Patient Temperature Monitoring Market Size (2024 – 2030)

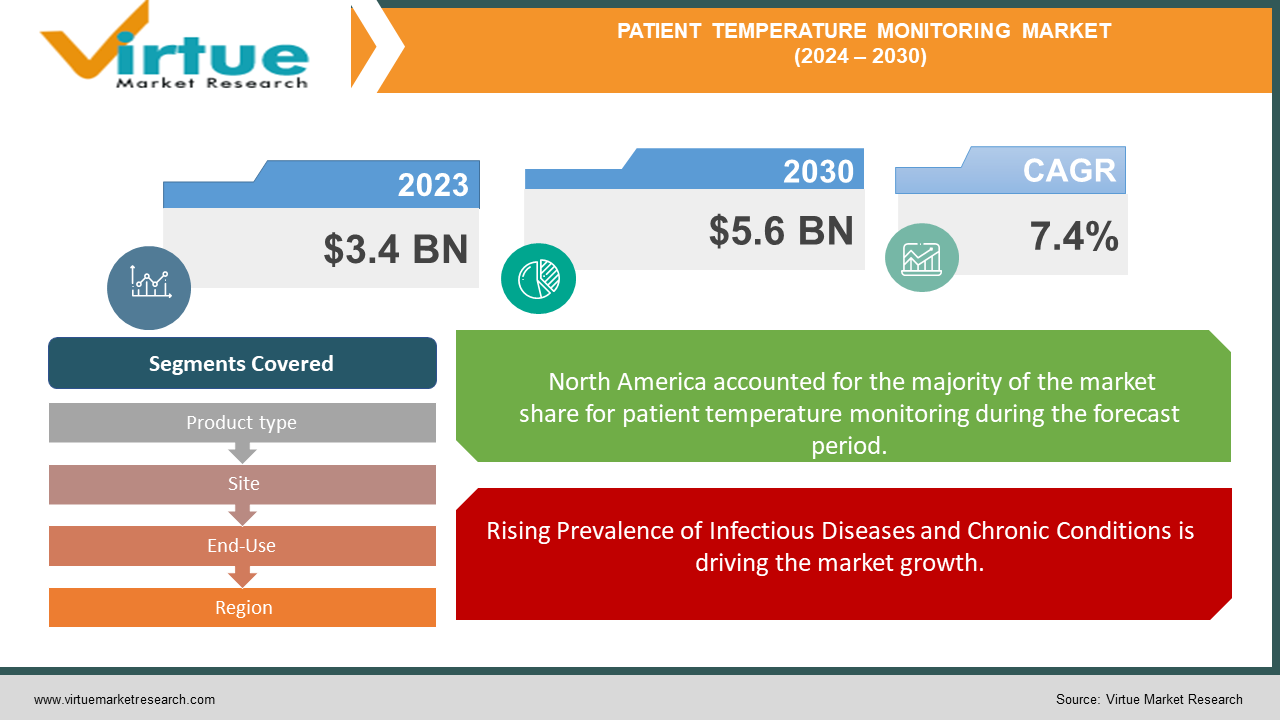

As of 2023, the Global Patient Temperature Monitoring Market is valued at approximately USD 3.4 billion and is projected to reach USD 5.6 billion by 2030, expanding at a compound annual growth rate (CAGR) of 7.4% during the forecast period.

Patient temperature monitoring is a crucial component of patient care management, allowing healthcare providers to detect early signs of infection, monitor the progression of diseases, and assess the effectiveness of treatments. The market's growth is further supported by technological advancements in temperature monitoring devices, including the development of non-invasive, wireless, and wearable technologies that provide real-time data and enhance patient comfort. The increasing adoption of telemedicine and remote patient monitoring solutions, driven by the need for continuous care, especially in home settings, is also significantly contributing to market expansion.

