Passenger Vehicle Exhaust System Market Size (2025 – 2030)

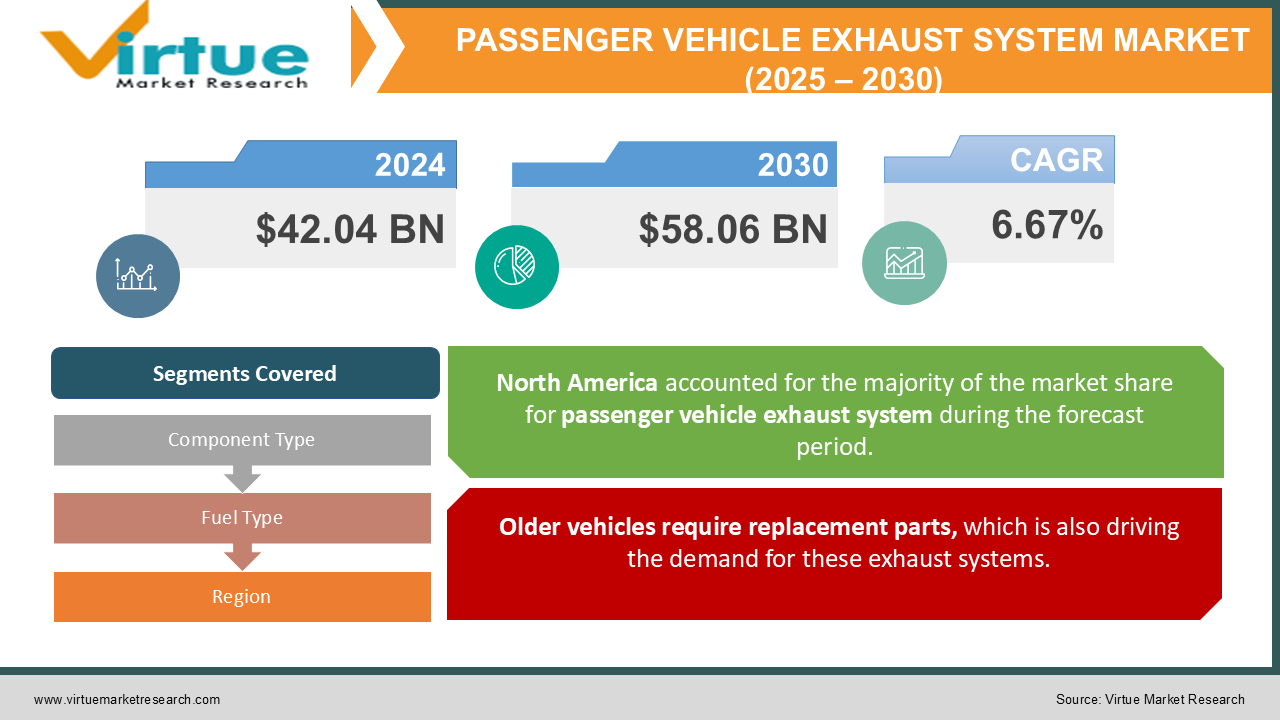

The Passenger Vehicle Exhaust System Market was valued at USD 42.04 billion and is projected to reach a market size of USD 58.06 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.67%.

The exhaust manifold collects and cools the exhaust gases emitted from engine cylinders before sending them down the downpipe to the catalytic converter. The passenger vehicle exhaust market is a niche component of the entire automotive market. While there has been consistent growth in the automotive sector which has translated to growth in the vehicle exhaust market, there have been concerns of a general slowdown due to a massive transition towards an eco-friendlier electric vehicle market. However, the more consistent growth in the hybrid market. Keeping in line with the shift towards lesser emissions, manufacturers are innovating exhaust pipe designs to help fit the lesser carbon emission threshold.

Key Market Insights:

-

Exhaust systems are becoming more effective and efficient because to innovations like exhaust gas recirculation systems and sophisticated catalytic converters. Furthermore, the utilisation of lightweight materials is improving the overall efficiency of vehicles.

-

Exhaust systems are getting more effective and efficient due to innovations like sophisticated catalytic converters and exhaust gas recirculation systems. In addition, the utilisation of lightweight materials is enhancing the overall efficiency of vehicles.

