PERC Solar Cell Market Size (2024 – 2030)

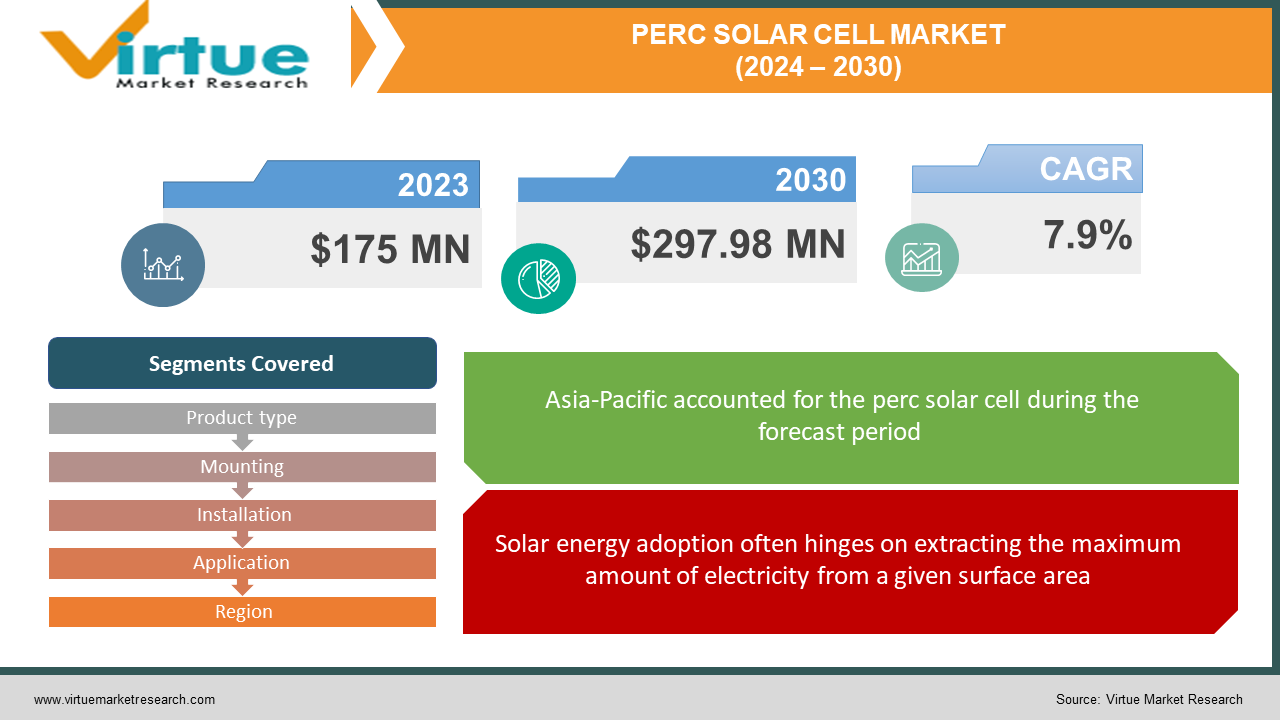

The PERC solar cell market was valued at USD 175 million and is projected to reach a market size of USD 297.98 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.9%.

Photovoltaic cells with a passivated emitter rear cell (PERC) architecture have rapidly gained market share in recent years. PERC cells aim to maximize solar conversion efficiency by reducing the electrical losses that occur in conventional crystalline silicon cells. They achieve this by adding an extra rear-surface passivation layer and optimizing the front emitter surface passivation. Since its commercialization less than a decade ago, PERC has quickly become the dominant cell technology for monocrystalline silicon photovoltaics manufacturers across the globe. The adoption of PERC has mostly been fueled by its increased efficiency over conventional cells. PERC architecture allows for conversion efficiencies of 21–22% by reflecting photons into the cell, while ordinary aluminum back surface field cells are only capable of 16–18% efficiency. The 7–9% relative efficiency increase enables the production of either the same amount of electricity from larger panels or the same amount from smaller, less resource-intensive panels. This results in a decrease in the levelized cost of power. In a short amount of time, PERC has taken over two-thirds of the monocrystalline market share due to its strong efficiency advantage over earlier cell designs.

Key Market Insights:

PERC technology undoubtedly rules the current solar cell market. Success breeds research and development. Newer concepts, like TOPCon and heterojunction solar cells, promise even greater efficiency gains. This means PERC may transition from being the pinnacle to being a solid, cost-effective baseline technology. Factors like low-light performance, temperature resilience, and even aesthetics matter in certain sectors of the market. PERC technology excels, but might not always be the optimal choice across all scenarios. The efficiency improvements PERC brings greatly outweigh the additional manufacturing costs. This fuels consumer-level demand, driving increased deployment and further investment in production. While the basic technology behind PERC remains static, manufacturing equipment and cell construction have become refined. This drives greater output efficiency within large-scale production facilities, reducing the cost per watt over time. Government subsidies, renewable energy targets, and mandates incentivize PERC-based solar installations. Where regulations change, it directly impacts panel choice and, ultimately, which cell technologies manufacturers push. Cloud-based software plays a major role in analyzing data. As panel output with PERC cells can be accurately forecast, this enables precision in predictive maintenance and remote monitoring, aiding the market's growth.

