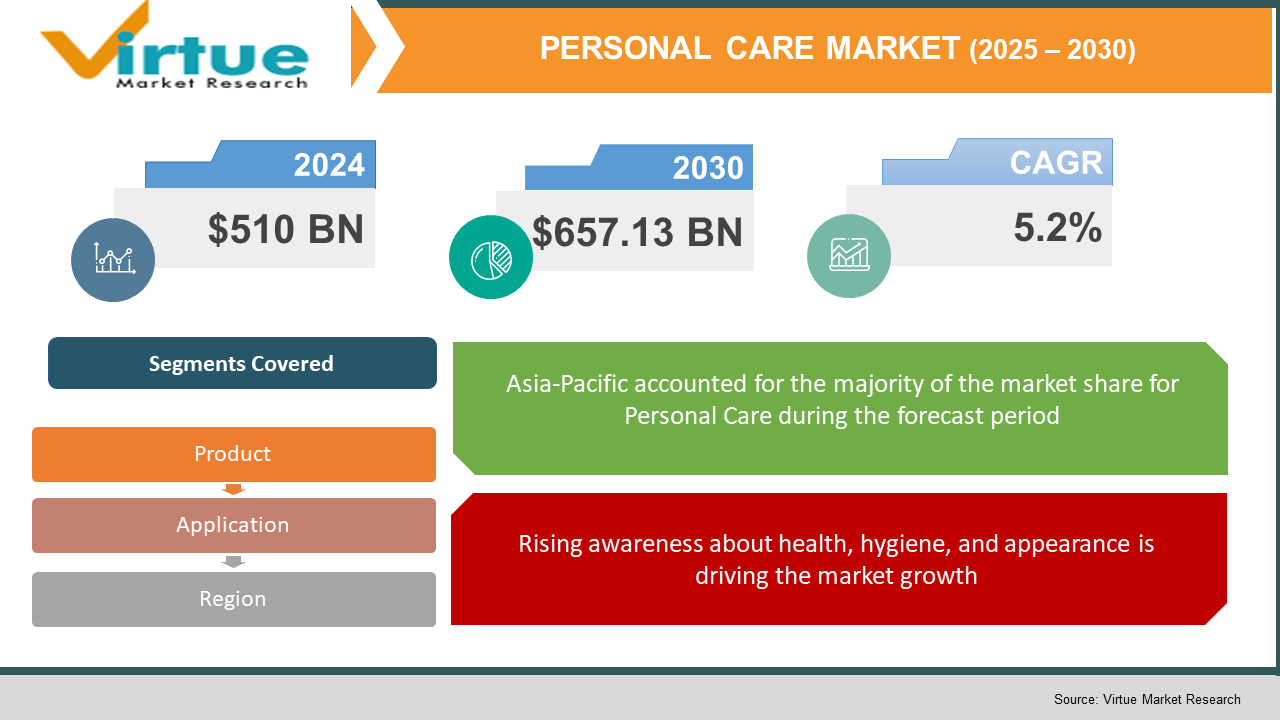

Personal Care Market Size (2025-2030)

The Global Personal Care Market was valued at USD 510 billion in 2024 and will grow at a CAGR of 5.2% from 2025 to 2030. The market is expected to reach USD 657.13 billion by 2030.

The Personal Care Market includes a wide array of products aimed at maintaining personal hygiene, grooming, and health. These products encompass skincare, haircare, oral care, cosmetics, fragrances, and hygiene products such as deodorants, soaps, and sanitary items. With rising consumer awareness, the personal care market has evolved from basic hygiene to include luxury, wellness, and eco-conscious elements. Consumers today are more informed and selective, opting for personalized, ingredient-transparent, and sustainable products. The market’s expansion is being driven by urbanization, increased disposable incomes, social media influence, and the convergence of beauty and wellness. Emerging trends such as clean beauty, gender-neutral formulations, and digital beauty tools continue to redefine how consumers engage with personal care brands globally.

