Permethrin Market Size (2024 – 2030)

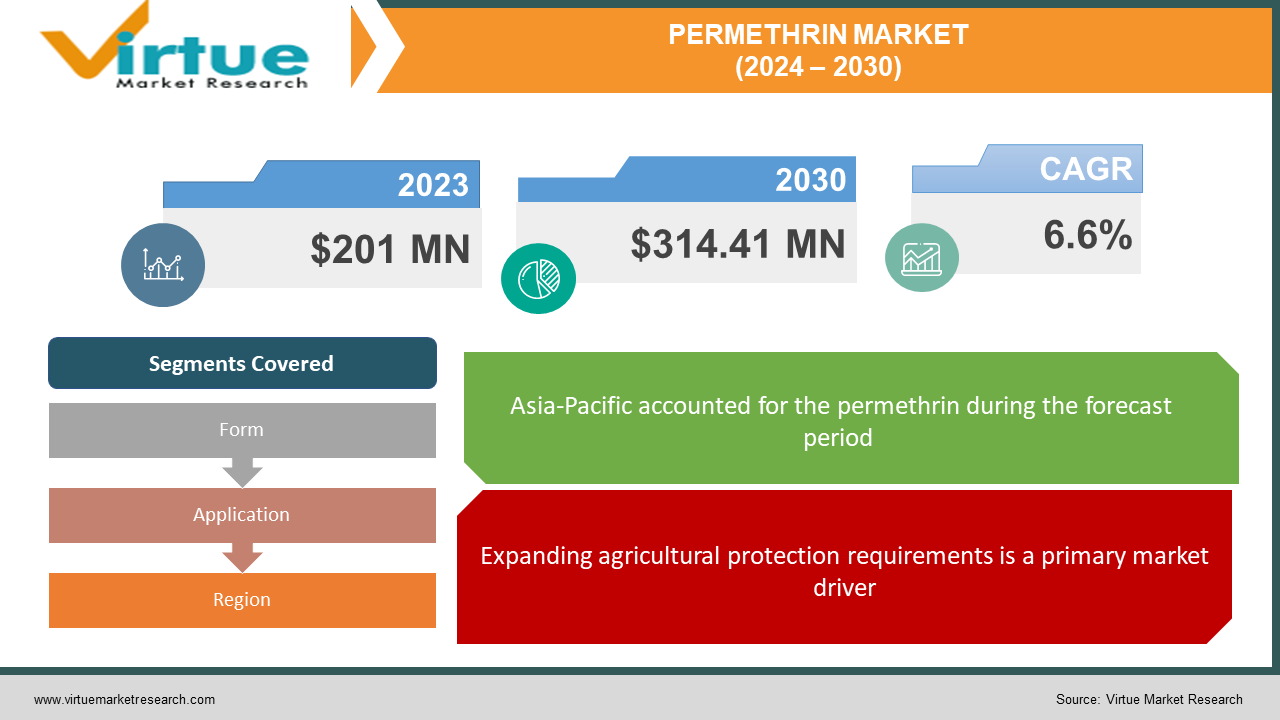

The permethrin market was valued at USD 201 million in 2023 and is projected to reach a market size of USD 314.41 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.6%.

Permethrin is a synthetic pyrethroid insecticide that is widely used to control insects such as lice, scabies mites, ticks, fleas, mosquitoes, and other arthropods. The permethrin market has seen steady growth over the past decade, driven by its low toxicity to mammals and high effectiveness across a broad spectrum of insects. Countries like China and India, with huge agricultural areas and rapid industrialization, support market growth in this region. North America and Europe are the other major shareholders. Rising environmental concerns and strict regulations have tempered demand growth to some extent in these mature regions. However, the introduction of newer low-toxicity variants like NRDC 161 continues to provide opportunities to manufacturers. The global permethrin market displays a high level of integration across the value chain. Efforts are ongoing to develop safer, more targeted applications to mitigate the adverse effects associated with permethrin's use. Partnerships with research organizations and marketing outreach programs also form part of prominent companies’ expansion strategies.

Key Market Insights:

The global permethrin market has witnessed steady expansion in recent years on account of several favorable factors related to agriculture, public health, industry, and pest control requirements. A major driver of permethrin demand is its prominent usage in agriculture and farming. As one of the most widely adopted crop protection chemicals, permethrin helps combat infestations, prevent crop losses, and increase productivity. With rising food requirements, there is greater pressure on yield enhancement, which spurs utilization further. The WHO estimates that, despite less than 2% arable land worldwide, pest destruction causes up to 40% potential yield loss annually. Insecticides thus serve an important role. Developing economies with large agrarian dependence, like China, India, Brazil, etc., display higher consumption trends. Another key application area is public health, especially vector control programs. Permethrin finds extensive usage in protecting against insect-borne tropical diseases like malaria, dengue, yellow fever, etc. that pose major health burdens. The veterinary health sector also contributes heavily to market development. Rising livestock numbers to satisfy meat and dairy requirements have increased disease vulnerability, like ticks, mites, and lice infestations. Permethrin doses in animal shelter disinfection, topical medicines, and veterinary hygiene products offer cost-effective and efficient solutions for farmers and pet owners alike. Permethrin market progression appears positive globally, considering broad-spectrum applications and increased pest proliferation. However, alternatives like biopesticides may pose competition in the long run.