-

The emergence of the EV market and its fast adoption since the start of the pandemic has also influenced the vehicle exhaust system market, manufacturers are becoming more conscious of this as these EVs do not require exhaust systems. This is prompting them to diversify their product offerings and to also explore new technology.

-

Companies put are ramping up spending on R&D as the threats of EVs to the market are becoming more real, Forvia, a major player in the market invested 1.03 billion in 2023 and similar investments in 2024 in R&D through its subsidiary ‘Clean mobility’ which does research on making the exhaust technology more efficient.

-

As disposable income in emerging markets has been increasing the demand for cars especially in urban and suburban areas has increased massively, also combined with cities adjusting infrastructure to accommodate more vehicles the demand for exhaust systems has increased.

Passenger Vehicle Exhaust Market Drivers:

While the EV market grows, demand for ICE (Internal Combustion Engine) vehicles and exhaust systems has rebounded post-pandemic.

Countries especially emerging market economies in the Asia-Pacific, Middle East and Africa have been slow to the adoption of EVs primarily because EVs require a lot of pre-existing infrastructure such as charging ports, specific mechanics etc which is not present in these countries. Also, the older and the 40+ generation still views petrol or diesel cars as safer bets than EVs, especially for travelling long distances. Cultural preferences, economic factors, and government policies also play a crucial role, as many of these economies still rely heavily on fossil fuel industries and have less aggressive incentives or mandates for EV adoption compared to developed markets. Consequently, despite the global push toward electrification, ICE vehicles continue to dominate sales in these regions, ensuring sustained demand for exhaust system components in the foreseeable future which will keep the demand for exhaust technology stable.

Older vehicles require replacement parts, which is also driving the demand for these exhaust systems.

Since ageing car fleets in numerous countries need new parts and updated exhaust components to meet changing pollution rules, the aftermarket business is also expanding. Furthermore, as a transitional technology, hybrid cars—which still have exhaust systems even if they have electric propulsion—are becoming more and more popular, guaranteeing that exhaust solutions will continue to be invested in. The marketplace for passenger car exhaust systems is anticipated to remain stable in the upcoming years due to these factors as well as continued government incentives for cleaner emission technologies rather than a complete transition to EVs.

Passenger Vehicle Exhaust Market Restraints and Challenges:

Regulations across the world are becoming much tighter when it comes to fuel-combustion vehicles.

Governments all over the globe are enforcing stricter regulations on fuel combustion vehicles in a bid to lower emissions and encourage cleaner mobility. To minimise pollution from internal combustion engine (ICE) vehicles, nations in Europe, North America, and some areas of Asia have implemented strict measures like China VI emission requirements, Corporate Average Fuel Economy (CAFE) rules, and Euro 7 standards. Automakers are being forced to create more sophisticated exhaust treatment technologies, such as selective catalytic reduction (SCR) systems, gasoline particulate filters (GPFs), and exhaust gas recirculation (EGR) systems, to comply with these regulations, which require lower emissions of carbon dioxide (CO₂) and nitrogen oxide (NOx). The demand for compliant exhaust systems is also being accelerated by several regions that are phasing out older, high-emission automobiles and enforcing higher fuel economy requirements. While these measures are aimed at promoting the shift toward electric vehicles, the immediate impact is a surge in the development and adoption of cleaner, more efficient exhaust technologies, ensuring continued relevance for the passenger vehicle exhaust market in the short to medium term.

Passenger Vehicle Exhaust Market Opportunities:

The passenger vehicle exhaust market presents several key opportunities despite the global shift toward electrification. The increasing demand for hybrid vehicles, which still rely on exhaust systems, offers a steady market for advanced emission control technologies. Additionally, as governments impose stricter regulations on fuel combustion vehicles, there is a growing need for innovative exhaust solutions such as lightweight materials, improved catalytic converters, and advanced filtration systems to reduce emissions. The aftermarket segment also holds significant potential, as ageing vehicle fleets and extended vehicle lifespans drive demand for replacement parts and upgrades. Emerging markets in Asia-Pacific, Latin America, and Africa, where EV adoption remains slow, continue to rely heavily on internal combustion engine (ICE) vehicles, ensuring sustained demand for exhaust systems. Furthermore, advancements in alternative fuel-powered vehicles, such as compressed natural gas (CNG) and hydrogen combustion engines, create opportunities for specialized exhaust technologies tailored to these new propulsion systems.