Key Market Insights

Wearable temperature monitoring devices dominate the market, accounting for over 35% of global revenue, driven by their ease of use, continuous monitoring capabilities, and growing adoption in both clinical and home care settings.

Non-invasive temperature monitoring methods represent the largest share of the market, reflecting over 60% of total revenue, due to their comfort, reduced risk of infection, and suitability for a wide range of patients, including neonates and the elderly.

North America leads the market, contributing to 40% of global revenue, owing to the advanced healthcare infrastructure, high adoption rate of innovative technologies, and a large patient pool with chronic conditions.

Global Patient Temperature Monitoring Market Drivers

Rising Prevalence of Infectious Diseases and Chronic Conditions is driving the market growth.

The growing incidence of infectious diseases, such as COVID-19, influenza, and sepsis, has highlighted the critical need for efficient patient temperature monitoring. Accurate and continuous temperature measurement is essential for detecting early signs of infection, enabling timely interventions, and preventing complications. Additionally, the increasing prevalence of chronic conditions like cancer, diabetes, and cardiovascular diseases, which require regular monitoring, is further driving the demand for temperature monitoring devices. These devices are integral in managing patients with compromised immune systems or those undergoing treatments that affect body temperature regulation.

Technological Advancements in Temperature Monitoring Devices are driving the market growth.

Innovations in patient temperature monitoring technologies are significantly contributing to market growth. The development of wearable, wireless, and connected devices that offer real-time monitoring and data-sharing capabilities is transforming patient care by enhancing convenience and reducing the need for frequent hospital visits. Advances in sensor technologies, integration with smartphones, and the use of AI for predictive analytics are further enhancing the functionality of temperature monitoring devices. These technological improvements are not only improving patient outcomes but also enabling healthcare providers to make more informed decisions, thus driving the adoption of advanced temperature monitoring solutions.

Shift Towards Home Care and Remote Patient Monitoring is driving the market growth The growing trend towards home care and the increasing adoption of telemedicine are creating significant opportunities for the patient temperature monitoring market. The aging population, rising healthcare costs, and the preference for home-based care are driving the demand for portable and user-friendly temperature monitoring devices that can be used outside traditional healthcare settings. Remote patient monitoring solutions allow for continuous temperature tracking and timely interventions, reducing the burden on healthcare facilities and improving patient compliance. This shift is particularly prominent in managing chronic diseases, post-operative care, and pediatric and geriatric populations, where regular monitoring is critical.

Global Patient Temperature Monitoring Market Challenges and Restraints

High Cost of Advanced Temperature Monitoring Devices is restricting the market growth.

Despite the benefits of advanced temperature monitoring devices, their high cost can be a significant barrier, particularly in low- and middle-income countries. The initial investment in wearable and wireless devices, along with the need for compatible infrastructure such as smartphones or tablets, can limit their adoption in resource-constrained settings. Additionally, the cost of maintaining and calibrating these devices, along with the potential need for software updates and data management systems, can add to the overall expense. These financial challenges may restrict the widespread adoption of advanced temperature monitoring technologies, particularly among smaller healthcare providers and in regions with limited healthcare budgets.

Privacy and Data Security Concerns are restricting the market growth.

The increasing use of connected and wearable temperature monitoring devices raises concerns about data privacy and security. The transmission of sensitive patient data over wireless networks can be vulnerable to cyber-attacks, data breaches, and unauthorized access, posing significant risks to patient confidentiality. Ensuring the security of patient information is critical, especially as more devices integrate with electronic health records (EHRs) and cloud-based platforms. Healthcare providers and device manufacturers must address these concerns by implementing robust security protocols, encryption, and compliance with data protection regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe.

