Passenger Vehicle Coatings Market Size (2024 – 2030)

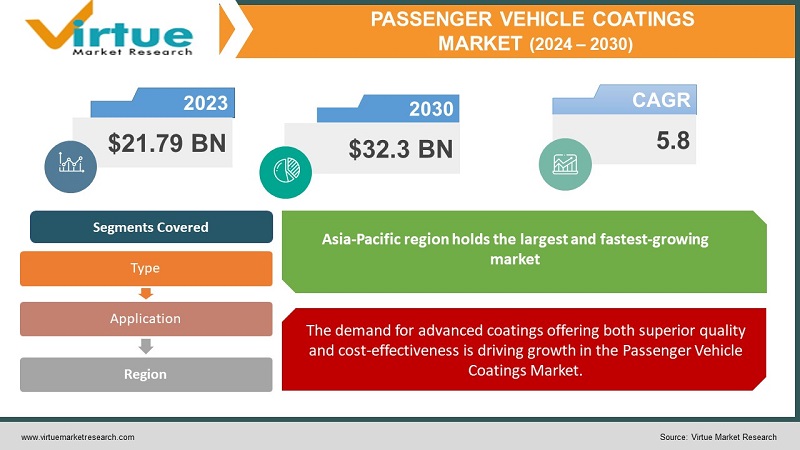

The Global Passenger Vehicle Coatings Market was valued at USD 21.79 billion and is projected to reach a market size of USD 32.3 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

The Passenger Vehicle Coatings Market is experiencing a dynamic transformation. In the 21st century, it has emerged as a significant global player, capturing the attention of both academic and professional communities. As the sector continues to expand, the demand for advanced coatings solutions in the automotive industry is also on the rise. This surge is expected to translate into a plethora of career opportunities over the next decade, within both the automotive and coatings industries. Consequently, leaders in this field must stay ahead by continually developing new skill sets and gaining a deeper understanding of the macro and micro factors influencing passenger vehicle coatings. This holistic approach ensures they remain well-equipped to navigate the evolving market dynamics while keeping a strategic focus on the broader industry landscape.

Key Market Insights:

The Passenger Vehicle Coatings Market reveals a shifting landscape driven by several factors. Growing environmental awareness and regulations have prompted a shift towards eco-friendly and low-VOC (Volatile Organic Compounds) coatings in the automotive sector. The demand for advanced technologies like waterborne and UV-cured coatings is on the rise, driven by their reduced environmental footprint and enhanced performance characteristics. Moreover, as consumers seek customization options, coatings with unique textures, colors, and special effects gain prominence, driving innovation in the industry. Additionally, the increasing popularity of electric vehicles (EVs) has spurred interest in coatings that offer thermal management properties to optimize battery performance. These insights underline the importance of adaptability and innovation in passenger vehicle coatings to meet evolving market demands and sustainability goals.

Passenger Vehicle Coatings Market Drivers:

The demand for advanced coatings offering both superior quality and cost-effectiveness is driving growth in the Passenger Vehicle Coatings Market.

The Passenger Vehicle Coatings Market is propelled by several compelling drivers. Firstly, stringent environmental regulations and the global commitment to reduce carbon emissions are pushing the automotive industry toward eco-friendly coatings. Waterborne and low-VOC coatings, which have lower environmental impacts, are in high demand. Secondly, the rising trend of vehicle personalization fuels the need for coatings that provide unique colors, textures, and effects, offering consumers a broader range of choices. Thirdly, the transition to electric vehicles (EVs) has accelerated, and coatings with thermal management capabilities are crucial to maintaining optimal battery performance. Additionally, technological advancements in coatings, such as self-healing and anti-scratch coatings, are gaining traction, enhancing the durability and aesthetics of vehicles. These drivers collectively underscore the industry's focus on sustainability, innovation, and customer preferences in the passenger vehicle coatings market.

Prolonged waiting times have emerged as a critical issue, prompting a parallel need for faster and streamlined processes in the Passenger Vehicle Coatings Market.

In the Passenger Vehicle Coatings Market, the automotive industry faces concerns related to production and delivery delays. Lengthy lead times between order placement and vehicle delivery can frustrate customers and hinder manufacturers' ability to meet demand effectively. Delays in the application of coatings, which are vital for vehicle protection and aesthetics, can impact production timelines and customer satisfaction. Prolonged lead times in coating processes can disrupt manufacturing schedules and potentially result in other complications, including production bottlenecks and customer dissatisfaction. Hence, addressing and minimizing these delays is crucial to ensuring the efficiency and competitiveness of the Passenger Vehicle Coatings Market.

The rising demand for advanced coatings in the Passenger Vehicle Coatings Market is being driven by factors such as the increasing preference for vehicle customization and the need for improved durability.