PERC Solar Cell Market Drivers:

Solar energy adoption often hinges on extracting the maximum amount of electricity from a given surface area.

The rear surface of a traditional solar cell reflects a significant portion of unabsorbed sunlight. PERC tackles this with a special passivation layer that reflects this light for a second chance to be converted into electricity. This seemingly simple tweak yields impressive efficiency gains. With PERC, generating the same amount of power requires fewer solar panels or a smaller overall solar array footprint. This is a crucial advantage in scenarios where space comes at a premium, both for commercial and residential projects. Homeowners with limited roof space can maximize their solar generation potential with PERC-based panels. This translates to faster payback on investment and reduced long-term electric bills. Large solar farms rely on energy density. PERC technology enables a significantly greater electricity output for a given land area, optimizing solar project economics.

The success of PERC is attributed to its ability to achieve remarkable increases in efficiency while just slightly raising production costs.

The adaptation of manufacturing processes from traditional solar cells to PERC-based production required relatively modest retooling and investment. This avoided a cost barrier commonly seen with entirely new technological breakthroughs. The meteoric demand for PERC cells triggered substantial scaling in manufacturing capacity. Mass production further drove down costs, making PERC technology accessible to a wider spectrum of projects, from single homes to large utility installations. PERC offered a clear value proposition over conventional cells: more energy produced at a marginally higher price point. This propelled rapid adoption and relegated less efficient older designs to niche markets or obsolescence. Enhanced manufacturing of PERC cells became subject to the same economy of scale effects seen throughout industrial history. Increased production leads to lowered costs per unit, allowing the higher efficiency of PERC to find an ever-wider market of feasible uses. This snowball effect broadened the potential customer base dramatically. In any technology market, customers make cost-benefit analyses. PERC's value proposition was crystal clear: a modestly increased price, outweighed by higher energy yields. Projects constrained by space saw quick payoff potential on their initial investment through higher electricity generation.

PERC Solar Cell Market Restraints and Challenges:

PERC solar cells represented a substantial step forward in solar energy conversion efficiency.

While ongoing incremental advancement continues, PERC is a fundamentally mature design approach. Researchers face inherent limitations regarding how much more efficiency improvement can be squeezed from standard PERC-type cells. Manufacturers focus on reducing micro-losses within production by perfecting the passivation layer process and other cell assembly practices. However, gains achieved this way are small percentages with minimal dramatic impact. PERC technology often delivers adequate efficiency for many applications. This creates less urgency for the rapid adoption of radically different yet costlier solar cell designs, absent dramatic shifts in government incentives or energy economics. Market focus turns to entirely new solar cell concepts: TOPCon, heterojunction cells, and potential tandem designs for layering materials. These hold the promise of greater efficiency but come at the risk of introducing higher manufacturing costs.

Solar energy rightly projects a green image, but manufacturing solar panels and associated components isn't without environmental complexities and risks.

From the mining and refinement of polysilicon to energy-intensive glass and aluminum frame manufacturing, solar panels entail an undeniable environmental footprint. Scrutiny is increasing to ensure production is as sustainable as possible. Solar panels have a significant lifespan, but as large-scale deployments reach the end of their service life, responsible handling and recycling of materials will become paramount. Developing robust recycling infrastructure trails the rapid production ramp-up. PERC cells, like many electronics, rely on international supply chains. Disruptions from geopolitical events, logistics turmoil, or raw material shortages can ripple through the market, increasing costs or delaying crucial solar projects. Manufacturers can no longer focus solely on maximizing panel efficiency at any cost. Sustainable materials, reduced energy use in production, and a 'design for recycling' approach will gain importance.

PERC Solar Cell Market Opportunities:

Government policies around the globe increasingly focus on the rapid reduction of traditional fossil fuel usage. Solar energy has secured its seat at the renewable energy table, and PERC technology, due to its maturity and cost-effectiveness, plays a prominent role in enabling this global shift. Tax incentives, renewable energy targets, and legislation phasing out fossil fuel subsidies create market conditions favorable to solar deployment. This isn't limited to developed nations; emerging markets are actively embracing solar as a path to both energy independence and environmentally sustainable development. Homes and businesses aren't simply energy users but can become micro-producers with PERC-based rooftop panels. Reduced reliance on traditional grids creates localized energy security and, sometimes, income potential. The high energy density of PERC means smaller installations can electrify rural areas or support disaster relief where traditional power infrastructure is compromised or entirely lacking. Battery storage solutions have advanced remarkably. Coupled with PERC, excess solar energy can be captured for later use when sunlight isn't available, providing on-demand reliability. Electric vehicles demand reliable charging options. PERC solar power is increasingly seen as a way to supplement, and sometimes even provide full self-sufficiency, for this growing automotive segment.

