Payment Gateways Market Size (2024 – 2030)

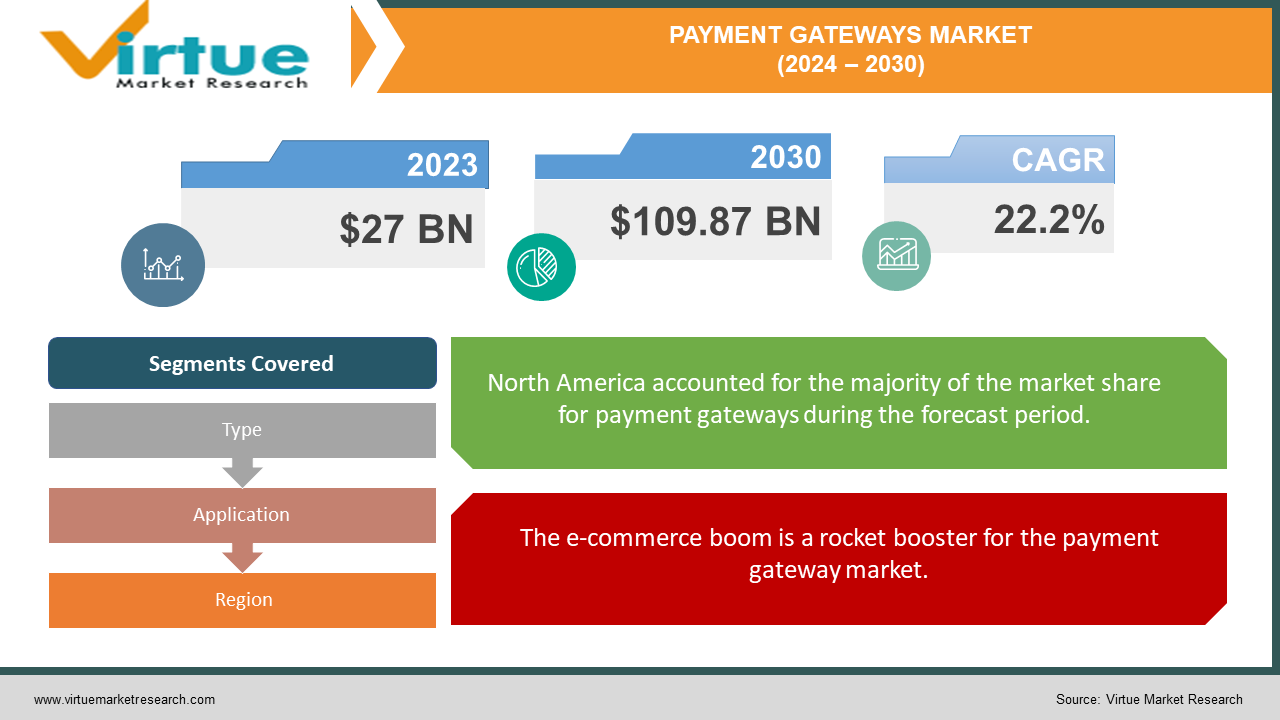

The Global Payment Gateways Market was valued at USD 27 billion in 2023 and will grow at a CAGR of 22.2% from 2024 to 2030. The market is expected to reach USD 109.87 billion by 2030.

Key Market Insights:

The Payment Gateway Market is experiencing a boom, fueled by the e-commerce surge and our growing love for mobile payments. It's a digital bridge between businesses and customers, ensuring smooth online transactions. Security remains a top priority, with gateways acting as fortresses against fraud. But the future is about frictionless experiences – imagine one-click payments and guest checkout!

Open Banking is unlocking a world of new options, from digital wallets to real-time transfers. Subscription services are on fire, and gateways are offering features like automated billing to keep things running smoothly. As internet access explodes in developing regions, the market is set for even more growth. In short, payment gateways are the secure and dynamic backbone of our thriving digital commerce ecosystem, constantly innovating to keep pace with the ever-evolving way we shop and pay.

Global Payment Gateways Market Drivers:

The e-commerce boom is a rocket booster for the payment gateway market.

As online shopping explodes in popularity, businesses scramble to equip themselves with secure and efficient payment processing solutions. Here's where payment gateways shine. They act as the trusted bridge between businesses and customers, ensuring a smooth and frictionless transaction experience. Imagine a bustling marketplace where customers browse virtual aisles, filling their online carts. Without payment gateways, the checkout process would grind to a halt. Gateways securely handle sensitive financial information, process payments from various sources like credit cards and digital wallets, and instantly confirm transactions. This not only streamlines the buying journey for customers but also empowers businesses to capture sales efficiently. With the e-commerce juggernaut showing no signs of slowing down, the demand for robust and user-friendly payment gateways is sure to keep this market on a steady upward trajectory.

