable to Rule Global Market Growth:

Based on modality, application, slice count, end user, and geography, the worldwide market for PET-CT scanning equipment has been divided into segments. The portable/stationary and bench-top segments of the worldwide PET-CT scanner devices market have been divided based on modality. Because of the rising demand for mobile PET-CT equipment, it is projected that the portable/stationary category will hold a significant portion of the worldwide market by 2031. A transportable digital PET/CT system with shared medical services was introduced in the United States in 2019 by United Imaging Healthcare. The business wants to bring PET/CT to areas where it isn't already available.

Global PET-CT Scanner Devices Market Challenges:

Elevated expenses for installation and upkeep might impede market expansion:

The significant expenses associated with these systems' installation and maintenance represent one of the key obstacles facing the industry participants. The adoption of new and innovative systems has been hindered, particularly in developing nations, by the significant money required for the newest technology and by the large and tightly controlled reconditioned systems market. Major local and international companies have also joined this lucrative market, providing healthcare institutions all over the world with affordable, reconditioned equipment. In addition, healthcare facilities favor inexpensive refurbished equipment over brand-new items. Furthermore, several nations have unfavorable healthcare reimbursement conditions. Reduced payer reimbursement for PET and SPECT treatments has led to a decline in outpatient volumes globally, which has restricted patient access to affordable, high-quality imaging and diagnostic services.

Global PET-CT Scanner Devices Market Opportunities:

Over the past several years, there has been a global increase in the frequency of chronic and infectious illnesses including cancer and heart disease, as well as a desire for improved diagnostic tools. Globally, the International Agency for Research on Cancer (IARC) estimates that 14.1 million new cases of cancer were reported in 2012. The most common of them was lung cancer (13%) and was followed by colorectal (11.9%) and breast cancer (11.9%). 9.7% of all. Furthermore, the market is expanding due to a rise in the incidence of brain illnesses including Alzheimer's and traumatic brain injury. Furthermore, there would be a notable global rise in the quantity of newly diagnosed cancer cases as well as cancer-related deaths. Furthermore, improvements in scanner technology enable quicker scan times than previous iterations and improved localization of activity to normal vs aberrant regions.

PET-CT SCANNER DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Slice Count, Isotope/Detector Type, Service Provider, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bruker Corporation, Siemens Healthineers, Koninklijke Philips N.V, GE Healthcare, Mediso Ltd., MinFound Medical Systems Co., Ltd, MR Solutions, Neusoft Corporation, SOFIE, Canon, Inc, United Imaging Healthcare Co |

Global PET-CT Scanner Devices Market Segmentation: By Type

-

Stationary Scanners

-

Portable/Mobile Scanner

The market is divided into two segments based on type: stationary scanners and portable/mobile scanners. The PET-CT Scanner Device Market was dominated by the Portable Scanners/Mobile Scanners segment in terms of revenue. This is due to the growing usage of mobile devices by small and medium-sized healthcare organizations. Moreover, the mobile device category offers benefits including cheaper costs, quicker installation times, fewer initial investments, and fewer patient travel. GE, Philips, Siemens, and other top manufacturers provide a range of portable PET-CT scanners.

Global PET-CT Scanner Devices Market Segmentation: By Slice Count

-

Low Slice Scanner (<64 Slices)

-

Medium Slice Scanner (64 Slices)

-

High Slice Scanner (>64 Slices)

The market is divided into three segments based on the number of slices: Medium (64 slices), Low (< 64 slices), and High (> 64 slices). With less than 64 slices, the Low Slice Cardiology sector held a substantial revenue share in the PET-CT Scanner Device Market. This is because medical implants are becoming more common, people are accepting sedentary lifestyles, and food habits are changing. Moreover, ongoing advancements in imaging technologies made possible by R&D initiatives are anticipated to propel the segment's growth during the projected period.

Global PET-CT Scanner Devices Market Segmentation: By Isotope/Detector Type

-

Fluorodeoxyglucose (FDG)

-

62Cu ATSM

-

18 F Sodium Fluoride

-

FMISO

-

Gallium

-

Thallium

-

Others

Fluorodeoxyglucose (FDG), 62Cu ATSM, 18 F Sodium Fluoride, FMISO, Gallium, Thallium, and Others are the market segments based on Isotope/Detector Type. The market for PET-CT scanner devices had the largest revenue share going to the fluorodeoxyglucose (FDG) category. For instance, cancer cells can absorb the common radiotracer F-18 fluorodeoxyglucose (FDG). This is due to a rise in the occurrence of chronic illnesses, a drop in the number of FDG side effects, and an increase in the number of FDG applications. In addition, it offers other benefits, such as the capacity to offer more precision and detail.