Key market insights:

Asia-Pacific accounted for 36% of the global personal care market share in 2024, making it the largest regional market.

Skincare remained the leading segment in 2024, contributing over USD 180 billion globally, driven by anti-aging and sun protection products.

E-commerce channels saw a 14% increase in personal care product sales year-on-year, primarily due to Gen Z and millennial consumers.

Demand for natural and organic personal care products grew by 17% in 2024, led by the US, Germany, and South Korea.

Men’s grooming products registered a CAGR of 6.8% from 2022 to 2024, as brands launched specialized skincare and haircare lines for men.

Personal care companies are increasingly investing in refillable and recyclable packaging, with sustainable packaging adoption growing by 11% in 2024.

Influencer and celebrity collaborations accounted for 21% of new brand launches globally in 2024, boosting brand recognition and reach.

Global Personal Care Market Drivers

Rising awareness about health, hygiene, and appearance is driving the market growth

One of the most significant drivers of the personal care market is the increasing consumer awareness regarding health, hygiene, and personal appearance. Today’s consumers recognize the strong link between appearance and self-confidence, as well as the social and professional implications of personal grooming. The COVID-19 pandemic intensified focus on hygiene, driving demand for hand sanitizers, antibacterial soaps, and hygiene-focused skincare. As education and access to information improve globally, even rural and semi-urban populations are adopting personal care routines. Awareness campaigns led by governments and NGOs also contribute to better hygiene practices, especially in developing countries. Additionally, the rise in screen time and video interactions through social platforms and professional meetings has led consumers to pay greater attention to their appearance, boosting categories like skincare, makeup, and haircare. This increased awareness has not only expanded product usage across age and gender groups but also deepened frequency of purchase and category diversification. Brands are leveraging this trend by offering products tailored for specific needs such as anti-aging, acne control, or skin brightening, along with educational content that helps consumers build personalized routines. This shift from basic hygiene to overall wellness and appearance is a long-term growth driver for the market.

Boom in e-commerce and digital engagement is driving the market growth

The rapid digitization of commerce and the rise of social media platforms have significantly transformed how consumers discover, evaluate, and purchase personal care products. E-commerce platforms offer convenience, access to international brands, personalized recommendations, and frequent promotional offers, all of which have attracted consumers globally. The boom in beauty-focused content on platforms like Instagram, TikTok, and YouTube has enabled even smaller brands to gain visibility and build loyal communities. Influencers and beauty vloggers play a key role in educating consumers, demonstrating products, and sharing honest reviews, which in turn fosters trust and drives purchase decisions. Artificial Intelligence and Augmented Reality technologies have further elevated the online shopping experience, enabling features like virtual try-ons and skin diagnostic tools that were once limited to physical stores. Direct-to-consumer (D2C) brands are thriving under this model, bypassing traditional retail channels and focusing on customer engagement, fast delivery, and product customization. As mobile and internet penetration increases, particularly in emerging economies, digital platforms are expected to become the dominant sales channel for personal care products. This digital transformation not only expands market reach but also provides valuable consumer insights, allowing brands to innovate and iterate faster than ever before.

Shifting preferences towards clean, natural, and sustainable products is driving the market growth

Environmental consciousness and concern for health have prompted a major shift in consumer preferences toward clean, natural, and sustainable personal care products. Clean beauty, characterized by formulations free of parabens, sulfates, and harmful chemicals, is becoming a mainstream expectation rather than a niche demand. Consumers are increasingly scrutinizing ingredient lists and favor brands that are transparent about sourcing, production processes, and ethical practices. Products with plant-based, cruelty-free, and vegan certifications are gaining traction, especially among younger consumers and urban populations. Additionally, sustainable packaging—such as biodegradable containers, refillable systems, and recyclable materials—is becoming a critical factor influencing buying decisions. Brands that fail to adopt eco-friendly practices risk losing relevance in the eyes of environmentally conscious consumers. Many companies are also adopting circular economy principles, where used packaging is collected and reused or responsibly disposed of. This demand is further supported by regulatory frameworks in Europe and North America that encourage green practices. Clean and sustainable personal care is no longer limited to premium segments; mass-market brands are also entering the space, making it more accessible. As this trend matures, it is likely to drive long-term structural changes in formulation, sourcing, and brand positioning.