PASSENGER VEHICLE EXHAUST SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.67% |

|

Segments Covered |

By Component Type, Fuel Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Benteler International Aktiengesellschaft, Continental AG, Forvia, Sejong Industrial Co. Ltd, Tenneco, Boysen, Bosal, Yutaka Giken company , Proton AG, Milltek Sport Ltd |

Passenger Vehicle Exhaust Market Segmentation: By Component Type

-

Muffler/Silencers

-

Exhaust Manifolds

-

Catalytic converters

-

Oxygen Sensors

In 2024, the exhaust manifold was the largest revenue-generating component at 42% in the North American automotive exhaust systems market. This trend is expected to continue, driven by the increasing sales and production of passenger vehicles. To lessen the noise generated by an internal combustion engine’s exhaust gas, silencers are necessary. The goal of silencer technological advancements is to reduce emissions and noise levels, which has led to their notable market expansion.

Catalytic converters play a pivotal role in reducing harmful emissions by converting pollutants into less harmful substances before they are released into the atmosphere. The adoption of advanced catalytic converters is driven by stringent emission regulations worldwide, necessitating efficient emission control technologies.

Passenger Vehicle Exhaust System Market Segmentation: By Fuel Type

-

Gasoline (Petrol)

-

Diesel

The passenger vehicle exhaust market is segmented by fuel type into gasoline (petrol) and diesel vehicles, each with distinct emission control requirements and market dynamics. Gasoline-powered vehicles dominate the passenger car segment globally due to their widespread availability, lower emissions compared to diesel, and increasing adoption of fuel-efficient technologies. Despite a decline in diesel passenger vehicle sales in several markets due to emission concerns, demand remains strong in regions like India, Southeast Asia, and parts of Europe, where diesel engines are preferred for their fuel efficiency and torque. Also, these technologies need to comply with the Euro 6 and Euro 7 standards which are the most stringent set of rules when it comes to emission control. As emission regulations tighten globally, both gasoline and diesel exhaust systems are evolving with advanced filtration and catalytic technologies, ensuring continued investment and innovation in the exhaust market.

Passenger Vehicle Exhaust System Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The North American market is driven by stringent emission norms, such as the Corporate Average Fuel Economy (CAFE) standards and Environmental Protection Agency (EPA) regulations, which have pushed automakers to adopt advanced exhaust treatment technologies. The United States and Canada remain key markets, with a strong demand for catalytic converters, diesel particulate filters (DPFs), and selective catalytic reduction (SCR) systems. Asia Pacific is the largest segment for the car market and as such also for the exhaust market. China, the world’s largest automobile market, enforces strict China VI emission norms, pushing for cleaner exhaust technologies. Meanwhile, India's BS-VI (Bharat Stage VI) regulations have spurred the demand for advanced catalytic converters and gasoline particulate filters (GPFs). Asia Pacific has contributed more than 60% of the exhaust market revenue since 2024. Europe has the strictest norms in Euro 7 for emissions. While the continent is not as car-focused as others it is still a sizeable market. With the EU pushing for phasing out new ICE vehicle sales by 2035, the market for traditional exhaust systems faces a long-term decline, though hybrid vehicle exhaust components remain in demand.

South America has one of the least stringent regulations when it comes to emission controls and governments have not indicated that will change in the near future as such the market is expected to grow at 7% CAGR which is better than the projected growth rates for all other regions. Additionally, the growing preference for compressed natural gas (CNG) and ethanol-powered vehicles is creating opportunities for customized exhaust technologies suited to alternative fuels. The Middle East and Africa (MEA) market remains dependent on gasoline and diesel vehicles, with a relatively slow transition to EVs due to limited infrastructure.