Permethrin Mark Drivers:

Expanding agricultural protection requirements is a primary market driver.

Expanding requirements for safeguarding agricultural yields and preventing food losses represent a fundamental factor underscoring growth in the global permethrin market currently. As populations expand exponentially, pressure on enhancing crop productivity has intensified greatly while land resources face continued decline. Additionally, climate change has facilitated earlier seasonal appearances and wider propagation among pest species, elevating yield vulnerabilities further. Insecticides like permethrin thus serve an integral role in realizing yield optimization goals. Permethrin protects against over 200 varieties of crop-damaging pests, including leafhoppers, beetles, weevils, caterpillars, aphids, etc., across the cultivation period. Left unchecked, these may account for up to 40% of losses, as per FAO estimates. The problem is especially severe in tropical and subtropical belts in Asia, the Pacific, and Latin America, where warmer conditions enable multiple generations per year, unlike temperate zones with single annual cycles. China and India represent key examples where governmental subsidization schemes improve farmer access to crop protection inputs, ensuring enhanced productivity, which translates to national GDP growth and self-sufficiency indices. Developing tropical regions display faster expansion trajectories compared to North American and European markets, where biological alternatives find increasing preference for conducive policies. Globally, about 3 million tons of active ingredients sold annually are insecticides, with the majority in Asia. Permethrin market expansion is fundamentally tied to enhancing crop protection capacities, supporting domestic and global food sufficiency goals, and minimizing qualitative and quantitative agricultural losses. Factors like population growth, dietary transitions, degrading land resources, and climate change impacts signal a continual rise in crop-safeguarding chemical demands.

The second key factor driving permethrin industry growth is the pronounced demand for targeting vector-borne tropical maladies globally.

The global burden of insect vector-spread illnesses has risen dramatically over the past decades, with warming climates expanding transmission ranges while population movement enables broader dispersion. Lacking viable vaccines, emphasis on elimination of carriers remains the key strategy underscoring widespread adoption in public health initiatives. This presents massive potential for growth within the synthetic pyrethroid domain, especially for permethrin, one of the safest and most economical options currently available. In the absence of viable vaccinations for many major vector illnesses so far, the emphasis remains on limiting infection sources through the elimination of mature insects and breeding grounds in communities demonstrating active transmission. This is enabled by the strategic deployment of residual sprays, larvicidal treatments, and sterilization drives containing active agents like permethrin, which is essential for mitigating disease spread cost-effectively while demonstrating negligible toxicity among humans at dosage volumes utilized. The unprecedented rise of insect-borne diseases over the past years shows little signs of abatement considering ecological changes that continue to expand transmission parameters. In the absence of immunization options, emphasis on mitigating infection sources reinforces growth avenues for agents like permethrin, already considered the gold standard for public health initiatives owing to their human safety profile and cost-effectiveness unmatched by alternatives.

Permethrin Market Restraints and Challenges:

A major challenge contributing to limiting permethrin usage includes rising ecological concerns associated with persistent application.

Concerns regarding ecological stability have emerged as a key restraint limiting adoption rates for permethrin applications globally. As governments and authoritative bodies prioritize environmental conservation efforts, usage protocols face tighter control, considering associated toxicity risks across different categories. Permethrin demonstrates substantially high survival duration outdoors owing to the stable synthetic formulation structure, nearly a month under certain conditions. This elicits greater vulnerability concerning runoffs into adjoining water bodies following agricultural or vector control spraying operations. Aquatic ecosystems often bear the brunt, considering their pronounced negative effects on development and reproduction among species, disrupting fundamental food chain dynamics. Half the global insecticide application is estimated to target cotton cultivation zones in developing economies where inadequate protocols exacerbate contamination levels, severely destabilizing river and lake biomes through excessive algal densities and symptomatic eutrophication. The knockdown effects may be irrecoverable beyond certain thresholds, as evidenced by certain Indian water bodies devoid of fish populations previously integral to supporting catch-yield-based rural livelihoods.

A further significant obstacle impeding the unrestricted expansion of the permethrin market is the increasing resistance tendencies among the targeted insect and pest species, which ultimately reduce the compound's long-term effectiveness.