The Passenger Vehicle Coatings Market is witnessing a surge in demand driven by factors specific to the automotive industry. The automotive sector faces escalating challenges in vehicle wear and corrosion protection. This has prompted a growing need for innovative coatings that can withstand the rigors of daily use and environmental factors. Government support and industry assistance further boost the market by incentivizing the development and adoption of advanced coatings. Consumers seek passenger vehicle coatings to address issues such as the high cost of vehicle maintenance and the necessity for rapid and effective solutions to maintain their vehicles' aesthetic appeal and structural integrity. This growing awareness and affordability of advanced coating solutions are key drivers fueling the demand in the Passenger Vehicle Coatings Market.

Growing governmental investments in infrastructure and support for technological advancements are propelling the Passenger Vehicle Coatings Market.

The surging investments in the Passenger Vehicle Coatings Market are experiencing robust growth, driven by government initiatives and funding that foster advancements in protective and aesthetic coatings for automobiles. The automotive industry benefits from government support aimed at improving transportation connectivity and fostering technological advancements. These efforts boost the development of coatings that enhance passenger vehicle protection and aesthetics. The automotive industry demands expertise in advanced coatings technology, further underscoring the importance of skill and specialization.

Passenger Vehicle Coatings Market Restraints and Challenges:

In the Passenger Vehicle Coatings Market, cumbersome administrative processes and regulatory complexities pose significant restraints, leading to delays, product development, and distribution.

The Passenger Vehicle Coatings Market, while thriving, does face certain restraints and challenges. One significant concern is the increasing stringency of environmental regulations, which push for the development of low-VOC (Volatile Organic Compounds) and eco-friendly coatings. Meeting these standards can be both technically challenging and financially demanding for manufacturers. Additionally, the ongoing shortage of key raw materials, such as certain chemicals and pigments, can disrupt supply chains and lead to cost fluctuations. Moreover, the market must grapple with the evolving preferences of consumers who seek customization options and coatings with specific functionalities. Lastly, the competitive landscape with numerous players vying for market share necessitates continuous innovation and differentiation, placing pressure on companies to invest in research and development. Addressing these challenges effectively is essential to maintaining and expanding the Passenger Vehicle Coatings Market in the face of evolving industry dynamics.

Passenger Vehicle Coatings Market Opportunities:

The Passenger Vehicle Coatings Market presents a spectrum of promising opportunities in today's dynamic automotive landscape. As the world shifts towards sustainability, the demand for eco-friendly coatings is on the rise. Companies that can develop and offer low-VOC and waterborne coatings stand to gain a competitive edge. Moreover, the advent of electric vehicles (EVs) creates new possibilities, as these vehicles often require specialized coatings for battery thermal management. In addition, the growth of the autonomous vehicle sector opens doors for innovative coatings that enhance sensors' performance. With an increasing emphasis on vehicle aesthetics and protection, there's also a growing market for customizable and high-performance coatings, catering to consumer preferences. Furthermore, expanding automotive markets in emerging economies present untapped potential for the Passenger Vehicle Coatings Market, offering room for growth and diversification. The convergence of these opportunities underscores the industry's potential for innovation and expansion in the coming years.

PASSENGER VEHICLE COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PPG Industries, BASF, Axalta Coating Systems, Nippon Paint, Kansai Paint, KCC Corporation, AkzoNobel, Cabot Corp, Eastman, Valspar |

Passenger Vehicle Coatings Market Segmentation: By Type

-

Water-based Coating

-

Solvent Coatings

-

Powder Coatings

-

High Solid Coatings

The Passenger Vehicle Coatings Market, Water-based Coating segment holds the largest market share. This dominance is fueled by the growing preference for eco-friendly and low-VOC coatings, in line with global sustainability goals. Water-based coatings offer a compelling combination of performance and reduced environmental impact, making them a top choice for both manufacturers and environmentally conscious consumers.

On the other hand, the Powder Coatings segment is experiencing the fastest growth. Powder coatings have garnered momentum due to their efficiency, resilience, and ability to create a sleek and visually appealing finish. Moreover, they generate fewer emissions during application, aligning with stringent environmental regulations. The surge in the electric vehicle (EV) market, often requiring specialized coatings for thermal management, has further accelerated the adoption of powder coatings in the automotive sector. As the automotive landscape continues to transform, the powder coatings segment is poised for significant and sustained expansion in the foreseeable future.

Passenger Vehicle Coatings Market Segmentation: By Application

-

Aftermarkets

-

OEM

The Original Equipment Manufacturers (OEMs) segment holds the largest market share. This is because OEMs are the primary manufacturers of vehicles and apply coatings during the production process. The OEM segment benefits from consistent demand driven by the production of new vehicles and the need for coatings that meet stringent quality and durability standards.

While the Aftermarkets segment is the fastest-growing segment. Aftermarkets cater to the needs of vehicle owners and repair shops looking to maintain, repair, or customize vehicles post-production. This segment experiences growth due to the increasing trend of vehicle customization, where consumers seek to personalize their vehicles with different coatings, colors, and finishes. Additionally, the need for maintenance and repair coatings to address wear and tear or corrosion issues in existing vehicles contributes to the robust growth of the aftermarket segment. As consumer preferences and vehicle ownership trends continue to evolve, the aftermarket segment is positioned for sustained expansion in the Passenger Vehicle Coatings Market.