Global PET-CT Scanner Devices Market Segmentation: By Service Provider

-

Hospitals

-

Diagnostic Centers

-

Research Institutes

-

Ambulatory Surgical Centers

The market is divided into hospitals, diagnostic centers, and research institutes based on the service provider. Hospitals accounted for the largest revenue share of the PET-CT Scanner Device Market by 35%. This may be attributed to several factors, including a rise in patient knowledge of hospital treatment, an expansion of the healthcare system, and a rise in the use of PET-CT scanners. The shift to minimally invasive surgeries and outpatient procedures, as well as the quick uptake of PET-CT scanners for pre-operative planning and post-operative evaluation in ambulatory surgical centers, are likely to propel the segment's growth during the forecast period.

Global PET-CT Scanner Devices Market Segmentation: By Application

-

Oncology

-

Neurology

-

Cardiology

-

Others

The market is divided into Oncology, Cardiology, Neurology, and Other segments based on application. The PET-CT Scanner Device Market was significantly dominated by the Cardiology sector by 28%. A tiny amount of radioactivity is used during a cardiac positron emission tomography (PET) scan to look at the heart muscle. In contrast to traditional nuclear stress testing techniques, cardiac PET/CT offers superior precision, lower radiation exposure, and more diagnostic efficacy for diagnosing coronary artery disease (SPECT). Cardiac PET/CT may be beneficial for patients with a high body mass index (BMI), breast implants, pleural or pericardial effusions, or a significant amount of breast/chest wall tissue. The oncology segment is anticipated that the sector will grow at the fastest rate over the projected period. The segment is likely to increase due to factors such as the increasing worldwide prevalence of cancer, the growing need for non-invasive imaging techniques for cancer diagnosis and treatment planning, the number of breakthroughs in PET-CT technology for oncology imaging, and the quick acceptance of PET-CT scanners in cancer research.

Global PET-CT Scanner Devices Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The PET-CT scanner device market is divided into six regions globally: North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. Due to the growing number of traumatic brain injury patients in the United States, North America is anticipated to have a dominating position in the worldwide PET-CT scanner device market by 45%. For example, the Centers for Disease Control and Prevention (CDC) estimate that in 2013, over 282,000 Americans received a diagnosis of brain damage, and approximately 50,000 of those cases resulted in traumatic brain injury-related deaths. It is thought to be a leading cause of mortality and disability in the United States.

Because of the large number of installed devices and the presence of prominent industry players like Siemens AG and Koninklijke Philips N.V. in the area that contribute significantly to the market's revenue share, Europe is also likely to see considerable growth in the PET-CT scanner device market. A study conducted in 2012 for the European Association of Nuclear Medicine (EANM) Annual Congress in France revealed that 577 PET and/or PET/CT providers operated throughout Western Europe, with PET/CT making up 92% of the installed systems.

Over the projection period, the Asia-Pacific area is anticipated to expand at the fastest rates, mostly as a result of better medical infrastructure, a rise in the number of hospitals with cutting-edge scanning equipment, the expansion of R&D departments, and greater healthcare.

COVID-19 Impact on Global PET-CT Scanner Devices Market:

The use of PET imaging allows the tracking of crucial pathophysiological changes in COVID-19 at the molecular level, hence offering crucial direction for the future diagnosis, assessment, and management of the virus. The most often employed PET imaging agent in COVID-19 patients is still F-labeled fluorodeoxyglucose (18F-FDG), a radiolabeled glucose analog. The combined PET/CT system may be used to concurrently characterize the structural and functional alterations of COVID-19. The positioning of the PET-CT scanning equipment on the market was aided by their usage in the diagnosis and assessment of COVID-19. The market for PET-CT scanning devices was shown to be positively impacted by COVID-19. This was linked to an increase in the use of PET-CT scans for COVID-19 diagnosis, assessment, and treatment. In addition, cancer patients receiving radiation therapy had a higher chance of developing a more serious illness. The market's growth was also influenced by people with cancer being concerned about COVID-19's effects on them, which is likely to increase demand for PET CT scanning equipment.

Global PET-CT Scanner Devices Market Recent developments:

Xeleris V, a novel virtual processing and review system, was unveiled by GE Healthcare. Additionally, Xeleris V assists in eliminating the need for a stand-alone nuclear medicine workstation, allowing physicians to securely view data from several places. Additionally, physicians now have rapid and simple access to the data they require to make individualized treatment decisions thanks to Xeleris V and its advanced AI capabilities combined with GE Healthcare's nuclear medicine scanners from the 800 and 600 Series.

In the Japanese domestic market, Shimadzu Corporation debuted the BresTome TOF-PET, a novel functional imaging system specifically designed for the head and breast. Double the resolution of standard whole-body PET systems is offered by the new technology. It can be used for therapeutic applications for brain tumors and epilepsy covered by Japanese public health insurance, as well as to assist in the clinical treatment of degenerative neurological illnesses, such as Alzheimer's disease.