Another major factor challenging unfettered adoption rates for permethrin includes surging resistance development among targeted insect and pest species. Following the introduction of pyrethroids in the 1970s, exponential agricultural usage has facilitated perceptible immunity markers across over 500 varieties so far that interfere with the compound's paralytic mechanism, minimizing knockdown potentials. Insects demonstrate enormous genetic adaptability, allowing rapid proliferation of traits and providing survival advantages against recurrent exposure to a particular toxin through successive generations. Behavioral modifications may also aid avoidance, contributing collectively towards diminished pesticide effectiveness necessitating greater concentrations. However, heightened intensities simultaneously exacerbate ecological stability risks and cost impediments for farmers, especially in developing economic zones with affordability constraints. Mosquito immunity has rendered certain malaria and dengue control programs ineffective, as endemic regions demonstrate virtually 100% resilience among carriers against WHO-approved dosages. Control failures resulting in upticks have been reported periodically across Sub-Saharan Africa and Southeast Asia, prompting authorities to alternate between limited pyrethroids, hoping to retain transient impacts before populations develop renewed tolerance. Agricultural pests also display lowered mortalities despite multiplex exposures, allowing elevated crop damage. Certain beetles and weevils demonstrate over 100 times their baseline lethal quotas without eliciting 90% mortality thresholds. While complete immunity remains unlikely owing to energetic tradeoffs for insects inhabiting resistance, diminished control capacities necessitate concentrated interventions promoting judicious usage protocols if permethrin's positioning persists as a widely adopted pest control agent globally. Advanced monitoring mechanisms, tracking resistance developments, and tailored responses represent proposed solutions going forward.

Permethrin Market Opportunities:

A major prospect includes greater adoption across developing tropical belt countries lacking adequate access currently. Latin America, African, and Asian regions host concentrated vulnerable populations facing severe disease burdens from insect pests. However, affordability issues and infrastructure barriers have constrained higher permethrin utilization, which is necessary for balancing productivity and infection control priorities. The infrastructural spread also supports decentralized production, limiting export volumes from China and India while supporting domestic growth initiatives. Industry leaders are therefore poised to capitalize on latent opportunities via localized production establishments and competitive pricing strategies in cost-sensitive markets. Permethrin's human safety profile has elicited high interest in topical formulations tackling parasitic infections like scabies, lice, and mites through specialized pharmaceutical products. Adoption across veterinary segments also remains resurgent, with a surging emphasis on livestock health management. Players like Bayer already market commercial products for pet parents and cattle owners. The fabric protection domain also offers consumption verticals, considering permethrin variants demonstrate no dermal sensitization while offering durable repellency and insecticidal capacity against mosquitoes, ticks, etc. across a spectrum of clothing types. Some market estimations suggest the apparel impregnation sector may grow at over 8% CAGR, much higher than crop protection segments. This signals strong upside potential. The permethrin industry retains high upside potential, buoyed by untapped markets and expanded application segments, despite certain limitations that have curtailed growth rates historically. Strategic commercialization efforts directed at novel user categories offer significant returns on investment for companies seeking to consolidate market shares further. The industry is well-positioned to capitalize on these high-return sectors going forward.

PERMETHRIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sumitomo Chemical, Yangnong Chemical, Bayer, Heranba, Tagros, Aestar |

Permethrin Market Segmentation: By Form

-

Liquid

-

Powder

-

Ready-to-Use Spray

-

Others

The liquid segment has the largest market share in 2023. This is widely accessible in a wide range of concentrations and can be diluted with water for a variety of uses. Agricultural sprays, treatments for lice and scabies, and consumer insect repellents all frequently contain liquid permethrin. In industrial settings and some agricultural uses, permethrin powder is frequently preferred. Its capacity to hold onto moisture and longer shelf life than liquid forms make it valuable. To make dust-based insecticides for treating crops or livestock, permethrin powder is frequently combined with other inert components. Ready-to-use spray is the fastest-growing. This form of permethrin offers the utmost convenience. Pre-mixed and packaged in spray bottles, these preparations find wide use in domestic settings for household pest control and direct application on clothing and gear as an insect repellent.

Permethrin Market Segmentation: By Application

-

Agriculture

-

Textile

-

Medical

-

Domestic

-

Personal Care

Permethrin holds the largest share in the agricultural sector. It's a broad-spectrum insecticide that protects crops against a wide range of destructive pests, such as aphids, beetles, caterpillars, and others. Farmers rely heavily on permethrin for increased yields and protection of their revenue streams. It is estimated to control a significant portion of the market, potentially around 40–45%. The textile category is the fastest-growing. Perchlorin treatment is used in textile applications to give textiles insect-repellent qualities. This is especially useful for mosquito nets, camping equipment, and outdoor apparel. This market is growing because people are becoming more conscious of vector-borne illnesses and because there is a need for fabrics that are resistant to insects, particularly in areas where these illnesses are common.