Market Opportunities

The Patient Temperature Monitoring Market offers substantial opportunities for growth, driven by the increasing focus on preventive healthcare and the rising demand for personalized medicine. The integration of AI, machine learning, and predictive analytics in temperature monitoring devices is creating new possibilities for early disease detection and personalized treatment plans. Moreover, the expansion of temperature monitoring into new applications, such as fitness and wellness, presents opportunities for device manufacturers to diversify their product offerings. The development of non-contact and continuous monitoring technologies, such as infrared thermometers and smart patches, is also opening new avenues for innovation. Companies that invest in research and development to create cost-effective, user-friendly, and secure temperature monitoring solutions are well-positioned to capitalize on these emerging opportunities.

PATIENT TEMPERATURE MONITORING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.4% |

|

Segments Covered |

By Product type, Site, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Hill-Rom Holdings, Inc., Omron Healthcare, Inc., Terumo Corporation, Microlife Corporation, Masimo Corporation, Medtronic plc, Cardinal Health, Inc. |

Patient Temperature Monitoring Market Segmentation - By Product Type

-

Wearable Temperature Monitoring Devices

-

Tabletop Temperature Monitoring Devices

-

Handheld Temperature Monitoring Devices

-

Others

Wearable temperature monitoring devices dominate the market, accounting for over 35% of global revenue. These devices, including smart patches, wristbands, and sensors, are increasingly popular due to their ability to provide continuous, real-time monitoring with minimal discomfort to patients. Wearable devices are widely used in hospitals, home care, and for remote monitoring of patients with chronic conditions. Tabletop and handheld temperature monitoring devices, which include digital thermometers and infrared thermometers, also hold significant market shares due to their ease of use and reliability in clinical settings.

Patient Temperature Monitoring Market Segmentation - By Site

-

Non-Invasive

-

Invasive

Non-invasive temperature monitoring methods represent the largest segment, capturing over 60% of the market. Non-invasive devices, such as ear thermometers, forehead thermometers, and wearable sensors, are preferred due to their comfort, ease of use, and reduced risk of infection. These devices are particularly suitable for vulnerable populations, including neonates, elderly patients, and those with compromised immune systems. Invasive temperature monitoring methods, such as esophageal or rectal probes, are used in critical care and surgical settings where precise core temperature measurements are necessary.

Patient Temperature Monitoring Market Segmentation - By End-Use

-

Hospitals

-

Clinics

-

Home Care

-

Ambulatory Surgical Centers

-

Others

Hospitals are the primary end-users of patient temperature monitoring devices, contributing significantly to market revenue. The need for continuous temperature monitoring in critical care units, emergency departments, and surgical suites drives the demand for advanced temperature monitoring solutions in hospitals. The home care segment is also experiencing rapid growth, fueled by the increasing preference for at-home management of chronic conditions, the rising elderly population, and the expansion of telehealth services. Ambulatory surgical centers and clinics also represent important end-use segments, with a growing focus on patient safety and the adoption of modern monitoring technologies.

Patient Temperature Monitoring Market Segmentation - Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America leads the Global Patient Temperature Monitoring Market, contributing to 40% of the total revenue. The region's dominance is driven by advanced healthcare infrastructure, high adoption rates of innovative technologies, and a large patient pool with chronic and infectious diseases. The presence of key market players and favorable reimbursement policies further support market growth in North America. Europe follows closely, with significant demand driven by an aging population and a strong focus on patient safety and quality of care. The Asia-Pacific region is expected to witness the highest growth rate, fueled by increasing healthcare investments, expanding middle class, and growing awareness about the importance of continuous patient monitoring in countries such as China, India, and Japan.

COVID-19 Impact Analysis on Patient Temperature Monitoring Market

The COVID-19 pandemic had a profound impact on the Global Patient Temperature Monitoring Market, accelerating the demand for temperature monitoring devices as fever became a key symptom for screening and monitoring the virus. The pandemic drove the widespread adoption of non-contact thermometers, wearable sensors, and remote monitoring solutions, as healthcare providers sought to minimize direct contact and reduce the risk of virus transmission. The surge in demand for temperature monitoring devices extended beyond healthcare facilities to public spaces, workplaces, and airports, contributing to a significant spike in market growth. However, supply chain disruptions, shortages of electronic components, and manufacturing delays posed challenges during the initial stages of the pandemic. As the market adapted to the increased demand, companies ramped up production and introduced innovative solutions to meet the evolving needs of healthcare providers and patients. The COVID-19 pandemic underscored the critical role of temperature monitoring in managing infectious diseases and is expected to have a lasting impact on the market's growth trajectory.