Global Personal Care Market Challenges and Restraints

Complex regulatory compliance and formulation standards is restricting the market growth

One of the primary challenges in the personal care market is navigating the complex and evolving regulatory landscape. Each region has its own set of compliance requirements, ingredient restrictions, and labeling standards, making global expansion particularly challenging for brands. For example, the European Union has banned over 1,300 substances in cosmetics, while the U.S. Food and Drug Administration (FDA) regulates personal care under relatively looser frameworks. This disparity requires brands to create different product formulations for different markets, increasing R&D costs and complicating manufacturing processes. Furthermore, the growing demand for clean beauty has led to greater consumer scrutiny and legal expectations around “natural” or “organic” labeling, which are not uniformly defined across markets. Mislabeling or failure to meet transparency standards can result in reputational damage, product recalls, or litigation. In addition, companies must comply with regulations related to animal testing, which are prohibited in several countries, further complicating product development pipelines. The increased use of biotechnology and novel ingredients adds another layer of complexity, as these innovations often fall into regulatory gray zones. Overall, maintaining compliance across jurisdictions while innovating responsibly is a significant challenge that can limit the speed and scope of global market expansion.

Intense competition and price sensitivity in mass-market segments is restricting the market growth

While the personal care industry continues to grow, it is also becoming increasingly crowded and competitive, especially in mass-market segments. Large multinational corporations dominate shelf space and digital presence, but the rise of local players, private labels, and D2C startups is creating price wars and promotional saturation. These new entrants often rely on aggressive pricing strategies and unique selling propositions such as “clean,” “sustainable,” or “customized,” which appeal strongly to digital-native consumers. However, this abundance of choice can lead to brand fatigue and consumer indecision. Established brands face pressure to continually innovate and refresh their offerings while maintaining affordability and quality. Moreover, economic uncertainties and inflationary pressures have heightened price sensitivity among consumers, especially in emerging markets. As a result, buyers may opt for smaller sizes, multipurpose products, or budget-friendly alternatives. Profit margins are under strain, and brand loyalty is harder to sustain. For premium and luxury segments, there’s an added challenge of justifying value amidst increasing skepticism and economic scrutiny. The resulting market environment demands high agility, efficient cost management, and continuous brand differentiation. Without these, even well-established companies risk losing market share to more adaptive and price-competitive newcomers.

Market opportunities

The Global Personal Care Market offers a range of compelling growth opportunities driven by consumer shifts, technological advances, and regional diversification. One major opportunity lies in personalization. With the proliferation of AI and data analytics, brands can now offer highly personalized product recommendations, skincare regimens, and haircare formulations based on individual needs, preferences, and even genetic profiles. This level of customization builds trust and loyalty, particularly among millennial and Gen Z consumers. Another strong opportunity is in emerging markets such as Southeast Asia, Africa, and Latin America. These regions are witnessing rising disposable incomes, urbanization, and youth-driven demographics, all of which are fueling demand for personal care products. Affordable, locally relevant formulations supported by strong digital marketing can make significant inroads in these underserved yet high-potential markets. Additionally, wellness-oriented personal care—combining mental well-being, stress relief, and self-care—has opened a new dimension. Products with aromatherapy benefits, soothing textures, or functional actives like adaptogens and CBD are increasingly sought after. There’s also a notable opportunity in male grooming, a previously underdeveloped segment now seeing exponential growth, particularly in beard care, skincare, and fragrances tailored for men. Furthermore, the rise of inclusive beauty—products that cater to diverse skin tones, hair textures, and gender identities—presents both a commercial and social impact opportunity. Brands that authentically embrace diversity in product development and marketing are poised to gain broader acceptance and loyalty. Finally, strategic partnerships with tech firms, biotech labs, and environmental NGOs can lead to innovations in smart skincare devices, sustainable ingredient sourcing, and carbon-neutral production practices. Together, these opportunities represent the next frontier of growth for the personal care industry.