Permethrin Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific represents the leading regional market, with the largest revenue share currently at 40%. The dominance of the Asia-Pacific market is attributed to the high agricultural density and tropical climate in countries like China, India, Thailand, Indonesia, etc., which facilitate greater pest manifestations and crop protection chemical usage. Increasing subsidization schemes for farmer inputs by governments focused on food self-sufficiency goals also drive regional growth. Europe is the fastest-growing region. Large-scale farming across Germany and the United Kingdom, existing infrastructure, and high consumer abilities promote permethrin adoption for meeting agricultural yield targets and managing vector-borne disease outbreak risks; the majority of usage is directed through public health bodies.

COVID-19 Impact Analysis on the Permethrin Market:

The advent of the COVID-19 pandemic delivered both positive and negative implications for global permethrin market dynamics by affecting demand determinants across key end-use segments. The overall impact was largely neutral, although projections indicate a rebound recovery is likely shortly. On the downside, temporary factors that constrained demand included quarantine and lockdowns at the manufacturing facilities of major producers, which stalled supply chains and created unavailability at supplier and distributor levels. Reduced workforce availability, containment zone protocols, etc. also hampered production capacities, barring essential chemical outputs. The closure of institutionalized pest control facilities like fumigation centers and sterilization departments because of estate restrictions also lowered permethrin volume utilization in municipalities. Initiatives are earlier prominent in curtailing vector-borne infection prevalence through mosquito and pathogen containment drives. At the same time, trade blockages owing to movement restrictions contributed to supply chain disruptions, limiting accessibility for agrarian sectors that conventionally demonstrated substantial permethrin consumption patterns historically and curtailing farm-level coverage and yield optimization objectives. India, for example, witnessed a nearly 20% decline in crop protection chemical revenues within the initial pandemic phase. Reduced affordability from diminished incomes also contributed to lowered product intakes. The global permethrin market shows signs of recovering to its historic trajectory; it is likely to expand at a 4% CAGR through 2028, approaching USD 1.2 billion. Strategic initiatives by manufacturers focusing on bio-efficacy enhancements and emerging application pipelines should help further industry value in the post-COVID era.

Latest Trends/ Developments:

The development of bio-based variants targeting selective toxicity improvements remains a key focus area. Companies are investing in molecular alterations that preserve insecticidal efficacy against target species while minimizing risks for non-target categories, including mammals and beneficial arthropods. Another recent trend includes concerted commercialization efforts towards expansion across non-conventional domains beyond prime agricultural usage. These relatively novel and niche sectors offer renewed growth avenues. Of particular interest are veterinary healthcare and fabric protection products. Leading manufacturers have forayed into the pet care segment with specialized offerings for flea and tick control, including spot-on treatments and infused collars harnessing permethrin's fumigation capacity. Textile partnerships also enable durable inhibition on garments using ultralow concentrations amid rising outdoor recreation. The fabrics retain repellency up to 70 washes while being safe for humans. Regional diversification has enabled companies to reach untapped markets with high agricultural dependence and tropical disease prevalence. Locally relevant pricing strategies and establishing new production units aid in deeper penetration across such cost-sensitive territories. Strategic decisions across safety, application scope, and geographical presence shall collectively aid the global permethrin industry in sustaining healthy adoption levels and counterbalancing limitations posed by regulatory controls or emerging substitutes. Investments in technical efficiencies also enable competitive differentiation for manufacturers.

Key Players:

-

Sumitomo Chemical

-

Yangnong Chemical

-

Bayer

-

Heranba

-

Tagros

-

Aestar

Chapter 1. Permethrin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Permethrin Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Permethrin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Permethrin Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Permethrin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Permethrin Market – By Form

6.1 Introduction/Key Findings

6.2 Liquid

6.3 Powder

6.4 Ready-to-Use Spray

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Form

6.7 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Permethrin Market – By Application

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Textile

7.4 Medical

7.5 Domestic

7.6 Personal Care

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Permethrin Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Permethrin Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Sumitomo Chemical

9.2 Yangnong Chemical

9.3 Bayer

9.4 Heranba

9.5 Tagros

9.6 Aestar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Expanding agricultural protection requirements and demand for targeting vector-borne tropical maladies are the main factors propelling the market.

Permethrin is highly toxic to fish, aquatic invertebrates, and beneficial insects like bees. Inadvertent runoff from agricultural fields or improper disposal can harm aquatic ecosystems. Permethrin can persist in the environment for a certain period, potentially leading to long-term accumulation in soil and water bodies.

Sumitomo Chemical, Yangnong Chemical, Bayer, Heranba, Tagros, and Aestar are the major players.

Asia-Pacific currently holds the largest market share.

Europe exhibits the fastest growth.