PERC SOLAR CELL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Product type, Mounting, Installation, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LONGi Solar, JA Solar, JinkoSolar, Trina Solar, Canadian Solar, Hanwha Q Cells, Risen Energy, Seraphim Solar |

PERC Solar Cell Market Segmentation: By Product Type

-

Monocrystalline PERC

-

Polycrystalline PERC

Monocrystalline PERC cells are both the largest and fastest-growing product type. They are made from a single silicon crystal and have a uniform structure, which translates to the highest efficiency. Although slightly more expensive, they enjoy widespread adoption due to their superior power output from an equivalent panel size. Recent estimates suggest their share could be in the 65-75% range. The cost advantage of polycrystalline PERC keeps it in a prominent market niche. It's often favored for less space-constrained projects where maximizing output per dollar spent takes priority over absolute panel conversion efficiency. Polycrystalline PERC is made from multiple silicon crystals; these cells are less efficient than monocrystalline but typically less expensive to manufacture. They have a characteristic bluish hue and mosaic-like pattern.

PERC Solar Cell Market Segmentation: By Mounting

-

Roof-top

-

Ground-mounted

Roof-top mounting currently accounts for the dominant share of over 60% of the market in 2023. Rooftop PV systems deployed on commercial and residential buildings represent the most common application for PERC panels, given the ease of installation and proximity to end-use electrical loads. Rooftop systems benefit from net-metering programs and feed-in tariffs in many countries. However, ground-mounted systems are forecasted to see the fastest growth, expanding at a CAGR of over 25% through 2030. Large utility-scale solar farms using ground-mount structures have become the preferred approach for rapidly scaling up solar capacity. Ground mounting enables optimal siting, panel tracking, and density on cheaper land unavailable for other uses. Favorable solar economics make ground systems cost-competitive with fossil fuels for bulk power generation without subsidies.

PERC Solar Cell Market Segmentation: By Installation

-

On-grid

-

Off-grid

-

Hybrid

On-grid systems represent the dominant segment, holding over 80% of the market share presently. Grid-connected systems that feed into public electricity networks remain the most common installation method, especially for larger commercial and utility-scale projects. Net metering and feed-in tariff policies also incentivize on-grid adoption. However, off-grid installations are projected to see faster growth at a CAGR exceeding 20% through 2030. Rapidly declining storage costs alongside solar are making isolated off-grid systems more affordable and reliable for remote areas lacking reliable grid infrastructure. Government programs to expand off-grid electrification in developing regions will further support growth. Hybrid models balancing grid power with solar are an emerging segment forecast to expand at a CAGR of over 15% as storage costs decline. Hybrid systems offer the reliability and stability of grid integration while harnessing solar savings.

PERC Solar Cell Market Segmentation: By Application

-

Residential

-

Commercial

-

Utility

Utility-scale systems are the dominant application segment, holding over 60% of the market share presently. Large solar farms supplying power to the grid account for the majority of demand for PERC panels, given favorable economics unlocked by scale. However, the commercial segment is projected to see the fastest growth at a CAGR exceeding 20% through 2030. The rising adoption of rooftop PERC systems in retail, warehouses, offices, and other commercial buildings is driving this growth. Attractive ROIs from replacing high retail electricity bills incentivize commercial solar uptake. Residential rooftop systems comprise around 15% of the market. While growth remains robust, driven by homeowner interest in energy savings and sustainability, the high upfront costs for small rooftop installations limit mainstream uptake compared to utility projects.

PERC Solar Cell Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific (APAC) region currently holds the largest market share, projected to be between 60% and 70% in 2023. China is a prominent global hub for the manufacture of solar technology and a significant player in the production of PERC cells, particularly large-scale utility-sized panels. Countries in Southeast Asia, such as India and Vietnam, are increasingly turning to solar energy for economic growth and home electrification, which is driving up demand for PERC cells both domestically and internationally. North America is the fastest-growing market, holding a substantial portion of around 20–25% of the market in 2023. State and federal regulations encourage the expansion of the solar industry. Early adoption of PERC in North America helped establish a pattern of adoption. Adoption rises in the residential and commercial sectors when people have high levels of environmental concern. Europe is thought to hold a 10-15% market share. Expanding solar power is encouraged by EU policies to meet carbon reduction targets. Germany initiated Europe's solar expansion, although today member states differ greatly in terms of incentives and demand. Africa, the Middle East, and Latin America all have potential, but their combined share is still very small, between 5% and 10%. Nevertheless, government programs and lower costs may accelerate adoption in these developing solar markets.