The rise of mobile wallets and contactless payments is like a shot of adrenaline for the payment gateway market.

Consumers are ditching their bulky wallets in favor of the convenience and security of smartphones. This shift in behavior is driving demand for payment gateways that seamlessly integrate with mobile wallets like Apple Pay and Google Pay. Imagine tapping your phone at a checkout counter instead of swiping a card – that's the frictionless experience gateways enable. But it goes beyond convenience. Mobile wallets offer robust security features, reducing the risk of fraud for both consumers and businesses. Additionally, mobile payments open doors for faster transactions and in-app purchases, further fueling the e-commerce fire. This is why businesses are actively seeking payment gateways that excel in mobile integration. By providing a secure and user-friendly mobile payment experience, gateways are not just keeping pace with consumer preferences, they're actively shaping the future of online transactions.

Growing Focus on Security is driving market growth.

The ever-present threat of data breaches and fraud casts a long shadow over the digital age, making robust security a top priority for both businesses and consumers. This is where payment gateways with advanced security features step in as shining knights, fortifying the online transaction landscape. These gateways go beyond simple data encryption, employing a multi-layered defense system. Imagine a high-security vault protecting sensitive financial information. Gateways utilize technologies like tokenization, where a unique identifier replaces actual card details, rendering them useless even if intercepted. Additionally, fraud prevention tools analyze transaction patterns in real time, identifying suspicious activity and preventing fraudulent purchases. This not only safeguards customer data but also shields businesses from financial losses. By prioritizing security and offering peace of mind, payment gateways are building trust and attracting businesses seeking a secure platform for their online transactions. In a world where vigilance is key, advanced security features are becoming a major differentiator for payment gateways in the competitive market.

Global Payment Gateways Market challenges and restraints:

Security Concerns:

Advanced security features are a double-edged sword for payment gateways. Yes, they attract customers seeking a haven for online transactions, but they also paint a target on the back of gateways, making them prime targets for cybercriminals. Data breaches can be devastating, eroding consumer trust and leading to hefty fines. To combat this, payment gateways need to be fortresses of security, constantly vigilant against evolving threats. This necessitates ongoing investment in cutting-edge security solutions like intrusion detection systems and regular penetration testing to identify and patch vulnerabilities. It's a never-ending arms race, demanding a proactive approach and a commitment to staying ahead of the curve. While this investment can be substantial, it's a necessary cost of doing business in the digital age. After all, robust security is not just a feature, it's the foundation for trust and the lifeblood of the payment gateway market.

Regulatory Landscape:

The global ambitions of payment gateways can be stymied by a regulatory labyrinth. Imagine a maze of complex and often conflicting regulations across different countries. This is the reality that payment gateways must navigate to operate seamlessly on a global scale. Each country has its own set of data privacy laws, security standards, and financial regulations that gateways must comply with. This creates a bureaucratic headache, forcing them to invest heavily in legal expertise and adapt their systems to comply with each market's specific requirements. The cost of achieving global compliance can be significant, especially for smaller players. This regulatory fragmentation hinders the ability of gateways to offer a truly unified experience for businesses looking to expand their reach internationally. Standardization efforts are underway, but for now, navigating this regulatory maze remains a complex and expensive hurdle for payment gateways seeking global dominance.

Market Opportunities:

The Payment Gateway Market is fertile ground for innovation, with opportunities blooming across the digital commerce landscape. Developing regions with surging internet access present a vast potential customer base, waiting to be won over with localized solutions. The booming subscription service industry craves gateways equipped for automated recurring billing. Open Banking's rise unlocks a world of new possibilities, demanding gateways that seamlessly integrate with APIs and offer a diverse range of alternative payment options. Frictionless user experiences will be king, with one-click payments, guest checkout, and mobile wallet integration becoming the norm. Security remains a top priority, and gateways that prioritize cutting-edge protection, advanced fraud prevention, and data privacy will be best placed to earn the trust that fuels the digital commerce engine. By embracing these opportunities and staying at the forefront of innovation, payment gateways will solidify their position as the secure and thriving backbone of the digital commerce ecosystem.