PERSONAL CARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L'Oréal, Procter & Gamble, Unilever, Estée Lauder, and Johnson & Johnson. |

Personal Care Market segmentation

Personal Care Market Segmentation By Product:

• Skincare

• Haircare

• Oral Care

• Deodorants and Fragrances

• Cosmetics and Makeup

• Hygiene Products

• Men’s Grooming Products

• Baby and Child Care

Skincare is the most dominant segment in the global personal care market, owing to increasing awareness about skin health, anti-aging, sun protection, and routine care. Skincare alone accounts for over 35% of the market. Innovations such as serums, facial oils, and dermatologically-tested products have fueled the demand. The segment benefits from strong consumer interest, constant product launches, and an ability to cater to diverse needs across age, gender, and skin types. Social media influencers and dermatologists contribute to continuous engagement and consumer education in this category.

Personal Care Market Segmentation By Application:

• Household/Individual Use

• Salons and Spas

• Online Subscription Boxes

• Travel and Hospitality

• Dermatology Clinics

• E-commerce Platforms (D2C)

Household or individual use remains the most dominant application segment due to the personal and routine nature of care products. Most consumers purchase personal care products for at-home use, forming habits around daily hygiene and grooming. This segment includes everything from toothpaste and shampoo to facial creams and deodorants. It benefits from high purchase frequency, brand loyalty, and increasing customization for home-use regimens. The shift to work-from-home has further accelerated demand for at-home self-care products.

Personal Care Market Regional segmentation

• North America

• Europe

• Asia-Pacific

• South America

• Middle East and Africa

Asia-Pacific is the dominant region in the global personal care market, contributing to more than one-third of total global revenues in 2024. This dominance is supported by several structural and cultural factors. The region is home to large, densely populated countries like China and India, where rising disposable income, urbanization, and youth demographics drive strong demand for personal care products. Additionally, cultural importance placed on grooming and skincare in countries like South Korea and Japan fuels innovation and early adoption of new trends. K-beauty and J-beauty are now globally recognized for their innovation, minimalistic regimens, and efficacy, influencing product development worldwide. The rise of local and regional brands that understand consumer preferences, such as skin tone-specific products or herbal formulations, further supports domestic consumption. E-commerce penetration and mobile-first consumer behavior have also created robust digital sales channels, helping global and local brands alike. Meanwhile, the expansion of organized retail chains and beauty specialty stores in tier-2 and tier-3 cities enhances accessibility and visibility. Governments in the region are also encouraging manufacturing through policies and incentives, turning countries like India into major production hubs. All these factors together position Asia-Pacific as both the largest and the fastest-growing region in the personal care market.

COVID-19 Impact Analysis on the Personal Care Market

The COVID-19 pandemic brought both challenges and transformation to the global personal care market. In the initial months of the pandemic, the industry experienced supply chain disruptions, labor shortages, and reduced retail footfall due to lockdowns and safety concerns. Demand for certain product categories such as makeup and fragrances declined temporarily as consumers stayed indoors and socialized less. However, other categories like hygiene products, skincare, and haircare saw significant growth as people turned to self-care and preventive health routines. The shift to remote work and increased time spent at home accelerated the use of skincare and wellness-related personal care items. DIY beauty treatments, home facials, and self-grooming became new habits. Meanwhile, digital sales surged as consumers increasingly shopped online. Brands that adapted quickly to digital-first strategies, strengthened e-commerce channels, and engaged through content marketing were able to maintain customer engagement and drive sales. The pandemic also heightened consumer awareness about product ingredients, safety, and sustainability, reinforcing demand for clean and natural personal care options. Supply chain resilience became a focal point for companies, with many seeking to localize manufacturing and build agile distribution networks. New hygiene-focused product lines such as antibacterial lotions and facial cleansers became permanent additions to brand portfolios. COVID-19 also accelerated the wellness trend, blurring lines between personal care, healthcare, and mental well-being. Overall, while the market faced short-term disruptions, the pandemic catalyzed lasting shifts in consumer behavior, product innovation, and go-to-market strategies that continue to shape the industry’s trajectory.