Latest Trends/Developments

Several trends and developments are shaping the Patient Temperature Monitoring Market. One notable trend is the increasing integration of AI and IoT in temperature monitoring devices, which is enhancing device connectivity, predictive analytics, and the ability to provide personalized care. The development of wearable and wireless temperature monitoring solutions that offer continuous, real-time data is gaining traction, driven by the need for patient comfort and ease of use. The rising adoption of non-contact thermometers, especially in public and workplace settings, reflects the ongoing focus on infection control and safety. Additionally, the market is witnessing a shift towards the development of eco-friendly and cost-effective temperature monitoring solutions, as manufacturers seek to address environmental concerns and expand access to advanced healthcare technologies. These trends are expected to drive further innovation and growth in the Patient Temperature Monitoring Market.

Key Players

-

3M Company

-

Drägerwerk AG & Co. KGaA

-

Koninklijke Philips N.V.

-

Hill-Rom Holdings, Inc.

-

Omron Healthcare, Inc.

-

Terumo Corporation

-

Microlife Corporation

-

Masimo Corporation

-

Medtronic plc

-

Cardinal Health, Inc.

Chapter 1. Patient Temperature Monitoring Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Patient Temperature Monitoring Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Patient Temperature Monitoring Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Patient Temperature Monitoring Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Patient Temperature Monitoring Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Patient Temperature Monitoring Market – By Product Type

6.1 Introduction/Key Findings

6.2 Wearable Temperature Monitoring Devices

6.3 Tabletop Temperature Monitoring Devices

6.4 Handheld Temperature Monitoring Devices

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Patient Temperature Monitoring Market – By Site

7.1 Introduction/Key Findings

7.2 Non-Invasive

7.3 Invasive

7.4 Y-O-Y Growth trend Analysis By Site

7.5 Absolute $ Opportunity Analysis By Site, 2024-2030

Chapter 8. Patient Temperature Monitoring Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Clinics

8.4 Home Care

8.5 Ambulatory Surgical Centers

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Patient Temperature Monitoring Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Site

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Site

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Site

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Site

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Site

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Patient Temperature Monitoring Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M Company

10.2 Drägerwerk AG & Co. KGaA

10.3 Koninklijke Philips N.V.

10.4 Hill-Rom Holdings, Inc.

10.5 Omron Healthcare, Inc.

10.6 Terumo Corporation

10.7 Microlife Corporation

10.8 Masimo Corporation

10.9 Medtronic plc

10.10 Cardinal Health, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As of 2023, the Global Patient Temperature Monitoring Market is valued at approximately USD 3.4 billion and is projected to reach USD 5.6 billion by 2030, growing at a CAGR of 7.4% during the forecast period.

The key drivers include the rising prevalence of infectious diseases and chronic conditions, technological advancements in temperature monitoring devices, and the shift towards home care and remote patient monitoring.

The Patient Temperature Monitoring Market is segmented by product type (Wearable, Tabletop, Handheld, Others), site (Non-Invasive, Invasive), and end-use (Hospitals, Clinics, Home Care, Ambulatory Surgical Centers, Others).

North America is the most dominant region, contributing to 40% of the global revenue, driven by advanced healthcare infrastructure, high adoption rates of innovative technologies, and a large patient pool with chronic conditions.

The leading players in the market include 3M Company, Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Hill-Rom Holdings, Inc., Omron Healthcare, Inc., Terumo Corporation, Microlife Corporation, Masimo Corporation, Medtronic plc, and Cardinal Health, Inc.