PAYMENT GATEWAYS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PayPal Holdings, Inc., Stripe, Visa Inc., Mastercard, Amazon.com Inc. (Amazon Payments), FIS (Worldpay), PayU, Adyen, Worldline, Mercado Pago |

Payment Gateways Market Segmentation: By Type

-

Hosted Payment Gateways

-

Non-hosted (Self-Hosted) Payment Gateways

Payment gateways come in two main flavors: hosted and non-hosted. Hosted gateways are like renting an apartment – the service provider manages everything (payment processing infrastructure) and businesses just need to move in (integrate the code). This user-friendly and cost-effective option is ideal for smaller merchants. On the other hand, non-hosted gateways are like owning a house – businesses have full control and can customize the experience (think renovations), but it requires significant investment and technical expertise to manage the infrastructure themselves. This approach offers greater flexibility but comes with a steeper learning curve.

Payment Gateways Market Segmentation: By Application

-

Retail & E-commercee

-

Travel & Hospitality

The Payment Gateway Market caters to a diverse range of industries. E-commerce reigns supreme, with online stores depending on gateways for secure transactions. Every "Add to Cart" click relies on these gateways to ensure smooth checkouts. Travel & Hospitality follows closely behind. Gateways ensure secure transactions for flights, hotels, and other travel arrangements, making the booking journey smooth and stress-free for both businesses and customers. These are just two prominent segments, highlighting the vital role payment gateways play in facilitating secure and efficient online transactions across various industries.

Payment Gateways Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia

-

South America

-

Middle East and Africa

The Global Payment Gateway Market is a tale of three continents: North America reigns supreme with its established e-commerce giants, while Asia Pacific rockets forward fueled by a mobile-first population. Sandwiched between them is Latin America, a young and tech-savvy region on the rise. Europe, with its focus on robust regulations, fosters secure payment solutions, while the Middle East and Africa, the slowest adopters, hold untapped potential with their growing mobile phone base and emerging mobile money solutions. This diverse landscape highlights the market's dynamism, with each continent poised for its unique growth trajectory.

COVID-19 Impact Analysis on the Global Payment Gateways Market

COVID-19 acted as a double-edged sword for the Global Payment Gateway Market. Lockdowns and social distancing measures triggered a surge in e-commerce, propelling the market forward. With physical stores shuttered, consumers turned to online shopping, pushing businesses to adopt secure payment gateways. This led to a rise in contactless payments and mobile wallets, as people prioritized minimizing physical contact. However, the pandemic also disrupted some sectors that heavily rely on gateways, like travel and hospitality. Overall, the positive impact outweighed the negative. The e-commerce boom and the accelerated shift towards digital payments created fertile ground for payment gateways, making them a critical element in the new normal of remote transactions. Looking ahead, this trend is likely to continue as consumers become increasingly comfortable with online shopping and digital wallets. Payment gateways that can adapt to this evolving landscape and prioritize security will be well-positioned to thrive in the post-pandemic world.

Latest trends/Developments

The Payment Gateway Market is a hotbed of innovation. Open Banking is unlocking a wider range of payment options, while gateways prioritize a frictionless user experience with one-click payments and mobile wallets. Security remains paramount with advanced fraud prevention and data privacy tools taking center stage. Subscription services are booming, and gateways are offering features like automated billing to streamline the process. Finally, with emerging markets experiencing a surge in internet users, payment gateways are tailoring solutions to these regions to unlock a vast new customer base.

Key Players:

-

PayPal Holdings, Inc.

-

Stripe

-

Visa Inc.

-

Mastercard

-

Amazon.com Inc. (Amazon Payments)

-

FIS (Worldpay)

-

PayU

-

Adyen

-

Worldline

-

Mercado Pago

Chapter 1. Payment Gateways Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Payment Gateways Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Payment Gateways Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Payment Gateways Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Payment Gateways Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Payment Gateways Market – By Type

6.1 Introduction/Key Findings

6.2 Hosted Payment Gateways

6.3 Non-hosted (Self-Hosted) Payment Gateways

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Payment Gateways Market – By Application

7.1 Introduction/Key Findings

7.2 Retail & E-commercee

7.3 Travel & Hospitality

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Payment Gateways Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Payment Gateways Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PayPal Holdings, Inc.

9.2 Stripe

9.3 Visa Inc.

9.4 Mastercard

9.5 Amazon.com Inc. (Amazon Payments)

9.6 FIS (Worldpay)

9.7 PayU

9.8 Adyen

9.9 Worldline

9.10 Mercado Pago

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Payment Gateways Market was valued at USD 27 billion in 2023 and will grow at a CAGR of 22.2% from 2024 to 2030. The market is expected to reach USD 109.87 billion by 2030.

The E-commerce Boom, Rise of Mobile Payments, and Growing Focus on Security are the reasons that are driving the market.

Based on Application it is divided into two segments – Retail & E-commerce, Travel & Hospitality.

North America is the most dominant region for the luxury vehicle Market.

PayPal Holdings, Inc., Stripe, Visa Inc., Mastercard, and Amazon.com Inc. are the leading players.