COVID-19 Impact Analysis on the PERC Solar Cell Market:

Polysilicon supply, essential for solar cell production, faced bottlenecks as upstream industry segments felt the impact of widespread shutdowns. Even when factories reopened, staffing limitations, safety measures, and supply imbalances curbed PERC cell production volumes. International shipping faced severe delays and surging costs due to port closures, reduced cargo capacity, and health protocols. This hindered both the export of PERC cells from manufacturing hubs and the delivery of necessary components for overseas installations. Uncertainty dominated business sentiment during the initial pandemic waves. Residential and commercial solar installations frequently went on hold as finances became squeezed and site access became challenging due to health and safety constraints. Larger utility-scale projects were not immune to delays. Consumers stuck at home, noticing rising energy bills, reconsidered solar to secure long-term savings and sustainability. However, some hesitated due to economic uncertainty and reduced sales-force interactions. Some governments with robust solar targets prioritize shovel-ready projects to aid economic recovery. Other regions had to temporarily curtail incentives to redirect funds towards the pandemic response.

Latest Trends/ Developments:

TopCon (Tunnel Oxide Passivated Contact) is a significant advancement building upon PERC architecture. By introducing a thin tunnel oxide layer and a polysilicon contact layer, TopCon cells dramatically reduce contact losses, boosting cell efficiency beyond the limits of traditional PERC. Manufacturers are rapidly transitioning to TopCon, and as its production scales, it promises higher power outputs within the same module dimensions. While TopCon is an evolution of PERC, heterojunction technology (HJT) represents a more dramatic shift. HJT cells use layers of amorphous silicon to passivate crystalline silicon, achieving even higher efficiencies than TopCon. The major challenge with HJT has been cost, but with recent manufacturing innovations lowering production expenses, HJT is becoming a strong contender for the efficiency crown.

Key Players:

-

LONGi Solar

-

JA Solar

-

JinkoSolar

-

Trina Solar

-

Canadian Solar

-

Hanwha Q Cells

-

Risen Energy

-

Seraphim Solar

Chapter 1. PERC Solar Cell Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PERC Solar Cell Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PERC Solar Cell Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PERC Solar Cell Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PERC Solar Cell Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PERC Solar Cell Market – By Product Type

6.1 Introduction/Key Findings

6.2 Monocrystalline PERC

6.3 Polycrystalline PERC

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. PERC Solar Cell Market – By Mounting

7.1 Introduction/Key Findings

7.2 Roof-top

7.3 Ground-mounted

7.4 Y-O-Y Growth trend Analysis By Mounting

7.5 Absolute $ Opportunity Analysis By Mounting, 2024-2030

Chapter 8. PERC Solar Cell Market – By Installation

8.1 Introduction/Key Findings

8.2 On-grid

8.3 Off-grid

8.4 Hybrid

8.5 Y-O-Y Growth trend Analysis By Installation

8.6 Absolute $ Opportunity Analysis By Installation, 2024-2030

Chapter 9. PERC Solar Cell Market – By Application

9.1 Introduction/Key Findings

9.2 Residential

9.3 Commercial

9.4 Utility

9.5 Y-O-Y Growth trend Analysis By Application

9.6 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 10. PERC Solar Cell Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Mounting

10.1.3 By Installation

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Mounting

10.2.4 By Installation

10.2.5 By Application

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Mounting

10.3.4 By Installation

10.3.5 By Application

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Mounting

10.4.4 By Installation

10.4.5 By Application

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Mounting

10.5.4 By Installation

10.5.5 By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. PERC Solar Cell Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 LONGi Solar

11.2 JA Solar

11.3 JinkoSolar

11.4 Trina Solar

11.5 Canadian Solar

11.6 Hanwha Q Cells

11.7 Risen Energy

11.8 Seraphim Solar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The fundamental reason behind PERC's dominance is its higher efficiency compared to traditional solar cells. The passivation layer on the rear of the cell reduces electron loss, allowing for greater energy conversion.

There are concerns that it might be approaching its theoretical efficiency limits. While innovations like TopCon are helping push those limits, there's uncertainty about whether PERC-based technologies can match the potential efficiency gains offered by future tech like tandem cells.

Longi Solar, JA Solar, JinkoSolar, Trina Solar, Canadian Solar, and Hanwha Q Cells are the major key players.

Asia-Pacific (APAC) currently holds the largest market share.

North America exhibits the fastest growth during the forecast period.