Passenger Vehicle Coatings Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region holds the largest and fastest-growing market in the Passenger Vehicle Coatings Market. This dominance is attributed to the thriving automotive industry in countries like China and India, where a burgeoning middle class and increased consumer spending have spurred substantial demand for passenger vehicles. The Asia-Pacific region benefits from robust manufacturing activities and a growing preference for customized and aesthetically appealing coatings in the automotive sector. With the rapidly expanding automotive market, particularly in emerging economies, this region experiences dynamic growth in the Passenger Vehicle Coatings Market. The adoption of advanced coatings, increasing vehicle production, and heightened environmental awareness contribute to this rapid expansion. Moreover, the Asia-Pacific region is at the forefront of electric vehicle (EV) adoption, which necessitates specialized coatings for battery management, further boosting the market's growth potential in this region.

COVID-19 Impact Analysis on the Global Passenger Vehicle Coatings Market:

The COVID-19 pandemic had a notable impact on the Passenger Vehicle Coatings Market. Initially, the market experienced disruptions in supply chains, as lockdowns and restrictions affected the production and distribution of coatings. The automotive industry, a key consumer of coatings, witnessed a slowdown as vehicle production halted or slowed down in response to reduced consumer demand and supply chain challenges. Additionally, consumers deferred vehicle purchases due to economic uncertainty, affecting the demand for coatings. However, the pandemic also spurred certain trends, such as an increased focus on vehicle sanitation and hygiene, leading to a heightened interest in antimicrobial coatings for interior surfaces. As the automotive sector gradually rebounded and adapted to the new normal, the Passenger Vehicle Coatings Market began to recover, emphasizing the need for coatings that address emerging consumer priorities.

Latest Trends/ Developments:

The Passenger Vehicle Coatings Market plays a pivotal role in supporting and synergizing with various interconnected industries. Its contributions extend to the automotive sector by providing coatings that enhance vehicle aesthetics, protection, and durability. These coatings help automakers meet consumer demands for customization and environmental sustainability, aligning with the broader automotive industry's goals. Additionally, the adoption of advanced coatings, particularly in electric vehicles (EVs), contributes to improved thermal management and extended battery life, fostering the growth of the clean energy and EV market segments. Furthermore, innovations in coatings technology, such as self-healing and anti-scratch coatings, have applications beyond passenger vehicles, benefiting industries like consumer electronics and aerospace, where durability and aesthetics are paramount. Thus, the Passenger Vehicle Coatings Market's innovations and advancements have a ripple effect, positively influencing and contributing to the growth and competitiveness of various related sectors.

Key Players:

-

PPG Industries

-

BASF

-

Axalta Coating Systems

-

Nippon Paint

-

Kansai Paint

-

KCC Corporation

-

AkzoNobel

-

Cabot Corp

-

Eastman

-

Valspar

-

In July 2022, AkzoNobel acquired the aluminum wheel liquid coatings business segment from Lankwitzer Lackfabrik.

-

In August 2022, Axalta introduced its next-generation basecoat technology tailored for the automotive refinish sector in Latin America.

-

In May 2022, BASF took a significant step in expanding its presence in the automotive coatings sector by enlarging its Automotive Coatings Application Center located at the Coatings Technology Center in Mangalore, India.

-

In April 2021, PPG successfully acquired Cetelon Lackfabrik GmbH, a renowned coatings manufacturer specializing in light truck wheels and automotive applications.

Chapter 1. Passenger Vehicle Coatings Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Passenger Vehicle Coatings Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Passenger Vehicle Coatings Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Passenger Vehicle Coatings Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Passenger Vehicle Coatings Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Passenger Vehicle Coatings Market– By Type

6.1 Introduction/Key Findings

6.2 Water-based Coating

6.3 Solvent Coatings

6.4 Powder Coatings

6.5 High Solid Coatings

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Passenger Vehicle Coatings Market– By Application

7.1 Introduction/Key Findings

7.2 Aftermarkets

7.3 OEM

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Passenger Vehicle Coatings Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Passenger Vehicle Coatings Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PPG Industries

9.2 BASF

9.3 Axalta Coating Systems

9.4 Nippon Paint

9.5 Kansai Paint

9.6 KCC Corporation

9.7 AkzoNobel

9.8 Cabot Corp

9.9 Eastman

9.10 Valspar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Increasing environmental awareness and regulations propel the demand for eco-friendly coatings, such as low-VOC and water-based options.

The Asia-Pacific region, driven by countries like China and India, holds the largest market share.

Challenges include meeting stringent environmental regulations, securing raw materials, addressing consumer customization demands, and remaining competitive in a crowded market.

The pandemic initially disrupted supply chains and reduced vehicle production, but it also accelerated trends such as increased interest in antimicrobial coatings for vehicle interiors.

It supports related industries by providing coatings that enhance vehicle aesthetics, protection, and durability, benefiting sectors like automotive, consumer electronics, and aerospace.