Latest trends/Developments

The personal care market is witnessing a wave of trends that are reshaping product innovation, branding, and consumer engagement. One prominent trend is the evolution of the wellness-centric personal care routine, where mental and emotional well-being are integrated into skincare and grooming rituals. Products infused with adaptogens, essential oils, and calming botanicals are in demand, offering both aesthetic and psychological benefits. Another trend gaining momentum is the use of biotechnology to create bio-based actives and lab-grown ingredients that offer high efficacy with minimal environmental impact. Companies are partnering with biotech firms to develop next-generation solutions for aging, acne, and sensitivity. Gender-neutral and inclusive beauty is another critical development, with brands launching products that cater to diverse skin tones, hair textures, and gender identities. Packaging design and brand language are also evolving to reflect this inclusivity. Personalized beauty continues to rise with AI-driven diagnostics, DNA-based product matching, and personalized subscription kits gaining traction. Augmented reality features such as virtual try-ons and face mapping tools enhance consumer confidence in online purchases. The clean beauty movement has matured, with consumers expecting not just chemical-free formulations but also ethical sourcing, carbon-neutral production, and full ingredient transparency. Waterless and solid personal care products are becoming popular for their environmental benefits and travel-friendliness. Influencer-led brands and celebrity collaborations remain impactful, but authenticity and brand values are now key to consumer loyalty. Finally, regional heritage and traditional remedies are being reinterpreted with modern science, giving rise to hybrid products that blend tradition with innovation.

Key Players:

- L'Oréal

- Procter & Gamble

- Unilever

- Johnson & Johnson

- Estée Lauder

- Beiersdorf

- Shiseido

- Colgate-Palmolive

- Amorepacific

- Coty Inc.

Chapter 1. Personal Care Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. PERSONAL CARE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. PERSONAL CARE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. PERSONAL CARE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. PERSONAL CARE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PERSONAL CARE MARKET – By Product

6.1 Introduction/Key Findings

6.2 Skincare

6.3 Haircare

6.4 Oral Care

6.5 Deodorants and Fragrances

6.6 Cosmetics and Makeup

6.7 Hygiene Products

6.8 Men’s Grooming Products

6.9 Baby and Child Care

6.10 Y-O-Y Growth trend Analysis By Product

6.11 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. PERSONAL CARE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Assessment and Progress Tracking

7.3 Personalized Learning Paths

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. PERSONAL CARE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Deployment Model

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Deployment Model

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Deployment Model

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Deployment Model

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Deployment Model

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. PERSONAL CARE MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 Wolfram Research

9.2 Saltire Software

9.3 The MathWorks

9.4 PTC

9.5 Maplesoft

9.6 Gurobi Optimization

9.7 GAMS Development Corporation

9.8 Signalysis

9.9 Civilized Software

9.10 McGraw-Hill Education

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Personal Care Market was valued at USD 510 billion in 2024 and will grow at a CAGR of 5.2% from 2025 to 2030. The market is expected to reach USD 657.13 billion by 2030.

Key drivers include rising health and beauty awareness, growth in e-commerce, and demand for clean and sustainable products

Segments include skincare, haircare, cosmetics, hygiene products, oral care, men’s grooming, and baby care.

Asia-Pacific is the dominant region due to large populations, cultural grooming traditions, and rising disposable incomes.

Leading players include L'Oréal, Procter & Gamble, Unilever, Estée Lauder, and Johnson & Johnson.