Biograph Vision Quadra, a CE-Marked positron emission tomography/computed tomography (PET/CT) scanner, was introduced by Siemens Healthineers. The novel approach is created for both translational research, which applies science to create treatments and practices that improve health outcomes, and clinical usage.

Key Players:

-

Bruker Corporation

-

Siemens Healthineers

-

Koninklijke Philips N.V

-

GE Healthcare

-

Mediso Ltd.

-

MinFound Medical Systems Co., Ltd

-

MR Solutions

-

Neusoft Corporation

-

SOFIE

-

Canon, Inc

-

United Imaging Healthcare Co

-

In Jan 2022: Neusoft Medical Systems, a preeminent worldwide supplier of clinical diagnostic and therapeutic solutions, and Positron Corporation cooperated to manufacture, distribute, and further advance the R&D of Positron's revolutionary PET/CT nuclear imaging technology. After the partnership, the two businesses would combine their nuclear cardiology services and PET/CT technologies while enhancing their clinical services and diagnostic capabilities for cancer imaging.

-

In Jul 2021: GE Healthcare partnered with Quibim, a pioneer in medical image processing and artificial intelligence (AI) worldwide. As part of this partnership, the two businesses would work together to build an advanced total-body PET/CT scanner for simultaneous whole-body imaging in a Temporary Business Association (TBA). The project, called IMAS (Imagen Molecular de Alta Sensibilidad), would focus on high-sensitivity molecular imaging.

Chapter 1. PET-CT Scanner Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PET-CT Scanner Devices Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PET-CT Scanner Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PET-CT Scanner Devices Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PET-CT Scanner Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PET-CT Scanner Devices Market – By Type

6.1 Introduction/Key Findings

6.2 Stationary Scanners

6.3 Portable/Mobile Scanner

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. PET-CT Scanner Devices Market – By Slice Count

7.1 Introduction/Key Findings

7.2 Low Slice Scanner (<64 Slices)

7.3 Medium Slice Scanner (64 Slices)

7.4 High Slice Scanner (>64 Slices)

7.5 Y-O-Y Growth trend Analysis By Slice Count

7.6 Absolute $ Opportunity Analysis By Slice Count , 2024-2030

Chapter 8. PET-CT Scanner Devices Market – By Isotope/Detector Type

8.1 Introduction/Key Findings

8.2 Fluorodeoxyglucose (FDG)

8.3 62Cu ATSM

8.4 18 F Sodium Fluoride

8.5 FMISO

8.6 Gallium

8.7 Thallium

8.8 Others

8.9 Y-O-Y Growth trend Analysis By Isotope/Detector Type

8.10 Absolute $ Opportunity Analysis By Isotope/Detector Type , 2024-2030

Chapter 9. PET-CT Scanner Devices Market – By Application

9.1 Introduction/Key Findings

9.2 Oncology

9.3 Neurology

9.4 Cardiology

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Application

9.7 Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 10. PET-CT Scanner Devices Market – By Service Provider

10.1 Introduction/Key Findings

10.2 Hospitals

10.3 Diagnostic Centers

10.4 Research Institutes

10.5 Ambulatory Surgical Centers

10.6 Y-O-Y Growth trend Analysis By Service Provider

10.7 Absolute $ Opportunity Analysis By Service Provider , 2024-2030

Chapter 11. PET-CT Scanner Devices Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Type

11.1.2.1 By Slice Count

11.1.3 By By Isotope/Detector Type

11.1.4 By Service Provider

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Type

11.2.3 By Slice Count

11.2.4 By By Isotope/Detector Type

11.2.5 By Application

11.2.6 By Service Provider

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Type

11.3.3 By Slice Count

11.3.4 By By Isotope/Detector Type

11.3.5 By Application

11.3.6 By Service Provider

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Type

11.4.3 By Slice Count

11.4.4 By By Isotope/Detector Type

11.4.5 By Application

11.4.6 By Service Provider

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Type

11.5.3 By Slice Count

11.5.4 By By Isotope/Detector Type

11.5.5 By Application

11.5.6 By Service Provider

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. PET-CT Scanner Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Bruker Corporation

12.2 Siemens Healthineers

12.3 Koninklijke Philips N.V

12.4 GE Healthcare

12.5 Mediso Ltd.

12.6 MinFound Medical Systems Co., Ltd

12.7 MR Solutions

12.8 Neusoft Corporation

12.9 SOFIE

12.10 Canon, Inc

12.11 United Imaging Healthcare Co

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global PET-CT Scanner Devices Market was valued at $2.33 billion, and is projected to reach a market size of $3.46 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 5.8%.

Increased Disease Prevalence Drives Up Demand for PET-CT Scanner Equipment and Stationary/Portable to Rule Global Market Growth.

Elevated expenses for installation and upkeep might impede market expansion.

Oncology application is the fastest growing in the Global PET-CT Scanner Devices Market.

Asia-Pacific region is the fastest growing in the Global PET-CT Scanner Devices Market.