Patient engagement solutions Market Size (2024 – 2030)

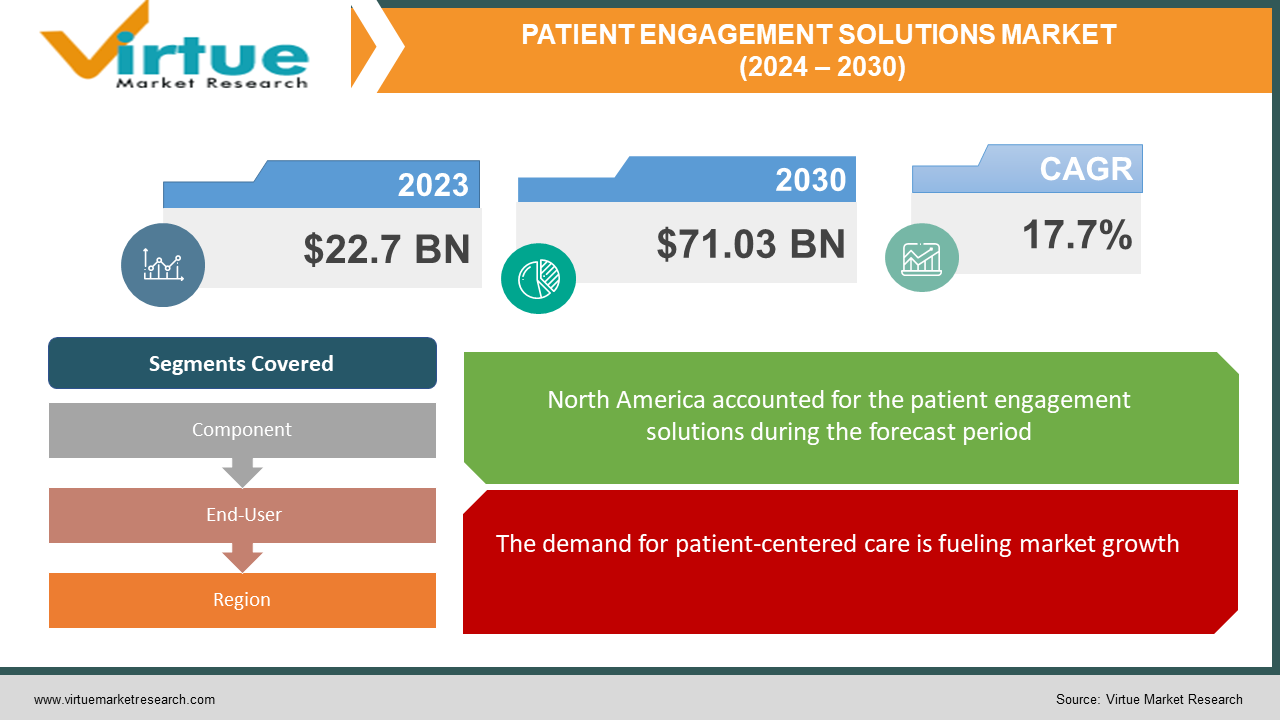

The global patient engagement solutions market was valued at USD 22.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2030, reaching USD 71.03 billion by 2030.

Patient engagement solutions, like portals, telehealth, and apps, empower patients to actively manage their health. They improve communication with providers, provide educational resources, and enable remote monitoring. This leads to better health outcomes, lower costs, and increased patient satisfaction. In essence, they bridge the gap between patients and healthcare, fostering a collaborative and informed approach to health management.

Key Market Insights:

The 17.7% CAGR growth is fueled by several factors: the rise of chronic diseases, increasing healthcare costs, and widespread technology adoption. Software reigns supreme within the market, followed by services. Chronic disease management leads the therapy segment, while communication reigns supreme in functionality, followed by education. Web and cloud-based solutions are gaining ground, showcasing a shift towards accessible technologies. Exciting trends are emerging: AI and machine learning are integrating, wearables and connected devices are gaining traction, and patient experience and value-based care are taking center stage. Opportunities abound for developers focusing on the specific needs of chronic disease patients, integrating AI for personalized engagement, offering user-friendly cloud solutions, and prioritizing data security and interoperability.

Patient Engagement Solutions Market Drivers:

The demand for patient-centered care is fueling market growth.

The patient engagement solutions market is constantly evolving. Firstly, patients themselves are embracing the reins of their health. As awareness spreads about the positive impact of engagement, from improved outcomes to lower costs, individuals are increasingly seeking tools and solutions to actively participate in their well-being. Secondly, healthcare systems are aligning with this shift. The rise of value-based care models, where providers are rewarded for engaging patients, creates a strong incentive to invest in patient engagement solutions. Finally, the growing burden of chronic diseases, which require ongoing self-management, underscores the critical role patients play in their health journeys. This potent combination of empowered patients, motivated providers, and a pressing need for proactive care is propelling the market forward at a steady pace, creating a win-win for both individuals and healthcare systems.