COVID-19 Impact Analysis on the Passenger Vehicle Exhaust Market:

COVID–19 had a massive impact on the auto industry as car sales dropped significantly and people also accelerated the demand for EVs in the immediate aftermath of the pandemic. Global car production fell by 16% in 2020 and this also affected the market for vehicle exhaust negatively. With stricter rules also coming in place, manufacturers had to innovate in a subsequently very inflation-ridden environment, which made access to capital much harder. However, as economies began to recover in 2021, the automotive sector rebounded strongly, particularly in emerging markets. With personal mobility gaining importance due to health concerns, there was a resurgence in passenger vehicle sales, leading to renewed demand for exhaust systems. Additionally, governments introduced stimulus packages and incentives to boost vehicle manufacturing, which helped the market regain momentum.

Latest Trends/ Developments:

Leading companies are actively enhancing their product portfolios and expanding their market presence. For example, BENTELER International Aktiengesellschaft, BOSAL, and Continental AG are investing in research and development to introduce advanced exhaust systems that meet evolving emission standards.

Tariffs are a big concern in the market as the new Trump administration has indicated and enacted some tariffs on countries like Canada, Mexico and China. This will increase the cost of inputs required to make these vehicle exhaust pipes which in turn will lead to an increase in car prices.

Automakers are shifting towards stainless steel, titanium, and ceramic-coated exhaust components to reduce vehicle weight and improve fuel efficiency. Automakers and exhaust system manufacturers are exploring sensor-based and AI-powered exhaust monitoring systems to enhance vehicle performance and reduce emissions.

Key Players:

-

Benteler International Aktiengesellschaft

-

Continental AG

-

Forvia

-

Sejong Industrial Co. Ltd

-

Tenneco

-

Boysen

-

Bosal

-

Yutaka Giken company

-

Proton AG

-

Milltek Sport Ltd

Chapter 1. Passenger Vehicle Exhaust System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Passenger Vehicle Exhaust System Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Passenger Vehicle Exhaust System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Passenger Vehicle Exhaust System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Passenger Vehicle Exhaust System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Passenger Vehicle Exhaust System Market – By Component Type

6.1 Introduction/Key Findings

6.2 Muffler/Silencers

6.3 Exhaust Manifolds

6.4 Catalytic converters

6.5 Oxygen Sensors

6.6 Y-O-Y Growth trend Analysis By Component Type

6.7 Absolute $ Opportunity Analysis By Component Type, 2025-2030

Chapter 7. Passenger Vehicle Exhaust System Market – By Fuel Type

7.1 Introduction/Key Findings

7.2 Gasoline (Petrol)

7.3 Diesel

7.4 Y-O-Y Growth trend Analysis By Fuel Type

7.5 Absolute $ Opportunity Analysis By Fuel Type, 2025-2030

Chapter 8. Passenger Vehicle Exhaust System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Component Type

8.1.3 By Fuel Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Component Type

8.2.3 By Fuel Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Component Type

8.3.3 By Fuel Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Component Type

8.4.3 By Fuel Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Component Type

8.5.3 By Fuel Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Passenger Vehicle Exhaust System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Benteler International Aktiengesellschaft

9.2 Continental AG

9.3 Forvia

9.4 Sejong Industrial Co. Ltd

9.5 Tenneco

9.6 Boysen

9.7 Bosal

9.8 Yutaka Giken company

9.9 Proton AG

9.10 Milltek Sport Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The passenger vehicle exhaust market was valued at USD 42.04 billion and is expected to reach USD 58.04 billion by 2030, growing at a CAGR of 6.67% over the forecast period (2025-2030).

While EVs do not require exhaust systems, hybrid vehicles still rely on exhaust components, keeping demand stable. Additionally, emerging markets in Asia-Pacific, South America, and Africa continue to favour internal combustion engine (ICE) vehicles, ensuring ongoing demand for exhaust technology.

The market is primarily driven by strict emissions regulations (Euro 7, China VI, BS-VI), increasing vehicle production in developing economies, and rising aftermarket demand for replacement exhaust components in older vehicles

Asia-Pacific contributes over 60% of the market revenue, led by strong vehicle production and emission regulations. South America is projected to grow at 7% CAGR, driven by ICE vehicle dominance and alternative fuel adoption (CNG, ethanol).

Leading companies like Forvia, Benteler, and Continental AG are increasing R&D investments in advanced exhaust technologies. Manufacturers are shifting to lightweight materials such as stainless steel, titanium, and ceramic-coated exhaust components to improve fuel efficiency.