Government initiatives are helping with the expansion.

Policies like Meaningful Use and HIPAA not only safeguard the data but empower its use for personalized engagement tools. Virtual consultations and remote monitoring are brought closer through government funding, breaking down access barriers. Public awareness campaigns further amplify the patient's voice, educating individuals on the value of taking charge. It is a multi-pronged approach, with regulations like HIPAA securing information, funding programs expanding telehealth options, and campaigns igniting patient empowerment. This government-led revolution creates fertile ground for the patient engagement solutions market to flourish, paving the way for a future where technology and informed patients join forces to transform healthcare.

The rise in technology is helping the market grow.

The healthcare landscape is undergoing a tech revolution fueled by patient engagement. Streamlining communication through EHRs and portals, scheduling virtual appointments with ease, and keeping track of our health with intuitive mobile apps are now possible. This is just the beginning. AI and machine learning personalize the experience, analyzing your data to deliver targeted insights and recommendations. Technology is empowering us to become active participants in managing our health. This technology boom breaks down barriers, making healthcare accessible, interactive, and, most importantly, effective. It's a revolution where patients take center stage, driving their wellness journey with the power of technology by their side.

Patient Engagement Solutions: Market Challenges and Restraints

Digital literacy and accessibility are some of the challenges that are currently being faced by the market.

The digital divide threatens to leave behind certain patient groups in the patient engagement boom. Lack of digital literacy, limited internet access, or affordability issues with devices can create an equity gap in healthcare. Elderly patients can struggle to navigate a complex patient portal, or a low-income family might be unable to afford a smartphone for health apps. This gap widens health disparities and undermines the very goal of patient empowerment. Addressing this challenge necessitates multilingual interfaces, user-friendly designs, subsidized devices, and digital literacy training programs, ensuring no patient is left behind in the era of digital health engagement.

Integrating new solutions with existing, often fragmented, healthcare IT infrastructure can be complex and costly.

These systems are often outdated, incompatible, and siloed, making data exchange a difficult process. This complexity translates to high costs. This can include the hiring of IT specialists, customizing software, and ensuring data security across all platforms. It's a major roadblock to seamless patient engagement, hindering information flow and hindering the potential of these new solutions to truly revolutionize healthcare.

High implementation costs are a challenging factor.

For many healthcare providers, particularly smaller clinics or those in underserved areas, the price tag of patient engagement solutions can be very hefty. From the initial purchase and installation to ongoing maintenance and staff training, the costs can quickly add up. This financial barrier limits their ability to offer these valuable tools to their patients, potentially widening the access gap and perpetuating health disparities. Innovative solutions like flexible pricing models, government subsidies, and open-source software development could help bring down the cost barrier and ensure all providers have the opportunity to unlock the benefits of patient engagement.

Market Opportunities:

Patient engagement solutions are poised for a $60.35 billion boom by 2029, fueled by empowered patients, rising healthcare costs, and supportive policies. Exciting opportunities lie in remote patient monitoring for chronic conditions, personalized medicine tools, AI-powered assistants, gamified platforms, and seamless integration with wearables, all empowering patients and easing burdens on healthcare professionals. This market is ripe for innovation, offering immense potential for solutions that prioritize patient engagement and proactive health management.

Traditional healthcare models may be resistant to adopting new technologies and workflows.

Traditional healthcare, steeped in established routines and procedures, can be wary of the disruptions new technologies bring. Clinicians, comfortable with familiar workflows, may resist the learning curve and potential disruption that patient engagement solutions present. Additionally, concerns about data security, reimbursement changes, and potential liability associated with these solutions can fuel hesitation. This resistance can create a logjam, hindering the integration of valuable tools that empower patients and improve healthcare delivery. Overcoming this hurdle requires a multi-pronged approach: highlighting the clear benefits for both patients and providers, offering robust training and support, and addressing data security concerns transparently. Ultimately, navigating this resistance is crucial to unlocking the full potential of patient engagement solutions and ushering in a new era of collaborative, patient-centered healthcare.

PATIENT ENGAGEMENT SOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.7% |

|

Segments Covered |

By Component, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cerner Corporation, Get Well Network, Athenahealth, Inc, Philips Healthcare, Klara Technologies, Inc, IBM Corporation, McKesson Corporation, Orion Health Ltd., Lincor Solutions, YourCareUniverse, Inc., WelVU |

Patient engagement solutions Market Segmentation - by Component

-

Hardware

-

Software

-

Services

The patient engagement market caters to diverse needs through its three main components: hardware like wearables and monitors for data collection, software platforms like patient portals and telehealth apps for engagement, and services for implementation, training, and data analysis. Software is the largest growing segment. The program makes it simple to access precise medication information and is quick to set up and use. Additionally, it facilitates the smooth digital transmission of prescriptions. Numerous businesses, including home healthcare management and healthcare management, use patient engagement solution software. Hardware is also experiencing growth due to rising chronic diseases and telehealth adoption. Services are the fastest-growing category. One of the most crucial elements of a patient engagement solution's effective operation is the service. The use of live training techniques facilitates the prediction and execution of solutions through the deployment of advanced analytics on-premises or in the cloud. It supports those applications. Interestingly, North America leads the market with its high healthcare spending and technology adoption, while Asia Pacific and Latin America show potential but face affordability and infrastructure hurdles. Understanding these segments and regional variations is crucial for tailoring solutions and driving market growth.

Patient engagement solutions Market Segmentation - By User

-

Provider

-

Payer

-

Patient

The patient engagement market tailors solutions for each healthcare player. The provider's segment is the largest growing in this market. Doctors, who are the providers, get tools to manage patients, improve communication, and optimize care, leading to better results and efficiency. Throughout the projection period, the payer segment is anticipated to grow at the fastest rate. The payer segment's growth may be ascribed to the growing use of patient and customer interaction solutions, which facilitate the delivery of value-based care and encourage broad coverage. The payers want to link patients at every step of therapy and manage patient care to boost growth. Insurance companies are also the payers who use them to track patient health, manage costs, promote preventative care for a healthier population, and lower expenses. Patients gain the power to manage their health, access information, and communicate directly with providers, fostering ownership and informed decisions. By catering to these diverse needs, the market empowers everyone, creating a more collaborative and patient-centered healthcare experience.

Patient engagement solutions Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market with its high healthcare spending, technology adoption, and chronic disease prevalence. Besides, this region has some well-established players who have a global presence. This contributes to a greater outcome. Some of the prominent ones include Cerner Corporation, Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., and GetWellNetwork, Inc. Europe is experiencing good growth, driven by an aging population and supportive government initiatives. However, the fastest-growing area is Asia Pacific, boasting a massive, increasingly tech-savvy population and government investments in e-health. While Latin America, the Middle East, and Africa hold smaller shares, they exhibit promising potential fueled by rising chronic disease burdens and modernization efforts.

COVID-19 Impact Analysis on the Patient Engagement Solutions Market

The COVID-19 pandemic significantly impacted the patient engagement solutions market, acting as both a challenge and an accelerator. The crisis highlighted the need for remote patient monitoring, telehealth consultations, and patient education tools, propelling market growth in these segments. However, disruptions to healthcare delivery and economic downturns presented challenges. Stringent regulations and data privacy concerns surrounding virtual care solutions were also amplified. Overall, the pandemic's impact is multifaceted, with long-term consequences still unfolding. While traditional patient engagement methods might see a decline, the increased acceptance and investment in virtual solutions will likely shape the market's future.

Latest trends/Developments

Patient engagement solutions are getting personalized. AI tailors strategies to individual needs, while wearables and apps seamlessly monitor chronic conditions. Engaging games boost treatment adherence, and mental health support is gaining ground with mindfulness apps and virtual therapists. Even voice assistants are getting involved, simplifying interactions, and providing information. This shift towards personalized, accessible engagement empowers patients and paves the way for a proactive future in healthcare management.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

Cerner Corporation

-

Get Well Network

-

Athenahealth, Inc

-

Philips Healthcare

-

Klara Technologies, Inc

-

IBM Corporation

-

McKesson Corporation

-

Orion Health Ltd.

-

Lincor Solutions

-

YourCareUniverse, Inc.

-

WelVU

Chapter 1. Patient Engagement Solutions Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Patient Engagement Solutions Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Patient Engagement Solutions Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Patient Engagement Solutions Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Patient Engagement Solutions Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Patient Engagement Solutions Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Patient Engagement Solutions Market – By End User

7.1 Introduction/Key Findings

7.2 Provider

7.3 Payer

7.4 Patient

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Patient Engagement Solutions Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Component

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Component

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Component

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Component

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Patient Engagement Solutions Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cerner Corporation

9.2 Get Well Network

9.3 Athenahealth, Inc

9.4 Philips Healthcare

9.5 Klara Technologies, Inc

9.6 IBM Corporation

9.7 McKesson Corporation

9.8 Orion Health Ltd.

9.9 Lincor Solutions

9.10 YourCareUniverse, Inc.

9.11 WelVU

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global patient engagement solutions market was valued at USD 22.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2030, reaching USD 71.03 billion by 2030.

Demand for patient-centered care, government initiatives, and the rise in technology are the reasons that are driving the market.

Based on component, it is divided into three segments: hardware, software, and services, and based on user, it is divided into three segments: provider, payer, and patient.

North America is the most dominant region in this market.

Cerner Corporation, Get Well Network, Athenahealth, Inc., Philips Healthcare, and Klara Technologies, Inc. are the major players.